|

Report from

Europe

EU tropical sawn hardwood imports remain static in

2016

In 2016, EU imports of tropical sawn hardwood were 1.04

million m3, unchanged from the previous year. The value

of EU imports increased by 2% to Euro775 million.

The average unit value of tropical sawn hardwood imports

into the EU in 2016 was Euro747 per cubic meter, up from

Euro730 per cubic meter the previous year.

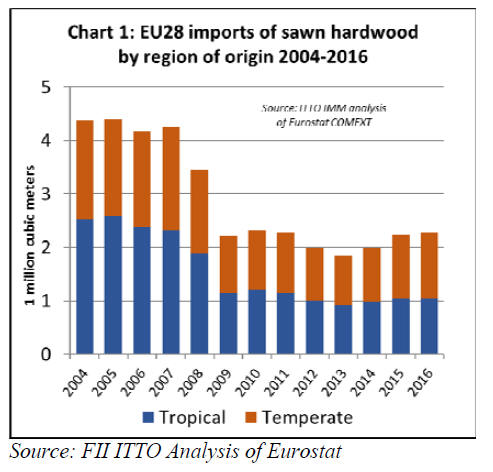

The volume of EU imports of tropical sawn timber

remains stalled at historically very low levels. Import

volume in 2016 was 12% higher than the all-time low of

930,000 m3 recorded in 2013 but remains 40% below the

levels prevailing before the global financial (Chart 1).

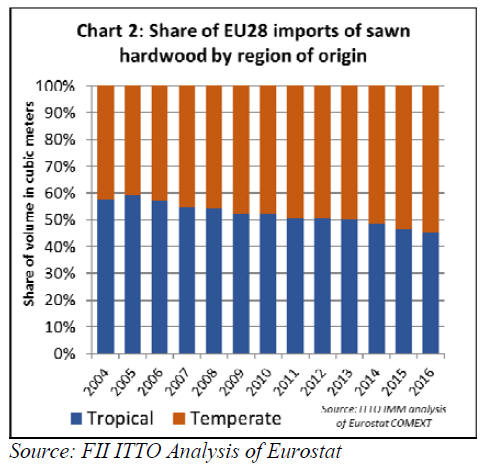

The share of tropical in total EU sawn hardwood imports

declined from 46.5% in 2015 to 45.6% in 2016, continuing

a long term downward trend (Chart 2).

In 2016, EU imports of temperate sawn hardwood

increased 3% to 1.24 million m3. This was mainly due to a

13% increase in EU imports of sawn oak from Ukraine in

response to tighter controls on log exports from that

country and extreme weakness of the Ukrainian currency.

Rising dependence in EU on tropical sawnwood from

Cameroon

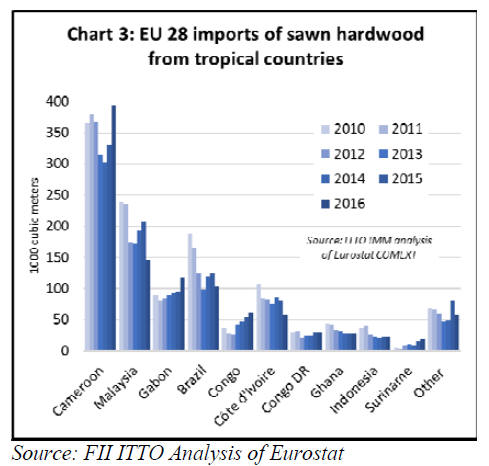

The most notable trend in the supply of tropical sawn

timber to the EU in 2016 was the rising dependence on

imports from Cameroon.

EU imports from Cameroon increased 19% to 395,000 m3

in 2016, growing particularly rapidly into Belgium but

with robust increases also into Italy, France, Spain, the UK

and the Netherlands (Chart 3).

There was a significant increase in EU imports of sawn

tropical wood from two other central African countries

during 2016. Imports were up 22% to 117,000 m3 from

Gabon and 13% to 62,000 m3 from the Congo Republic.

Imports from both countries mainly enter the EU by way

of Belgium.

However last year there was a particularly large increase

in UK imports from Congo Republic, from 6500 m3 in

2015 to 14000 m3 in 2016.

A combination of factors contributed to rising EU imports

from Cameroon, Gabon and Congo Republic during 2016

including the relative weakness of the euro against the

dollar (which tends to favour African countries where

currencies are linked to the euro); continuing efforts to add

value prior to export in central Africa; and recent progress

to implement forest certification in the Congo region.

In contrast to imports from central Africa, EU imports of

sawn hardwood from West Africa were low and declining

in 2016. Imports were down 30% to 57,000 m3 from Cote

d’Ivoire and 2% to 27,000 m3 from Ghana, a reflection of

the limited availability of hardwoods favoured in the

European market.

