2. GHANA

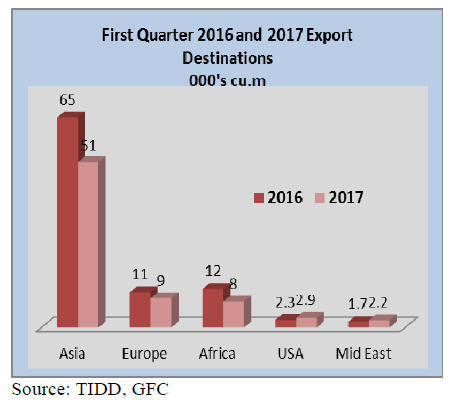

First quarter exports down 21%

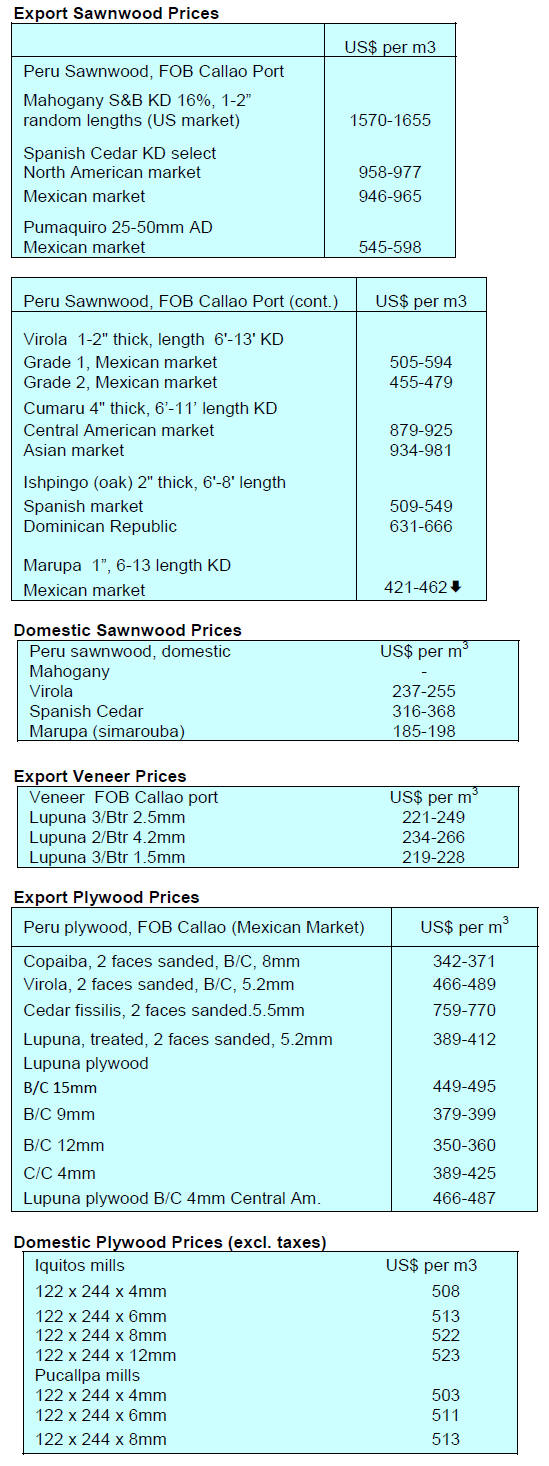

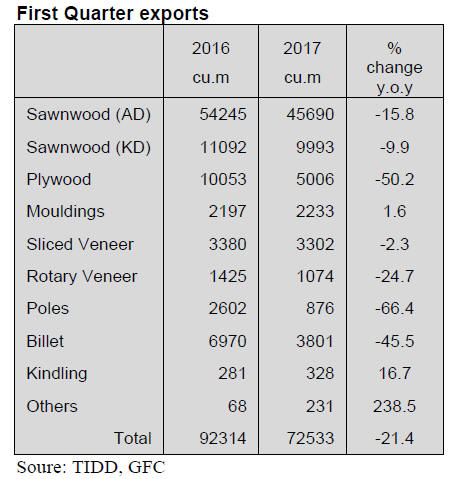

Data from Ghana’s Timber Industry Development

Division (TIDD) shows that wood product exports in the

first quarter 2017 totalled 72,533 cu.m compared to 92,314

cu.m for the same period in 2016, a 21% decline.

Export values in the first quarter 2017 were also down by

around the same amount. The decline in exports was

observed for all major wood products.

