Japan

Wood Products Prices

Dollar Exchange Rates of 10th

May 2016

Japan Yen 109.27

Reports From Japan

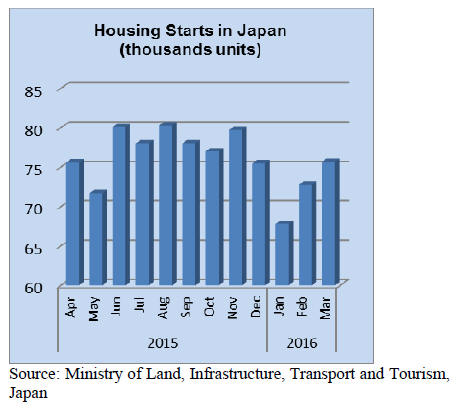

Annual housing starts forecast at 600,000

by 2025

The Japan Center for Economic Research (JCER) has

produced a medium term industry outlook. For the housing

and construction sectors the outlook points to continued

contraction against the backdrop of a decline in the

number of households.

As the number of households declines housing

construction, says JCER, will be limited to rebuilding

aging infrastructure as there will no longer be a need to

increase the stock of homes. In some prefectures in Japan

the number of households has already started to fall.

According to JCER the decline in the number of

households could leave national annual housing starts at

around 600,000 by 2025.

Construction activity in the non-housing sector (offices

and stores) is expected to remain flat. Nonresidential

construction is also susceptible to the population decline.

The sectors in which domestic production will grow are

processing and assembly type manufacturing sectors,

including general machinery and transport machinery and

the health and nursing care and business services sectors

says JCER.

Activity in the agricultural, forestry and fishing sectors

will inevitably fall due to the aging of the workforce in

these sectors and due to more reliance on imports as trade

agreements are concluded.

Due to the population decline and aging, a decline in the

domestic workforce is inevitable. Labour shortages are

already emerging in the health, nursing care and

construction sectors and the development of human

resources plans to meet expected long-term labour demand

is required.

For more see:

http://www.jcer.or.jp/eng/economic/medium.html

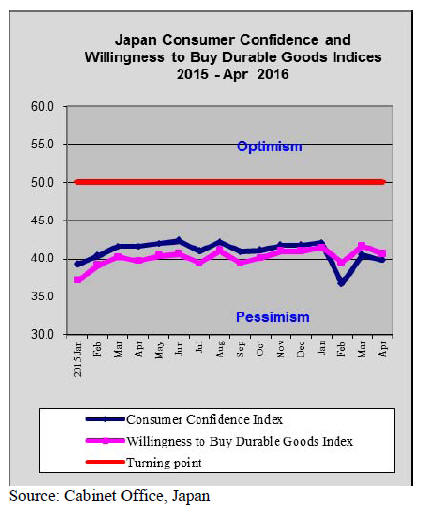

Consumer confidence falls but not as much as

forecast

The latest consumer confidence survey released by Japan’s

Cabinet Office showed that confidence weakening less

than forecast in April following from the rise a month

earlier.

The overall index fell to 40.8 in April from 41.7 in March

while the Willingness to buy durable goods index was also

down.

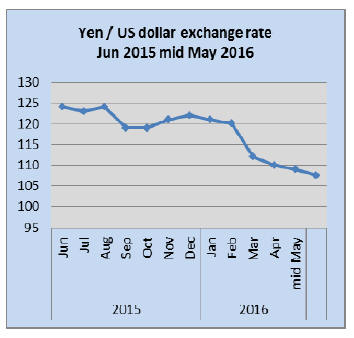

Intervention possible as yen surges against the

dollar

Taro Aso, Japan's Finance Minister has tried to talk down

the yen/dollar exchange rate by stating he was "prepared to

undertake intervention" in exchange markets if the yen

continued to rises. This sparked a flurry opposition from

financial leaders around the world.

However , a former government official who was involved

in market interventions in the past said US criticism of

Japan’s currency strategy would not prevent it from

deliberately weakening the yen. A yen/dollar exchange

rate above 110 is central to the Bank of Japan’s inflation

boosting policy.

Since the beginning of the year, the yen has risen sharply

against the dollar but, for now seems to have settled at

around 108 to the US dollar. Despite the statements from

the Japanese government buyers continue to pour into yen

pushing up against the dollar.

