|

Report from

Europe

EU recovery still slow and fragile

Eight years on from the financial crises, the recovery in

the EU timber market remains slow and fragile. There is

Europe-wide economic growth and key market sectors

such as construction, furniture, and flooring are

expanding, but the rate of increase rarely exceeds 2% per

year in any individual sector or European country and

some are still flat-lining.

Deflation remains a constant threat despite a Euro 60

billion-a-month programme of quantitative easing

implemented by the European Central Bank – recently

extended at least until March 2017.

Slow growth, low interest rates and quantitative easing has

led to persistent weakness in the value of the euro and

other European currencies on international exchange

markets. Political and economic problems mean that the

Russian rouble and other Eastern European currencies are

even weaker than the Euro.

This, in turn, is undermining demand for imports from

other regions, including the tropics, into the EU and

boosting the relative competitiveness of European

manufacturers.

The UK's decision to exit the EU, taken in a referendum

on 23 June, is another concern, both for the direct effects

on the UK economy and the fallout for wider political and

economic stability in Europe.

Overall the outlook of tropical suppliers of wood products

into the EU is not particularly encouraging.

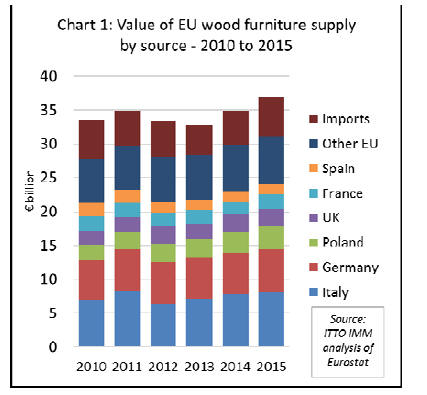

EU furniture production increases 4.4% in 2015

Eurostat has just published the PRODCOM industrial

production data for 2015 which indicates modest growth

last year in the EU wood furniture sector.

Domestic production of wood furniture (excluding kitchen

furniture) increased 4.4% to Euro31.15 billion in 2015.

Production increased in all the main EU manufacturing

countries including Italy (+4% to Euro8.06 billion),

Germany (+4% to Euro6.35 billion), Poland (+9% to

Euro3.42 billion), the UK (+1% to Euro2.59 billion),

France (+3% to Euro2.05 billion), Spain (+7% to Euro1.53

billion), Sweden (+2% to Euro1.02 billion), Lithuania

(+3% to Euro740 million), Romania (+4% to Euro690

million), and Portugal (+2% to Euro640 million).

Imports of wood furniture from outside the EU were worth

Euro5.73 billion in 2015, 13% more than in 2014, but still

only 16% of furniture supply in the EU. (Chart 1).

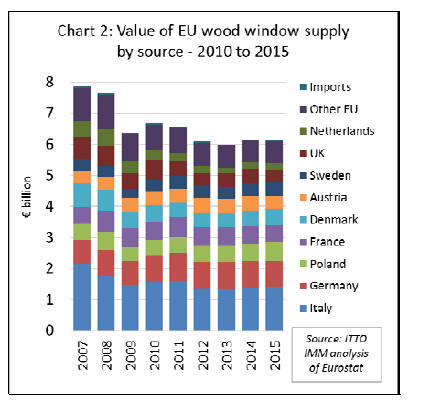

Sluggish growth in European window production

The total value of wood windows supplied to the EU

increased only 1.2% to Euro6.11 billion in 2015. There

was rising production in Italy (+2% to Euro1.42 billion),

Poland (+8% to Euro620 million), Denmark (+9% to

Euro550 million) and the Netherlands (+2% to Euro210

million).

Imports of wood windows from outside the EU also

increased by 41% to Euro30 million but still represented a

very small share of overall supply.

These gains were offset by falling production in Germany

(-4% to Euro810 million, France (-5% to Euro530

million), Austria (-9% to Euro410 million) and the UK (-

13% to Euro410 million). Wood window production in

Sweden remained stable at Euro440 million in 2015.

(Chart 2).

