Japan

Wood Products Prices

Dollar Exchange Rates of 10th

December

2017

Japan Yen 112.22

Reports From Japan

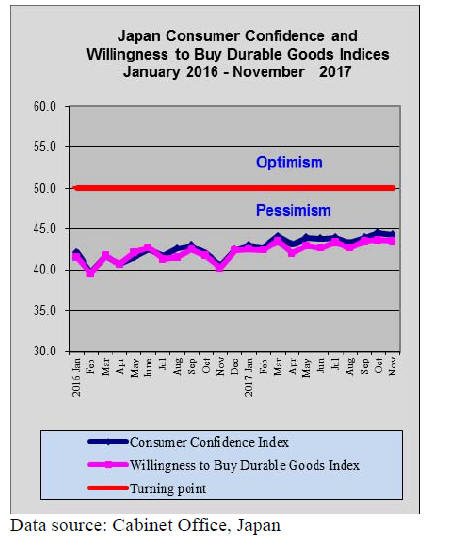

Modest economic

growth but prices stagnant

The Finance Ministry said in the July-September period

capital investment by Japanese companies rose over 4%

year on year marking the fourth straight quarter of gain.

This has encouraged analysts to suggest the signs are of a

modestly improving economy.

In the third quarter of 2017 the Japanese economy grew at

an annualised rate of 1.4%, the longest period of

consecutive growth in 16 years.

On the basis of recent data the Japanese government is

expected to revise up its growth forecast for 2018 as an

expanding global economy should drive capital

investments by Japanese companies even higher.

Economists say monetary policy is a strong driver of

current growth and, while the macro-picture is

encouraging, prices are not rising much which calls into

question the approach being taken by the Bank of Japan.

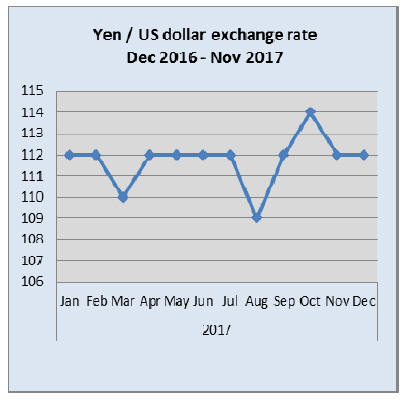

Dollar falls on Jerusalem announcement then up on

US tax plan

After suffering from a decline when the US administration

announced recognition of Jerusalem as the capital of

Israel, the US dollar rebounded to a 3 week high against

the yen in early December driven higher after the US

Senate approved the tax reform bill. This strengthening

was also supported by improved private-sector

employment data.

In mid-December the US dollar was trading at around yen

112 to the US dollar, a rate that is favourable to exporters.

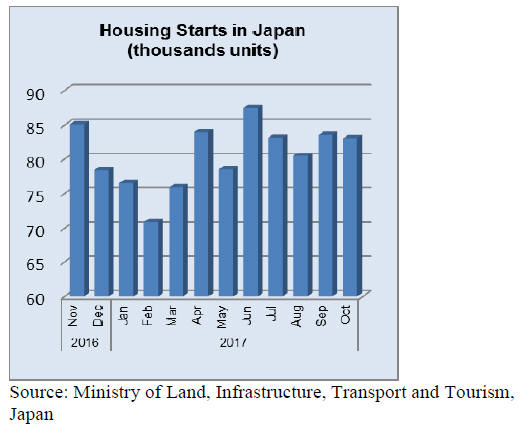

Inheriting a house – a potential nightmare

In Japan the prospect of inheriting the parental home has

now become a nightmare, particularly those who live and

work far from their parents’ home and do not plan to

return. Inheriting a house involves becoming responsible

for maintenance and taxes and perhaps a hefty inheritance

tax bill, the law for which has recently been changed to

widen its net.

An inheritance can be disclaimed which would mean the

house can be abandoned adding to the already massive

stock of empty houses in Japan. The alternative would be

to pay for the property to be demolished but then the land

tax would kick-in at a much higher rate than if there was a

house on the land.

This very unusual state of affairs and has spawned a

growing business in house renovations. Several of the

major houses building companies are expanding their

businesses into house refurbishment but this is still

relatively rare in Japan. As the population of Japan

shrinks and with the economic prospects still bleak

renovated buildings represent a niche in the housing

market.