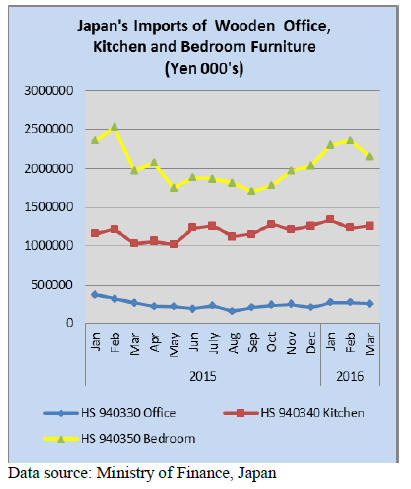

Japan’s furniture imports

The value of Japan’s imports of wooden bedroom

furniture fell almost 16% in the first quarter of 2016

compared to the first quarter in 2015. In contrast, imports

of kitchen furniture rose 13% in the first quarter of this

year compared to the same period last year. 2016 first

quarter imports of wooden office furniture were at about

the same level as in the first quarter in 2015.

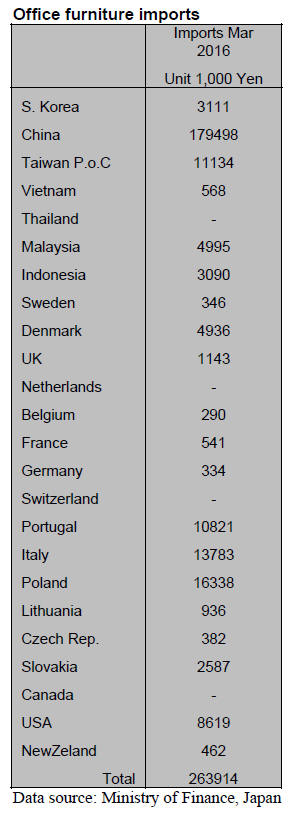

Office furniture imports (HS 940330)

Compared to February, Japan’s March imports of wooden

office furniture were down around 6%.

China remains the main supplier of wooden office

furniture to Japan accounting for just over half of all

wooden office furniture imports. In March this year

imports from China rose 26% while imports of wooden

office furniture from Poland, one of the main suppliers,

dropped a massive 60% but imports from Italy were flat.

The top three suppliers China, Poland and Italy accounted

for almost 80% of Japan’s March imports of office

furniture. In previous months shippers in Portugal were

major contributors to Japan’s sources of office furniture

but in March there was a significant fall in imports from

Portugal.

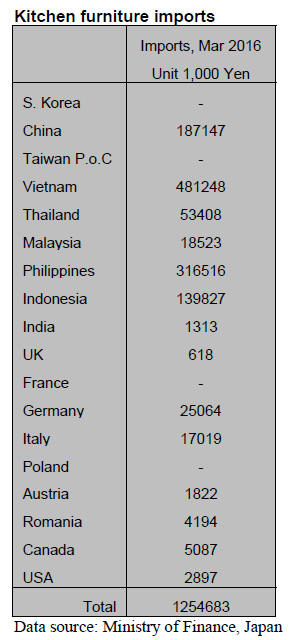

Kitchen furniture imports (HS 940340)

In March this year the top four suppliers of kitchen

furniture to Japan accounted for the lion’s share of imports

(over 90%). Vietnam alone accounted for 38% followed

by the Philippines 25%, China 15% and Indonesia 11%,

almost exactly as in February this year.

Year on year March 2016 imports of wooden kitchen

furniture were up 22% but compared to levels in February

only a slight rise was observed.

Of the four main suppliers in March Vietnam, the number

one supplier saw a slight improvement in its value of

exports of kitchen furniture to Japan. The big winners in

March were exporters in the Philippines who saw Japan

buying 15% more than in February.

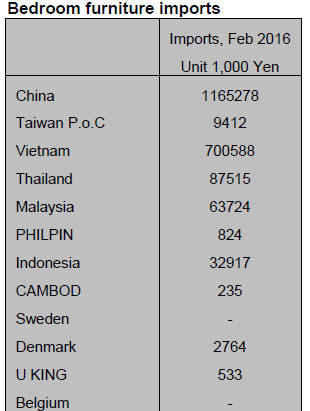

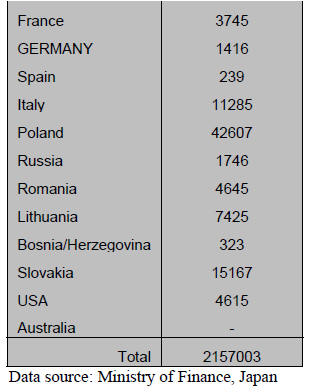

Bedroom furniture imports (HS 940350)

A correction in the growth of Japan’s imports of wooden

bedroom furniture has been observed. March 2016 imports

were down almost 9% compared to levels in February but,

year on year, March 2016 imports were higher.

