Japan

Wood Products Prices

Dollar Exchange Rates of 10th

September 2017

Japan Yen 109.39

Reports From Japan

Geopolitical risks undermine

sentiment

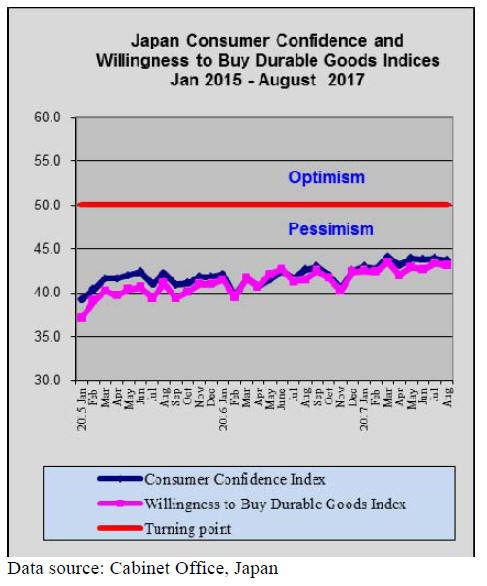

Cabinet Office data shows that consumer sentiment

weakened in August with the consumer confidence index

falling to 43.3 from 43.8 in July. All four components of

the indicator declined from July.

The overall livelihood indicator fell, likewise, consumer

views on income growth deteriorated in August and the

indicator for employment also declined. Of particular

interest to the furniture sector was the decline in

consumers’ willingness to buy durable goods.

In contrast, Japan’s manufacturing PMI in August rose

slightly but was below analyst’s expectations. The

improvement in manufacturing was mainly attributed to an

improvement in both domestic and international demand.

However, while a recovery in global demand is helping

Japan’s economy the risk of conflict in North Korea is

impacting business sentiment.

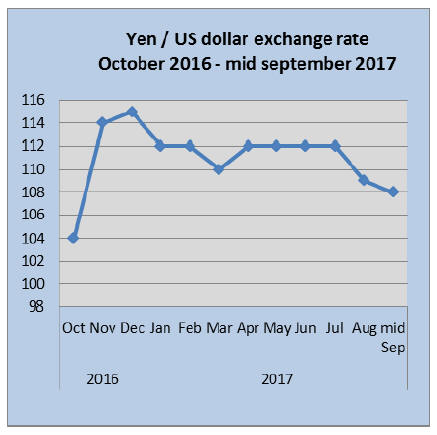

Yen buffeted by storms and North Korea

Early September was a turbulent month for the yen. The

impact of hurricane Irma on the US/yen exchange rate was

immediate. At one stage the yen was 107 to the dollar but

the dollar quickly recovered.

As if violent storms were not enough, North Korea fired a

missile over northern Japan and then conducted a massive

nuclear bomb test but despite these events the yen

remained in demand. But, there are some questioning how

long the yen will retain its safe-haven status. If conflict in

the region escalates there will be a major re-alignment of

exchange rates.

Re-tech, technology applied to home valuations

Selling a home in Japan can be a nightmare. Traditionally

newly built homes in Japan depreciate at a startling rate, It

is not uncommon for a new home to be valued at around

half of the original cost within a few years.

Part of this problem is the reliability of

valuations of

secondhand homes. Valuing a home is most commonly

done by appraisal companies and in many cases their

assessment methods are specific to their own interests

such that assessed values can be inconsistent or out of

touch with market reality.

Home sellers in Japan now have an alternative means to

get their home valued – Re-tech, short for real estate

technology, which uses software to access huge amounts

of data to forecast the current and future prices of

secondhand homes.

Analysts in the housing sector say Re-tech technologies

may be of help in addressing the problem of the 8 million

or more vacant and unsaleable homes in Japan.

Import round up

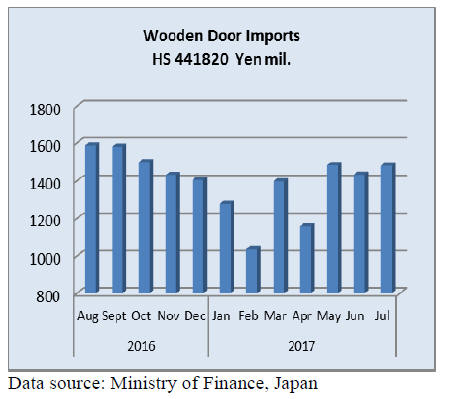

Doors

The value of Japan’s July imports of wooden doors (HS

441820) was little changed from the previous month but

was up 25% year on year.