Eurostat import data indicates a big decline in EU imports

of Malaysian sawn timber in 2016, with nearly all the fall

recorded as occurring into the Netherlands. Unfortunately,

Dutch sawn hardwood import data has been unreliable in

recent years, indicating a very significant upturn in import

volume from Malaysia in 2015 followed by a crash in

2016.

Malaysian trade statistics, which appear to be more

accurate, confirm that there was a rise in sawn hardwood

exports to the Netherlands in 2015 followed by a decline

in 2016, but the level of volatility is much less than

suggested by Eurostat.

During 2016, Malaysian sawn hardwood imports were

relatively low and flat into the other main EU markets for

this commodity, including the UK, Germany, France and

Belgium. This is due both to the continuing weakness of

the euro against the dollar and the reorientation of

Malaysian exporters away from European markets for

sawn lumber in favour of emerging markets and valueadded

products such as LVL, doors and other joinery

products.

Eurostat data suggests that EU sawn hardwood imports

from Brazil fell 16% to only 104,000 m3 in 2016, only just

above the all-time low of 99,000 m3 recorded in 2013.

Imports from Brazil fell into both the Netherlands and

France in 2016, a trend only partly offset by a slight rise in

imports into Belgium.

As for Malaysia, the Eurostat data is questionable

(particularly for Dutch imports) and contradict Brazilian

trade statistics which indicate a slight rise in exports of

sawn hardwood to the Netherlands and several other EU

countries in 2016.

Despite these discrepancies, it is clear that Brazilian sawn

hardwood exports into the EU are now very low by

historical standards and that a large proportion of the

relatively limited volume of this commodity that Brazil

makes available to international markets is now destined

for other countries.

Global Trade Atlas data indicates that Brazil exported

284,000 m3 of sawn hardwood in 2016, of which 39,000

m3 went to China, 39,000 m3 to India, 31,000 m3 to

Vietnam and 28,000 m3 to the US.

Brazilian exports of sawn hardwood to all EU countries

were 94,000 m3 in 2016, up from 81,000 m3 in 2015, but

well below levels before the financial crises which were

typically in excess of 500,000 m3 per year.

EU tropical wood imports increasingly shipped

through Belgium

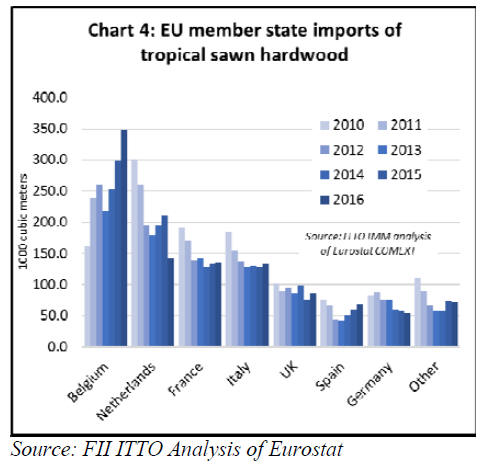

On the demand side, the most notable trend in EU tropical

sawn hardwood imports during 2016 was increasing

concentration of trade through Belgium (Chart 4). This

trend is much more indicative of changes in distribution

channels for tropical wood within the EU than of

variations in regional demand.

For reasons probably associated with differences in transit

times or local costs, EU tropical wood importers currently

prefer the Belgian port of Antwerp over the Dutch and

French ports. The wood entering by way of Belgium is

being distributed throughout North Western Europe.

The focus on Belgium is also linked to the rising

dependence on tropical sawn wood from Central Africa

where kiln drying facilities are limited. Much of the

African wood shipped into Belgium arrives green and will

be kiln dried there, or in Netherlands or northern France,

before being distributed into other parts of Europe.

Spain’s tropical wood market recovers some ground

Hardwood consumption in Spain has recovered some

ground, but growth remains slow and hardwood products

are coming under renewed pressure from substitutes,

including other wood non-wood products.

More positively for tropical wood, tightening supply and

rising prices for European oak and American white oak, is

encouraging some importers to focus again on tropical

wood.

These were some of the messages that came out of the

General Assembly of the Spanish timber trade association

AEIM held in Madrid on 10 March. The Assembly was

attended by 78 representatives of timber companies

including distributors, manufacturers and agents from

across Spain, the highest level of attendance ever

recorded.

Overall the view was that supply and demand in the

tropical hardwood market in Spain is reasonably well

balanced, with sufficient supply to match demand which is

still limited but rising slowly.

The main tropical species imported into Spain are ayous

for interior mouldings and iroko for window frames, with

small volumes of other species such as sapele, tali,

cumaru, and jatoba for various niche applications.

Spain imported around 68,000 m3 of tropical sawn

hardwood in 2016, a gain of 14% compared to the

previous year. Imports from Cameroon, by far the leading

supplier, increased sharply, by 24% to 45,000 m3 in 2016.

There was also a 4% increase in imports from Brazil to

8500 m3 and a 54% increase in imports from Gabon to

3500 m3. These gains offset a 23% fall in imports from

Cote d’Ivoire to 3200 m3 and 60% decrease in imports

from Congo Republic to only 1100 m3.

