|

Report from

Europe

EU trade with Indonesia in the spotlight following

FLEGT licensing

Indonesia issued the first ever FLEGT licenses in mid-

November last year with high expectations that these

would boost the value and share of Indonesia’s wood

exports to the EU.

This is a reasonable expectation, given the very significant

commitment and investment by Indonesia, supported

through the FLEGT Voluntary Partnership Agreement

with the EU, and the mandatory requirement that all

timber and timber products exported from Indonesia to the

EU must now be licensed.

The fact that EU importers no longer need to undertake a

potentially expensive due diligence assessment to

demonstrate EUTR conformance for any timber product of

Indonesian origin should give a significant edge in the

EU’s highly competitive market.

Nor has Indonesia stopped short at imposing a requirement

for exports to the EU. The SVLK certification system on

which FLEGT licensing is based (and which was first

introduced in 2010) is now mandatory for nearly all wood

produced and traded in the country and applies to

industrial plantations (HTI), natural forest concessions

(HPH) and community plantation forests (HTR).

Anecdotal evidence indicates that Indonesia’s SVLK

certificates and FLEGT licenses have been well received

and are at least benefitting some Indonesian suppliers. For

example, the Jakarta Post reported on 17 March that

“many exhibitors at the recent Indonesian International

Furniture Exhibition (IFEX) said the SVLK helped them

increase exports, especially to the EU”.

The news report quotes one Indonesian furniture exporter

as suggesting that “with the SVLK, buyers from the EU

are more confident about us and we can even sell directly

to them without using traders, and so we enjoy high profit

margins and a market under our own brand”. The increase

in profit margin in this instance was reported to be up to

40% compared to 10% previously.

There is similar anecdotal evidence from European

importers. In an interview published on the Global Timber

Forum website in February this year, a representative of

one of Europe’s largest importers of Indonesian plywood

said that “arrivals from Indonesia have increased over the

last few weeks as importers and traders are stocking up on

FLEGT licensed material”.

He noted that the FLEGT license has given European

importers more confidence to engage in active promotion

to increase sales of Indonesian plywood and to make more

product available in the market. He added that Indonesia

will have an increasing advantage over time as EU

Competent Authorities are getting stricter and there are

more checks on operators.

These early anecdotal reports are encouraging, but they

refer to isolated cases and the underlying question of the

extent to which FLEGT licensing contributes to real

increases in export share and value remains uncertain.

Relaunch of IMM programme to monitor impact of

FLEGT licensing

This is a question which will be a key focus of the FLEGT

Independent Market Monitoring (IMM) programme which

prepared baseline market research during the period March

2014 to 2016, and which was relaunched on 1 April 2017.

IMM is a multi-year project supervised by ITTO and

financed by the EU to support implementation of VPAs

between the EU and timber supplying countries.

The task of assessing the impact of FLEGT Licensing on

Indonesian trade with the EU and other markets is

complicated by the changing profile of timber product

exports from Indonesia. In Europe, the trade has

traditionally viewed Indonesia primarily as a source of

tropical hardwood plywood and decking.

While these products are still significant, Indonesia has

evolved a very diverse wood manufacturing sector and

supplies the EU with increasingly wide range of more

added value wood products such as furniture, doors and

other joinery.

In 2016, the value of EU imports of joinery products from

Indonesia was close to €75 million and wood furniture

around €300 million. This compares to EU imports of

around €70 million of decking and other mouldings and

€75 million of plywood from Indonesia.

Last year the EU also imported pulp and paper products

from Indonesia with a total value of €225 million.

Although this is only a very small proportion of both EU

and Indonesian trade in pulp and paper, the industry is so

large that this value is comparable to that of wood

products.

If all these products are considered and Brazil is excluded

(since most Brazilian wood product exports now derive

from outside the tropical region), Indonesia is the largest

tropical supplier of forest products to the EU by a

significant margin.

Total EU forest product imports from Indonesia were just

over €1 billion in 2016, up 3% on the previous year. This

compares to EU imports of €816 million from Vietnam

and €550 million from Malaysia (both of which unlike

Indonesia exported less to the EU in 2016). Last year

Indonesia accounted for 24.4% of EU imports wood

products from the tropics (by value), up from 23.8% the

previous year.

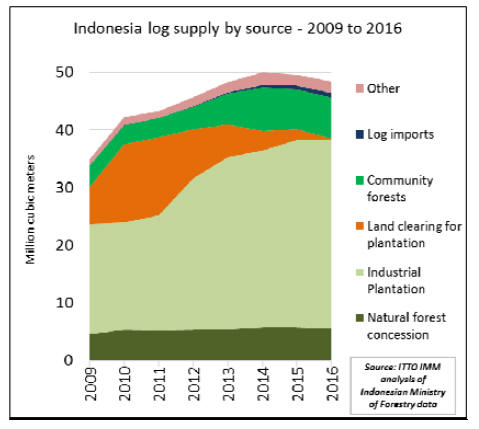

Changing profile of Indonesia’s wood product supply

The changing profile of Indonesia in product supply is

closely tied to the changing structure of the resource.