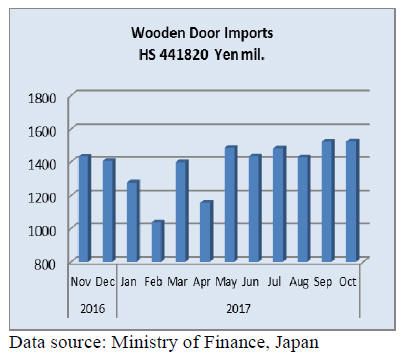

Import round up

Doors

Year on year, Japan’s October 2017 imports of wooden

doors (HS441820) were at around the the same level as in

October 2016 and month on month the value of imports

was also flat. From May this year the value of monthly

imports of wooden doors has hovered around yen 1.5

billion.

In October, China was the largest supplier of wooden

doors accounting for 55% on imports followed by the

Philippines (21%) and both Indonesia and Malaysia at 8%

each. These four shippers accounted for over 90% of

Japan’s October wooden door imports.

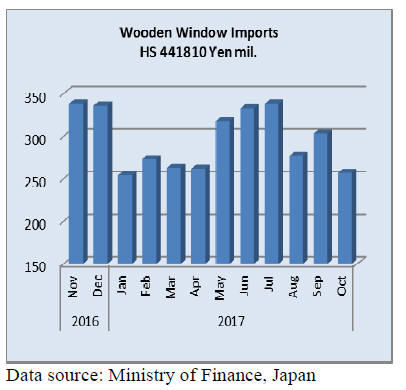

Windows

The rise in the value of wooden window imports in

September 2017 now seems to have been a one-time event

as October figures show imports dropping sharply and

even falling below the level in August, the builders

holiday month in Japan.

Year on year, October 2017 wooden window imports were

down over 40% compared to 2016 and compared to levels

in September a 15% drop was observed. Around 90% of

Japan’s wooden window imports originate from just three

sources, China (32%), the Philippines (29%) and the US

(27%).

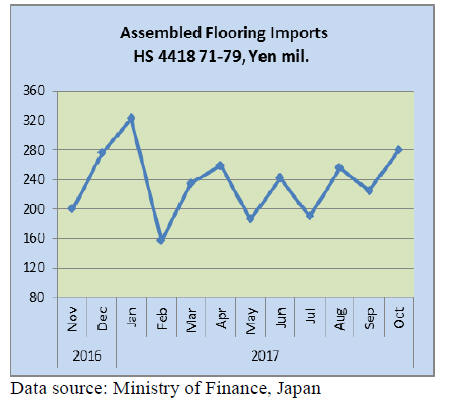

Assembled flooring

The value of Japan’s October 2017 imports of assembled

wooden flooring (HS441871-79) was almost 25% higher

than a month earlier and since July there has been a steady

rise in the value of imports despite the periodic ups and

downs.

Year on year, October 2017 assembled flooring imports

were flat. Of the various categories being tracked HS

441875 accounted for the bulk of October imports (82%)

with China being the main supplier followed Indonesia,

Vietnam and Malaysia. For HS441879 which accounted

for 12% of October imports the main suppliers were

Indonesia and China.