The main exports in the first quarter 2017 were air dried

sawnwood, kiln dried sawnwood, plywood, billets and

sliced veneer.

In the first quarter overland exports of plywood and

sliced

veneer were 4,547 cu.m and 32 cu.m respectively. There

were no exports of sawnwood to neighbouring countries in

the first quarter. Primary products accounted for 6.5% of

first quarter exports, secondary products accounted for the

bulk of exports (at 90%) with the balance being tertiary

product exports.

The main species exported included papao/apa, wawa,

teak, ceiba and senya.

Ghana continued to maintain its major markets. Only the

US and Middle East registered increased imports of wood

products from Ghana in the first quarter of 2017 against

that of 2016. Exports to all other markets declined.

UK-Ghana Trade and Investment Forum

The Ghana Investment Promotion Authority (GIPA) and

the UK-Ghana Chamber of Commerce (UKGCC) held a

UK-Ghana Trade and Investment Forum 2017 on 28 June.

The Forum which aimed to attract foreign investments

from UK businesses provided the first initiative on

investments by Ghana’s new government.

Senior Minister, Yaw Osafo-Maafo, lead the Ghana

delegation which included businessmen to discuss topical

issues aimed at building upon the strong economic

relationship between the two countries. The UK is one of

the leading markets for Ghana’s wood products.

3.

SOUTH AFRICA

Steep decline in business confidence

The domestic media in South Africa are reporting the

latest RMB/BER Business Confidence Index (BCI) which

shows business confidence at a low last seen during the

2009 recession.

Analysts write that the decline in sentiment is about more

than the increased political uncertainty as the current

downswing began more than 3 years ago.

Political maneuvering and the recent credit rating

downgrades have added to the downward spiral in

sentiment driven by weak business activity.

In each of the five sectors assessed to compile the index,

manufacturing, retail trade, wholesale trade, motor trade

and the building sector were all in negative territory. It has

been reported that business conditions in the

manufacturing sector worsened in the second quarter of

this year.

The building sector index fell from the already low 42

points in the first quarter to 36 in the second quarter driven

down mainly by weak non-residential building activity.

Against the backdrop of weak business sentiment it is

something of a surprise to see the Rand has been

surprisingly steady given that the country is in recession.

For more see:

https://www.ber.ac.za/BER%20Documents/RMB/BERBusiness-

Confidence-Index/?doctypeid=1050

Until the housing sector comes back to life markets

will remain quiet

The pine market has been steady over the past two weeks

say traders. The loss of a sawmill in the Cape fires and the

resultant damage to plantation forests in the Cape has not

affected the market. Analysts say the pine market was

oversupplied and this is likely to continue while demand is

weak.

There are very few long term contracts for the truss

manufacturers so they are operating hand to mouth with no

work between orders. The rebuilding in the fire damaged

Cape areas will generate some new business but it is

expected that there will be a slow start in rebuilding. Most

of the damage is under inspection by the insurance

companies which have yet to release funds.

The commercial property market has provided a little

business but, as the latest RMB/BER survey shows,

activity is well down. It is expected that there could be a

short-term boost in shop-fitting due to the liquidation of

some big retailers and some overseas operations such as

River Island closing their operations.

The board market is also depressed say analysts and the

arrival of some imported panels at very competitive prices

because of the strong Rand has unsettled the market for

domestic products. The entire panel market is very quiet

as, up to now, the promised government infrastructure

programme has not started yet.

Demand for meranti is very quiet and shippers have not

been successful in securing better prices mainly due to

their need to remain competitive with other materials such

as Aluminium.

Traders report some demand for Acajou but the supply of

Kiaat from Mozambique has basically dried up because of

heavy demand from the Chinese market.

Demand for American hardwoods remains steady, being

kept alive by shop-fitters and there is some demand from

high end furniture manufacturers but the low and medium

price markets are very weak. The June issue of Sawmilling

South Africa has reported seven South African designers

are working with American Hardwood Export Council

(AHEC), to design a ‘Seed to Seat' project at 100% Design

South Africa 2017.

The ‘something to sit on’ pieces, which will be made from

a selection of four American hardwood species - American

cherry, tulipwood, soft maple or red oak - will be unveiled

at 100% Design South Africa 2017, running from 9-13

August in Johannesburg.

4.

MALAYSIA

Best growth rate in two years

The latest Malaysia Economic Monitor launched by the

World Bank has reported that, at 5.6% year-on-year

growth. Malaysia achieved its highest quarterly growth

rate in two years.