This is evident from data published by the Indonesian

Ministry of Forestry on the source of log supply which

shows that industrial plantations are becoming

increasingly important while the share of supply from

natural forests is falling.

Production from sustainably managed concessions in

natural forest is now stable, but there has been a sharp

decline in forest conversion operations (Chart below).

Last year Indonesia produced 47.5 million m3 of logs of

which 69% derived from industrial plantations (HTI), 15%

from community forests (HTR), 12% from natural forest

concessions (HPH), less than 1% from land clearing, and

4% from a variety of other sources.

This compares to 2009 when log production was 34.8

million m3 of which 55% was from industrial plantations

(HTI), 11% from community forests (HTR), 13% from

natural forest concessions (HPH), 18% from land clearing

operations, and 3% from a variety of other sources.

Another complexity in monitoring market impacts of

FLEGT licensing is that the EU only takes a relatively

small share of Indonesia’s total timber product exports.

The priority attached to the EU in market development,

and the size of flows to the EU, are therefore heavily

dependent on events in other parts of the world.

Data from the Environment and Forestry Ministry show

that total forest product exports through Indonesia’s

legality licensing system were 17.46 million tons with a

value of USD9.27 billion in 2016. Of these exports the EU

accounted for only 4.7% of tonnage and 9.4% of value.

The large majority of Indonesian forest product exports

are destined for other Asian markets (86% of tonnage and

71% of value) while exports to North America are also

significant (4.3% of tonnage and 10.7%) of value.

While the EU has a low share of Indonesia’s total forest

product exports, the data is influenced by the small

proportion of Indonesian pulp and paper destined for the

EU.

In the EU, Indonesia faces very stiff competition from

Brazil in the market for chemical pulp (which derives from

fast-growing plantations of eucalyptus and other hardwood

species) and from domestic European producers in supply

of finished paper products. The majority of Indonesia’s

pulp and paper product exports are destined for China and

other Asian markets.

The EU is relatively more important in Indonesian exports

of some wood products, most notably furniture. Of

Indonesia’s total wood furniture exports of 435,000 tonnes

with a value of USD1.34 billion in 2015, 127,000 tonnes

(29%) with a value of USD319 million (24%) were

destined for the EU.

A preliminary review of prospects for Indonesian wood

products in the EU market due to FLEGT licensing was

provided in a previous ITTO MIS report (16-30 Sept

2017).

This suggested that FLEGT licensing offers an immediate

opportunity for Indonesian suppliers to retake share in

those sectors – such as decking, plywood and flooring -

where Indonesian products are familiar to EU importers

and already favoured for their strong technical

performance, but where demand has been dampened by

concerns over the legality of wood supply.

It also suggested that, in isolation, FLEGT licensing is less

likely to generate immediate benefits in those high value

sectors like furniture and joinery where the specific

technical and environmental features of Indonesian wood

products have been less significant barriers to

competitiveness than wider issues such as labour costs, red

tape, logistics, processing efficiency, innovation, and

marketing.

In these sectors, increasing share is only likely to be

achieved if FLEGT licensing is combined with market

development initiatives to improve the international

competitiveness of Indonesian wood manufacturers across

a wider range of issues.

However, the long-term benefits of investment in these

initiatives, alongside FLEGT licensing, would be

considerable given the sheer size of markets for consumer

products like furniture, the relatively high proportion of

Indonesian furniture exports already destined for the EU,

and the greater potential to add value to wood fibre.

Near real‐time monitoring of FLEGT licensed trade

The ITTO FLEGT IMM has been gearing up to test these

various assumptions, as nearly as possible on a real-time

basis.

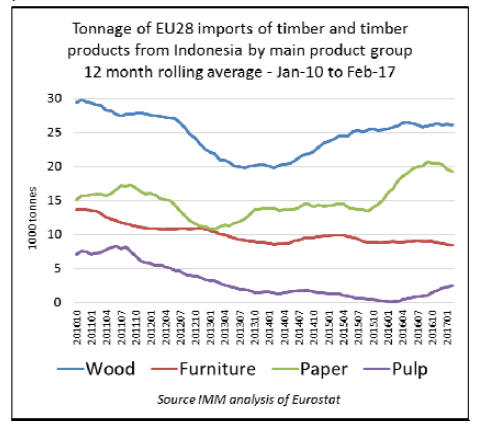

To provide a taste of the kind of analysis being

undertaken, the following three charts show the evolution

of EU imports from Indonesia, on a monthly basis, in the

7-year period running up to, and immediately following,

the issue of the first FLEGT licenses in November 2016.

