|

Report from

Europe

Slowing pace of EU tropical timber imports during first

half

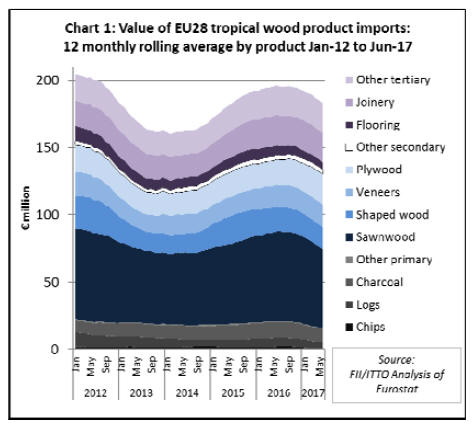

The slowdown in EU imports of tropical timber products

registered in the first quarter of 2017 continued into the

second quarter. Twelve monthly rolling average imports,

which peaked at just below Euro196 million in June 2016,

fell to Euro183 in June 2017. Most of the rise and

subsequent slowdown in EU tropical imports was driven

by sawn wood. (Chart 1).

The decline in EU tropical wood imports this year is, in

some ways, even more troubling than other larger

downturns which have regularly afflicted the European

trade in the last decade. The downward trend runs contrary

to broader economic conditions across the continent

which, while hardly buoyant, are more robust than at any

previous time in the last five years.

The downturn comes at a time when EU tropical wood

imports have barely recovered from the all-time low of

2013 and affects nearly all products and EU markets.

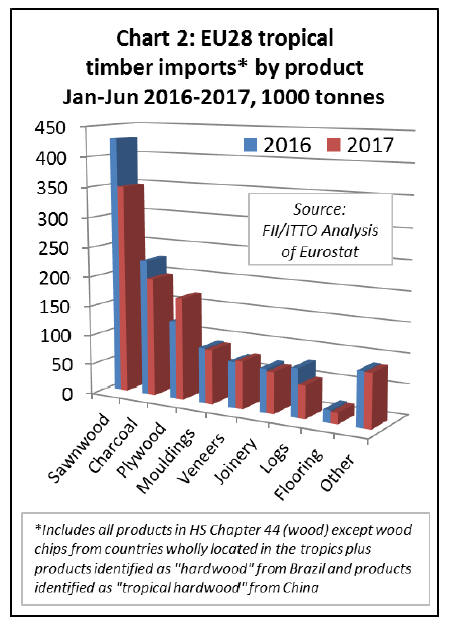

Only plywood and veneer imports rise in first quarter

In the first half of 2017 compared to the same period in

2016, total EU imports of tropical timber products

declined 8% to 1.12 million metric tonnes (MT).

There was an 18% decline in EU imports of tropical sawn

to 349,000 MT, a 13% decline in imports of tropical

charcoal to 199,000 MT, a 33% decline in imports of

tropical logs to 54,000 MT, and an 11% decline in imports

of tropical flooring to 19,000 MT.

These losses were only partly offset by a 31% rise in

imports of tropical plywood to 171,000 MT and a 3% rise

in imports of tropical veneer to 78,000 MT. (Chart 2).

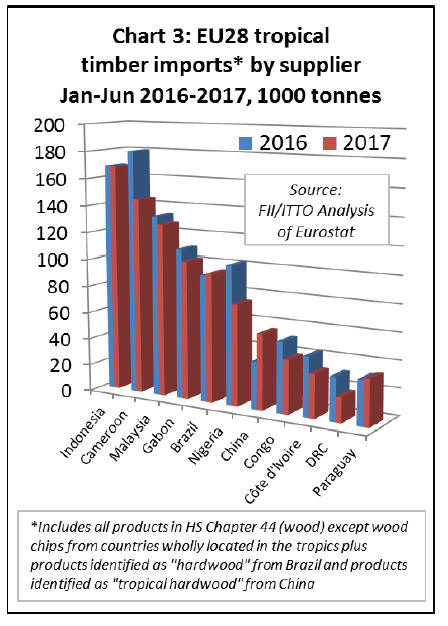

The EU imported 168,000 MT of tropical timber products

from Indonesia in the first 6 months of 2017, exactly

equivalent to the same period in 2016. This is much less

than hoped since Indonesia became the first country to

issue FLEGT licenses in November 2016. However,

Indonesia has performed better than nearly all other

tropical timber supplying countries in the EU market this

year.

EU imports declined from all other major tropical

supplying countries in the first half 2017, with the lone

exception of Brazil. Imports from Brazil were 95,000 MT

during the period, a slight (2%) increase compared to the

first half of 2016.

