Japan

Wood Products Prices

Dollar Exchange Rates of 25th

August 2017

Japan Yen 109.30

Reports From Japan

Inflation to gain solid foundation if wages

rise

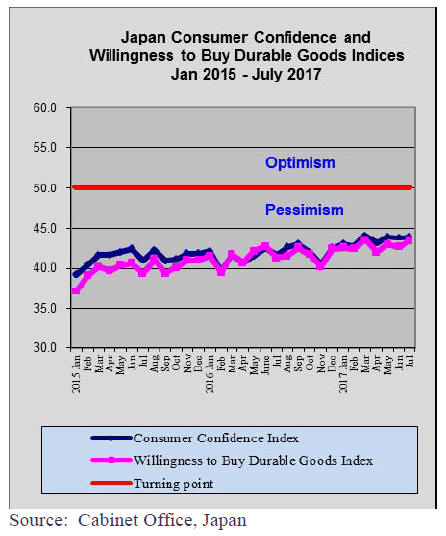

Rising energy costs lifted in inflation in July and an

upward trend would be driven by further gains in energy

costs and could be sustainable if wage growth and

consumption pick up.

The Ministry of Internal Affairs reported that the core

consumer price index for July, which excludes fresh food

prices, rose 0.5% marking the seventh consecutive

monthly rise. As unemployment in Japan is currently very

low wages should rise which would lift household

incomes and encourage consumer spending.

However, the Bank of Japan (BoJ) Governor, Haruhiko

Kuroda, warned that the 2% inflation target remains

distant and that the current pace of growth in the Japanese

economy looks unsustainable. He said “I think (the recent

quarterly) 4% growth is excellent but we don’t think 4%

growth can be sustained. Around 2% growth is likely.”

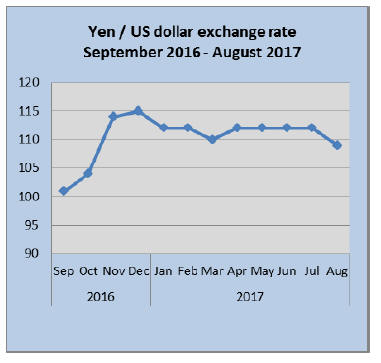

Yen testing new strength

The yen continued to strengthen against the US dollar in

the second half of August helped by the weaker US dollar

and reports that suggest US inflation is not matching the

Federal Reserve’s targets.

The Yen was hovering at around 109/110 to the US dollar

in late August. As annual inflation is still now where near

the BoJ target of 2% it is very unlikely that the BoJ will

change course on interest rates any time soon.

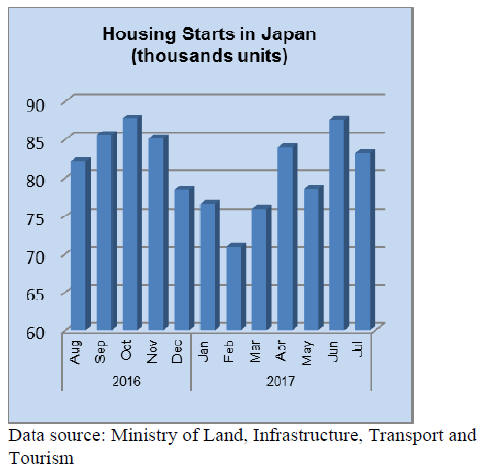

Housing starts affected by holidays

The August ‘Bon’ holiday in Japan is on a par with the

New Year’s holiday in terms of importance and family

preparations. While not an official holiday, almost all

companies close for 4-5 days and families head out of the

cities back to their hometowns.

With construction companies losing 4-5 days of work time

it is not surprising that housing starts in August dipped.

However, August 2017 starts were some 2% below levels

in August 2016 and compared to July starts were down

5%.

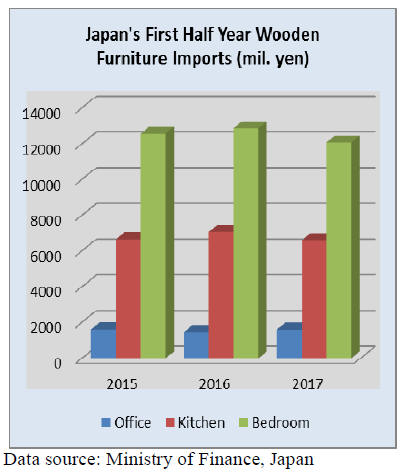

Japan’s wooden furniture imports

Bedroom furniture dominates Japan’s wooden furniture

imports followed by kitchen furniture and office furniture.

While wooden office furniture imports in the first half of

2017 were higher than in the two previous years office this

was not the case for either kitchen or bedroom furniture

where the value of imports in 2017 was down on the two

preceding years.

