Japan

Wood Products Prices

Dollar Exchange Rates of 25th

May 2017

Japan Yen 111.34

Reports From Japan

Consumer spending still frozen

Japan’s economy grew 0.5 percent in the first three

months of 2017 marking its fifth straight positive quarter,

the longest expansion in more than a decade.

Figures recently released show that GDP was boosted by

exports and by investments related to development of

centres for the Tokyo Olympics in 2020. However,

looking ahead analysts foresee a slowing in the second

half of this year due mainly to a slowing of demand in

China.

Despite the good news on exports consumer spending in

Japan has not stirred and it needs to if deflation is to be

driven back. Individual spending accounts for more than

half of Japan’s GDP. Government figures show the

average of monthly consumption per household for March

was yen 300,889, down 5.3% year on year.

Private sector sentiment remains positive

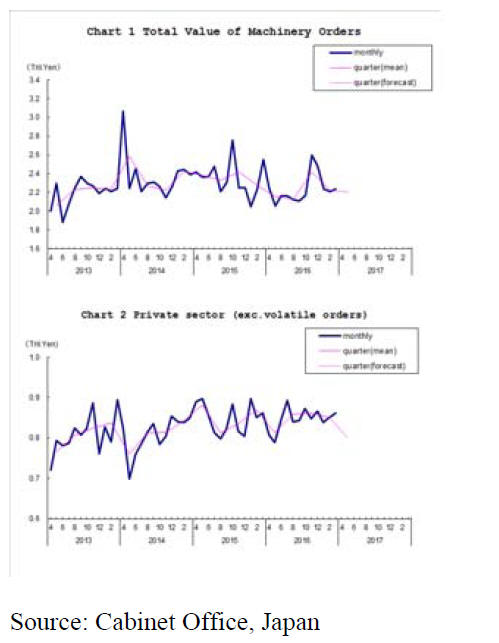

Cabinet Office data on private-sector machinery orders

showed a modest month on month improvement in March

marking the second consecutive month of gains driven

largely by investment by manufacturers.

The Cabinet Office press release says the total value of

machinery orders received by 280 manufacturers operating

in Japan increased by a seasonally adjusted 1.3% in

March. But for the first quarter 2017 machinery orders

were down almost 8% compared to the last quarter 2016.

The figures on machinery orders are viewed as an

indicator of capital spending sentiment by the private

sector. Analysts say the machinery order data tends to be

volatile so not too much should be read into a single

month movement as this does not indicate that the

moderate, broad-based improvement in capital expenditure

is in reverse.

See: http://www.esri.cao.go.jp/en/stat/juchu/1703juchu-e.html

Competitively priced yen welcomed by exporters

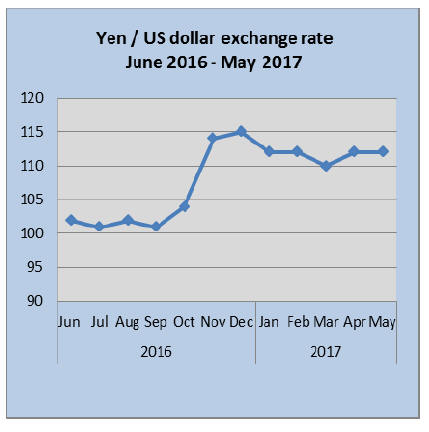

In mid-May the US dollar weakened against the yen

pushing the yen close to the 110 level for the first time in

months.

The weaker dollar was deemed a reaction to fears

that the

controversies swirling in the US administration would

hold back planned tax cuts and infrastructure spending,

both of which have been welcomed by the private sector.

However, towards month end the dollar rose again

shedding the losses sustained mid-month and settled back

at around 112 to the dollar.

