Japan

Wood Products Prices

Dollar Exchange Rates of 25th

November

2017

Japan Yen 112.25

Reports From Japan

Wage hike the key to boosting

consumer confidence

and spending

While the Japanese economy is seeing the longest period

of sustained expansion in the past 15 years buoyed mainly

by exports, private consumption, the most important pillar

of growth, has not expanded.

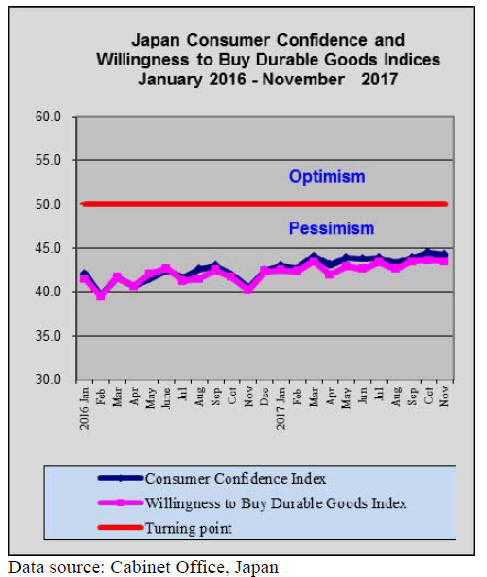

The recent consumer confidence survey conducted by the

Cabinet Office shows that overall confidence improved in

November and the sentiment index for general households,

which includes views on incomes and jobs, rose from the

previous month, a third straight monthly uptick.

However analysts caution that the pace of recovery in

consumer sentiment is muted and potentially unstable.

Boosting consumer spending will require companies to

begin diverting some of huge their cash reserves to wage

increase, only then will sentiment get a substantial boost.

The recently announced changes to the tax structures

could have a negative impact on consumer sentiment.

Prospects for inflation improve

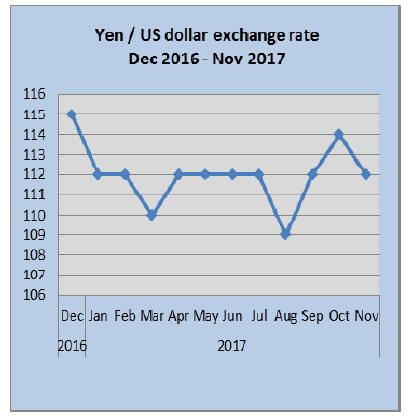

Over the past weeks the yen has strengthened against the

US dollar reaching the 112 yen per dollar level in late

November.

As the Japanese economy continues to improve many are

forecasting that the Bank of Japan (BoJ) may soon begin

easing out of its easy money policy which would cause a

further strengthening of the yen. But, a strong yen would

undermine exports, the main source of growth at present.

The BoJ has maintained its position that it will

continue

with its current policies until the 2% inflation target has

been achieved which, according to analysts at Morgan

Stanley, could be sooner rather than later given projections

of global inflation trends.

Despite weak October data builders have seen

orders

for housing surge

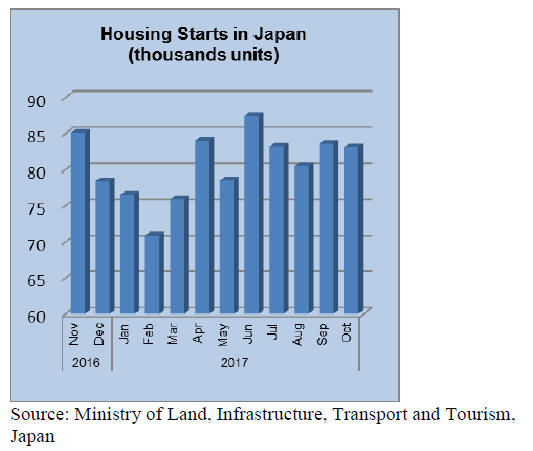

Year on year, Japan's housing starts have fallen for four

consecutive months and the October data from the

Ministry of Land, Infrastructure, Transport and Tourism

shows that in October the pace of year on year decline has

picked up speed.

October housing starts were down around 5% from a year

earlier and at about the same level as in September. For

the year as a whole annualised starts are likely to come in

at around 930,000, a disappointing figure for the timber

sector.