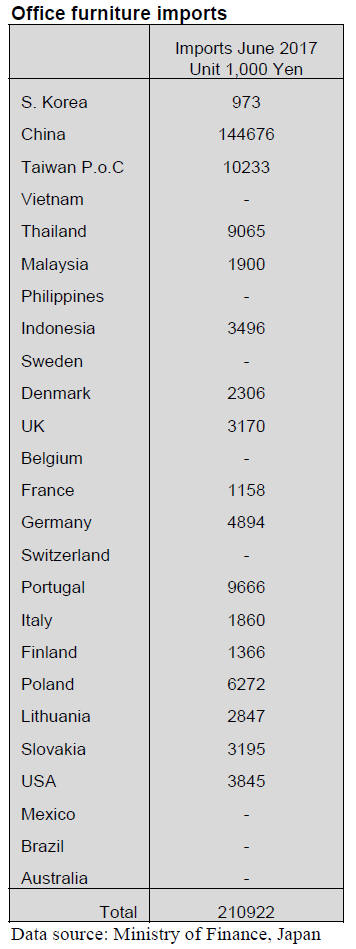

Office furniture imports (HS 940330)

In June three shippers, China, Taiwan P.o.C and Portugal

accounted for almost 79% of Japan’s wooden office

furniture imports.

China is the largest supplier at 69% of all June

2017

imports of the product followed by Taiwan P.o.C (5%) and

Portugal (4.5%). Shippers in Thailand accounted for

around 4.5% of June 2017 wooden office furniture imports

by Japan.

Year on year, June 2017 imports of wooden office

furniture were 50% higher than in June 2016 when office

furniture imports fell dramatically. Month on month June

2017 wooden office furniture were down 20%.

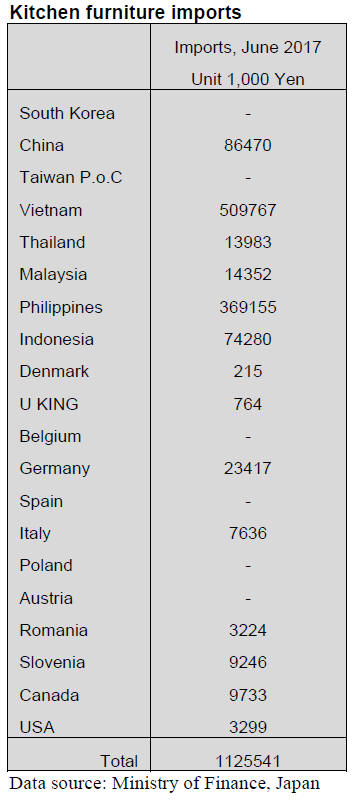

Kitchen furniture imports (HS 940340)

Year on year, Japan’s imports of wooden kitchen furniture

fell slightly (-4%) but compared to the value of May

imports there was a modest rise in June.

The top three shippers of kitchen furniture to Japan,

Vietnam, the Philippines and China continue to account

for almost all (86% in June 2017) of Japan’s wooden

kitchen furniture imports. In June, imports from Vietnam

rose 9%, imports from the Philippines jumped 16% while

imports from China fell over 30%.

The main EU shippers of wooden kitchen furniture to

Japan are Germany and Italy but shipments are small

compared to those from Asian suppliers.

Bedroom furniture imports (HS 940350)

The volatility in the value of Japan’s imports of wooden

bedroom furniture reported in previous reports continued

into June 2017. After appearing to recover in May the

value of June 2017 imports dipped again dropping 9%.

Year on year, June 2017 imports of wooden bedroom

furniture dropped 9%. China was the main supplier in

June, continuing its dominance of bedroom furniture

imports into Japan but June shipments from China were

flat.

On the other hand, shipments from the other main

suppliers, Vietnam and Malaysia, were moving in opposite

directions. June shipments from Vietnam dropped 20%

while shipments from Malaysia rose 11%.

The top three suppliers of wooden bedroom furniture

to

Japan in June were China (62% of all arrivals), Vietnam

25% of arrivals and Malaysia a modest 3% of arrivals.

For the first time this year the value of shipments from

Mexico were high enough to enter the top shippers.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (Tropical) logs

Demand for South Sea hardwood logs for plywood

manufacturing has been declining year after year. Import

of logs for the first half of this year was only 61,527 cbms,

33.6% less than the same period of last year. There are

only several mills using South Sea logs in Japan and log

importers have difficulty to make one full shipload.

In Sarawak, Malaysia, timber premium was raised about

US10 per cbm since last July so meranti regular log FOB

prices for Japan are about US300 per cbm, US15 up from

June. In Japan, log prices are up by 500 yen to 12,000 yen

per koku. This price is more than twice as high as North

American Douglas fir logs and Russian logs for plywood.

Hardwood lumber demand is mainly free board of South

East Asian products, which is used for window frame and

interior finishing of stores. Imported volume in the first six

months was 235,990 cbms, 5.7% less.

Lumber manufacturers in producing regions have hard

time to secure materials logs due to harvest restrictions

and increase of imposing tax. Indonesian mercusii pine

laminated free board prices are about US960, US50

increase in last several months. The prices in Japan are

110,000 yen per cbm. The importers need to have 120,000

yen.

Keruing and merapi solid wood lumber has particular use

for truck body and ships’ interior. The volume is limited

but the prices have been increasing so users look for

substituting materials.