April housing starts confound forecasters

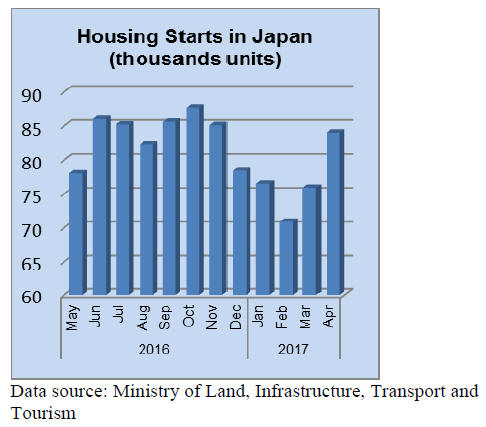

Data from Japan’s the Ministry of Land, Infrastructure,

Transport and Tourism Japan's shows that

housing starts shot up higher than in March. This

confounded analysts who had forecast a decline.

Year on year April housing starts were up 2% and

compared to March 2017 there was an 11% rise in April.

Looking at the data for the first four months of the year

there was a 3% rise in starts compared to the same period

in 2016.

On the basis of the latest data, 2017 annualised housing

starts could come in at around 1.0 million.

Japan’s wooden furniture imports

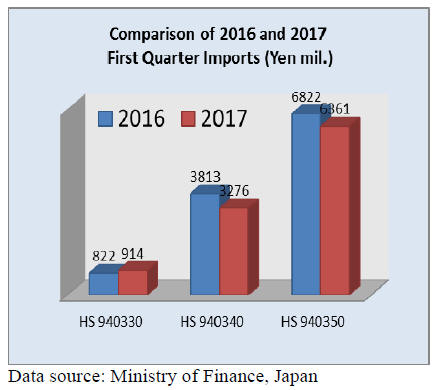

The value of Japan’s first quarter 2016 and 2017 imports

of wooden office, kitchen and bedroom furniture is shown

below.

While first quarter imports of wooden office furniture

(HS940330) were 11% higher than in the same period in

2016 the value of imports of both wooden kitchen and

bedroom furniture (HS 940340 and 940350) fell in the first

quarter of 2017 from a year earlier.

Wooden kitchen furniture imports in the first quarter 2017

were down 14% from a year earlier and wooden bedroom

furniture imports dropped 7% over the same period.

Office furniture imports (HS 940330)

In March imports of wooden office furniture from the EU

accounted for 27% of all imports of this category of

furniture, however, the main supplier was China

accounting for almost all of the balance.

In February imports from China fell month on month

but

this was reversed in March as imports from China more

than doubled.

While China remains the main supplier other individual

supply countries in March include Taiwan P.o.C (5%) and

Portugal (4.5%).

Month on month, Japan’s imports of wooden office

furniture rose 64% in March. The very low figure reported

for February imports was exceptional and may be a

statistical error. Year on year March imports were also

higher, increasing 27% from March 2016.

Kitchen furniture imports (HS 940340)

Wooden kitchen furniture imports to Japan in March were

down 15% year on year and flat compared to levels in

February.

Vietnam maintained its position as the top supplier of

wooden kitchen furniture accounting for over 40% of all

imports of HS 940340 products. The Philippines was the

second largest supplier in March (18%) followed by China

and Indonesia. The top four shippers accounted for over

85% of all arrivals of wooden kitchen furniture in March.

Bedroom furniture imports (HS 940350)

There was a sizeable increase in imports of wooden

bedroom furniture in March compared to a month ealier.

March 2017 imports were up 40% month on month and up

9% year on year.

Producers in China saw March shipments rise nearly 60%

and producers in Vietnam also saw shipment rise (23%).

China remained the number one supplier of wooden

bedroom furniture in March followed by Vietnam and

Thailand. The top three shippers accounted for over 90%

of Japan’s wooden bedroom furniture imports in March

this year.

