|

Report from

North America

Fourth consecutive decline in hardwood plywood

imports

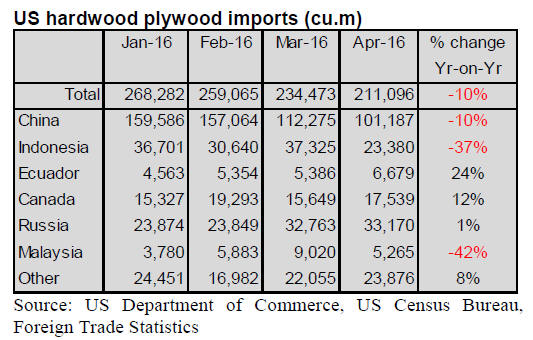

US hardwood plywood imports were down 1% in April,

the fourth consecutive month-on-month decline. A total of

211,096 cu.m. were imported in April, worth US$122.1

million. Year-to-date import volumes remain slightly

higher (+1%) than in April 2015, but the value of year-todate

plywood imports decreased 7% compared to 015.

Lower plywood imports from China and Indonesia were

largely responsible for lower April figures. Imports from

China were 101,187 cu.m. in April, down 10% from

March while imports from Indonesia fell by 37% monthon-

month to 23,380 cu.m.

Malaysian shipment plunged by over 40% from March to

5,265 cu.m. Year-to-date plywood imports from Malaysia

were down 21%.

Plywood imports from Russia, Canada and Ecuador

gained in April as did imports from Uruguay (5,413

cu.m.), Guatemala (3,537 cu.m.) and Brazil (2,356 cu.m.).

Higher moulding imports

US hardwood moulding imports grew 7% in April to

US$14.8 million. Year-to-date imports were 3% higher

than in April 2015.

All major suppliers increased shipment to the US market

in April led by Brazil (US$3.9 million) and China (US$3.5

million). The greatest monthly increase was in imports

from Malaysia (US$1.9 million).

Year-to-date imports were also up, except for imports

from China, which were down 13% compared to April

2015.

Decline in wood flooring imports

After two consecutive months of growth, US wood

flooring imports declined in April from the previous

month. Hardwood flooring imports dropped 5% to US$2.5

million. Imports of assembled flooring panels were

US$10.2 million, down 2% from March. Both were down

11% in year-to-date imports compared to April 2015.

However, hardwood flooring imports from Indonesia

increased in April to US$889,707, but year-to-date imports

remain below 2015 levels. Only China showed slightly

higher year-to-date imports (+1%) from April 2015.

Brazil, usually a minor hardwood flooring supplier to the

US market, increased shipments to US$154,148 in April.

Overall declines were similar for assembled flooring

panels, except for Indonesia and Thailand which posted

significant gains in year-to-date imports compared to the

same time last year.

Year-to-date imports from Thailand doubled from April

2015, while imports from Indonesia were up 12%.

China remains the largest supplier of assembled wood

flooring panels, but year-to-date imports were down by

almost one third from April last year.

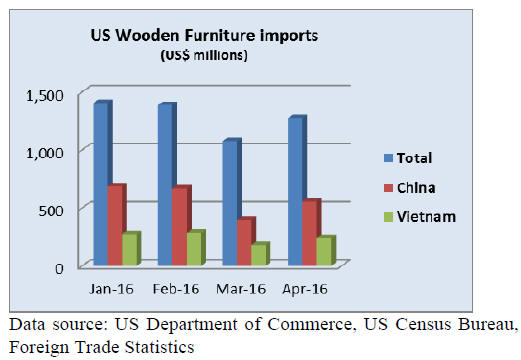

Recovery in wooden furniture imports in April

Following a significant drop in wooden furniture imports

in March, US imports largely recovered in April. Wooden

furniture imports were worth US$1.27 billion in April, up

5% year-to-date.

Much of the month-over-month growth was in imports

from China (US$555.1 million, +40%) and Vietnam

(US$239.7 million, +33%). Mexican shipments were

slightly up in April, while imports from Canada, Malaysia

and Indonesia declined.

