Japan

Wood Products Prices

Dollar Exchange Rates of 27th

March 2017

Japan Yen 110.66

Reports From Japan

Weak consumer spending and stronger yen

unsettles

Bank of Japan

Bank of Japan Governor, Haruhiko Kuroda, has indicated

that while business conditions and prices are improving in

Japan there are downside risks as overall economic

activity, especially consumer spending, is not yet firm

enough to lift inflation to the 2% target the Bank has set

itself. Because of this he said it is too early to be

considering easing monetary stimulus.

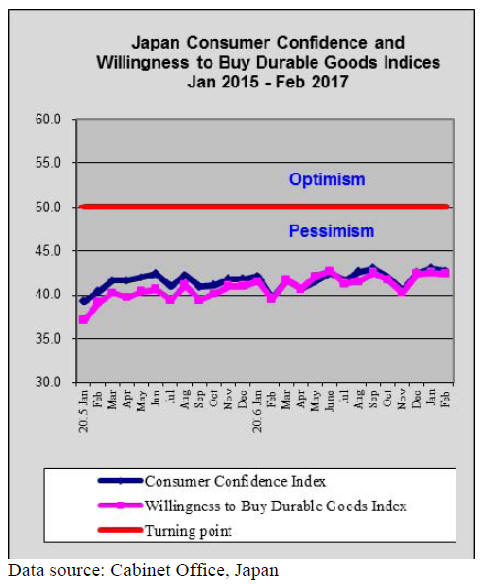

Retail sales were unchanged from a month earlier

according to the February survey which indicated

consumers cut back on durable goods purchases after

employers offered the lowest spring wage increases in four

years.

However, manufacturers appeared more confident in a

March poll but the recent strengthening of the yen will

surely hurt sentiment if it does not pull back from recent

highs against the US dollar.

Another period of stronger yen forecast

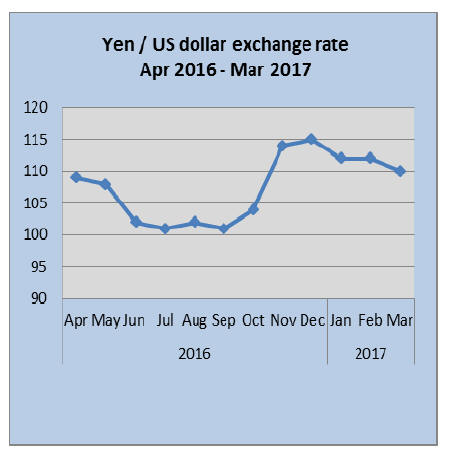

The Japanese yen/dollar exchange rate has rolled back to

the same level as in March 2016, around 110 to the dollar.

In recent months the yen weakened considerably boosting

the stock market which is dominated by exporters and

providing some glimmer of hope to the Bank of Japan as it

seeks to deliver on its 2% annual inflation target.

The set-backs that the new US administration has faced in

delivering on campaign promises has undermined

confidence that the Republican led government US

monetary and fiscal policies would drive the dollar higher.

Another factor driving the yen stronger has been

comments from the US Federal Reserve that it is now

inclined to slow the pace of interest rate rises which favor

a weak yen.

February housing starts mark forth monthly

decline

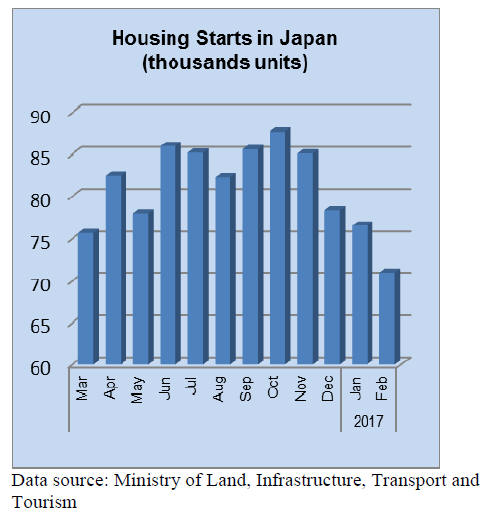

The results of the Ministry of Land, Infrastructure,

Transport and Tourism assessment of February housing

show a decline in starts, marking the fourth straight

monthly decline.

February housing starts dropped just over 8% compared to

January and year on year February starts were down

almost 3%.