The three main suppliers in July were China (60%)

the

Philippines (19.5%) and Malaysia (8%) just topping

shipments from Indonesia.

These three have consistently topped the league of

suppliers for the past 12 months. In contrast to the

volatility in import values seen during the early part of the

year over the past 3 months the level of monthly imports

has stabilized.

Windows

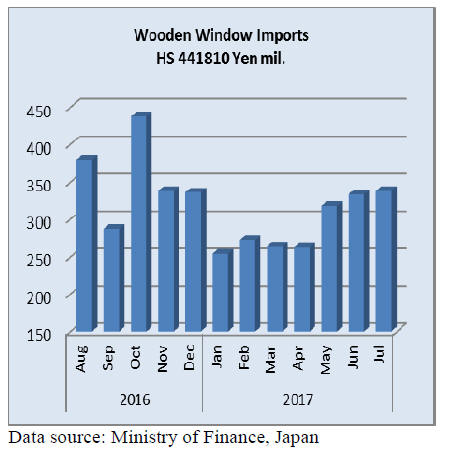

Japan’s imports of wooden windows (HS 441810) in July

were 3% down year on year but largely unchanged from a

month earlier. Shippers in 3 countries dominated Japan’s

July wooden window imports, China (36%), the

Philippines (24%) and the US (24%).

Over the past 3 months wooden window imports have

gradually risen after the lows recorded at the beginning of

the year. In the first 4 months of the year wooden window

imports fell to the lowest level for the past 3 years.

Assembled flooring

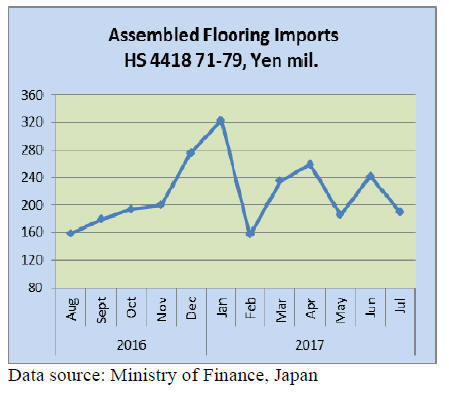

The volatility in imports of assembled wooden flooring

(HS441871-79) observed in the year to-date continues.

After rising in June the value of imports fell once more in

July. However, the seesaw trend in imports has been a

feature of deliveries for several years and as such does not

indicate any particular underlying trend.

Year on year, Japan’s July assembled flooring imports

were up 7% but compared to the value of June imports

they were down 21%. The main category of assembled

flooring imports in July was HS 441875 accounting for

just over 70% of all assembled flooring imports. HS

441873 imports and HS 441879 imports were much

smaller (9% and 19% respectively). In each category

China was the main supplier.