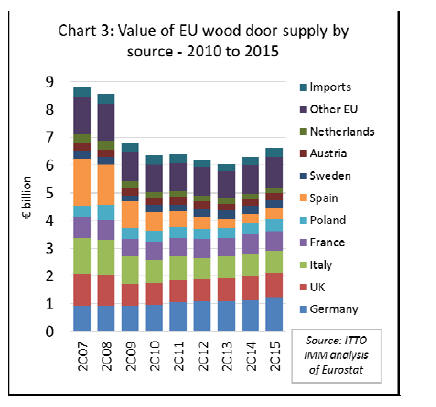

More robust growth in the EU wood door sector

Growth in the EU wood door sector was more robust than

in the window sector in 2015. The total value of wood

doors supplied to the EU increased 7% to Euro6.62 billion

in 2015. There was rising production in Germany (+6% to

Euro1.21 billion), UK (+7% to Euro930 million), Poland

(+11% to Euro440 million), Spain (+19% to Euro420

million) and the Netherlands (+5% to Euro180 million).

Imports of wood doors from outside the EU increased by

17% to Euro33 million. These gains were offset by falling

production in France (-2% to Euro690 million, Sweden (-

1% to Euro260 million), and Austria (-3% to Euro250

million). Wood door production in Italy remained stable

at Euro800 million in 2015. (Chart 3).

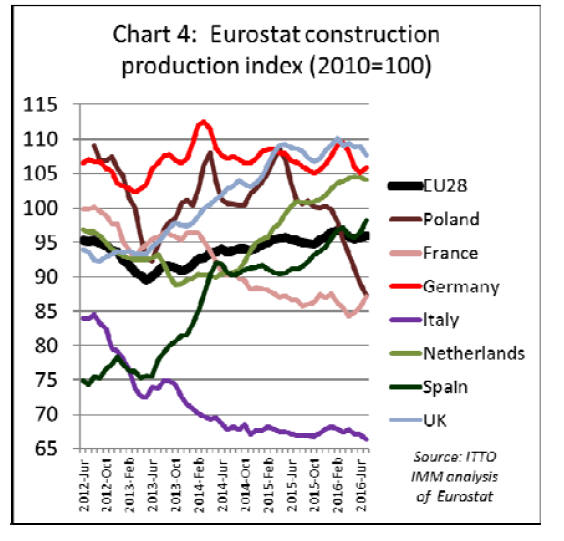

EU construction dips again in 2016

Rising furniture and joinery production in the EU during

2015 mirrors the slow recovery in construction activity

during the year.

The Eurostat Construction Production Index for EU

member states shows that construction activity rose

sharply at the end of last year, with notable upturns in

Germany, the UK, Spain, the Netherlands and France.

However, activity across the EU dipped again this year.

Activity in Poland has slowed very dramatically during

2016. The total value of EU construction in July 2016 was

still 5% lower than in 2010 and 20% down on 2008. The

Italian market remains particularly weak (Chart 4).

FLEGT licenses fine, but success in the market

depends on quality, shipment and price

Earlier this month, ITTO reported that Indonesia is due to

issue the first FLEGT licenses in November and observed

that the Indonesian government and industry are looking

to these licenses to deliver significant market advantages

(ITTO TTM Report 1–15 September 2016).

There are reasons for optimism, FLEGT Licensing gives a

green lane through the EUTR due diligence procedures,

the economic advantages of developing a single unified

system for all exporters, and the greater confidence such a

system offers to both buyers and investors.

These are all benefits which will give Indonesian wood

products a competitive edge in the EU market in the

months ahead. However, prospects for Indonesian timber,

and indeed any timber supplier into the EU market, are not

only dependent on their ability to provide legality licenses.

The first question for international buyers, both in the EU

and elsewhere, is not whether or not they have a FLEGT

license or other assurance of legality or sustainability, but

rather are they able to offer products which are good

quality, on time and at a reasonable price.

Various indices of international competitiveness suggest

that Indonesian exporters face significant challenges on

these wider market issues. For example, in 2015, the

World Bank ranked Indonesia at 109th on the “Ease of

Doing Business” (EDB), significantly lower than

Indonesia’s direct competitors in the timber sector such as

Malaysia (18th), Thailand (49th), China (84th) and

Vietnam (90th).