The good news in the October data is that orders received

by the main house builders has improved which, if

translated into starts during the remainder of this year,

then total starts for 2017 may not be as bad as forecast.

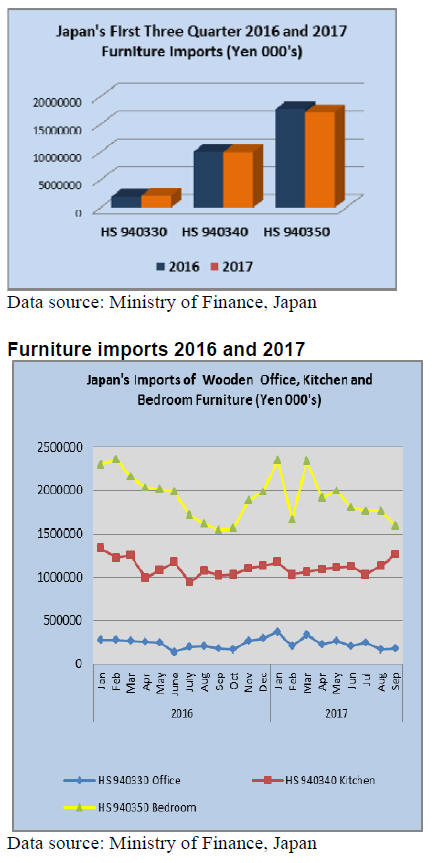

Japan’s wooden furniture imports

Furniture import data from the Ministry of Finance

illustrates how remarkably unremarkable are the trends in

Japan’s furniture imports. Looking back over the past five

years the value of imports of the three categories of

furniture tracked has swung but in a very narrow range.

In addition, there has been virtually no change in the main

sources of supply. Foreign manufacturers, if they can meet

the quality requirements in the Japanese market, can be

assured of regular business.

A comparison of the value of imports in the first three

months of 2016 and 2017 reinforces the notion of how

stable demand is in Japan. In the first nine months of the

year imports of wooden office furniture (HS 940330) rose

7%, imports of wooden kitchen furniture were flat while

the value of imports of wooden bedroom furniture were

down 3%.

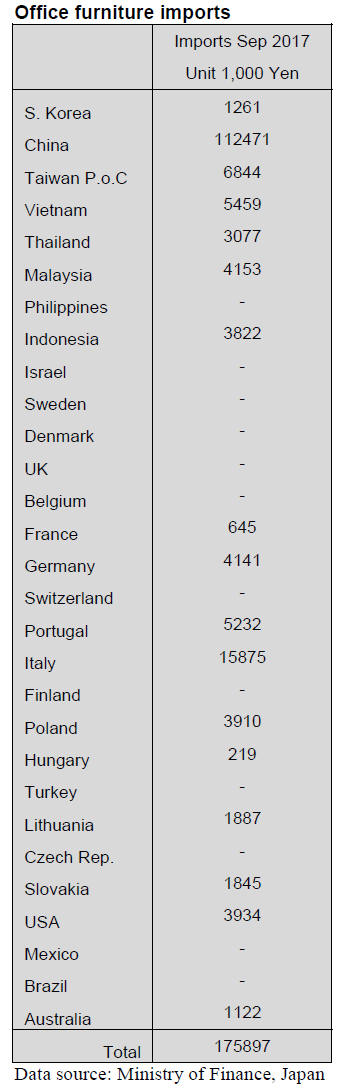

Office furniture imports (HS 940330)

Japan’s imports of wooden office furniture are small

compared to the value of wooden bedroom and kitchen

furniture imports.

Year on year, the value of September imports of wooden

office furniture was little changed fro levels in August and

imports have been sustained at a very consistent level over

the past six months.