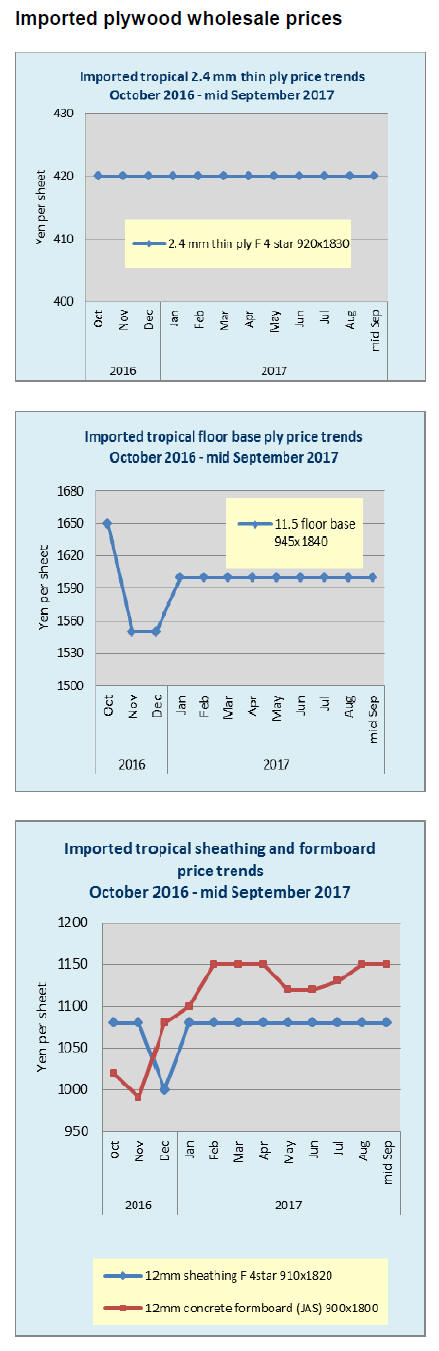

Plywood

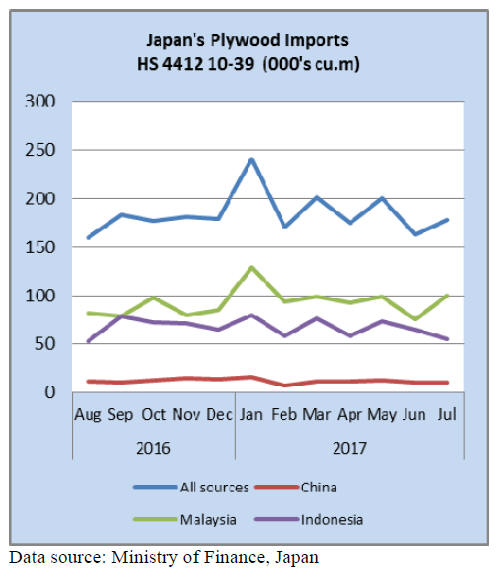

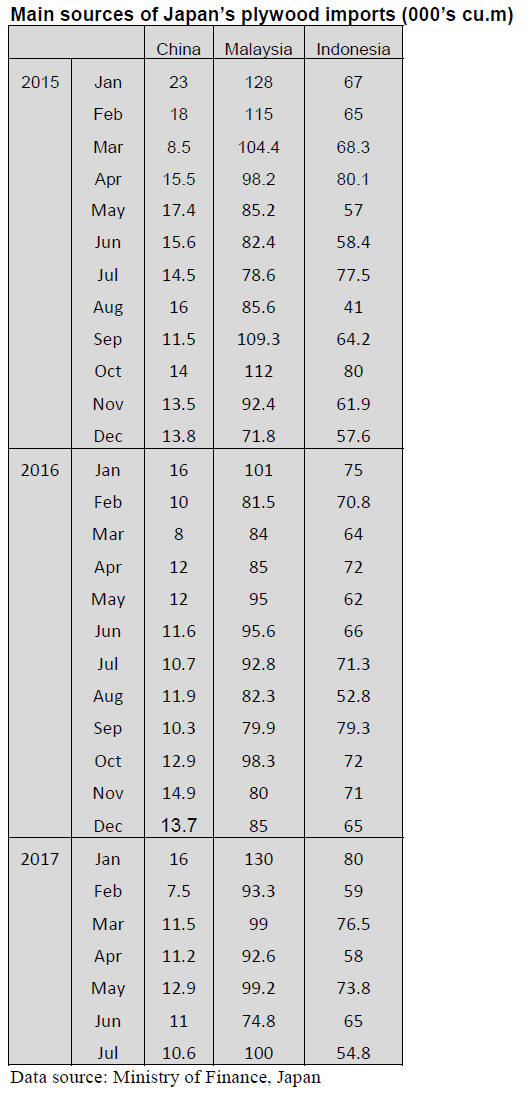

Some 88% of Japan’s July plywood imports were recorded

as HS 441231 with the balance being HS 441233 (4%) and

HS 441234 (8%). Year on year, July imports were down

5% with July imports from China being unchanged from a

year earlier, imports from malaysia rising 8% and imports

from Indonesia dropping 24%.

In July Malaysia was the main supplier of plywood to

Japan accounting for 56% of all imports followed by

Indonesia (31%) with most of the balance coming from

manufacturers in China.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (Tropical) lumber import

For the first six months of the year, import of South Sea

lumber was 235,990 cbms, 5.7% less than the same period

of last year. In this, laminated free board was 129,996

cbms, 5.1% less.

In the South East Asian countries, log procurement is

getting difficult by harvest restrictions. Indonesian lumber

manufacturers of laminated free board struggle to secure

enough logs in competition with overseas log buyers like

India and Vietnam.

Prices of Indonesian merkusii pine laminated free board

climbed to $950 per cbm C&F, which costs about 120,000

yen per cbm in Japan. Chinese red pine laminated free

board prices are also up by active economy in China.

Import volume of Indonesian free board was 47,067 cbms,

4.3% less. 14,707 cbms from Vietnam and 59,553 cbms

from China.

Hardwood lumber was 36,560 cbms, 7.2% less and

hardwood processed lumber (tongue and groove) was

56,882 cbms, 7.2% less. Rail ties were 3,336 cbms, 21.1%

less.

Wood product export in the first half of 2017

Wood products export value during January and June this

year was 15,820 million yen, 38.6% more than the same

period of last year. By destination in value, China remains

the top then Philippines increased considerably. It

increased by more than 20% to Korea.