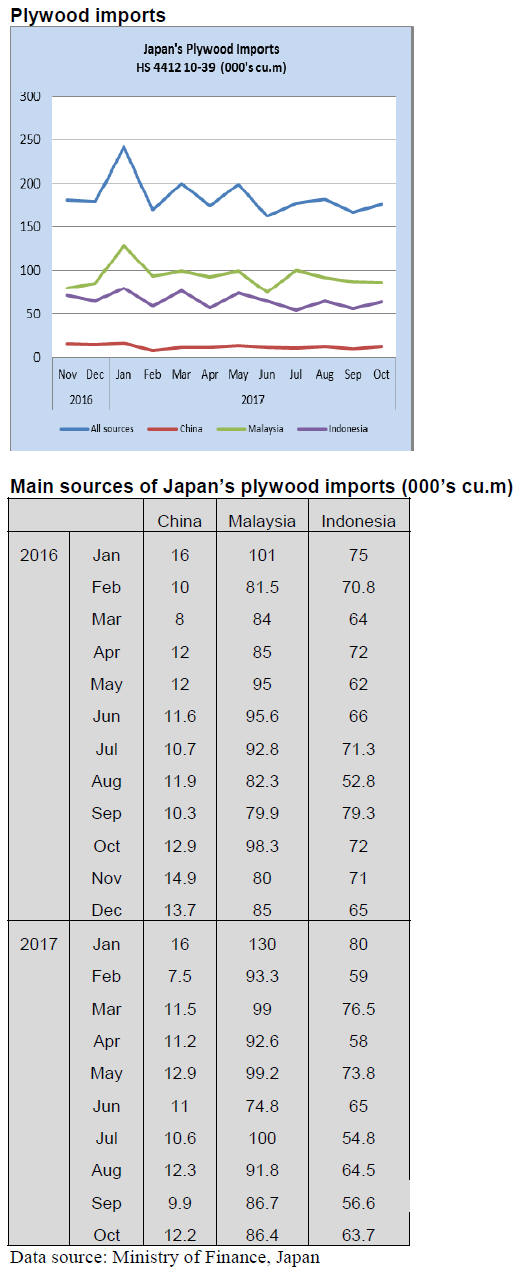

Plywood

Japan’s October 2017 imports of plywood (HS441210-31)

were flat year on year but compared to a month earlier

October import volumes were up slightly.

Since June this year Japan’s plywood imports have

remained at around 170,000 cubic metres per month and

shipments from the main suppliers, Malaysia, Indonesia

and China have moved within a very narrow band.

Shipments from Malaysia are mostly of HS 441231 with

smaller volumes of HS 4412 33 and 34. Shipments from

Indonesia follow a similar pattern with most being HS

441231 but more HS 441234 is shipped from Indonesia

than Malaysia.

In contrast plywood shipments from China are of more

varied specifications with HS 441231 accounting for most.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

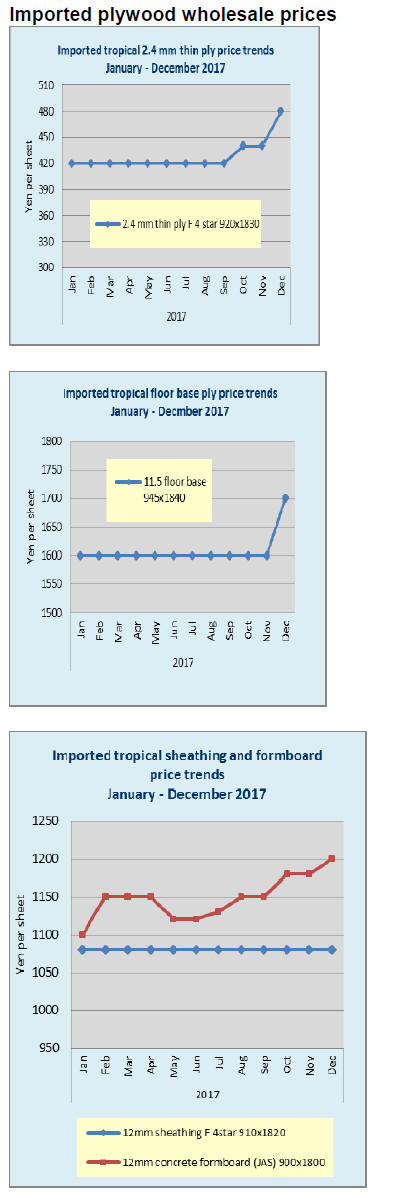

Soaring Malaysian and Indonesian plywood export

prices

Export prices of Malaysian plywood are climbing again.

Before log production recovered, rainy season started

since late October and log production will stay low until

rainy season is over in March next year.

Log prices continue firm and the government of Sarawak

will raise timber harvest tax since January next year,

which is another factor to push log prices up.

In this situation, plywood mills in Sarawak propose about

$600 per cbm C&F on 3x6 JAS coated concrete forming

panel for shipment in January and $520-530 on uncoated

concrete forming panel. They are $30 higher than present

prices.

Major plywood manufacturers in Sarawak carry almost six

months order files due to delayed production and

shipments. Structural and uncoated concrete forming panel

are rather easy to produce compared to coated panels

while coated concrete forming panels need quality logs,

which are hard to come by so the manufacturing is limited.

