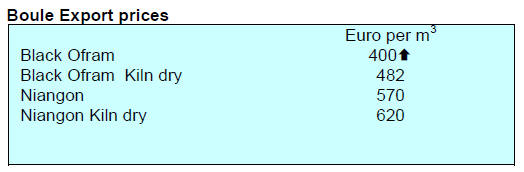

2. GHANA

Export volumes slump

The volume and value of Ghana’s timber exports has been

falling in each of the past five months. According to the

Timber Industry Development Division (TIDD) of the

Forestry Commission, the country secured Euro 62.65

million from the export of 116,952 cu.m of wood products

in the first 5 months of this year representing a 27% drop

in value and a 31% drop in volumes compared to the same

period in 2016.

The average unit price of wood products in the period

January to May 2017 dropped to Euro 536/cu.m from Euro

564/cu.m in the same period in 2016, an almost 5%

decline.

Secondary wood products (sawnwood, boules, veneers and

plywood) accounted for 82% of exports followed by

primary product exports (poles and billets) 7% with the

balance being tertiary wood products (mouldings, flooring,

dowels and furniture parts).

Asian markets accounted for close to 70% of all wood

product exports with China and India being the leading

importers.

EU imports of wood products from Ghana have been

falling over the past months. Analysts suggest the fall in

exports is most likely linked to the growing problem mills

have in securing adequate log supplies.

Because this is seen as a long term problem some millers

are asking the government to allow timber imports which

would secure existing businesses, maintain employment in

the sector and possibly lead to more investment in

processing capacity.

Growth to get boost from extension of IMF credit

facility

The Government of Ghana has extended its credit facility

programme with the International Monetary Fund (IMF)

by a year. This follows the conclusion of an assessment of

the Extended Credit Facility by the IMF’s board. The

Fund has also approved a US$94 mil. disbursement to the

government as part of the overall US$918 mil. support

programme.

A lecturer at the University of Ghana, Dr. Eric Osei-

Assibey, has applauded the extension saying it will boost

investor confidence in the economy. Ghana’s Vice

President, Dr. Mahamudu Bawumia, has said economic

growth could top 6% by the end of this year.

3.

SOUTH AFRICA

Out of recession but growth tepid

GDP figures for the second quarter of 2017released by

Statistics South Africa (StatsSA) showed growth of 2.5%,

a reversal of the 0.7% decline reported in the first quarter.

Analysts say that, while the South African economy has

snapped the technical recession, GDP growth is not strong

enough with projections for 2017 GDP likely to be below

1%.

The South African economy has been dragged down by a

deterioration in both consumer and business confidence,

much of which is due to the uncertain political

environment.

Negative sentiment and weak currency weighing on

construction sector

According to StatsSA, the total value of recorded building

plans passed in the country grew by 6% cent in 2016

compared to a year earlier.

However, the pace of growth slowed this year due to

the

economic slowdown, poor investor sentiment, high

unemployment and a weak currency all of which are

weighing on the construction sector spending.

Government efforts to balance supply and demand for

social housing will be the main driver of demand for new

residential units and the continued trend to urbanization is

generating demand for residential and infrastructure

development.

Take-aways from Master Builders’ Congress

Speaking at the Annual Congress of Master Builders SA

the South African Minister of Economic Development,

Ebrahim Patel, said the his department is consulting with

the National Treasury with a view to securing a multiyear

budget system which would help the construction

sector weather the cyclical trends in investment especially

for large scale projects.

In looking ahead the Minister said” the South African

economy has been impacted by the change in China’s

growth model and by African growth levels tapering

down”.

Adrian Saville, Chief strategist at Citadel Investment

Services, told the Master builders Congress that spending

on its infrastructure development projects are key in

driving the economy forward but that government

investment in infrastructure has fallen and is dragging

down the overall economy .

Data show that infrastructure investment had fallen below

target by between 1.8% and 3.8% over the past 5 years. He

pointed out that “South Africa required an infrastructure

investment rate of between 7 to 9 percent per annum to see

any real growth in the economy. The country has only

invested 5.2 percent from 2010 to 2015.”

In concluding he said prospects are not good as the South

African economy is not growing fast enough to lower

unemployment.

4.