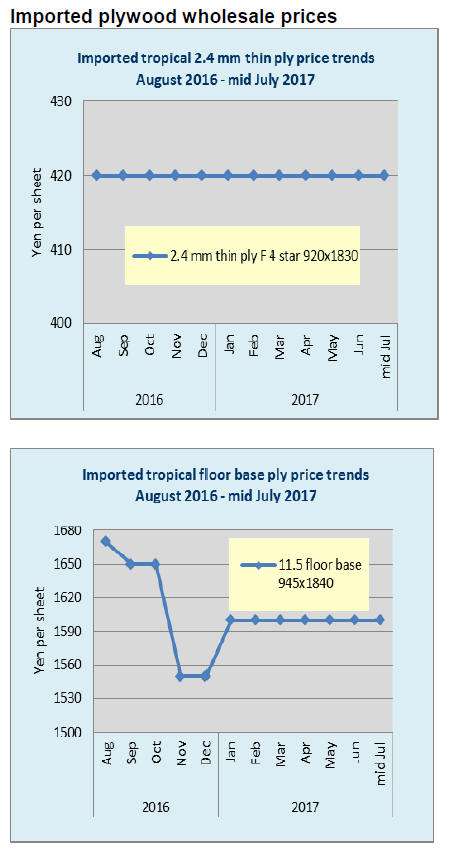

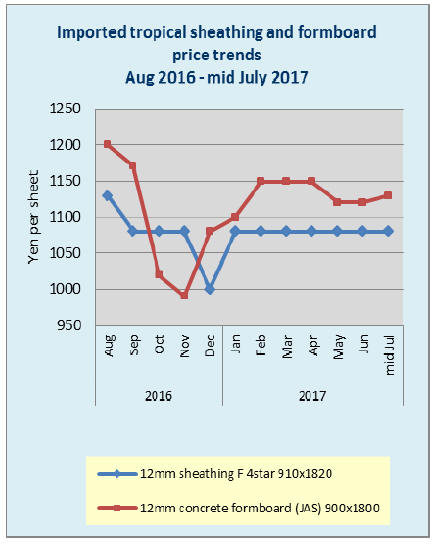

June plywood supply

Total plywood supply in June was 495,500 cbms, 0.1%

less than June last year and 3.3% less than May. Domestic

plywood supply continued high by full production of

plywood mills so the supply exceeded 270 M cbms after

three months since last March.

Meantime, imported plywood volume declined to 217,000

cbms because of decrease of Malaysian supply, which was

about 22% less than June last year.

Domestic softwood plywood supply was 286,600 cbms,

6.7% more and 9.4% more. Supply tightness is now

disappeared and the mills can make immediate deliveries.

The demand by large house builders and precutting plants

have ample orders since April so that orders for plywood

continue firm and steady.

The shipment was also firm with 263,000 cbms, 3.0%

more and 9.4% more. This is the highest monthly

shipment in last three years.

The inventories of softwood plywood were 93,900 cbms,

2,600 cbms more than May but the level of inventories

continue low.

Decrease of Malaysian plywood in June was large with

22.0% less than June last year and 24.6% less than May.

Plywood mills in Malaysia and Indonesia suffer log supply

shortage by foul weather so the shipments delay by about

a month and a month and half.

Log supply shortage continues in July and August so

major supplier in Sarawak, Malaysia announced 30%

production curtailment after September. Volume of

imported plywood seems to continue declining in coming

months.

North American logs and lumber import for the

first six

months

Imported volume of North American logs for the first half

of the year was 1,369,400 cbms, 8.5% less than the same

period of last year. North American lumber was 1,096,004

cbms, 2.4% more.

Decrease of log import is result of high import volume of

last year and increase of lumber is also reflected by

smaller volume of last year. Compared to 2015, log import

is 6.8% more and lumber is 4.8% less.

Supply of Douglas fir and hemlock logs and lumber on

coastal regions was tight due to log supply shortage by

severe winter weather. SPF lumber supply from interior

was steady but now future supply may be affected

expanding forest fires in interior of British Columbia.

By supply source, logs from the U.S.A. were 881,142

cbms, 11.6% less than the same period of last year and

from Canada were 487,988 cbms, 2.4% less.

Log prices in the U.S.A. have stayed at high level,

supported by active domestic market and expansion of log

export to China. Demand for Canadian logs is supported

by active production of plywood mills in Japan but winter

weather was also severe in coastal B.C. so the log prices

also stayed up high.

By species, all the species except for hemlock declined.

Particularly red cedar and yellow cedar (cypress)

decreased considerably because of delay of harvest by foul

weather and active demand in the U.S. market, which

pushed log prices largely.

Like log supply, lumber supply is also affected by heavy

snow in winter, which hampered log harvest on high

elevation so hemlock and cypress supply dropped by slow

start of log harvest.

Supply of SPF lumber from interior was not affected by

snow but the prices climbed by low inventories in Japan

and active domestic market of North America. Forest fires

in interior B.C. would influence SPF supply in the second

half.

|