These charts establish the baseline against which the

impact of FLEGT licensing on Indonesia’s trade with the

EU trade will be assessed.

Because EU imports from Indonesia tend to be highly

seasonal (furniture imports rise sharply in the run-up to

Christmas and January sales, while decking importers

build stock in the winter months in preparation for the

spring and summer surge in demand), the charts show 12-

month rolling average data to remove short-term

variability and highlight long term trends.

Tonnage data is provided here rather than value data to

remove variations due to very volatile exchange rates

during the period – notably the 20% fall in the value of the

euro (and linked currencies like the Polish zloty and

Swedish krona) against the U.S. dollar between 2014 and

2015, and a 30% decline in the value of the British pound

between mid-2014 and the end of 2016 (with a particularly

steep plunge after the Brexit vote in May 2016).

The chart above shows that while pulp and paper have

recently become more important in the mix of products

imported into the EU from Indonesia, imports of wood

products (i.e. those listed in Chapter 44 of the

internationally harmonised HS system of product codes)

are still the largest component.

The data shows that after a period of recovery in 2014 and

2015, EU imports of Chapter 44 wood products from

Indonesia stabilised at the higher level in 2016 (averaging

around 25000 tonnes per month).

While it is sStill very early days there was no immediate

discernible uptick in total EU imports of these products

between December 2016 and February 2017 after the first

licenses were issued.

EU imports of wood furniture from Indonesia were

declining between 2010 and 2013 and then in 2014

showed slight and short-lived signs of recovery. In 2015

and 2016, the decline in imports resumed and continued

through to February 2017.

Trends in pulp and paper imports from Indonesia have

followed a very different path. The EU was importing

small volumes of Indonesian chemical wood pulp before

2013, but these volumes fell to negligible levels in 2014

and 2015, presumably in the face of very stiff competition

from Brazil. However, there were signs of a revival in EU

imports of Indonesian wood pulp from the middle 2016,

although the volumes involved are still very restricted.

EU paper product imports from Indonesia, while still

limited, also recorded a significant uptick in 2016,

averaging below 15,000 tonnes per month at the start of

the year rising to over 20,000 tonnes at the end of 2016.

EU paper imports from Indonesia dipped a little at the start

of this year.

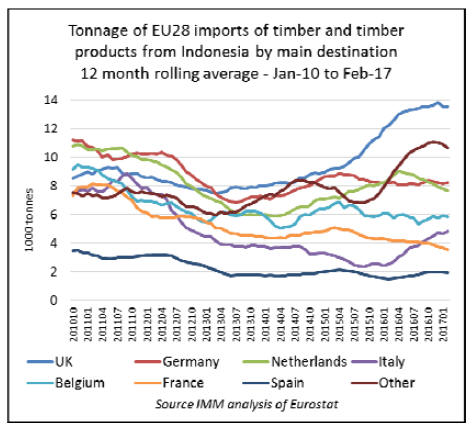

The chart above shows how EU imports of Indonesian

forest products has varied in different EU member states

over the last seven years.

Following a surge in imports between 2014 and 2016, the

UK has emerged as by far the largest single importer in the

EU – which highlights the significance of imminent Brexit

negotiations on the future direction of policy in relation to

FLEGT licensing.

The recent surge in UK imports from Indonesia has been

distributed across a range of product groups including

paper, plywood, and wooden doors and furniture.

Another notable trend in the Chart is the recent sharp rise

in imports by Italy and a range of “other” EU countries not

previously significant importers of Indonesian forest

products.

Italy has emerged as the leading destination for EU

imports of Indonesian wood pulp in the last two years, and

is also importing a small but rising volume of Indonesian

paper products. The “other” EU countries now importing

more from Indonesia are also mainly trading in Indonesian

paper products and all are in South-Eastern Europe –

Slovenia, Romania, Hungary, and Greece.

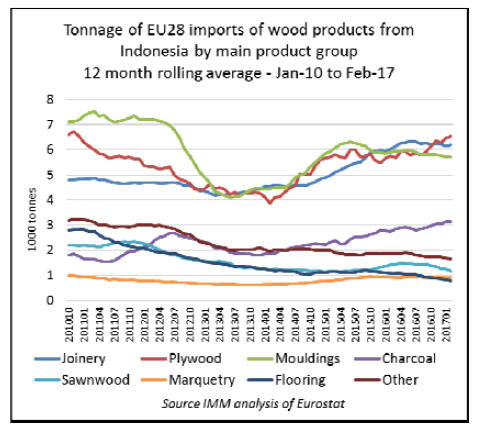

The chart left focuses in on trends in EU imports of HS

Chapter 44 wood products from Indonesia. It shows that

EU imports of Indonesian joinery products (mainly doors),

mouldings (mainly external decking) and plywood all

increased in 2014 and 2015, before stabilising and

converging at around the same level of 6000 tonnes per

month throughout 2016.

