|

Report from

North America

Higher year on year January 2016 imports

US imports of most processed wood products declined

from December to January with the exception of

hardwood mouldings. However, Imports remained

significantly higher compared to January 2015.

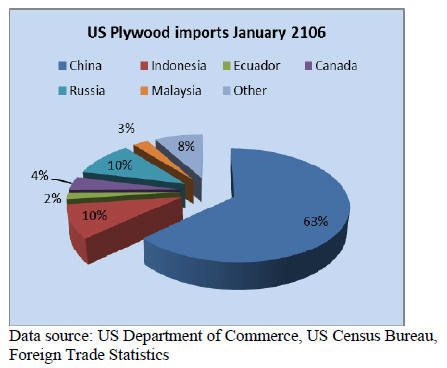

Hardwood plywood imports down in January

Hardwood plywood imports fell 9% in January to 268,282

cu.m., worth US$154.2 million. Year-to-January imports

were 13% higher than in January 2015.

Imports from China were unchanged at 159,586 cu.m. in

January, while imports from most other major suppliers

declined.

Indonesia’s shipments to the US fell 39% to 36,701 cu.m.

but were above January 2015 volumes. Hardwood

plywood imports from Malaysia dropped 66% from

December to just 3,780 cu.m.

Italy, Taiwan P.o.C and Vietnam shipped substantially

more plywood to the US market in January compared to

the previous year. Imports from Italy were 8,427 cu.m., up

from an average 2,000 cu.m. per month in 2015.

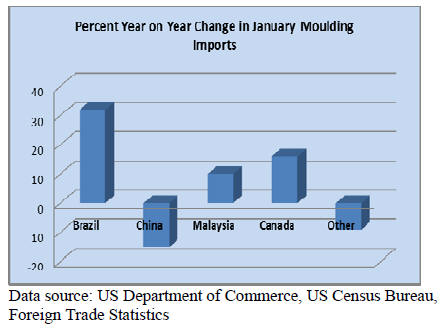

Higher moulding imports from Brazil and Malaysia

Hardwood moulding imports were worth US$16.7 million

in January, up 3% from the previous month.

Imports from Brazil and Malaysia recovered after

declining towards the end of 2015. Imports from Brazil

were US$5.2 million in January, up 40% from December

and one third higher than the same time last year.

China was the second-largest source of mouldings at

US$4.9 million. Imports from China declined month-onmonth

as well as compared to January 2015.

Imports from Malaysia were worth US$1.1 million in

January, up 21% from December and 10% up from last

January. Moulding imports from Indonesia increased to

US$748,956 in January.

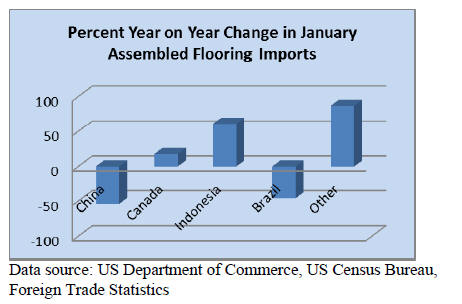

Lower flooring imports but higher Indonesian

shipments

Both hardwood flooring and assembled flooring panel

imports declined in January. Hardwood flooring imports

declined month-on-month to US$3.3 million in January.

But US imports were 25% higher than in January 2015.

Indonesia was the only major source of imports with

higher shipments to the US in January.

Hardwood flooring imports from Indonesia were worth

US$806,440 in January, followed by China with

US$743,100. Malaysian shipment fell to US$547,150 in

January. Imports from Vietnam halved from December to

US$280,950 in January.

Imports of assembled flooring panels declined 12% to

US$8.9 million in January, down 22% from January 2015.

The drop was mainly in imports from China. China’s

shipments fell 30% from December to US$3.2 million.

Imports from Canada and Indonesia increased.

Imports from Indonesia were valued at US$851,767 in

January, up 61% from the same time last year.

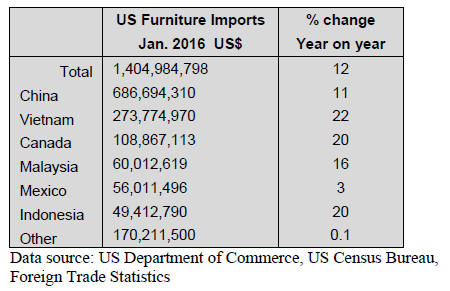

Drop in furniture imports from Mexico

The total value of wooden furniture imported in January

declined 2% from the previous month to US$1.40 billion,

but imports were 12% higher than in January 2015.