Wooden furniture imports from India decreased 23% to

US$18.4 million in April, but year-to-date were up 17%.

Imports of all types of wooden furniture grew in April.

Imports of upholstered furniture increased the most,

followed by ‘other’ furniture and kitchen furniture.

Federal Reserve leaves interest rates unchanged

Unemployment declined by 0.3 percentage points to 4.7%

in May, according to US Bureau of Labor Statistics. The

International Monetary Fund (IMF) predicts 2.2%

economic growth for the US this year, down from last

year's 2.4%. Unemployment is predicted to remain below

5%.

The IMF cited low productivity growth, income insecurity

and poverty as chief challenges to stronger economic

growth. The IMF assessment of the US economy was

completed before the Brexit referendum in the UK. Some

analysts expect lower US GDP growth in the second half

of 2016 as a result of the Brexit vote.

The US Federal Reserve has kept interest rates at between

0.25% and 0.5% in June. The Reserve Chair Janet Yellen

said the job market and the possibility of UK’s exit from

the EU were factors in the decision. A rate raise is still

possible at the next Federal Reserve meeting end of July

or more likely in September.

US consumers expect a slower pace of economic growth

in the year ahead, according to the University of Michigan

Index of Consumer Sentiment. Consumers were a bit less

optimistic in late June but consumer spending is predicted

to remain relatively high. Over the past 18 months the

consumer sentiment index has been quite stable with a

positive trend, despite more volatile GDP growth rates.

Growth in wood product manufacturing but decline in

furniture retail sales

Economic activity in the manufacturing sector expanded in

May for the third consecutive month, according to the

Institute for Supply Management. In April wood product

manufacturers reported the strongest growth of all

manufacturing industries.

The wood products industry led the manufacturing sector

in terms of production growth and new orders for export.

The furniture industry reported a decline in May,

according to the institute’s survey.

New furniture orders in the first quarter of 2016 were

slightly less than the first quarter in 2015, according to

latest Smith Leonhard survey of residential furniture

manufacturers and distributors. Furniture shipments were

up in the first quarter, but the latest retail figures from the

Census Bureau show a decline in furniture store sales from

March to April.

Housing starts flat but builders’ confidence up

Housing starts were at a seasonally adjusted annual rate of

1,164,000 in May, almost unchanged from April. Starts

were 10% above the May 2015 rate, according to US

Census Bureau data.

Housing starts increased in the West and South but

declined in the Midwest and Northeast. Single-family

housing starts were up 0.3% in May, while multi-family

construction declined to 396,000.

The number of building permits in May were at a

seasonally adjusted rate of 1,138,000, up 0.7% from April

but below May 2015 levels.Despite overall housing starts

being flat from April, home builders are positive about the

market. Builder.

Confidence in the market for newly constructed singlefamily

homes rose two points in June to a level of 60 on

the National Association of Home Builders/Wells Fargo

Housing Market Index (HMI). This is the highest reading

since January 2016.

North American Leaders’ Summit in Canada

Canada hosts the North American Leaders’ Summit end of

June where the leaders of Canada, Mexico and the US will

discuss key priorities to create a more integrated and

sustainable North American economy. In view of the

Brexit vote the leaders are expected to emphasize the

importance of free trade in the North American market.

Canada will rescind visa restrictions on Mexican travelers

that were imposed in 2009. Both countries plan to work

more closely against what they perceive as US

protectionist measures. Canada and Mexico will also sign

a memorandum of understanding on ways to engage

indigenous people as partners in resource development.

Canadian domestic market still affected by low oil

prices

Canadian businesses are positive about future sales

growth, especially US demand, according to the latest

Bank of Canada Business Outlook Survey. Domestic

demand is more sluggish because of lower oil prices.

Companies tied to the energy sector are curtailing

spending on investments.

Canadian housing starts were slightly down in May from

the previous month at a seasonally adjusted annual rate.

Multi-family starts decreased, while the smaller singlefamily

home market grew.

|