The positive growth was driven by strong private

consumption supported by improving labour market

conditions. Increased private investments and major

government-led infrastructure projects also contributed.

The improved economic conditions in the US helped

export growth and stabilised commodity prices.

Strong cooperation amongst the timber industry

The Malaysian timber industry has a unique structure due

to the different laws and regulations on forestry in the

three geographical regions of the country; Peninsular

Malaysia, Sarawak and Sabah. In each region the industry

has developed with its own characteristics.

However, and despite the different industry structures,

cooperation between the various sectors of the timber

industry is very strong as demonstrated during a recent

meeting of the Malaysian Timber Association (MTA) in

Sandakan, Sabah.

The MTA was formed when nine timber associations

across the country came together: the Bumiputra timber

and furniture entrepreneurs, Furniture Council, Wood

Industries, Moulding and Joinery Council, Sabah Timber

Industries, Sarawak Timber, Panel Products Manufacturers

and Timber Exporters.

A recent meeting of the MTA provided a platform for

members to share information and discuss challenges and

to find ways to work together as one national industry.

In the June meeting participants aimed to build upon the

momentum which was generated after the MTA Timber

Workshop was held in Kuching last December.

That Workshop brought together over 100

participants (66

companies and 35 Government/timber agencies).

Sarawak exports dip but investments continue

The Sarawak timber industry saw an 8% decline in export

values between January and May this year largely due to

the uncertain global economic situation. January to May

exports totalled RM 2,404 million as compared to RM

2,627 million for the same period last year.

However, the Sarawak Timber Industries Development

Corp (STIDC) and its subsidiary companies will continue

to invest said the Minister of Industrial and Entrepreneur

Development as the timber industry is still the biggest

contributor to the state’s economy after oil, gas and palm

oil.

Plywood is the main timber export in Sarawak with

exports in the first five months of this year being worth

RM1,254 million, slightly down on the same period last

year.

Other export products were logs (RM507 million),

sawnwood (RM344 million), plywood (RM122 million)

and veneer (RM64 million).

Japan is still the main market for Sarawak wood products

with exports being worth RM961 million between January

and May, followed by India (RM354 million), South

Korea (RM229 million), Taiwan P.o.C (RM176 million)

and the Philippines (RM152 million).

5. INDONESIA

Addressing over-population in Java

Coordinating Minister for Economic Affairs, Darmin

Nasution, said the government plans to distribute land

outside of Java such as in Bangka Belitung with the aim of

encouraging people to relocate as Java Island is heavily

populated.

See: http://nasional.kontan.co.id/news/usai-lebaran-programbagi-

bagi-lahan-dimulai

Dubai exhibition a success for Indonesia

In a press statement, Gusmalinda Sari, of the

Dubai/Indonesian Trade Promotion Center (ITPC) said

demand for Indonesia’s wooden products in the Middle

East countries could reach as much as US$1 billion.

During the International Design Exhibition 2017 in Dubai,

Indonesia exhibited various unique wood products. The

press statement said "The originality of Indonesian woods

and its natural design are demanded by high-class

consumers, especially from Europe, US, and the Middle

Eastern countries."

Fears that peatland regulation will disrupt raw

material

supplies

The Indonesian Minister of Trade, Enggartiasto Lukita,

has said it would be very sad if manufacturers have to

import raw materials because resources in the country’s

industrial plantation forests decline due to the impact of

the peatland protection regulation.

The Minister said the peatland protection policy should

not disrupt existing business operations as this will

adversely affect economic growth prospects.

See:

http://industri.bisnis.com/read/20170618/99/663867/soalpp-

gambut-mendag-jamin-pasokan-bahan-baku-

Boosting SME furniture exports

Gati Wibawaningsih, Director General of Small and

Medium Industries in the Ministry of Industry, has

reported that the value of furniture exports in 2016

dropped to US$1.04 billion from US$1.21 billion in 2015.

In an effort to reverse this trend the DG said the ministry

will work to improve the competitiveness of the domestic

furniture and handicraft industries as the sector has great

potential.

The Ministry of Industry has several programmes to

encourage SMEs in the country, one of which is the socalled

KITE policy which makes imports of materials to

be manufactured for export easier.

Religious and indigenous leaders discuss

rainforest

protection

Religious and indigenous leaders have met in Norway to

discuss ways to expand protection of tropical rainforests.

Norway hosted the event with participation of Christian,

Muslim, Jewish, Hindu, Buddhist and Daoist

representatives as well as indigenous peoples.