Of the approximately 2% of March shipment from the EU,

more than half was from Poland.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

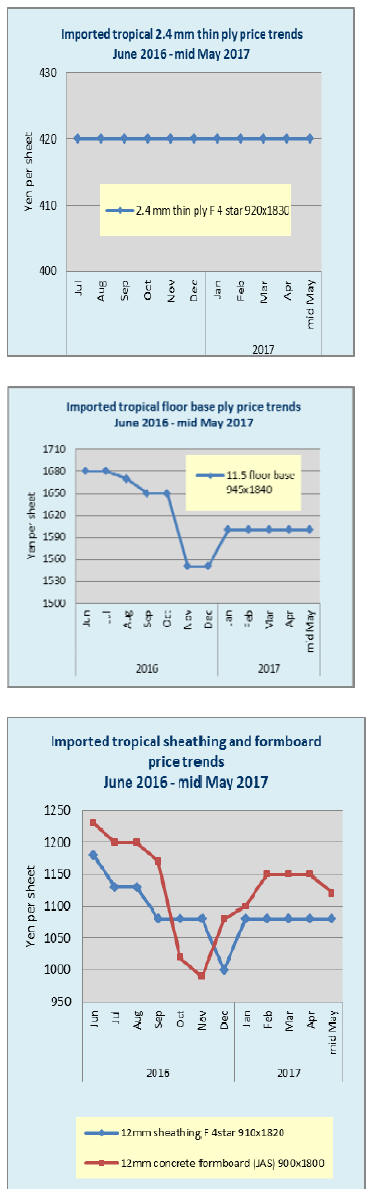

Price hike of Malaysian plywood

Malaysian plywood manufacturers are proposing higher

export C&F prices one after another.

The reason is higher cost of logs by newly imposed higher

timber premium since July 1 this year. Price increase

varies by plywood mills but in general, about $25 per cbm

increase for June and July shipment is proposed.

Sarawak plywood mills have not been able to increase the

export prices because of depressed market in Japan but

they are cornered by high log cost so this hike is

inevitable.

In Sarawak, weather continues unstable even after rainy

season was over in March with sporadic heavy rain in

April and May so that transportation of logs are difficult in

poor road condition. Then tight illegal log harvest

restriction reduced availability of logs so some plywood

mills stopped operation for ten days a month because of

shortage of logs.

Sarawak plywood mills are in very tough situation by log

supply shortage and higher prices brought by increase of

timber premium by the government.

Plywood mills ask the Sarawak government to reduce the

rate of increase or postponement of increase but the

requests are ignored.

Sarawak Timber Association (STA) declared uniform

production reduction of plywood in August last year to

increase the export prices but the demand in Japan had

been stagnant even after such production curtailment. The

importers were not able to accept higher C&F prices so the

increase remained in small degree.

Indonesian plywood manufacturers follow suit to

Malaysian manufacturers and started proposing higher

C&F prices. The market prices in Japan have been inching

down but by price increase proposal by the Malaysian

manufacturers, skidding of the prices are slowing and

should be bottoming out.

South Sea(Tropical) logs

Log supplying regions of Malaysia and PNG are in dry

season but continue to have unstable weather so log supply

has been tight. Indian buyers are bullishly buying logs but

not enough volume. Japanese buyers are not able to have

enough logs in Sarawak so they buy more in Sabah.

Sarawak, Malaysia reduced export log quota in 2016 then

since July this year, timber premium rate is raised, which

pushes log cost up so that log suppliers need to increase

log export prices.

Japan has been steadily procuring logs with firm

production of South Sea plywood but logs they are

consuming now is high because of weak yen at the time of

import.

Sarawak meranti log prices for Japan now are unchanged

at US$275-280 per cbm FOB but future prices will be

higher for sure. Log prices in Sabah are also climbing

together with Sarawak.

Chinese log purchase in PNG and Solomon Island is very

active then Indian log buyers come to fill up short supply

in Sarawak so competition is hard. Log prices are climbing

in PNG and Solomon Islands not only by purchase

competition but also by lower log production by

unfavorable weather.

|