The top three suppliers, China (54%), Vietnam (32%) and

Thailand (around 4%) accounted for around 90% of March

imports of wooden bedroom furniture. Imports from China

rose slightly in March from a month earlier but both

Vietnam and Thailand saw March shipments to Japan fall

steeply.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

SL World markets Malaysian OSB

SL World Co., Ltd. (Shizuoka prefecture) starts marketing

Malaysian OSB for crating. It has been selling the product

as trial to see how the market reacts and now it decided to

sell widely. The product is produced by Pioneer OSB,

which started in June last year at Alor Setor, Keda

province of West Malaysia.

Main raw materials are rubber wood and MLH. Its annual

production is 240,000 ton. It has continuous press of

German Dieffenbacher to produce OSB with thickness of

8 to 36 mm of 4x8. So far, it has been marketing in

Malaysia, Singapore, Thailand and Australia. SL World

sells 8 mm thick 4x8 OSB for crating.

It will market in Tokyo regional market first then will

expand the area. SL World has been marketing

Vietnamese plywood and European OSB for crating. It

also offers other materials like Chilean, North American

and domestic crating lumber.

Selco Homes aims non-residential buildings

Selco Home Co. Ltd. (Sendai, Miyagi prefecture)

de4cided to concentrate on non-residential wooden

buildings. It already has sales of 1.1 billion yen in this

term and aims to make sales of 3 billion yen in three years.

It decided to build its own three stories wooden building in

Sendai as a model unit with large size laminated lumber.

Selco Home is the largest dealer of imported Canadian

house and has built 820 units a year with its partners but it

is inevitable to see declining trend of detached residential

houses so as another growing market, it decided to

concentrate in large non-residential wooden buildings.

It has completed commercial facility of about 2,000 square

meters in Sendai. It has another 20 orders like medical

clinic and pharmacy then participated Canadian project to

restore the North East earthquake damaged area.

A sample non-residential wood building is being built. It is

three stories wooden building with floor space of over

3,000 square meters. The main structural materials are

Canadian large sized laminated lumber with other

domestic made laminated lumber. It is quasi fire proof

structure by char margin design.

The largest post is 420 mm Douglas fir to show soft

woody feeling. Interior has also woody tastewith western

red cedar. Locally made CLT is used for floor, wall,

staircase.The first floor is used for office for renovation

business and exhibition site for non-residential wooden

building. Second and third floor are used as office.

It is also a successful bidder for multi-purpose

rehabilitation facility at 637.2 million yen to build five

wood buildings. This facility is built for lodging for people

who desire to do farming from outside of the prefecture so

this also generates new local employment.

It also has power generation facility as beetle damaged

trees are chipped and used as biomass fuel, which gives

heat for the facility.

The company says that cost of wood building is about

20% lower than concrete building so it’s worth

challenging quasi fire proof large wood buildings.

First CLT production plant completed

Meiken Lamwood Corporation (Okayama prefecture),

laminated lumber manufacturer, has completed

construction of CLT production plant, which is the first

CLT production plant in Japan.

The plant has floor space of 6,000 square meters then

another 3,400 square meters for processing plant. In the

first floor of the plant, there is lamina drying stacking

machine then four kiln dryers are set next to stacking

machine. Steam is sent from biomass power plant, which

is on the other side of the road. Waste from molder is sent

to power plant as fuel.

Dried lamina with length of 2,000 – 4,200 mm is sent to

the second floor, where it goes through test machine of

bending stress, moisture content measuring machine,

surface scanner, horizontal finger jointer and six axis

molder. Finished lamina of long 8-12 meter lamina are cut

into short lamina, which is sent to press after adhesive

sprayer.

The maximum size of CLT is 300, 3,000, 12,000 mm in

thickness. Adhesive is isocyanate. The president says this

is the first CLT plant in Japan but has no order yet but in

three years, target is to produce

30,000 cbms a year.

Russian logs and lumber

Log harvest season in Russia is over. Log supply of red

pine, whitewood and larch is limited. Then China, which

had been using low grade logs for engineering works

materials but now it is looking for quality logs and genban

as they use for furniture and free board.

In Japan, there are inquiries of quality and standard KD

red pine taruki but the inventory is low so wholesalers

have hard time to secure the volume. Russian suppliers’

offer prices on KD taruki 30x40 mm are unchanged at

$450-465 per cbm CIF.

Russian sawmills are having trouble of getting enough

logs so they need to stretch out much further area to have

logs. The Russian sawmills are trying to increase the

export prices but Japan side is unable to follow higher

prices.

In Japan market, there are increasing arrivals of quality red

pine KD taruki but the market has not recovered well

enough so that wholesalers secure large volume yet.

Meantime, large builders have more works so that there

are increasing inquiries on standard quality taruki but it is

not strong enough to push the market prices up.

|