Of these products, only plywood registered an uptick in

early 2017 lending some early statistical support to

anecdotal evidence of EU importers stocking up

immediately following issue of the first licenses.

Notable trends in other product groups are the progressive

rise in EU imports of charcoal from Indonesia – a product

which incidentally is excluded from both the FLEGT

licensing requirements in Indonesia and the due diligence

requirements of the EUTR – and the continued slide EU

imports of Indonesian wood flooring to negligible levels.

In coming months, IMM will look closely at the evolution

of all these trade flows, comparing the flows with those of

competing products, while also monitoring underlying

economic conditions, and factors such as exchange and

freight rates with an important bearing on relative

competitiveness.

The statistical analysis of trade data will be supported by a

network of IMM correspondents which are currently being

recruited to liaise with relevant authorities and keep track

of important developments on the supply side in Indonesia

and other VPA Partner countries They will undertake

market assessment interviews with traders and other

interests in seven EU countries which together account for

over 90% of all imports of wood products from VPA

partner countries into the EU (Belgium, France, Germany,

Italy, Netherlands, Spain and the UK).

ETTF forecasts stability in European tropical wood

trade in 2017

The European Timber Trade Federation's latest newsletter

includes a commentary on the tropical hardwood trade in

Europe by Armand Stockmans, Director of Belgium-based

Somex Wood Import.

Stockmans suggests there will be no seismic trends this

year, although there are concerns beyond trading factors,

such as the extent to which FLEGT-licensed timber will

impact demand for certified sustainable timber.

According to Stockmans, while 2016 ended with a

slowdown, and individual markets are showing a range of

trends, overall indicators point to general stability.

France, for instance, remains difficult. Prices and volumes

are low and turnover decreasing.

However, the Netherlands is picking up with timber and

construction sectors ahead nearly 9.5% in the last three

months. Initial 2016 growth in Belgium petered out in the

second half. But currently the situation looks stable.

Meanwhile, Spain is in better mood and consumption is

increasing.

The supply side looks reasonably calm, says Stockmans,

with availability and price trending static or down for

some species, but up for others. Asian demand is picking

up again in Africa and some species like Tali and Azobe

logs are difficult to get.

However, Sipo prices are level and Iroko is rising, but

slowly. FSC Ayous is scarce and demand is strong. But

Padouk availability has improved, thanks to lower demand

from China and India. In fact shortage turned into a

surplus, although, with strong Belgian consumption and

Asian buyers returning, this could evaporate.

Stockmans observed that sapele prices are up again too;

5% generally, and 10% for fixed sizes. The basis of this

though is the positive Dutch market, which is moving

increasingly to finger-jointed product in sapele and

meranti.

After increases in heavier variants Nemesu and Bukit,

Meranti prices have plateaued at a higher level. Suppliers

of Brazilian decking also upped prices, which buyers,

mainly in France, refused to pay. Once existing stock is

exhausted, however, Stockmans expects that these

increases will feed through.

Stockmans also notes demand increases for finger-jointed

laminates in all European countries – presenting an

opening for using lesser known species.

Stockmans believes that the arrival of the first FLEGTlicensed

timber from Indonesia is positive overall but also

suggested that availability of FLEGT-licensed timber

could lead buyers and suppliers settling for legally assured

only and not progressing to FSC or PEFC-certified

material.

Stockmans observes that "in Africa we’re already hearing

‘Our FLEGT VPA will soon be implemented, we don’t

need to do anything until then’ - to minimise these risks,

while welcoming FLEGT-licensing, the trade should

emphasise that our goal is legality and sustainability."

The ETTF newsletter is available at:

http://www.ettf.info/sites/ettf/files/ETTF%20Newsletter%20Win

ter-Spring%202017.pdf

EU slaps antidumping duty on Chinese plywood

In an official release dated 5 April 2017 the European

Commission has imposed an anti-dumping duty on EU

imports of okoumé plywood (CN 4412311010) originating

in China.

The product is defined as follows: plywood consisting

solely of sheets of wood, each ply not exceeding 6 mm

thickness, with at least one outer ply of okoumé not coated

by a permanent film of other materials, originating in the

PRC, currently falling within CN code ex 4412 31 10

(TARIC code 4412 31 10 10)

The decision comes after the European Timber Trade

Federation lodged a complaint asking for an investigation

on pricing of plywood from China.

Representatives of more than 25% of the total EU

producers of okoumé plywood complained that Chinese

plywood is being sold at a very low price.

For the full details see: http://eur-lex.europa.eu/legalcontent/

EN/TXT/?qid=1493369751449&uri=CELEX:32017R06

48

|