MALAYSIA

Raw material and labour shortages

to drive down

export prospects

The Ministry of Plantation Industries and Commodities

(MPIC) has revised projections of the country’s woodbased

exports from RM53 billion a year to between RM25

and RM30 billion by 2020. In 2009, the MPIC had

projected that the wood-based exports will hit RM53

billion by 2020.

Minister Mah Siew Keong said the revision was made due

to a likely shortage of raw material as well a shortage of as

skilled and unskilled workers. First half year wood product

exports totalled RM11.5 billion, a 5.2% increase year-onyear.

In 2016, exports stood at RM22 billion.

Mah said it is crucial for the government and sector

stakeholders to overcome the shortage of labour and of

raw materials and to embrace e-commerce and

digitalisation to improve profitability.

At a recent National Timber Industry Policy (NATIP)

gathering, the Minister reported that his ministry will also

implement a national initiative, namely the development

of the 2050 National Transformation Plan for the

commodity sector including the timber industry.

Belt and Road Initiative

After the new US administration pulled out of the Trans

Pacific Partnership the attention of Malaysia has shifted to

China’s Belt and Road Initiative (BRI). This is perhaps

China’s biggest initiative to date in an effort to energise

the global economy through infrastructure projects in 65

countries.

The BRI refers to the land-based "Silk Road Economic

Belt" and the seagoing "21st Century Maritime Silk

Road". The routes cover more than 60 countries and

regions from Asia to Europe via Southeast Asia, South

Asia, Central Asia, West Asia and the Middle East,

currently accounting for some 30 per cent of global GDP

and more than 35 per cent of the world's merchandise

trade.

Malaysia is assessing the potential in the new markets

being opened up by the BRI especially commodity

products. In 2016, exports of major commodities were:

palm oil RM 67.58 billion; rubber and rubber products

RM 24.79; timber and timber products RM 21.86 billion

and cocoa RM 5.74 billion.

Boosting furniture sales to China

In a 10 September press release the Malaysian Timber

Council (MTC) said China continues to provide healthy

gains for Malaysian furniture manufactures. The two

countries have enjoyed healthy trade ties and aim to

achieve a bilateral trade worth US$160 billion by 2020.

In 2016, timber and wood products exports to China were

valued at RM846.8 million, an almost 4% increase from

the previous year. Furniture remains the main export of

Malaysian timber products to China in value terms,

amounting to RM121.7 million which marks a 91%

increase from the previous year.

To build on the strong trade ties the MTC participated in

the China International Furniture Expo organised by the

China National Furniture Association and Shanghai UBM

Sinoexpo International Exhibition Co Ltd.

This year, the exhibition was held 12-15 September at the

Shanghai New International Expo Centre (SNIEC) in

Pudong, Shanghai, China. The exhibition will run

concurrently with the Furniture Manufacturing and Supply

China 2017 event at SNIEC.

Last year, 18 companies participated in the fair under

MTC’s Malaysia Pavilion. This year, MTC lead a

delegation of 20 companies to showcase their best selling

products under the Council’s Malaysia Pavilion.

For more see:

http://mtc.com.my/images/media/508/201707_Furniture_China_

2017_-_Pre_release_ENG.pdf

Agarwood entrepreneurs promote wide range of

products

The Malaysian Timber Industry Board (MTIB) organised

the inaugural Malaysia Agarwood Fair to further develop

the Karas (Kekaras) and Agarwood industry in Malaysia.

The exhibition was held in Kuala Lumpur. This three-day

exhibition gathered Malaysian Agarwood entrepreneurs

and promoted their products to the public. It was also a

platform for local entrepreneurs to exchange ideas and

experience of agarwood.

Kekaras is a gaharu-producing tree from the Aquilaria

species. There are 22 Aquilaria species worldwide, out of

which five are found in Malaysia namely; Aquilaria

malacenssis, beccariana, hirta, rostrata and microcarpa.

Locally known as gaharu, Agarwood is now considered an

important non-timber forest product. It has been used for

hundreds of years for medicine and as basic material to

produce perfumes. Today, Agarwood is traded in more

than 18 countries and demand has risen significantly over

the past 30 years.