The UNCTAD Line Shipping Connectivity Index shows

that the logistics of shipping to world markets are

significantly more challenging in Indonesia than in other

South East Asian countries.

In practice these indices imply that Indonesian products

tend to be more expensive and to be subject to longer

delivery times than competing products from elsewhere.

At a High Level Market Dialogue held in Jakarta in

November 2015, the Chairman of the Indonesian Furniture

and Craft Association AMKRI commented that some

furniture manufacturers are moving away from Indonesia

to Vietnam because of ‘red tape’ and cost. Prices for

equivalent furniture manufactured in Indonesia may be

15% to 20% higher than in Vietnam.

The wider macro-economic background in Europe also

presents challenges to Indonesian wood products.

Indonesian exporters have to contend with the relative

weakness of the euro, slow pace of recovery from the

financial crises, the dominant position of domestic and

Chinese manufacturers, and the strong fashion for

temperate woods and wider market prejudices against

tropical timbers.

But it would be wrong to over emphasise the downside.

Growth in the EU may be slow, but it is significant given

the sheer size and wealth of the European economy.

Despite barriers to Indonesia’s competitiveness in the EU,

Indonesia is now the largest single supplier of tropical

timber products into the EU by a significant margin.

In the 12 months to end June 2016, the EU imported

Euro1.01 billion of timber products from Indonesia,

including Euro490 million of wood products (HS 44),

Euro310 million of wood furniture (HS 94) and Euro213

million of paper (HS 48).

This compares to Euro799 million from Vietnam (second

largest supplier - nearly all furniture) and Euro533 million

from Malaysia. Indonesia accounted for nearly a quarter of

all EU timber product imports from tropical countries in

the twelve month period.

Indonesia’s competitive position in various sectors

In practice the competitive position of Indonesian timber

products in the EU varies widely between sectors. In some

sectors for niche tropical wood products, Indonesia is

already the leading supplier and FLEGT licenses will

provide an opportunity to extend this lead.

Indonesia is the largest external supplier of “continuously

shaped” wood (HS code 4409) which includes both

decking products and interior decorative products like

moulded skirting and beading.

EU imports of this commodity from Indonesia increased

3% from 88 000 cu.m in 2014 to 91000 cu.m in 2015 and

Indonesia’s share of total imports (tropical and temperate)

in both years was around 26%.

Indonesia is also the largest tropical supplier of wood

flooring to the EU. Although still low by historical

standards, EU imports from Indonesia increased 4% to

1.59 million sq.m in 2015.

This is only a very small share of the overall EU market,

which consumes over 100 million sq.m of wood flooring

every year and which imported 29 million sq.m in 2015.

However, the FLEGT license should help rebuild the niche

market for tropical wood floors, which still offer strong

benefits - including a unique look and good durability –

but have gone out of fashion in the EU in recent years.

It’s notable that China, by far the EU’s largest single

external supplier of wood floors, suffered a set-back in the

EU market last year, with EU imports of Chinese wood

flooring falling 7.4% to 17.5 million sq.m, the lowest level

since 2005.

Whether this might signal new opportunities for

competing external suppliers like Indonesia, or is a sign of

consumers turning more to domestic products, is hard to

say at this stage.

Plywood is a market sector where FLEGT licenses might

play an important role to boost demand for Indonesian

product. EU imports of plywood from all sources

increased sharply between 2013 and 2015, from 3.38

million cu.m to 3.92 million cu.m, a level not seen since

before the financial crises.

However, imports from Indonesia and other tropical

countries have remained stubbornly low in recent years.

After increasing 3% to 308,000 cu.m in 2014, EU imports

of plywood from tropical countries fell back 6% to

291,000 cu. m in 2015.

The share of tropical countries in EU plywood imports fell

from 9.2% in 2013 to only 7.8% in 2015, the lowest level

for at least the last 20 years, and probably much longer.