Organizers said the Oslo Interfaith Rainforest

Initiative

was the first to gather religious and indigenous peoples to

seek out common ground to protect forests. They hope to

organize a summit in 2018.

Inspired by Pope Francis’ outspoken stance on global

warming and overdevelopment in his 2015 ‘Laudato Si

Encyclical’, the groundbreaking event was held in Oslo

and backed by Norway’s King Harald V.

See: http://fore.yale.edu/files/Interfaith_Rainforest_Initiative.pdf

6. MYANMAR

MTE planning to resume harvesting

The Myanmar press (Daily Eleven) has quoted Myanma

Timber Enterprise (MTE) Deputy General Manager, Wai

Kyaing, as saying MTE has plans to resume the harvesting

this year after the year-long logging suspension.

According to the media, MTE will harvest 17,000 tons in

the Taninthari Region in south western Myanmar. It has

been reported that trees above the minimum girth limit

have already been marked for felling.

The plan outlined in the press suggests MTE will subcontract

the logging since MTE does not have the

sufficient harvesting capacity. If this is the case then it

would contradict earlier statements that suggested no subcontracting

will be permitted.

Analysts write that it appears sub-contractors will be paid

rather retain some of the logs as payment which was the

previously arrangement. It has been reported that some

community forestry members in the area have written to

the Ministry of Forestry objecting to the planned

harvesting.

EU and Myanmar take proactive steps on timber

legality assurance

The European Timber Trade Federation (ETTF) has issued

a special edition of its Newsletter focused on Myanmar.

This looks closely at issues concerning Myanmar timber

and especially teak exports.

See: http://www.ttf.co.uk/article/special-edition-of-ettfnewsletter-

focused-on-myanmar-now-availa-568.aspx

The publication summarises the recent Environmental

Investigation Agency analysis and outlines the efforts by

the Myanmar authorities, the domestic trade and their

international partners in addressing legality assurance.

The ETTF newsletter special editions says “Alarms have

sounded recently over proof of legality of Myanmar

timber and notably teak exports to the EU. However EU

and Myanmar authorities and timber trade representatives,

including the ETTF, have been liaising closely and are

taking steps to tackle legality assurance deficiencies,

confusion and misinformation.”

In concluding, the ETTF says “while major challenges

remain they have confidence that, with cooperation and

commitment, these can be overcome.”

Tougher penalties in Draft Forest Law

The Draft Forest Law has been published for discussion.

Analysts say the most significant change is the toughening

of penalties (fines and imprisonment). The previous law

remained unchanged since its introduction in 1922.

Foundations for greater Myanmar/India trade

Myanmar is India's gateway to South East Asia and

ASEAN and India is seeking greater economic integration

through its 'Act East' policy (the new government of India

has made its relations with East Asian neighbours a

foreign policy priority).

Myanmar and India share a land border of over 1,600 km

as well-being adjacent across the Bay of Bengal.

Recently Myanmar’s Minister of Commerce Than Myint

and India’s Commerce and Industry Minister, Nirmala

Sitharaman, met to discuss ways to boost trade and

investment.

Sitharaman said that the bilateral trade between the

countries has a much larger untapped potential and she

sought cooperation from Myanmar to actively pursue

enhanced road, sea and air connections between the two

countries.

India's trade with Myanmar grew by 6% percent from

US$2.05 billion in 2015 -16 to US$ 2.18 billion in 2016-

17. Both the sides also agreed to explore opening of two

new trade points at Pangkhuwa and Zoninpuri.

7. INDIA

Record low inflation boost hopes for rate

cut

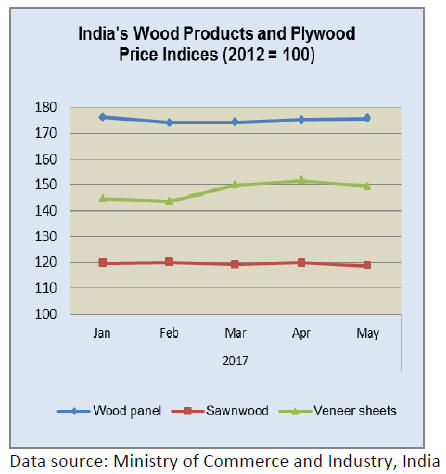

India’s official wholesale price index for all commodities

(Base: 2011-12=100) for May 2017, released by the Office

of the Economomic Adviser to the government (OEA),

declined by 0.4% to 112.8 (provisional) from 113.2 for the

previous month.