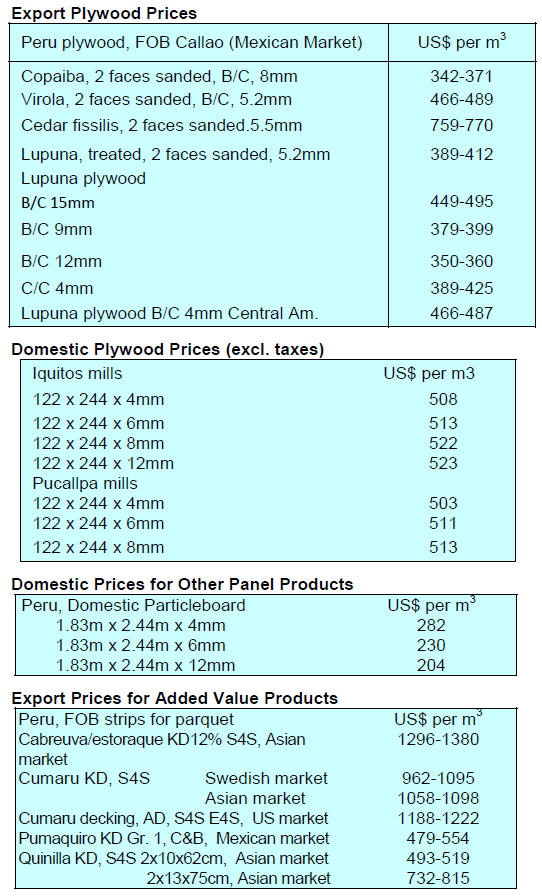

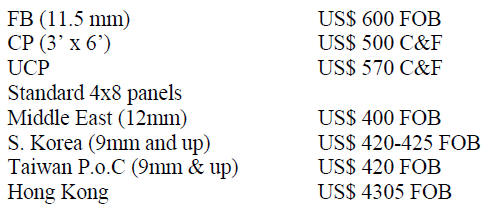

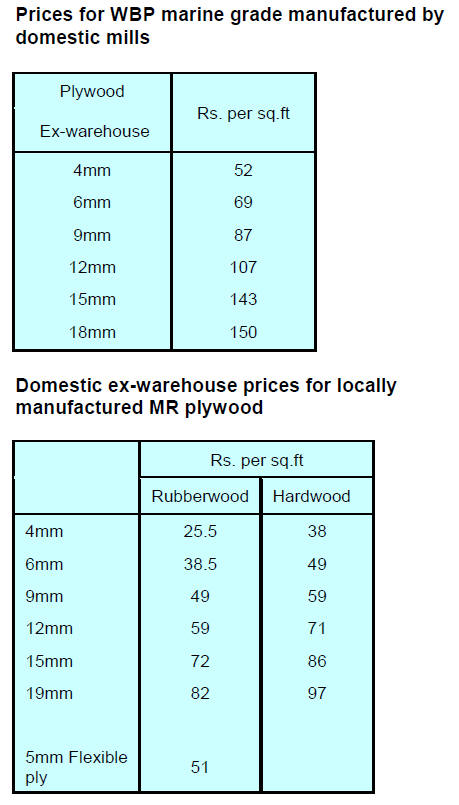

August plywood prices

Plywood traders based in Sarawak reported the following

export prices:

5. INDONESIA

SFM information system to be launched

Indonesia’s Ministry of Environment and Forestry has

launched a Sustainable Forest Management Information

System (SIPHPL). The system is intended to improve

transparency and accountability in the timber supply

chain.

The Minister of Forestry, Siti Nurbaya, said she expects

the system will reconcile data on the timber supply chain.

Later this system will be combined with the existing

Timber Product Administration Information System

(SIPUHH), Non-Tax State Revenue Information System

(SI PNBP), Information System of Online Wood Industry

Raw Material Fulfillment Plan (SIRPBBI), Electronic

Monitoring and Evaluation (E-Monev), and Legality

Information System Wood (SILK).

Eventually all logs will have a barcode to facilitate

tracking, revenue collection and elimination of illegal

timber.

In related news the Indonesian Forest Entrepreneurs

Association (APHI) believes that adopting digital

information systems in forestry will encourage better

management. APHI Chairman, Indroyono Soesilo, says a

sustainable forest management information system will

stimulate more efficient forest management which in turn

could enhance the performance of business sector.

Calls for review of timber permit system

Regulatory problems are still an obstacle in the

development of furniture and handicraft industry in

Indonesia. Of particular concern is the timber utilisation

permit system which is difficult for small industries to

comply with.