Furniture imports from China, Mexico and Indonesia

declined, while Vietnam, Canada and Malaysia shipped

more in January.

China’s furniture shipments were worth US$686.7 million

in January. Vietnam gained market share with imports

worth US$273.8 million. Vietnam’s share in total wooden

furniture imports was almost 20% in January. The recent

gain in import share by Vietnam was not at the expense of

China but largely because of reduced imports from

Europe.

Furniture imports from Malaysia grew to US$60.0 million

in January, surpassing Mexican shipments to the US.

Imports from Mexico fell 16% month-on-month to

US$56.0 million. Furniture imports from Indonesia were

almost unchanged in January at US$49.4 million.

Imports of not upholstered wooden seats increased 13% in

January, while upholstered seating declined 5%. Wooden

bedroom furniture imports were down 4%. Other types of

wooden furniture were almost unchanged from the

previous month.

GDP growth revised up to 1% in final quarter of 2015

Real GDP growth in the fourth quarter of 2015 was

stronger than previously estimated. The GDP grew by 1%

in the fourth quarter, not 0.7% as previously estimated,

according to the US Bureau of Economic Analysis. In the

third quarter, GDP increased 2.0%.

Stronger residential construction and consumer

consumption increased in the fourth quarter. Lower

imports contributed to GDP growth.

Unemployment was unchanged at 4.9% in February.

Industries with employment gains included retail trade.

The US Federal Reserve has decided to keep interest rates

between 0.25% and 0.5%. The central bank raised rates

last in December. The Federal Reserve announced it

would raise rates only twice a year in 2016, instead of the

previously expected four times. This gives the US

economy more time to recover given the risks from global

economic and financial developments.

Growth in wood products and furniture manufacturing

Economic activity in the manufacturing sector contracted

in February for the fifth consecutive month, according to

the Institute for Supply Management. The overall

economy continued to grow in February.

The wood products sector and furniture manufacturing

reported growth in February, despite the overall slowdown

in manufacturing. Wood products and furniture reported

the second and third-highest growth rate, respectively, of

all industries.

Consumers confident on personal finances and job

market

Consumer confidence declined in early March, according

to University of Michigan Index of Consumer Sentiment.

Americans were concerned about prospects for the

economy and the possibility of higher gasoline prices.

Despite some uncertainty consumers remained optimistic

about their personal finances and the job market. Growth

in personal consumption is forecast at 2.7% during 2016.

Housing starts up in February

2016 started with strong indicators from the market for

new housing. Housing starts in February were at a

seasonally adjusted annual rate of 1,178,000. This is 5%

higher than in January and 31% above the February 2015

rate of 900,000.

Single-family starts were almost unchanged from the

previous month at a rate of 731,000 in February.

The number of building permits approved in February was

at a seasonally adjusted rate of 1,167,000. This is 3%

below the January rate but higher than in February 2015.

Decline in sales of existing homes

Sales of existing homes fell 7% at a seasonally adjusted

annual rate in February, according to the National

Association of Realtors. Low supply, coupled with rising

prices in many areas of the country, were the main reasons

for the decline in home sales. Sales were still higher than

in February 2015.

Growth in homes sales may slow in 2016 if prices

continue to go up while potential buyers worry about

economic prospects and affordability. A slowdown in

sales would affect demand for wood products used in

repair and renovations.

Canadian government tries to cool housing market

Canadian housing starts grew 29% in February at a

seasonally adjusted annual rate, according to early

estimates by the Canadian Housing and Mortgage

Corporation. Despite the corporation’s forecast of

moderation in multi-family construction, the number of

multi-family starts increased significantly in February.

Sales of existing homes also increased in February, rising

by 0.8% from January on a seasonally adjusted basis,

according to the Canadian Real Estate Association.

Toronto and Vancouver had the strongest sales activity.

Home prices increased by over 20% in Vancouver from

just one year ago.

The federal government introduced new mortgage

insurance rules to contain risks in the housing market,

especially in Vancouver and Toronto. The new rules came

into effect in mid-February, but may have fuelled sales in

early February. The provincial government in British

Columbia announced it will track whether home buyers

reside in Canada or abroad. This is in response to claims

that foreign investors are a major driver of the hot housing

market.

It is unclear if or how the government will put restrictions

on the housing market to reduce home price increases. It

appears unlikely that the rate of new construction would

be significantly reduced given the region’s population

growth. The luxury market could be affected, including for

high-end wood products.

|