The annual rate of inflation, based on monthly WPI, stood

at 2.17% (provisional) for May 2017 compared to 3.85%

for the previous month. Inflation for this financial year so

far was -0.35% compared to a rate of 2.51% in the

corresponding period last year.

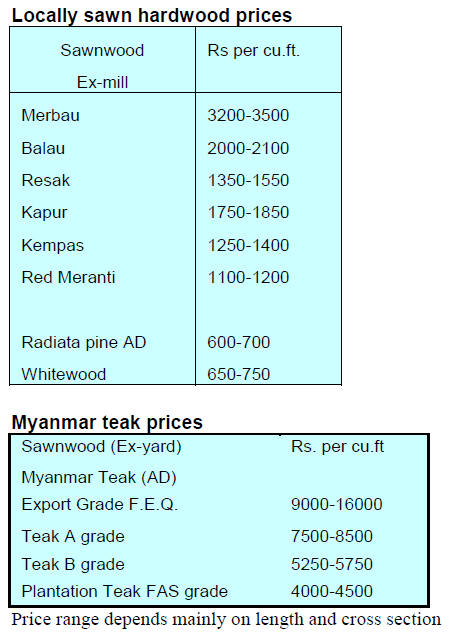

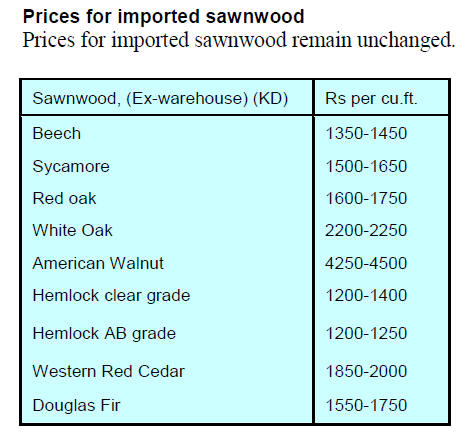

The index for manufactured wood and cork products

declined by 0.5 percent to 130.6 (provisional) from 131.3

(provisional) for the previous month, This says the OEA

was partly due to lower prices of veneer sheets, sawnwood

and particleboard. In addition, food prices fell in May and

this is fueling discontent amongst farmers. The private

sector hopes the record low inflation will lead to an

interest rate cut by Reserve Bank of India.

The press release can be found at:

http://eaindustry.nic.in/cmonthly.pdf

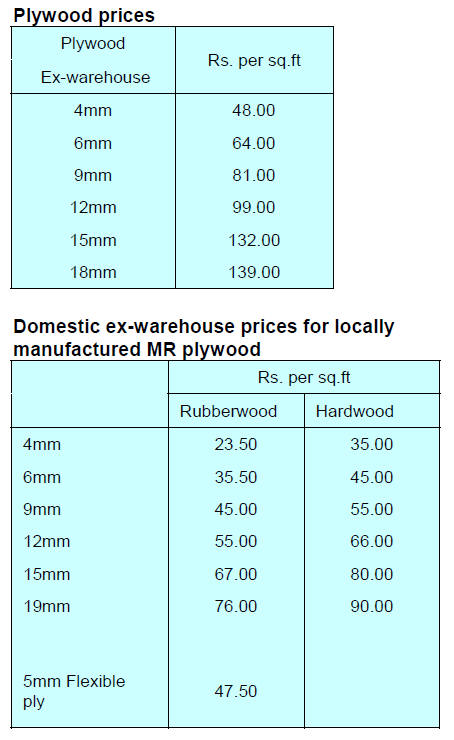

Industry calls for review of GST for panels

The assigned rate of tax under the new Goods and

Services Tax (GST) system has been released. Rates range

from 5% to 28% with essential food items attracting zero

tax.

For wood products falling within HS 44 a GST of 28% has

been set and this has caused widespread dissatisfaction

amongst manufacturers of which some 85% are SMEs.

Currently these SMEs enjoy exemption from excise duty

on sales up to Rs.15 million but when the GST is applied

on 1 July this year the excise duty exemption will be

withdrawn.

Panel manufacturers have made representations through

their State Finance Ministries to the Central Government

requesting a review of the rate from 28% to 12%.

Reconstituted panel makers are arguing that a 28% duty on

particleboard and MDF is too high because these products

are made mostly from plantation wood, wood residues and

agri-residues.