For China market, Japanese cedar logs are more

competitive than New Zealand radiate pine logs and in

June, log export volume exceeded 100,000 cbms. For

Philippines, lumber export increased by about 30%. Total

export of plywood was 56,000 cbms out of which 90% is

gone to Philippines.

It looks like packaged export of lumber and plywood.

There is increasing share of Japanese cedar lumber

exported to Korea, which is processed in China and

Vietnam. Also precut housing materials are exported to

Korea.

New trend is lumber export to the U.S.A. The volume was

4,600 cbms, 315% more. This appears to be fence

materials in the U.S. market.

Tight supply of all types of wood panels

After supply of floor base plywood from South Sea

countries gets tight, there are structural changes in wood

panel market as floor base users try to switch to other

materials, which influences not only domestic softwood

plywood but particleboard, OSB and MDF.

Every panel manufacturers try to catch this market and

manufacture value added new products, which reduce

supply of traditional panels.

With various harvest restrictions and environmental

consideration, material log supply is getting tighter and

tighter in Indonesia and Malaysia and there are

considerable delays of arrival of ordered cargoes.

To replace hardwood to softwood, initially users had

uneasiness of quality so it took time before users decided

to use softwood plywood then since 2016, monthly

volume has been about 10,000 cbms and there are more

orders now.

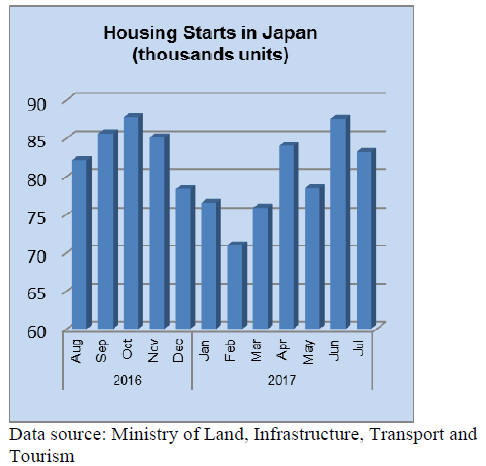

For domestic plywood manufacturers, new product is

necessary with depopulation in future in Japan but in last

two years, with active housing starts, mills are busy

catching up orders of structural panels as their priority is

to satisfy needs of structural panels and the orders

continue coming in so mills have very little time to fill up

demand of floor base panels.

Currently, South Sea countries suffer foul weather and

harvest areas are further inland so log production is very

low therefore, arrivals of floor base panel are delayed by a

month or more. The prices are up and the inventories in

Japan are extremely low.

Floor manufacturers are increasing production of

composite floor of softwood plywood and thin MDF. Sales

of composite floor in the first six months of this year were

60% more than last year and particleboard floor base is

also up by 13%. This increased demand for MDF and

OSB.

Thin MDF is necessary to make composite floor but there

are only four MDF manufacturers to supply thin softwood

MDF for flooring. Also hardwood thin MDF is getting

tight by this move. Tight supply of structural plywood is

likely to stimulate demand for particleboard bearing wall.

Therefore, shifting of floor demand is causing supply

tightness of all kind of wood panel.

Plywood

Supply of domestic softwood plywood is getting tighter

again. July plywood supply was 499,000 cbms, 0.6% less

than July last year and 0.7% more than June. The supply

was below 500,000 cbms for two consecutive months. In

this, domestic softwood plywood production was 261,600

cbms while the shipments were 262,100 cbms, 4.8% more

and 0.3% less so the inventories were 93,400 cbms.

Orders had been active from direct users like

housebuilders and precutting plants as compared to dull

orders from wholesalers but since late August, orders from

wholesale channels started picking up to build up

inventories to deal with possible supply shortage in

demand busy fall season. Now deliveries delay by about a

week or two but delay does not impact actual construction

works.

Imported plywood in July was 225,200 cbms, 6.6% less

and 3.5%more. By source, 101,900 cbms from Malaysia,

6.5% more and 32.5% more, 60,600 cbms from Indonesia,

22.6% less and 17.9% less and 47,700 cbms from China,

7.9% less and 9.5% less.

Drop of Indonesian supply is considerable and supply of

thin and medium thick plywood from Indonesia is critical

and users frantically look for substitutions.

Orders rush to domestic South Sea hardwood plywood

mills but they are not able to have enough material logs.

Meantime, on coated concrete forming plywood from

Malaysia, the importers ask over 1,300 yen per sheet due

to higher cost of future arrivals but the demand continues

slow so wholesale prices are about 1,270-1,280 yen.

|