2. GHANA

Centre aims to make Ghana preferred

investment

destination in Africa

The Ghana’s Mission to the United Nations recently

organized an investment forum as part of activities to mark

Ghana’s 59th independence anniversary.

Ghana’s Minister for Private Sector Development, Dr.

Abdul Rashid Pelpuo detailed the country’s wealth of

natural resources including timber, supportive investment

laws and socio-economic stability as advantages for

potential investors.

Mrs. Mawuena Trebarh, Chief Executive Officer of the

Ghana Investment and Promotions Centre (GIPC) said

procedures for setting up businesses in Ghana were

straight forward.

The Ghana Investment Promotion Centre (GIPC) recorded

appreciable levels of Foreign Direct Investment (FDI)

inflows in 2015 after 2 years of implementing the new

investment law, the GIPC Act, 2013 (Act 865).

Highlights of recorded investments have been published

by the GIPC and show that 170 projects had been

registered worth an estimated US$2.68 billion in 2015.

The potential for job creation from registered projects in

2015 was 14,948, an increase of 14% year on year.

GIPC says “As part of our strategy for 2016, the GIPC

will focus on improving upon its operational efficiency,

provide higher level services and roll out the second phase

of our "Think Ghana Make it Happen" campaign with the

target of propelling Ghana to become the preferred

investment destination in Africa.”

For more see: http://www.gipcghana.com/

Manufacturing could find a sound footing says

industry association

In a related development, an analysis by the Association of

Ghana Industries (AGI) on manufacturing activities in the

country last year noted the decline in output.

The report said the AGI was confident the sector could get

onto a sound footing if the government addresses the high

rate of inflation, stabilises the exchange rate and creates

conditions for a lowering of interest rates. The basis for

sustained expansion of manufacturing rests, says the

association, on addressing the severe power shortages

currently being experienced.

Risk to regional trade as neighbours try to stablise

economies

Ghana has placed a ban on imports of many items from

Nigeria, including oil, apparently in response to what is

considered the unreasonable move by Nigeria’s “Import

Prohibition list” which is being used to limit the amount of

foreign exchange provided to Nigerian importers. Ghana is

Nigeria’s regional largest trade partner importing a high

proportion of Nigerian oil output.

The moves by each country will weaken regional trade as

Ghana and Nigeria are said to account for about 70% of

the GDP in the ECOWAS countries.

For more see:

http://venturesafrica.com/here-is-what-ghanas-ban-on-nigeriangoods-

means/

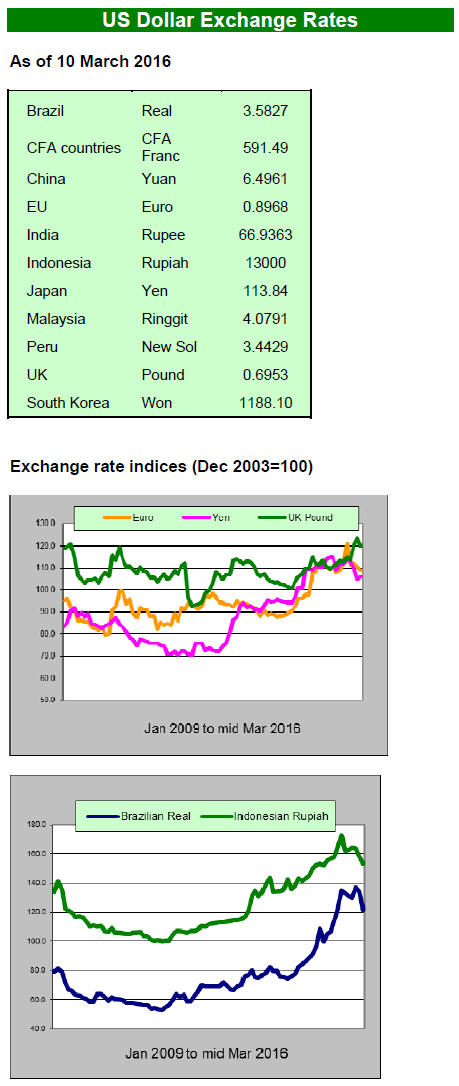

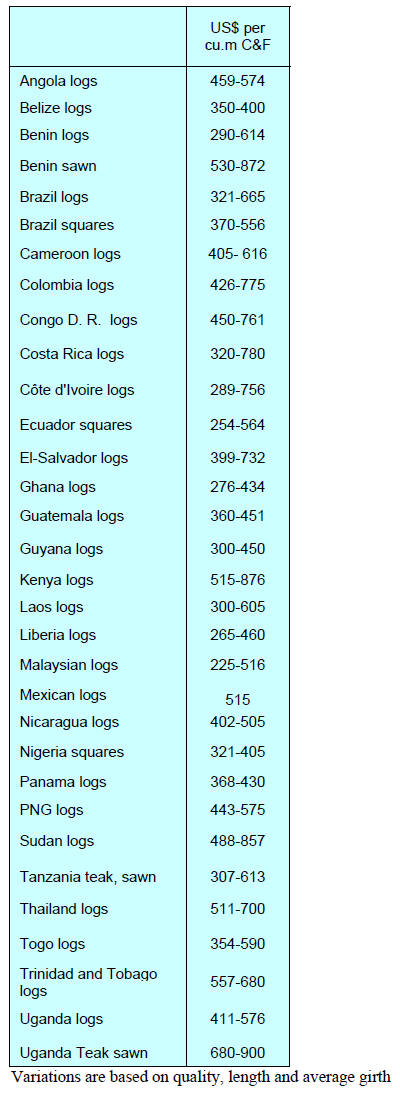

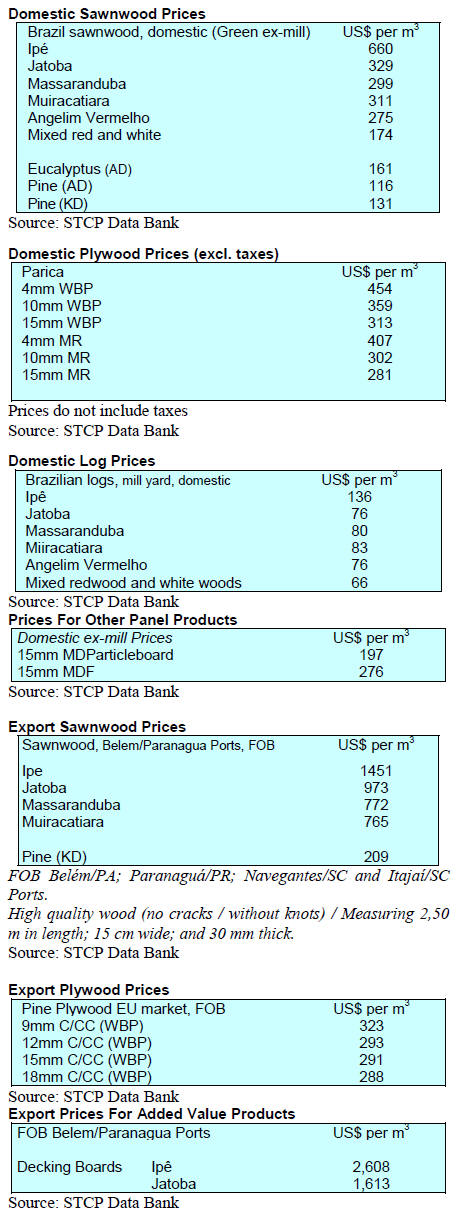

Mid-March prices

Prices for wood products remained unchanged as of 30

January.

3. MALAYSIA

Furniture makers urged - explore

markets for solid

wood furniture in China

The Minister of Plantation Industries and Commodities,

Douglas Uggah Embas, has urged furniture manufacturers

to work together and promote Malaysian furniture so that

the 2020 target of RM53 billion (approx. US$12.9 billion)

export earnings can be achieved.

Malaysia's timber and timber product exports rose by 6.3

per cent to RM21.7 billion (approx. US$ 5.3 billion) in

2015 from RM20.4 billion in 2014.