New MDF plant for Andhra Pradesh

The times of India has reported that Rushil Decor Ltd is

planning to build a MDF plant at Atchutapuram, a village

in Visakhapatnam district, located in the Indian state of

Andhra Pradesh. The plant will have a daily capacity of

600 cubic metres.

It is reported that the State Investment Promotion

Board

has granted several concessions for the company under the

state industrialisation policy.

See: http://timesofindia.indiatimes.com/city/visakhapatnam/mdfmanufacturing-

unit-to-be-set-up-in-vizagsoon/

articleshow/57695658.cms

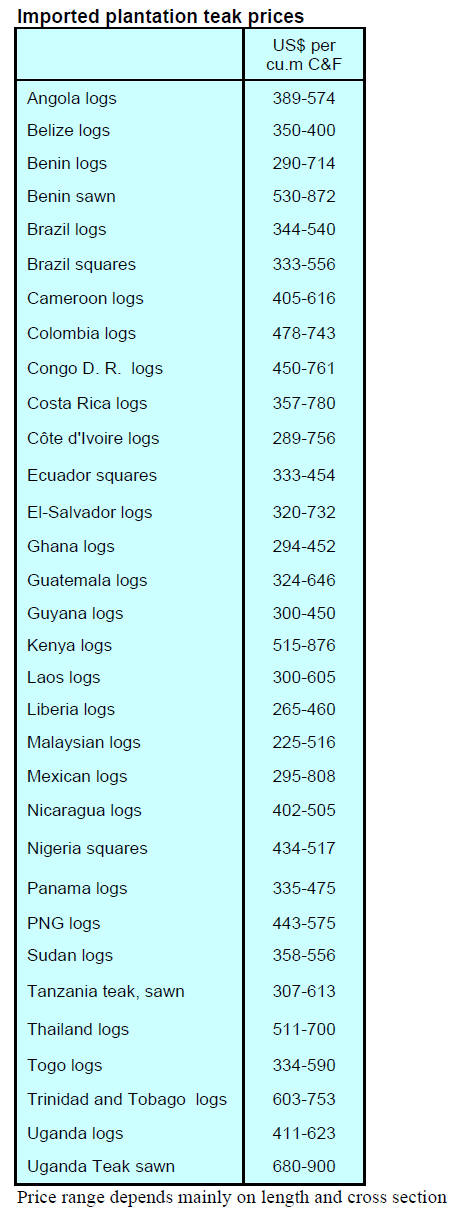

Imported plantation teak

Demand for imported plantation teak logs remains robust.

Shippers have been increasing the volumes available and

have not allowed importers to raise C&F prices even

though freight rates are beginning to climb.

Panel production by SMEs at risk from GST

The impact of the GST on plywood prices will be

significant if the duty rates remain as proposed. At 28%

duty the production of panels by SMEs will be severely

curtailed as many are expected to go out of business.

The impact of the GST on the major plywood

manufacturers will be less severe but with a sharp fall in

production from the SMEs and demand could outstrip

supply. Everyone in the industry is hoping for stability in

the market and anticipates the government will review the

GST on wood based panels.

MumbaiWood 2017 to attract pan Asia visitors

India’s furniture market is projected to grow significantly

up to 2019 and the Western Region is expected to offer the

greatest opportunities due to the presence of large number

of industrial hubs and upcoming infrastructure

developments in these regions.

The 3rd MumbaiWood fair will be held 12-14 October

2017 at the Bombay Exhibition Centre, in Goregaon,

Mumbai and is now featured as an international trade

show set to attract pan Asia visitors.

The event will be a unique platform in the western India

for domestic and global brands to showcase furniture

manufacturing and woodworking technologies, raw

materials, fittings, accessories and products.

See: www.mumbai-wood.com/

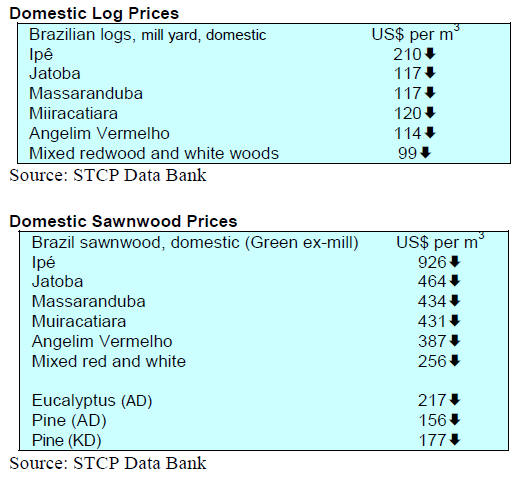

8. BRAZIL

May inflation, the lowest since 2007

Brazil's economy is forecast to grow 0.4 percent in 2017

after contracting more than 3% in each of the past two

years. In May, government data showed better than

expected job creation as the economy slowly emerges

from its deepest-ever recession.