Chairman of the Indonesian Furniture and Handicraft

Industry Sssociation (HIMKI) in Slema, Raya Rian

Hermanan, is asking policy makers to review the permit

system as this is a considerable constraint for businesses.

Furniture exporters face tough competition in

international markets

The President/Director of PT Integra Indocabinet, Halim

Rusli, has said, while it is now easier to secure verified

legal raw materials, the Indonesian furniture industry is no

more competitive than other Asian countries in the main

international markets.

In addition, said Halim, only a handful on Indonesian

companies are serious exporters shipping a mere 50-60

containers per month to the US market. This is because

most companies are constrained by government

regulations related to timber legality verification system

(SVLK).

According to Halim, competition in the US furniture

market is fierce with China accounting for around 50% of

US imports and Vietnam also capturing a large slice of the

market.

This is unfortunate, said Halim, as Indonesia has the raw

materials and human resources for a vibrant furniture

export sector.

According to Gati Wibawaningsih, Director General,

Small and Medium Industry Sector in the Ministry of

Industry, the government plans to help small and medium

industries, especially those in the furniture sector to

market their products online.

She said, data is showing that online sales are outpacing

conventional marketing options. It appears that growth of

conventionally marketed furniture has been growing by

about 1% per year while online market growth is around

5%. The government plans to work with the private sector

and provide training on on-line selling techniques.

6. MYANMAR

New teak plantation investment approved

According to a press release from the Myanmar

Investment Commission a permit has been issued to UKbased

Global Agricultural Joint Venture Co Ltd. for the

establishment of teak plantations.

The investment is said to amount to USS115 million. The

area allocated for plantation development is in the

vicinity of Bago Yoma, a range of low mountains and

uplands between the Irrawaddy and the Sittaung River in

central Myanmar.

Commercial logging of the natural forest was suspended in

this area for ten years starting from 2016-17. This

investment is said to be in line with the policy of

government to ensure adequate forest resources and

expanded forest cover.

Joint venture reveals tax payments

The Myanmar Forest Joint Venture Corporation, the only

operational joint venture in the forestry sector, held its

Annual General meeting recently where it announced

gross profit of 3,515 million Kyats (around US$2.6

million).

The Forest JV Corp. stated it paid around US$13 million

in corporate tax, commercial tax and other taxes to the

state over the past 23 years. The government holds a 55%

share in this joint venture.

Infrastructure developments to open inland trade

Myanmar transport authorities are ready to pilot the

shipping of containers from Thilawa Port Myanmar

International Terminals, a deep river port 25 kilometres

south of Yangon in Myanmar to Simikhone Port.

The Simikhone Ayeyarwaddy harbour is under

construction in the Myothar Industrial City close to

Mandalay.

The test shipment will be overseen jointly by the Inland

Water Transport Authority and SA Marine Co.

In related news, India and Myanmar recently concluded an

agreement to strengthen maritime security cooperation

under a ‘White Shipping Agreement’, an information

protocol that provides for the exchange information on

shipping in oceanic territories.

7. INDIA

Housing starts crash in first half of year

Property consultant firm Knight Frank has reported that

housing starts in India’s eight largest cities fell over 40%

in the first half of 2017, the biggest drop in the last seven

years. The weak market sentiment was, said the

consultants, due to the lingering effects of demonetization

and the problems builders are having dealing with new

regulations.

The worst affected cities were the National Capital Region

(NCR) and Ahmadabad which saw a drop of over 70% in

starts compared to a year earlier. On the bright side, the

Knight Frank report says affordable housing contributed

around 71% of the total launches in the first half of this

year up from a share of 52% in the first half of last year.

In related news Knight Frank has reported that India is

amongst the top 10 price appreciating housing markets.

For more details see:

http://www.knightfrank.co.in/news/india-among-top-10-priceappreciating-

housing-markets-knight-frank-global-house-priceindex-

q2-2017-011952.aspx

and

http://www.livemint.com/Companies/LqbH0BigmF7B4ekXhyY

TDP/Home-launches-in-JanuaryJune-fall-41-in-biggest-declinein.

html

Huge volume of illegal red sander logs seized

Red sander logs valued at Rs160 million were seized by

officials of the Directorate of Revenue Intelligence (DRI).

The logs were en-route from Chennai Port to Port Klang,

Malaysia.

