|

Report from

North America

Hardwood plywood imports decline for third

consecutive month

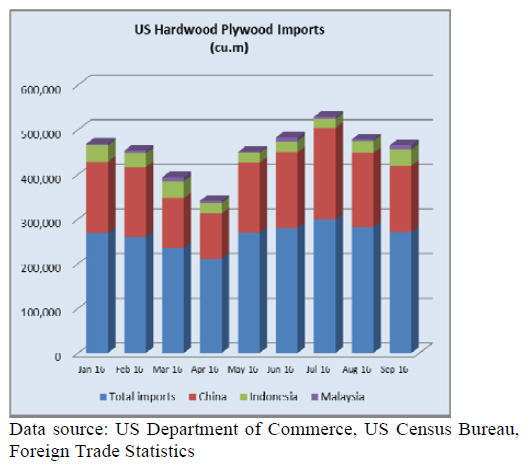

Hardwood plywood imports declined for the third

consecutive month in September to 270,584 cu.m. The

value of plywood imported in September was down 3%

from the previous month.

Year-to-date, the value of plywood imports increased in

September for imports from Canada, Ecuador, and to a

lesser degree, Malaysia. Despite the higher volumes

shipped for most other suppliers the value of plywood

exports to the US market declined compared to September

2015.

The largest month-on-month drop was in plywood imports

from China. The US imported 148,645 cu.m. from China

in September, worth US$89.6 million. Year-to-date import

volumes from China were 1% higher than in September

2015.

Hardwood plywood imports from Malaysia almost tripled

in September from the previous month to 9,825 cu.m.

Despite this month¡¯s growth in shipments, year-to-date

imports from Malaysia were down from September 2015.

Hardwood plywood imports from Indonesia and Ecuador

were also up in September, but year-to-date import

volumes remain below 2015 levels.

Tropical veneer imports down in September

Tropical hardwood veneer imports fell by more than half

in September to just US$1.1 million. Imports from

practically all countries declined. The largest monthly

decrease was in the two largest suppliers Italy and China.

Year-to-date imports of veneer remain significantly up

(+46%) compared to September 2015.

Higher moulding imports from Malaysia

Imports of hardwood moulding were worth US$15.7

million in September, down 12% from the previous

month. Year-to-date imports were 4% below September

2015.

Imports from Brazil and Malaysia increased in September

despite the overall decline. Brazilian shipments to the US

were worth US$4.6 million. Imports from Malaysia

increased to US$1.2 million in September. Moulding

imports from China were down one third from August.

Year-to-date moulding imports from Canada and Malaysia

were up compared to the same time last year, while China

and Brazil shipped less this year.

Malaysia and Indonesia lose imports share in

hardwood flooring

Imports of hardwood flooring and assembled flooring

panels decreased in September. Hardwood flooring and

assembled flooring panel imports were worth US$3.3

million and US$13.9 million, respectively, in September.

Year-to-date imports of assembled panels were up 13%

compared to September last year, while hardwood flooring

imports declined year-to-date.

Hardwood flooring imports from Malaysia and Indonesia

fell in September. Last year both countries were the largest

suppliers to the US market, but 2016 year-to-date China

has become the largest source of hardwood flooring

imports.

Canada shipments of hardwood flooring also grew in 2016

helped by a more favourable exchange rate.

Imports of assembled flooring panels from all major

suppliers except Brazil declined in September. Imports

from Brazil increased to US$685,136, but year-to-date

imports were down 14% from September 2015.

China remains the largest source of assembled flooring

imports and its shipments to the US increased 16% yearto-

date from September last year. Indonesia, Thailand and

Vietnam also expanded their share in US imports in 2016.

Wooden furniture imports down 8% in September

Wooden furniture imports declined 8% in September to

US$1.33 billion. Year-to-date imports were up 2% from

September 2015.

Furniture imports from most countries decreased in

September except from Indonesia. Imports from Indonesia

grew in September (US$36.5 million), but year-to-date

they were still 9% lower than at the same time last year.