With the latest figures the annualised housing start

forecast dropped to 940,000 from the 1.0 million

determined in January. On the other hand, construction

companies report orders grew in February and were much

firmer than in February last year.

Japan’s wooden furniture imports

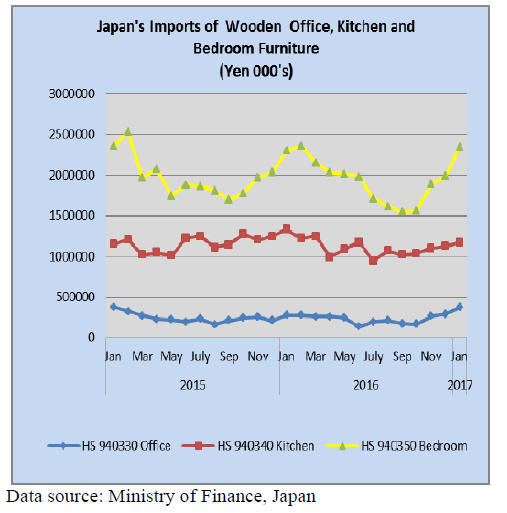

2017 got off to a good start for exporters of wooden office

and bedroom furniture to Japan. The value of wooden

office furniture imports to Japan in January 2017 were up

34% year on year and up 27% month on month and the

value of wooden bedroom furniture imports jumped 18%

year on year. The value of imports in January 2016 was

lifted by the weaker yen (120/US$) compared to the

stronger yen in January this year.

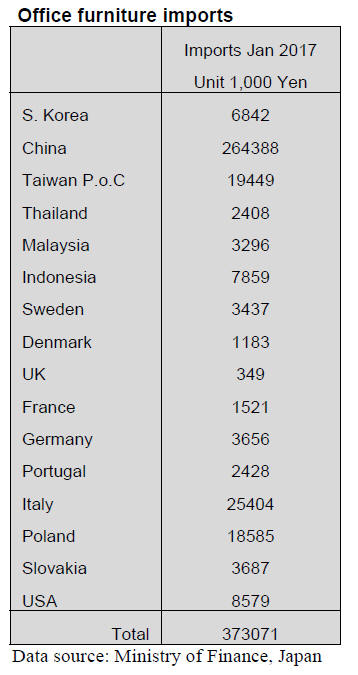

Office furniture imports (HS 940330)

The value of Japan’s wooden office furniture imports has

been rising for three consecutive months from November

last year. January 2017 shipments from China grew

substantially lifting China’s contribution to total wooden

office furniture imports to just over 70%. The other

suppliers were Italy (7%) Taiwan P.o.C (5%) and Poland

(5%).

In January this year most shippers saw increase in the

value of imports by Japan.

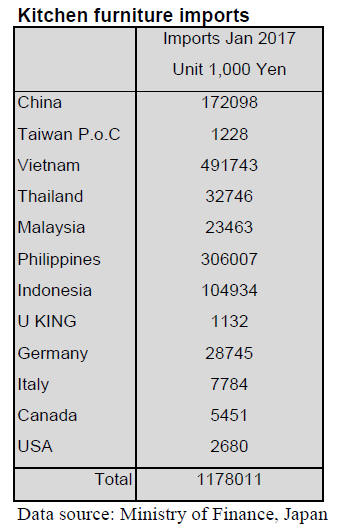

Kitchen furniture imports (HS 940340)

In contrast to the rise in imports of wooden office and

bedroom furniture, Japan’s January imports of wooden

kitchen furniture dropped year on year (-11.5%) but

compared to a month earlier imports rose slightly.

Despite the year on year fall in the value of wooden

kitchen furniture there has been a steady increase in the

value of imports from September 2016.

In January 2017 the top suppliers were Vietnam (42%),

the Philippines (26%) and China (15%) and if shipments

from Indonesia are included then almost 70% of imports

for the month are accounted for.

The big winners in January 2017 were China and Vietnam

followed by Indonesia and the Philippines both of which

saw an increase in shipments of around 7%.