Inflation in Brazil continued to moderate in May, sliding

below the Central Bank’s target of 4.5%. Inflation has

been slowly falling throughout 2017 which led the Central

Bank to cut interest rates from 11.25% to 10.25% in May

2017. May inflation was the lowest since 2007.

Efforts on sustainable production of high value timber

The Brazilian forestry sector has been engaged in research

on development of forest plantations using native timber

species and in May, Futuro Florestal, a pioneer company

in the field of commercial plantation of high value tropical

timber species organized a workshop on ‘Sustainable

Production of High Value Timber’.

Entrepreneurs, professionals, farmers, researchers and

prospective investors discussed the development of several

species, with emphasis on African mahogany (Khaya spp),

teak (Tectona grandis), guanandi (Callophyllum

brasiliensis) and other hardwood species.

The workshop sought to draw attention to the

opportunities for alternative timbers for sustainable

development of the tropical solid wood production chain.

Experimental plantations of some native and exotic high

value species have been established by Futuro Floresta.

These efforts are in line with commitments made by the

Brazilian government in the Paris Agreement where the

country took on the task of recovering 12 million hectares

of forests by 2030 through forest restoration projects in

legal reserve areas and Permanent Preservation Areas

(APPs).

Another issue discussed was the São Paulo Agribusiness

Expansion Fund (Fundo de Expansão do Agronegócio

Paulista - FEAP). This offers credit lines in addition to

those offered through the Brazilian Development Bank

(BNDES) for forest plantations, agroforestry, agrosilvopastoral

systems and for the recovery of legal reserve

areas.

New protected forest areas in the Amazon

New protected forest areas have been established in the

municipalities of Manoel Urbano (68,537 hectares) and

Feijó (86,582 hectares) in Acre State.

The combined protected area is called the "Complex

Affluent State Forest of Jurupari Seringal (Floresta

Estadual do Afluente do Complexo do Seringal Jurupari)”

and was handed to the government of Acre by the Federal

Government in 2014.

This protected area is part of a series of conservation areas

in Brazil created to protect the soil and other natural

resources and the environment. This new protected area is

considered “temporary” as it will be reviewed in five years

and may be renewed for a further five years to allow for

research to continue.

Socioeconomic studies will be carried out so that

sustainable development and management of the forest is

possible allowing for forest management and extraction of

wood and non-wood forest products within the

conservation unit.

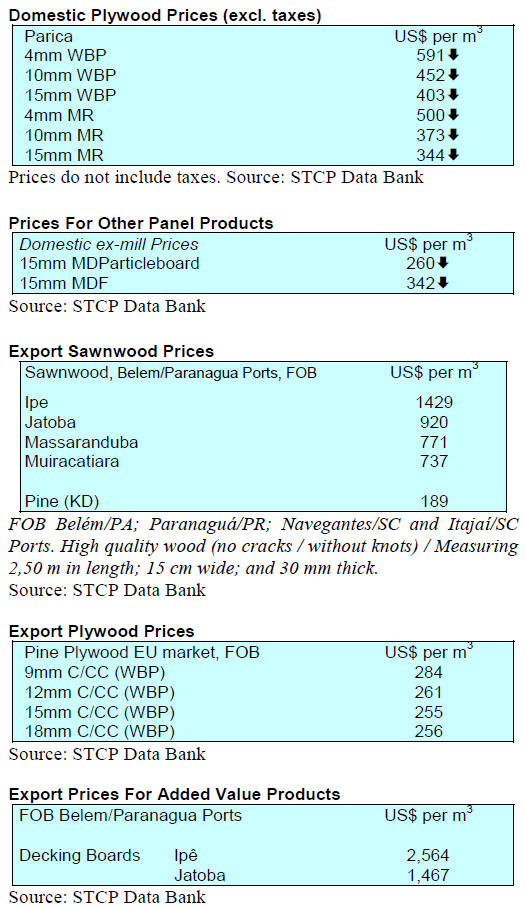

Export round-up

In May 2017 Brazilian exports of wood-based products

(except pulp and paper) increased 23.3% in value

compared to May 2016, from US$ 191.8 million to US$

236.5 million.