Compered to August, September wooden office furniture

imports moved up around 5% with China being the main

supplier at just over 60% of all shipments. The other main

suppliers in September were Italy (9%) and Taiwan P.o.C

(4%)

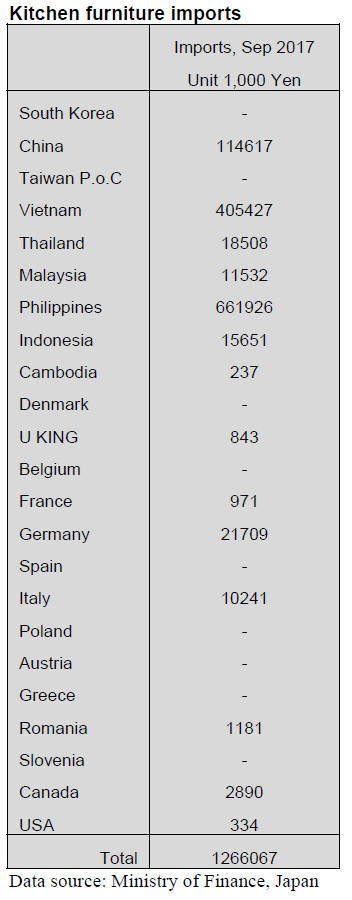

Kitchen furniture imports (HS 940340)

The value of Japan’s imports of wooden kitchen furniture

has been steadily rising since July. Year on year,

September imports were up 24% but compared to levels in

August they were down 12%. Despite the seemingly sharp

increase in September imports of wooden kitchen

furniture, shipments throughout the year to-date have been

within a fairly narrow range.

For the first time shipments from the Philippines topped

those from Vietnam. In September shipments from the

Philippines were double that in August while shipments

from Vietnam were down 20%.

The combined shipments from the Philippines, Vietnam

and China account for over 90% of all September

shipments of wooden kitchen furniture.

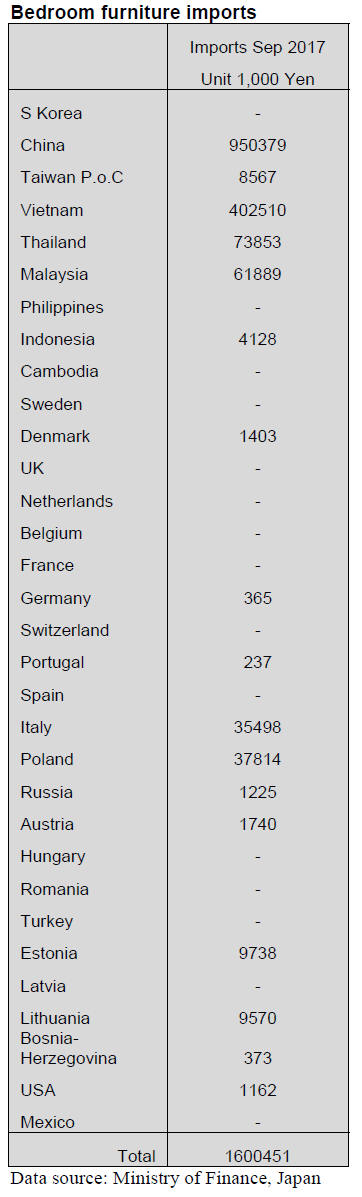

Bedroom furniture imports (HS 940350)

The import data seems to suggest there is an issue with

import values of wooden bedroom furniture. Import

trends for wooden office and kitchen furniture have not

changed significantly during the year but for wooden

bedroom furniture there has been a steady downturn in the

value of imports beginning in the first quarter of this year.

However, looking back a few years it appears that

imports

of bedroom furniture are more cyclical than for either

office or kitchen furniture with a decline seen mid-year to

be followed by a surge at year end. This year however the

reversal of the downward trend has yet to be seen.

On past trends an uptick in the value of bedroom furniture

should emerge in the final quarter of the year.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Plywood market overview

In 2016, one of major plywood plants had fire damage and

the supply disrupted. Kyushu had earthquake and plywood

demand for restoration was busy. Housing starts were

active particularly on rental units and units built for sale so

that plywood consumption increased and supply shortage

occurred in late 2016. This stretched into the first quarter

this year then the demand started simmering down so

panic situation was over.

Looking at trend of softwood plywood inventories, they

were 128,400 cbms in March last year, which was the

peak then they have continuously declined month after

month. They dropped below 100,000 cbms in August last

year and recorded less than 80,000 cbms in January this

year.

Despite effort to bring the inventory level up by the

manufacturers, there is additional demand for nonstructural

panel of floor base due to short supply of

imported plywood so March production was 264,500 cbms

and the shipment was 254,900 cbms then in April, the

production was 252,000 cbms and the shipment was also

252,000 cbms.