Year-to-date China¡¯s furniture exports to the US were

unchanged from September 2015, despite a 7% monthover-

month decline this September.

Canada, Mexico and India had the strongest growth in

year-to-date wooden furniture exports to the US market.

Imports of non-upholstered seats were unchanged from

August, while all other types of furniture imports

decreased in September. The strongest monthly decline

was in kitchen furniture imports.

Stronger GDP growth in third quarter

GDP increased at an annual rate of 2.9% in the third

quarter of 2016, based on the first advance estimate by the

Bureau of Economic Analysis. In the second quarter, real

GDP increased 1.4%.

The unemployment rate was practically unchanged at

4.9% in September, according to the US Bureau of Labor

Statistics. Employment in construction, manufacturing,

wholesale and retail trade changed little from the previous

month.

Economic activity in the manufacturing sector expanded in

October, according to the Institute of Supply Management.

Furniture and related products manufacturing reported

growth in October following a month of lower output.

Wood product manufacturing shrank for a second

consecutive month in October.

The US manufacturing industry reported little impact on

their businesses this quarter from the bankruptcy of the

Hanjin Shipping Company. Over half of the companies

surveyed by the Institute of Supply Management were not

affected, while 30% reported a small, but not serious

impact.

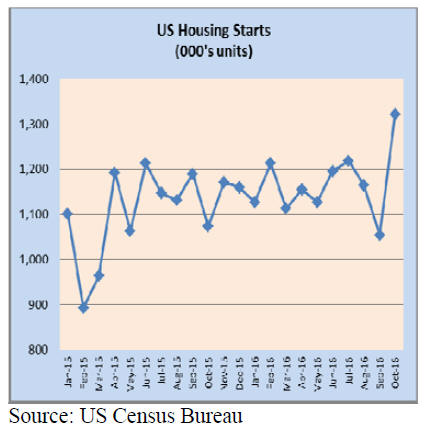

Housing starts and existing home sales at highest

level since 2007

Housing starts soared by 26% in October to a seasonally

adjusted annual rate of 1.32 million units, according to the

US Department of Housing and Urban Development and

the Commerce Department.

Construction of new single-family houses reached their

highest level since October 2007. Multi-family housing

starts production jumped almost 70% from the previous

month. However, the National Association of Home

Builders still expects lower multi-family construction

overall this year than in 2015.

Builders¡¯ confidence in the market for new single-family

homes held steady in November. The survey was carried

out by the National Home Builder Association before the

election in early November.

The number of building permits issues, which indicates

future building activity, changed little in October. Singlefamily

permits increased slightly to 762,000, while multifamily

permits declined by 3%.

Sales of existing homes sales reached the highest level at a

seasonally adjusted annual rate in October since February

2007, according to the National Association of Realtors.

Sales were 6% higher than at the same time last year. The

National Association of Realtors Sales credits pent-up

demand and economic growth with the upswing in sales.

Long-term downward trend in single-family house

construction in Canada

Housing starts in Canada fell 12% in October at a

seasonally adjusted annual rate. The decline was mainly in

multi-family construction, but single-family starts also

fell.

The Canadian Housing and Mortgage Corporation

forecasts slightly lower starts for this year and next year

than in 2015. High home prices have contributed to

affordability challenges, especially among first-time home

buyers.

Construction of single-family homes has trended

downward since 2009. In 2016 the average share of singlefamily

homes in total starts was 67% in the US compared

to 30% in Canada. The downward trend in single-family

construction is expected to continue in the next two years

as house prices in the major cities have become

unaffordable to most Canadians.

US Lumber Coalition petitions government to impose

duties on Canadian imports

The US Lumber Coalition has filed a petition with the US

government to impose duties on sawn softwood from

Canada.

The group alleges that provincial governments in Canada

subsidise softwood producers, mainly by selling trees from

public land to sawmills at lower than market value prices.

Softwood is not included in the North American Free

Trade Agreement NAFTA and the 2006 softwood lumber

agreement expired last year.

|