Imports from Indonesia fell 5% from 117,000 m3 in 2014

to 112,000 m3 in 2015.

However, Indonesia became the largest single tropical

supplier of plywood to the EU last year as imports from

Malaysia fell 11% from 121,000 m3 in 2014 to 107,000

m3 in 2015.

In recent years, tropical hardwood faced plywood has lost

share in the EU mainly to Chinese plywood faced with

temperate hardwood (including poplar, eucalyptus and

birch), and to Russian birch plywood.

The plywood sector has been a strong focus for EUTR

enforcement activities to date and, given difficulties of

establishing traceability and relatively high illegality risk

of some competing suppliers, Indonesia FLEGT license

should significantly boost competitiveness in this sector.

Uphill struggle to increase share of EU furniture

market

Indonesia faces more of an uphill struggle to increase

market share in the furniture sector. This is particularly

critical given the sheer size of the market and the potential

it offers to add value to the wood resource.

However, it’s also a sector where the technical advantages

of tropical wood are less relevant – at least in the interior

furniture market which dominates sales – than wider

competitiveness issues such as labour costs, red tape,

logistics, processing efficiency, innovation, and marketing.

Indonesia faces considerable competition in this sector,

not least from the EU’s domestic furniture manufacturers

which are hugely dominant, accounting for 84% of all

furniture supplied within the EU in 2015.

One clear sign of the rising global competitiveness of

EU’s domestic manufacturers, boosted by the weak euro,

is the region’s rising trade surplus in wood furniture.

While EU countries imported wood furniture worth

Euro5.78 billion from outside the EU in 2015, EU exports

of wood furniture rose to Euro8.73 billion in 2015, up only

3.5% from 2014 but 51% more than in 2009.

EU imports of Indonesian wood furniture increased by 7%

to Euro316 million in 2015, which is encouraging but less

dramatic than from other countries. EU imports of wood

furniture from Vietnam increased 21.6% to Euro725

million in 2015. This follows 19% growth the previous

year and is a clear demonstration of Vietnam’s rising

competitiveness in global furniture manufacturing.

Despite Vietnam’s rise, more than half of all EU wood

furniture imports, Euro3.15 billion, came from China in

2015, with deliveries rising 12%.

In 2015, EU imports also increased rapidly from Malaysia

(+12% to Euro191 million), Turkey (+21% to Euro183

million) and India (+23% to Euro162 million).

Mixed prospects for FLEGT licensed timber products

In short, there are reasons to believe that FLEGT licensing

will help improve competitiveness and could provide a

fairly immediate boost to trade in those sectors where

Indonesia has already established a strong market position

and where EUTR regulatory activity has been focused –

such as decking, plywood and wood flooring.

However, significant gains in market share over the long

term, particularly in high value sectors like furniture, will

only be achieved if FLEGT licensing is combined with

policies to improve the international competitiveness of

Indonesian wood manufacturers across a wider range of

issues.

The good news is that the FLEGT process has some

potential to enhance this process through the role it plays

to increase industry co-operation, improve dialogue and

information exchange with customers and suppliers, raise

the overall image of Indonesian products and potentially

encourage investment by reducing actual and perceived

business risk.

Indonesian supply of wood products to the EU must also

be set within the context of the wider market opportunities

available to Indonesian manufacturers. The influential

“Global Construction 2030” report by Oxford Economics

published in 2015 forecast that Indonesia will rise to

become the world’s fourth largest construction market by

2030.

The value of Indonesian construction is predicted to rise

from around US$250 billion in 2015 to nearly US$700

billion in only 15 years, moving up from its current

position as the 11th largest market to overtake Japan.

The same report suggests that European construction will

also grow, but only slowly from around US$1,800 billion

in 2015 to US$2,250 billion in 2030, little more than the

total value of the European market in 2007 before the

crash (US$2200 billion).

Therefore, the key challenge, and opportunity, for the

SVLK system on which FLEGT licensing is based may

ultimately lie in the role it plays to promote efficient

delivery of legal and sustainable timber products into the

domestic market and to promote new investment in forest,

technical and human resources to supply that market.

|