There is no surplus to build inventories as produced

volume is shipped out immediately. In June, the monthly

shipment recoded the highest in last five years.

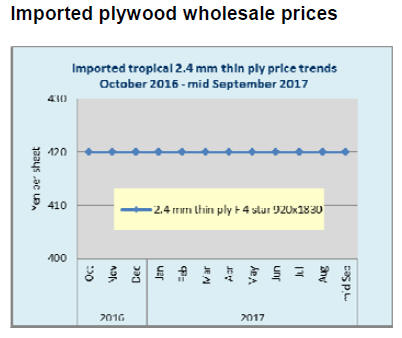

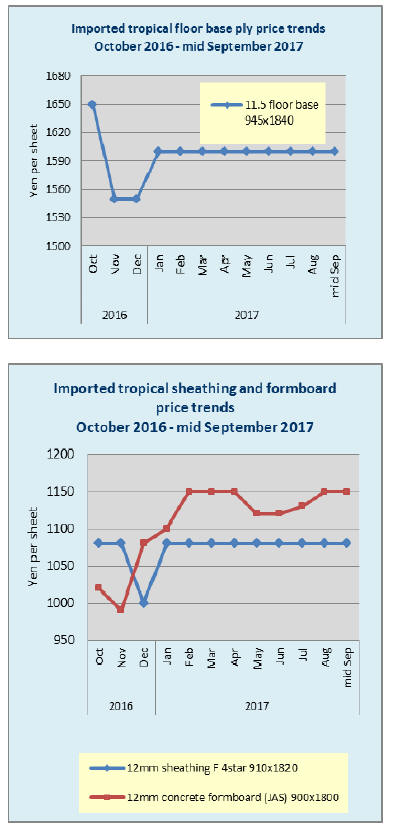

Imported plywood market last year was dull. With strong

yen, bearish mood prevailed on imported plywood and the

movement stagnated with the prices dropping in Japan.

Meantime, suppliers faced log supply shortage by foul

weather and stricter harvest restriction so that the log

prices soared. At the same time, the Malaysian

government imposed higher timber premium, which is

another reason of higher log prices. Frustrated with

sluggish Japan market, Malaysian plywood manufacturers

decided to reduce the production uniformly in August last

year then raised the export prices to cover high cost.

As the yen weakened in late last year, price skidding in

Japan stopped then since last July, both suppliers’ export

prices and market prices in Japan started moving up. Total

supply volume for the first eight months of this year was

1,944,500 cbms, 5.4% more than the same period of 2016

but the volume in last three years was the lowest in last ten

years.

Reason of dull demand for concrete forming panel is

use

of precast concrete (PC). Actually PC, which does not

need concrete forming panels, was active last year but

with urban redevelopment spreading in major populated

regions, PC supply is short so that more buildings are

being built with concrete, which needs concrete forming

panels so the demand should return. Domestic plywood

manufacturers are busy to supply structural panels and

have very little room to make concrete forming panels.

Looking at future of tropical hardwood supply, producing

regions have much more concern to environmental

protection and resource conservation. Tighter control of

illegal harvest, tighter control of harvest volume by the

government and diameter harvest restriction indicate

declining supply of natural wood. Also there are new log

buyers from emerging countries like China, India and

Middle East countries, which look for supply of wood

everywhere.

There are two plywood mills left to consume tropical

hardwood logs in Japan. Both are in Niigata. One

produced about 41,000 cbms for the first nine months of

this year.Due to delayed shipments of Malaysian and

Indonesian plywood, orders to supplement imported

plywood rushed in but log supply from the South East

Asian sources has been tight and imported veneer is also

hard to get so the production is limited. It is considering to

use other species like cedar, cypress and domestic

hardwood.

Another mill mainly produces hybrid plywood with

tropical hardwood, Russian red pine and domestic cedar.

The production for the first nine months was 38,800 cbms.

They realize that South Sea hardwood log supply

continues declining so they need to look for other

materials.

South Sea logs and lumber

South Sea log prices were calming down after India’s

purchase slowed down then there is mood of picking up

prices again. Reasons are that Sarawak government will

raise royalty after January next year and slow log

production due to very short dry season this year.

Log supply will decrease for certain by shrinking harvest

quota and additional levy of various taxes.