Chua Chu Chai, Chairman of Export Furniture Exhibition

2016 (EFE), recommended that Malaysian furniture

manufacturers should explore markets for solid wood

furniture in China as consumers there appreciate solid

wood furniture and China's consumption is expected to

grow by five to six per cent this year.

Chua was speaking as he promoted the EFE 2016, a fourday

exhibition themed 'Fine Furniture World Market'.

Expanding chip and particleboard production

As a sign of growing optimism, a major producer of

particleboard and particleboard based products,

HeveaBoard, announced plans to invest RM 20 million

(approx. US$ 4.9 million) to increase capacity.

HeveaBoard utilises rubberwood residues and has

subsidiaries producing downstream Ready-to-Assemble

furniture manufacturing and other panel products.

In 2015 Heveaboard exported about 80% of its

particleboard production mainly to China, Japan, South

Korea, India. Most RTA items are for Japan, Europe,

Australia and the United States.

2016 export quota for ramin and gaharu

The Malaysian Timber Industry Board (MTIB) has

announced a 10,000 cu.m, 2016 export volume quota for

ramin (Gonystylus spp.) products.

The export quota for Karas/Gaharu (Aquilaria spp.)

products, including wood chips, wood blocks and essential

oils is 150,000 Kg for 2016.

Importing timber under TLAS

The MTIB has announced new import regulations for logs,

large square and scantlings as well as plywood. With

effect from 1 January 2016, applications for import

licenses for logs, large square and scantling and plywood,

shall include documentation on source to ensure only

legally harvested timber and products enter the country.

This regulation is to fulfil the requirements of Malaysia’s

Timber Legality Assurance System.

Coming down heavy on illegal operators

Sarawak State Forestry Director, Sapuan Ahmad, is on

record as saying the department will hit hard those

companies found using illegally harvested logs once the

one year grace period since the endorsement of a new

forest ordinance ends in April 2016.

The Forests Ordinance 2015 includes provision for tough

penalties. For example, anyone operating an unregistered

sawmill could face a penalty of between RM500,000 and

RM10 million and/or imprisonment.

The state has introduced an enhanced tracking system

through which timber taken from licensed areas must be

certified and royalty stamped at one of the 48 ‘One-Stop

Compliance Centres’ (OSCC) across the state.

It is understood that the police force, Marine Department,

Malaysian Anti-Corruption Commission (MACC) and

Sarawak Forestry Corporation (SFC) will assist track and

seize illegal logs.

4. INDONESIA

Number of accredited SVLK assessors

continues to

grow

Currently there are 16 independent SFM assessors and 21

timber legality verification companies/bodies accredited

by the National Accreditation Committee (KAN). As the

numbers of accredited assessors grows so does the

credibility of the county’s Timber Legality Assurance

System.

Claims of circumvention of SVLK

Forest Watch Indonesia, an Independent Forestry

Monitoring Network and the Environmental Investigation

Agency have released a report entitled ‘Loopholes in

Legality’ which claims unscrupulous traders have

exploiting the Ministry of Trade Decree allowing SMEs to

export without full SVLK verification. The Decree also

removes the requirement that companies register with

Indonesia's Forestry Industry Products Exporter Registry

(ETPIK).

The report ‘Loopholes in Legality’ claims SME export

declarations are being used by companies that are not

members of the Indonesian Furniture and Craft

Association (Association of Indonesian Furniture and

Handicraft or AMKRI).

For more see:

http://jpik.or.id/shadowy-brokers-exploit-loopholes-in-ministerof-

trade-decree-threatening-indonesias-timber-laws-and-aneutrade-

deal/

5. MYANMAR

Preparing for VPA negotiations

A Gap Assessment Workshop on Myanmar’s Timber

Legality Assurance System was conducted by the

Myanmar Forest Certification Committee (MFCC) and the

EU-FAO-FLEGT Programme on 3 March 2016 in

Yangon.

The Secretary of the MFCC, Barber Cho, in addressing the

workshop said the assessment was helpful to the VPA

negotiation team since members would be better equipped

to understand the situation in terms of gaps between the

existing TLAS and compliance and between the existing

TLAS and VPA-TLAS.