A press release from the DRI said the goods had been

declared as garments and floor mats.

The export of red sanders in any form is prohibited.

Over

the past 3 years the DRI in Chennai seized 176 metric

tonnes of red sanders logs worth over Rs710 million.

Imported plantation teak

Demand for imported plantation teak remains steady. But

the burden on wholesalers of paying almost 24% in basic

duty plus GST and surcharges on logs is stretching their

cash flows to the limit. Pressure continues for a revision of

the GST on wood and wood products.

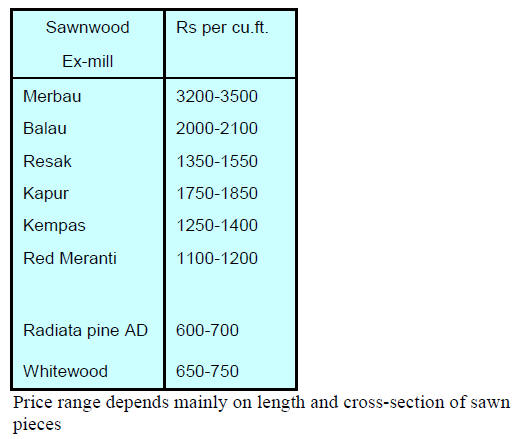

Locally sawn hardwood prices

Exmill prices for hardwoods are unchanged but are subject

to an 18% GST.

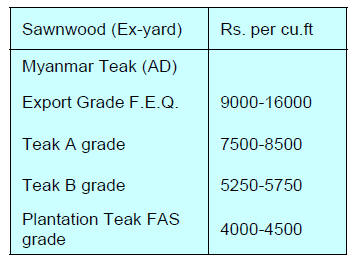

Myanmar teak prices

There were no changes in prices over the past two weeks

and the availability of sawn Myanmar teak is reported as

satisfactory. However, sales have been affected by the

high GST rates.

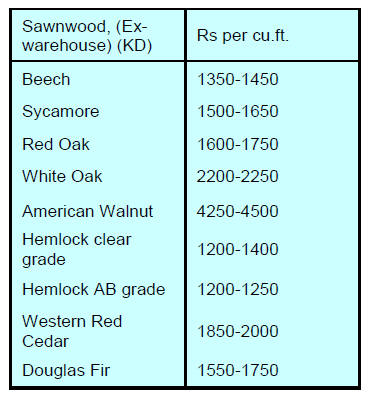

Prices for imported sawnwood

Prices for imported sawnwood (KD 12%) remain

unchanged.

Plywood prices

Until the outcome of negotiations on the GST rates for

panels prices remain unchanged.

8. BRAZIL

Furniture export set to grow

After the market instability of 2016 the performance of the

Brazilian furniture industry has started to improve.

Between January to March this year furniture exports

totalled U$141 million, an 8% increase compared to the

same period in 2016.

According to IEMI (IEMI - Inteligência de Mercado)

analysis of data from the Ministry of Development,

Industry and Foreign Trade (MDIC), around 26% of

exports went to the US followed by 12% to the UK and

10% to Argentina.

Expectations for further expansion of exports in the

second half of 2017 are high even though the pace of

export growth appears to be slowing.

The industry cites rising costs as a major hurdle to be

overcome. IEMI expects a rise of 4.5% in furniture exports

in dollars for 2017.

The range of styles and quality of Brazilian furniture

industry has widened in recent years which is giving a

boost to exports according to the Brazilian Foreign Trade

Association (Associação de Comércio Exterior do Brasil -

AEB).

Economic importance of the planted forest industry

According to the Brazilian Tree Industry (IBA) 2017

report launched recently, in 2016 the Brazilian planted

forest sector experienced a crisis stemming from the

severe weakening of the national economy and forestry

sector growth fell 3.3% compared to a year earlier.

Although this 3.3% decline was significant it was lower

than seen in the overall economy (-3.6%), in the industry

in general (-3.8%) and in agriculture (-6.6%). In 2016 the

Brazilian planted forest sector contributed 1.1% to total

GDP and 6.2% of the industry sector contribution to GDP.

The Brazilian planted forest sector was responsible for

generating R$11.4 billion in federal, state, and municipal

taxes throughout 2016, which corresponds to 0.9% of all

taxes collected in the country. However, this was 5%

down year on year due mostly to the drop in domestic

sales of paper, wooden panels and solid wood products.