EU imports of tropical products (nearly all plywood) also

increased 60% from China to 56,000 MT in the first half

of 2017.

In contrast, direct EU imports of tropical products from

Cameroon declined 20% to 145,000 MT, Malaysia

declined 4% to 128,000 MT, Gabon declined 8% to

102,000 MT, Nigeria declined 27% to 75,000 MT (mainly

charcoal), Congo declined 24% to 40,000 MT, Côte

d'Ivoire declined 27% to 32,000 MT and DRC declined

43% to 19,000 MT. (Chart 3).

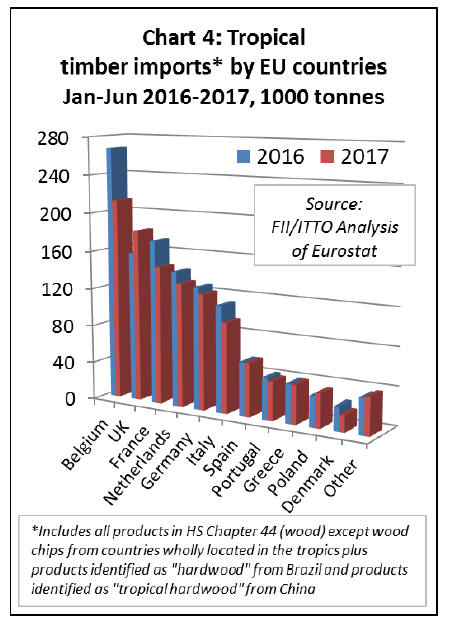

After rising strongly in 2016, imports of tropical timber

products in Belgium declined 21% to 212,000 MT in the

first half of 2017. Imports in France, Germany and Italy,

which were sliding in 2016, declined further in the first

half of 2017.

Imports fell 16% to 146,000 MT in France, 5% to 122,000

MT in Germany and 16% to 95,000 MT in Italy. After

showing signs of recovery last year, imports in the

Netherlands weakened in the first half of 2017, falling 8%

to 131,000 MT. (Chart 4).

Improving Euro zone economies not lifting tropical

imports

The decline in tropical wood imports into eurozone

countries is surprising given evidence of improving

economic conditions in the region. Growth in the eurozone

picked up to its fastest pace since 2011 in the second

quarter of this year, with GDP in the past 12 months rising

by 2.2%.

In the three months to June the eurozone economy grew

by 0.6%, matching the same healthy number from the first

quarter of the year. German GDP grew by 0.6% in the

quarter, Spain¡¯s by 0.9%, France¡¯s by 0.5% and the

Netherlands by an unexpectedly strong 1.5%.

This positive trend has contributed to a sharp increase in

the euro-dollar rate, from 1.05 in early January 2017 to

nearly 1.20 by the end of August. It¡¯s possible that this rise

in rates is acting temporarily to discourage imports. EU

buyers are often unwilling to build stock at a time when

euro import prices are falling and they anticipate further

price decreases in the future.

It is significant that the UK is the only major EU market

where tropical wood imports held up well in the first half

of 2017. UK imports increased 21% to 90,000 MT during

the period.

Again, this seems to conflict with underlying economic

trends. The UK grew by 0.3% in the second quarter of

2017, a significantly slower rate of increase than the major

eurozone economies. Much of this growth was driven by

the service sector. Industrial output shrank by 0.4% and

construction contracted by 0.9% during the same period as

uncertainty has mounted since the Brexit vote.

This uncertainty is also reflected in exchange rates. The

British pound has weakened sharply against the euro and

stayed quite flat against the dollar this year. In contrast to

eurozone importers, those in the UK had an incentive to

build stock in the first half of 2017 in expectation of a

further weakening in the exchange rate and rising import

prices later in the year.

If the divergent trend in UK and eurozone imports of

tropical timber in the first half of 2017 is driven mainly by

short-term changes in exchange rates, then a reversal may

be expected in the second half of the year - UK imports

are likely to slow and eurozone imports to rebound again.

However, if the downward trend in the EU tropical timber

trade continues, even as economic activity recovers in the

eurozone, then it will be necessary to look to more

fundamental causes.

It is possible, for example, that the combined effect of

increased EUTR enforcement, limited availability of

independently certified or legally verified tropical timber,

the difficulty of demonstrating negligible legality risk in

the absence of such certification, the existence of large

alternative markets where there is still little demand for

such assurances, and the further development of wood and

non-wood substitutes, will be a long-term and ever

deepening slump in the EU market for tropical timber

products.

|