Year on year, May pine sawnwood exports increased 41%

in value to US$ 39.5 million. In volume terms, exports

increased 29% over the same period from 152,300 cu.m to

196,000 cu.m.

May 2017 tropical sawnwood exports increased 14% in

volume, from 32,500 cu.m in May 2016 to 37,100 cu.m in

May 2017 while the value of exports increased 6.5% from

US$ 15.4 million to US$ 16.4 million, over the same

period.

Pine plywood exports increased 28% in value in May 2017

compared to levels in May 2016, from US$ 34.5 million to

US$ 43.7 million. In volume terms, exports increased 17%

over the same period, from 131,700 cu.m to 154,000 cu.m.

Tropical plywood, exports also increased in May rising

2.5% in volume terms year on year but the value of

exports fell around 2% from 12,100 cu.m (US$ 5.0

million) in May 2016 to 12,400 cu.m (US$ 4.9 million) in

May 2017.

First rise in furniture exports since 2010

Encouragingly, wooden furniture exports rose from

US$36.2 million in May 2016 to US$42.2 million in May

2017, an almost 17% increase. In the first five months of

this year wooden furniture exports rose 7% year on year

according to the Ministry of Development, Industry and

Foreign Trade (MDIC). Exports by the furniture sector

reached US$242.5 million in this period.

It has been forecast that 2017 wooden furniture exports

will be around 8% higher than last year. If this growth is

achieved it will be the first rise in furniture exports since

2010. Among the main importers are the United States, the

United Kingdom and Argentina.

9.

PERU

150,000 hectares of natural forest lost

annually

Each year Peru loses an average of 150,000 hectares of

natural forest due to deforestation caused by migratory

agriculture and subsistence activity that devastates the

Amazon.

According to the National Forestry and Wildlife Service

(Serfor), other causes of deforestation that put the

country's 74 million hectares of forest at risk are illegal

logging, illegal mining and coca leaf cultivation.

John Leigh, Executive Director of Serfor, has pointed out

that deforestation is concentrated in areas coinciding with

the poverty map of the Amazon. Because of this, he said,

it is the State's duty to ensure sustainable use of the

resource for the benefit of the local population. "We have

to give the forest a strong economic value and promote the

wealth that it can produce in its natural sustainably

managed state to avoid a change of land use or illegal

activities” said Leigh.

Elaboration of Forest Plan

In the process of building the National Forestry and

Wildlife Plan, which sets targets up to 2021, Serfor

started the first in a series of meetings with various

stakeholders in the forestry sector. The goal is for this plan

to become a consensual tool to promote the sustainable use

of wild flora and fauna.

Leigh explained that the preparation of this plan will

receive input from various ministries, the private sector,

universities, civil society institutions and other interested

parties.

This plan aims to establish a strategy for implementing

and movimg forward the forestry sector to conserve

biodiversity and at the same time generate and evenly

distribute wealth. A draft document will be ready by year

end, said Leigh.

Results of national forest and wildlife inventory

Serfor and FAO have announced the preliminary results of

the National Forest and Wildlife Inventory in a publication

titled ‘Our Forests in Numbers’.

This document compiles all the information gathered and

analysed at national level since 2013 for 4 sub-populations

or forest eco-zones in Peru: Coast, Sierra, Selva Baja and

Hidromórfica (flooded forest).

The INFFS provides specific data on plant and animal

species and their level of vulnerability. In addition,

information has been collected on the amount of carbon

contained in the biomass of all the eco-zones analysed;

essential data to assess the contribution of forests to the

mitigation of climate change.

The field data compilation for this National Forestry and

Wildlife Inventory began in 2013 and its execution

continues to cover the entire national territory. The INFFS

is a key tool for decision making on the forest resource.

Agrobanco launches ‘Green Bank’ project

The Agricultural Bank (Agrobanco) has launched a "Green

Bank" project with the aim of promoting the sustainable

use of resources and conservation of the environment

through specialised financing for sustainable projects,

good environmental practices and agroforestry.

For more see: http://www.andina.com.pe/Ingles/noticiaagrobanco-

launches-new-project-to-boost-sustainableagriculture-

in-peru-672656.aspx

Green Bank has secured support from the European Union

and the French Development Agency and is part of the

institutional mission and commitment of Peru to reduce

emission of greenhouse gases. The introduction of the

‘Green Bank’ offers an innovative approach to sustainable

business for the creation of economic, social and

environmental value in the projects financed.

Such a project will contribute to food security and

incorporate the need for adaptation and mitigation in

strategies for sustainable agricultural development to

address climate change.