In 2016, export revenue from the Brazilian planted forest

industry reached US$8.9 billion, a 1.1% decrease

compared to 2015. A drop in export prices for these

products was the main reason for the fall in revenue. In

terms of volume there was a 14% increase compared to the

previous year.

Research group promotes forestry for local

communities

The Mamirauá Institute (MI), which maintains a research

group on forest ecology, is monitoring forest recovery in

the Amazonas State, northern Brazil. This is being done to

assess the sustainability of current timber management

regimes as forestry is an alternative income source for

several Amazonian communities.

The work of the institute has been recognised and certified

by the Bank of Brazil (BB) Foundation (Fundação Banco

do Brasil) and through certification the MI initiatives has

become part of the Social Technology of BB Foundation

serving as an example to be replicated in other areas.

The Mamirauá Institute's Community Forest Management

Programme is funded by the Amazon Fund, managed by

the National Development Bank (BNDES).

The Bank of Brazil Foundation´s award counts on support

from UNESCO in Brazil, the Latin American

Development Bank (CAF), the World Bank, the Food and

Agriculture Organization of the United Nations (FAO) and

the United Nations Development Program (PNUD).

9.

PERU

Two companies lead furniture imports

The combined furniture imports of two retailers, Peruvian

Homecenters (Promart) and Sodimac accounted for 51%

of the total US$30 million furniture imports into Peru in

the first half of this year.

Imports by Promart, the brand used by Peruvian

Homecenters stores, grew 24% compared to the first half

of 2016, while first half imports by Sodimac grew 68.4%

compared to 2016. Other main importers of furniture were

Saga Falabella and Tottus Hypermarkets.

Brazil was the main supplier of furniture to Peru in the

first half of 2017 at US$ 20.2 million followed by China

(US$3.3 million), the United States (US$1 million) and

Malaysia (US1 million).

Promotion of conservation of Amazon forests

Under the National Forest Conservation Programme for

the Mitigation of Climate Change (Forest Program) the

regional government of Loreto and the Ministry of the

Environment (Minam) are joining forces to promote the

conservation of some 350,000 hectares of forests.

The Minam Forest Program provides economic incentives

to native communities for the development of productive

activities, strengthening surveillance of the forest and

improving communal management. The aim is to have

within two years approximately 350,000 hectares under a

forest conservation plan.

However, despite the best efforts of the authorities,

according to the National Forestry and Wildlife Service

(Serfor) in 2016 at total of 164,662 hectares of Amazon

rainforest were lost, an increase of 5.2% over 2015. The

Departments with the greatest loss of forest cover

compared to 2015 were Junín, Loreto, Cusco, Cajamarca,

Puno, Ayacucho, Huancavelica, Piura, Amazonas and

Pasco.

The monitoring carried out in 15 Amazonian departments

shows that in Loreto (northern area), Ucayali (Curimana),

Madre de Dios (Río Tambopata) and Junín (Anapati

River) forest losses have been recorded due to natural

events that occurred during the last three years, apparently

from wind and floods but the authorities say this requires

more detailed analysis.

During the period 2001 to 2016 there was a loss of

1,974,209 hectares of Amazon rainforest, with an annual

average loss of 123,388 hectares.

Serfor Executive Director, John Leigh, said that with these

data call for immediate preventive action against

reforestation. He emphasised that Minam is also aware of

the early warnings of an increase in loss of forest cover.

Forest Investment Plan to cut rate of

deforestation

In October 2013 Peru's Forestry Investment Plan was

approved. This was created to contribute to the reduction

of deforestation. The plan is supervised by the Ministry of

the Environment (Minam).

Three projects formulated with the support of the Inter-

American Development Bank (IDB), have been authorised

for execution beginning in 2018. A fourth project is

currently being formulated with the assistance of the

World Bank (WB) for review in late 2018.

Peru is one of the first eight countries to benefit from the

Forest Investment Program (FIP), an initiative of the

Climate Investment Funds (CIF) established by agreement

by member countries of the United Nations Framework

Convention on Climate Change in 2008.

The main objective of the FIP is to promote and facilitate

measures to promote transformational changes in public

policies for the reduction of greenhouse gas (GHG)

emissions in developing countries.