At the AEIM General Assembly concerns were expressed

over the increasing problems to source European oak, a

situation which has arisen due to restricted harvesting and

strong demand for logs from other sectors, notably the

barrel stave market, and for overseas export, particularly

to China and Vietnam. Prices for American white oak

have also been rising on the back of improved domestic

US demand and export demand in the Far East.

Spanish importers are struggling to pass on higher white

oak prices to consumers. As a result importers have been

running down existing stocks and seeking cheaper

alternatives. Some are buying in more American red oak,

which is currently about 20% cheaper than white oak.

Some are also now sourcing more ayous and other African

timbers.

As for other wood products, Spanish timber traders at the

AEIM General Assembly commented that consumption of

structural products, such as laminated beams, and of

treated wood for exteriors is now increasing in Spain.

The economic situation in Spain is improving but still

uncertain. The headline economic figures are encouraging

but the financial crisis and the current political and

economic uncertainty in the Eurozone is affecting

consumer confidence. Unemployment is still high and

consumers are reluctant to spend on what they see as

luxury items such as hardwood furniture, kitchens and

flooring.

The use of hardwood is restricted to the higher value end

of the market although the boom in tourism is still fuelling

strong demand for hotel and restaurant renovation

especially in coastal regions.

There also appears to be a move at the lower, more cost

sensitive, end of the market away from solid hardwood

towards cheaper substitutes such as veneer boards or nonwood

materials like vinyls and ceramics, some of which

imitate the look of wood.

CLT - a new high volume market for structural

hardwoods

While much of the discussion at the TTF Conference

focused on constraints and suggested that market prospects

for hardwoods in the UK will remain restricted, the TTF

Conference ended on a more optimistic note. A

representative of one of the UK’s largest engineering firms

highlighted the considerable market potential for

hardwood Cross Laminated Lumber (CLT).

Use of CLT, which is extremely strong and stable and can

be engineered to extremely high tolerances, is allowing

timber to be used for the first time for high-density highrise

construction.

The world’s tallest timber building - completed in 2016 in

Vancouver, Canada - has 18 storeys made possible by the

use of CLT. Another project just launched in Amsterdam

will involve construction of a 21-storey building in CLT.

CLT production capacity in Europe has risen dramatically

in Europe in recent years and now amounts to close to 1

million cu.m per year, concentrated in Germany and

Austria. While production to date has been almost

exclusively in softwoods (mainly Spruce), there is

growing interest in using hardwoods.

AHEC has been playing a leading role to develop potential

for hardwood CLT in Europe and elsewhere. It has been

involved in two high profile demonstration projects – the

Endless Stair and the Smile – in which leading architects

were commissioned to construct large installations as

prominent features at the London Design Fair. Both

installations demonstrated CLT manufactured using

American tulipwood.

These demonstration projects encouraged construction of

the first permanent structure in hardwood CLT, a

“Maggie’s Centre” building recently completed in Oldham

in the north of England.

These various CLT projects have shown that use of

hardwood for CLT is more expensive than softwood on a

per cubic meter basis, but that the extra cost can be offset

by the much higher strength achieved by hardwoods.

This allows smaller volumes to be specified, saving on the

cost of purchasing and transporting materials.

Use of hardwood CLT also allows the creation of less

bulky and more attractive structures, particularly as

architects are increasingly keen to leave the structural CLT

elements exposed for display in the finished building.

While at present only temperate hardwoods are being

considered for use in CLT, a representative of one large

hardwood manufacturer at the TTF Conference suggested

there may well be opportunities for tropical hardwood in

this sector, given the high strength to weight ratio of many

tropical species, and their durability (implying particular

advantages for CLT elements exposed to the weather).

While there is potential for use of tropical wood CLT in

Europe, it was also noted that some of biggest

opportunities may well be in tropical countries where there

is rapid growth in demand for more efficient and

sustainable high-density construction systems.

The TTF Conference also highlighted that there is much

work to be done to exploit the opportunity. The

sustainability argument is important but in this sector, as

in others, it was emphasised by the representative of one

leading UK engineering firm, “there is not a single UK

developer who will pay any more for sustainability”.

He noted that for commercial building “the advantage of

wood is speed” and that CLT buildings are “the flatpacked

furniture of the construction sector”.

It was also emphasised that using any wood for structural

applications is a very different proposition from use in

joinery – if a building collapses people may be killed and

the developer is liable.

Any hardwood producer wanting to participate in the CLT

market will have to perform structural testing and make

available structural strength data. This testing is too

expensive and time-consuming to be carried out for

individual projects.

Therefore, it must be carried out well in advance and the

data made readily available. It was also noted that CLT

manufacturers, while utilising lower grades of sawn

timber, will require wood to be kiln dried and supplied in

standard widths and lengths rather than in random sizes.

|