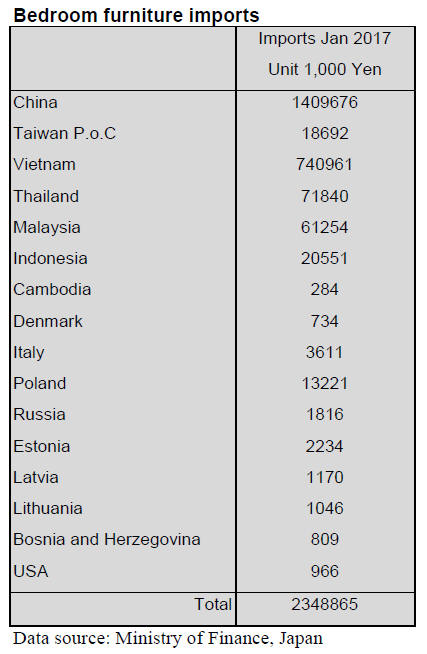

Bedroom furniture imports (HS 940350)

Japan’s imports of wooden bedroom furniture exhibit a

distinctive cyclical pattern, In 2015 and 2016 imports

peaked in December/January only to begin to tail off midyear.

January 2017 imports of wooden bedroom furniture

appear to be following the same trend as there has been a

steady rise in imports since September 2016.

Year on year, the value of Japan’s wooden bedroom

furniture imports remain flat but January 2017 imports are

well up from a month earlier. Japan’s January 2017

imports of wooden bedroom furniture were dominated by

two suppliers China and Vietnam with China accounting

for 60% and Vietnam supplying another 30%.

With 90% of imports accounted for other suppliers had a

hard time in January with only Thailand, Malaysia,

Indonesia and Taiwan P.o.C making it into the top 20

suppliers.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

South Sea (Tropical) log imports in 2016

South Sea log import in 2016 was 193,192 cbms, 20.6%

less than 2015.By source, 101,284 cbms from Sabah,

Malaysia 2.6% more than 2015. 53,780 cbms from

Sarawak,Malaysia, 40.1% less than 2015. 33,058 cbms

from PNG,8.2% less. 5,070 cbms from Solomon Islands,

73.1% less.

Weather in Sarawak, Malaysia was unstable all through

the year so log production was slow. Then the government

of Sarawak reduced quota of log export, which resulted in

considerable drop of export volume.

Log production was smooth in Sabah with favorable

weather so that both Japan and India increased purchase in

Sabah to make up for log shortage in Sarawak. Japan

failed to buy enough logs pushed by aggressive purchase

by India. Also log prices stayed up high, which

discouraged purchase by Japan.

There are only few plants consuming South Sea logs

steadily but the mills have been having hard time to pass

higher cost onto sales prices particularly when the yen got

weaker. Import of South Sea lumber in 2016 was 494,872

cbms, 2.6% less than 2015. In this, lumber was 225,864

cbms, 4.2% less and free board was 269,018 cbms, 1.3%

less.

Log export prices in February continue firm in Sabah and

Sarawak, Malaysia. Log harvest stopped temporarily

during Chinese New Year holidays in February.

Log importers are arranging ships for late February and

early March loading but it is hard to have enough quality

logs like regular meranti and to fill up ships, it is necessary

to load small and super small meranti logs.

Plywood mills in Japan want regular logs even with higher

prices as recovery is better. Log suppliers’ offer prices

remain unchanged for March shipment.

Main buyer, India is quiet with reduced volume so the

suppliers cannot be bullish.Sarawak meranti regular prices

are US$275-280 per cbm FOB.

In Sarawak, since January this year, log harvest quota

changed from yearly to monthly so if log harvest volume

is more than regulated quota, logs are not allowed to haul

out and not allowed to carry over to next month so log

suppliers produce only 90% of quota. This reduces

available volume inevitably.

Revision of JAS

Revised draft of the Japan Agricultural Standard (JAS) is

submit to the Diet, which is now being held with the

purpose of promoting export of Japanese agricultural and

marine products. After discussion at the Upper House and

Lower House, it will enter into force within a year.

The main purpose is to use JAS for promotion of Japanese

agricultural and marine products at overseas market. Point

is to make changes of various standards much easier.

Present JAS rules only quality of the products. After the

revision, it sets partial standard on manufacturing,

management, method of measuring and analysis.

In manufacturing standard of wood, if new manufacturing

or technique in drying, fire proofing and anti-fungus are

established to make product as value added product,

standardization of such new technique appeal to

differentiate the product from other products.

In management standard, it appeals maintaining quality of

wood product if management standard is established to

handle product under cover to prevent rain in every step of

inventory or transportation.