Production of plantation wood is also affected by foul

weather so plywood mills and laminated lumber mills

experience difficulty to secure material logs and logs for

export are in the same condition.

Meranti regular log prices in Japan have been levelling off

at about 12,500 yen per cbm FOB truck then after January

2018, the prices would be up by 500 yen. Domestic

plywood mills seek quality logs even with high prices and

to find niche market rather than low prices.

Movement of laminated free board is finally recovering.

Demand for large shopping facilities is active so that the

inventories of distributors are down.

Export prices by the suppliers in Indonesia stay up high

because of log shortage but the prices in Japan are holding

at about upper half of 110,000 yen per cbm FOB truck.

Seminar on Korean wood products market

The Japan Wood Products Export Promotion Council held

wood products export seminar in Fukuoka in October.

This is particularly aiming export to Korea so it invited

wood products buyers and scholars. Some Korean college

professor gave lecture on wood demand in Korea and

import of wood products.

According to this lecture, wood demand in Korea in 2016

was 9,003,000 cbms of logs, out of which 5,151,000 cbms

of domestic logs and 3,852,000 cbms of imported logs.

Self-sufficiency rate is 16.2%.

Main source of log import is radiate pine logs from New

Zealand.

In 2016, 2,842,000 cbms from New Zealand, 254,000

cbms from the U.S.A., 279,000 cbms from Canada,

100,000 cbms from Japan, 23,000 cbms from Russia and

18,000 cbms from Europe. 50% of logs from Japan is

cypress and 90% of lumber is also cypress.

64% of land is covered with forest in Korea but majority

of wood demand relies on imported materials. Large scale

plantation started in 1970s and forest resources are

maturing and 50% is over 40 years so self-sufficiency rate

is steadily improving.

In wood import business, log import is not increasing

while import of finished wood products is increasing.

Import of lumber from Russia and Chile, plywood and

MDF from China and South East Asia, particleboard from

Thailand and Rumania is increasing.

Various Korean wood products buyers explained present

demand for Japanese wood products. Japanese cypress is

very popular in Korea. Main use of Japanese wood is wall,

molding and furniture.

Cypress is used for flooring, bath tub and wall. Problem is

different specification of Japanese standard and Korean

standard, which is main reason of higher cost. For instance

Korean standard log lengths are 2.5 and 3.7 meters while

Japanese standard is 2.3 and 4 meters.

Because of high cost of Japanese cypress, in Korea,

domestic cypress and Chinese cypress are used but the

supply is very limited. It is medically proved that volatile

organic compounds of phytoncide cypress has sterilising

power and effective to atopic aczema so plantation of

cypress has been expanding.

In the largest plantation area, 2.5 million cypress trees of

over 50 years are available. Cedar is not as demanded as

cypress in Korea.

Specification of cypress laminated lumber is thickness of

12,15,18,24,30 mm x 1,220 mm x 2,440 mm. Moulding

board is 12 x 60 x 2,400 mm and 12 x 80 x 2,400 mm.

Wood based housing has been steadily increasing in

Korea. 11,826 units in 2012. 17,043 inn 2016 and 8,767

for the first six months of 2017. 2x4 construction is

majority for apartment. Plywood, laminated lumber,

particleboard and MDF are used for interior finishing.

Notice of JAS revision

Revision of JAS on laminated lumber is notified on

October 20. Preservative treatment of lumber is officially

approved.

Thickness of decorative veneer and number of ply of

lamina on decorative laminated lumber and standard of

length of finger joint is revised to actual condition.

Thickness of veneer overlaid on decorative laminated

lumber used for head jamb and sill is changed to 0.5 mm

or more from present 1.5 mm or more. Revision is made

based on the fact that there has not been claim of

delamination and cracking even with thin veneer.

Cedar’s four plied structural laminated post has been

widely used now without any problem so now four ply is

officially approved from present five ply.

Length of finger joint is changed from more than10.5 mm

to 6.0 mm or more after popular use of micro finger

jointer.

The Ministry of Agriculture, Forestry and Fisheries

revised JAS on plywood and added clause of preservative

treatment. It is divided into two categories of treated

plywood and treated veneer. Preservative treated plywood

is used for not only house building but also exterior for

which untreated plywood was hard to use. This will

expand market of domestic softwood plywood.

|