Actually many plywood mills are forced to reduce the

production by log supply shortage and they decide what to

produce depending on quality of logs as they come in.

Indonesian plywood manufacturers are in the same

situation with log supply shortage and climbing labor cost

so they are raising the export prices to follow Malaysian

move.

Present market prices of 3x6 JAS coated concrete forming

panel in Japan are about 1,350 yen per sheet delivered but

the inventories in distribution channels are very limited so

distributors have to accept $600 prices as even shipment

ofcontracted volume is largely delayed.

Plywood meeting by three countries

Japan, Taiwan and Korean plywood manufacturers had a

meeting at Nagoya in late October. Many subjects were

discussed.

Close information exchange on

utilization of Close information exchange on

utilization of

wood biomass energy based on cascade use of

wood.

Establishment of law to use only logs

harvested Establishment of law to use only logs

harvested

from legally approved forests with sustained

yield system.

Request to the government to maintain

import Request to the government to maintain

import

duty including use of safeguard on plywood and

board products.

Promotion to develop technical measures

to Promotion to develop technical measures

to

improve performance and quality of plywood and

board.

Efforts to prevent global warming with

carbon Efforts to prevent global warming with

carbon

fixation through expansion of plantation and

demand of wood products.

Log supply/ demand of PKS, wood chip

and fuel Log supply/ demand of PKS, wood chip

and fuel

logs needs to be watched as demand for

recyclable energy is rising worldwide.

China is becoming major manufacturing

country China is becoming major manufacturing

country

of plywood and board by increased import of logs

from all over the world.

Demand for plantation wood and softwood

logs Demand for plantation wood and softwood

logs

has been increasing for India and Middle Eastern

countries so it is necessary to exchange

information on demand of logs by other countries

without delay.

Shin-ei Plywood to build new mill in Ohita

Shin-ei Plywood Co., Ltd. (Tokyo), one of Seihoku group

companies, will build a new plywood mill in Ohita

prefecture as the second base mill in Kyushu. Shin-ei has

plywood mill in Minamata, Kumamoto prefecture, only

one plywood mill in Kyushu, which produces softwood

structural panels and concrete forming panels for coating.

In 2015, it increased the production by 30% to deal with

busy demand of thick panel for floor, wall and roof

sheathing in Kyushu.It has been running full since it

increased the production but is not able to catch up busy

demand so it decided to build another mill in Ohita.

Minamata mill consumes 300,000 cbms of logs, out of

which 240-250 M cbms are local domestic logs from

Southern Kyushu (Kumamoto, Miyazaki and Kagoshima

prefecture).

New Ohita mill will consume about 108,000 cbms of local

logs (70% cedar and 30% cypress) to produce 68,000

cbms of softwood structural plywood, which will be

marketed in Kyushu.

Plywood

Movement of plywood on both imported and domestic

continues steady. On domestic softwood plywood, both

production and shipment continue record high level.

October plywood production was 280,300 cbms, 6.2%

more than October last year and 1.8% more than

September.

The shipment was 286,200 cbms, 4.8% more and 2.2%

more. Softwood plywood production was 267,800 cbms,

6.5% more and 1.9% more. The shipment was 273,100

cbms, 5.8% more and 2.1% more. Both are monthly

highest record.

Production of non-structural panel was 14,000 cbms,

59.2% more and 53.3% more with shipment of 14,400

cbms, 68.0% more and 39.5% more. This is replacing

demand of South Sea hardwood floor base, which arrivals

are largely delayed.

The inventories of softwood plywood were 100,500 cbms,

4,700 cbms less than September. The manufacturers’

inventories are dropping with the shipments exceeding the

production so supply side fears supply shortage but

precutting plants and wholesalers have secured enough

inventories so they are not worried about supply shortage.

Market prices of imported plywood have been

gradually

climbing. Supply of thin panel and floor base from

Indonesia continues short.

The shipments of imported plywood have been largely

delayed by log supply shortage at producing regions,

where rainy season has started so log supply will not

recover until spring of next year. Since shipment time is

uncertain, the buyers in Japan commit whenever offers are

made regardless of the prices.

|