Regarding standard on measuring and analysis, if

objective visual standard can be made to judge luster of

wood, number of dead knots and size of large knots, it

would be a method of appealing beauty of solid wood by

JAS.

In proposing a new standard by producer or producing

region, precise standard to apply without change needs to

be made but under revised rule, new standard can be

proposed in rather imperfect shape.

Also in JAS mark, additional writing such as guaranteed

quality or guaranteed of freshness can be printed.

In overseas market, it is common to call ‘certification’,

which proves fitting standard such as ISO and the Forest

Certification system by third party so revision includes

changing from JAS approved to JAS certified.

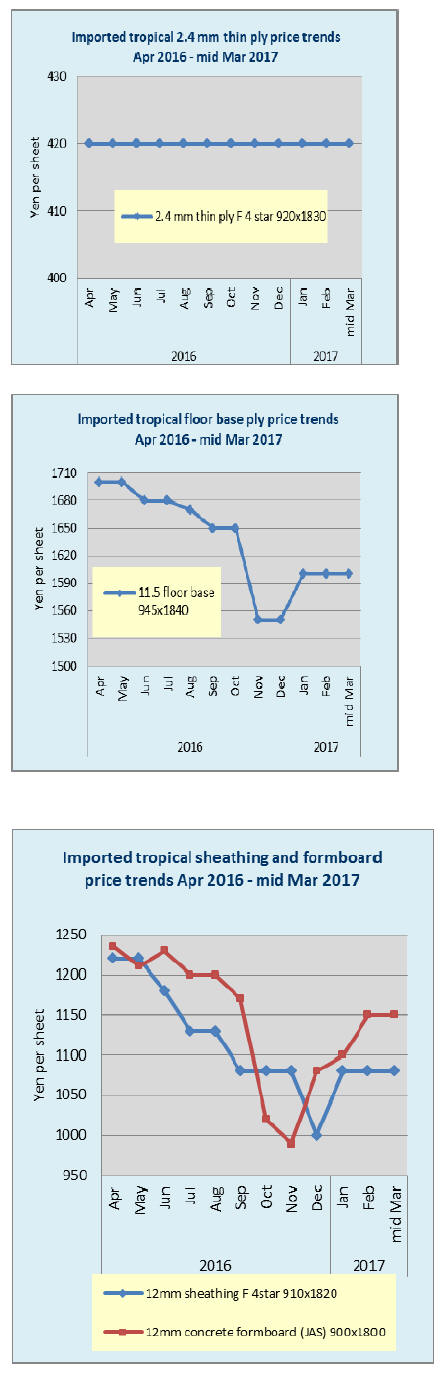

Production of composite flooring in 2016

Production of composite flooring in 2016 was 67,825,000

square metres, 4.4% more than 2015. Active housing starts

supported increased production. Market of composite

flooring has changed largely in 2016.

Floor base is shifting from South Sea hardwood plywood

to domestic cedar plywood. Sheet type with resin based

materials for surface decoration also largely increased.

In 2016 production, floor base with South Sea hardwood

plywood including composite with MDF was 44,573,000

square meter, 12.9% less than 2015. In total production

share of imported hardwood plywood is still high with

66% but compared to 2015’s 78.7%, 12.7 points dropped

in 2016.

Meantime, domestic floor base (domestic plywood and

combination of plywood and MDF) was 11,781 M square

metres, 101.3%. Share of domestic base is 17.4% but from

2015’s 9%, 8.4 points increased in 2016.

Domestic base with cedar, cypress and fir plywood

combined with thin MDF to make surface smooth has

been increasing largely in last one and two years because

imported plywood prices have been high and exchange

fluctuation influences yen cost but domestic products are

nothing to do with exchange rate then the government

encourages use of domestic wood with point system and

consumers’ concern to environmental protection promote

use of domestic wood products.

About 80% of composite flooring is used for floor heating

floor: By technical improvement, domestic wood base can

be used for floor heating floor so share of domestic floor

base will continue increasing while South Sea hardwood

plywood cost seems to keep climbing due to tight log

supply.

Production of particleboard base type increased to

5,501,000 square metres in 2016, 164.5% more. It is

ecological product and cost performance is good. For

surface coating, use of sliced wood veneer decrease and

there are more use of resin based materials like olefinic

resin.

|