MFCC conducted a further public consultation on SFM

and C&I for both natural and plantation forests) on 4th

March and managers from the Forestry Department and

Extraction Agency Managers from the Myanma Timber

Enterprise attended along with representatives from FSC

and PEFC. Expectations are high for a policy shift towards

forest conservation by the new NLD-led government.

Barter trade in Northwest to be halted by India

The border trade between India and Myanmar has been

affected by a decision by Indian authorities to restrict trade

facilitation to the formal banking system. Until the change

much of the cross border trade was made possible through

acceptance of an ‘informal’ barter system.

Beginning early December 2015 all trade had to be settled

through the formal banking system or the Asian Clearing

Union, a regional cross-border payment network.

Analysts comment that it will take time for the new

regulations to be implemented as the formal banking

system in rural Myanmar is not well developed.

In related news, an additional four foreign banks have

been granted licenses in Myanmar bringing to 13 the

number of international banks in the country. The latest

additions are the Bank for Investment and Development of

Vietnam, State Bank of India, Sun Commercial Bank

(Taiwan P.o.C) and Shinhan Bank (South Korea).

6.

INDIA

First cities under ‘Smart City Programme’

selected

CREDAI has welcomed the selection of the cities for the

first round of development as ‘smart cities’saying this

initiative provides a tremendous opportunity for the real

estate sector especially in the affordable home market.

Bhubaneswar, Pune, Ahmedabad, Chennai and Bhopal

have been selected as the first batch for the ‘Smart City’

programme. The New Delhi Municipal Council (NDMC)

is also included for the first round of development.

Jaipur, Surat, Kochi, Jabalpur, Visak hapatnam, Solapur,

Davanagere, Indore, Coimbatore, Kakinada, Belagavi,

Udaipur, Guwahati and Ludhiana are the other cities

selected in the first batch. Realtors see business

opportunities in all ‘Smart City’ projects.

See:

http://www.credai.org/sites/default/files/Realtor%20see%20big%

20opportunity.pdf

The Centre for Science and Environment, quoting the

Ministry of Housing and Poverty Alleviation, said there

was a shortfall of at least 18.6 million homes in the

country and that most were required by those in the socalled

economically weaker section (EWS) and low

income groups (LIG) in Indian society.

Report on Plywood and laminates market

Daedal Research has produced a report on the Indian

plywood and laminates market covering 2015-2019.

In a press release Daedal says “The report assesses the

market sizing and growth of the Indian plywood and

laminates Industry over the years with detailed analysis.

This report analyses this market segment and major end

users the report also discusses key factors driving growth

of the industry, major trends and challenges faced by

manufacturers of plywood and laminates.

Further, major producers such as Century Plywood,

Greenply Plywood, National Plywood and Kitply Plywood

are also analysed in the report. “

The executive summary says “Plywood is the most

demanded product of this industry followed by laminates.

MDF on the other hand is a small segment of the Indian

industry. The market could be segmented on the basis of

distribution channels where the unorganised market

accounts for the major share.

However with changing consumer preferences the market

has seen a shift towards the organised segment due to

increased demand for good quality and branded products.

The share of organised players in the industry is expected

to rise further in the years to come. This shift is taking

place primarily due to urbanisation and more disposable

income. “

For more see:

http://www.slideshare.net/daedal/indian-plywood-and-laminatesand-

market-trends-opportunities-20152019-new-report-bydaedal-

research

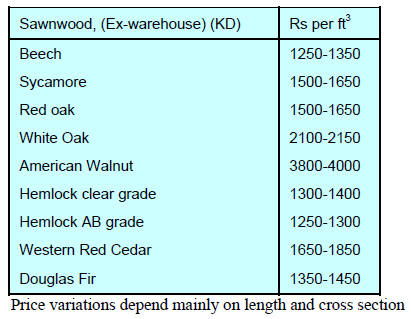

Canadian team promotes BC timbers

A 22 member Canadian delegation including

representatives form major companies such as Canfor and

West Fraser as well as industry association representatives

recently visited Bengaluru and Mysore with a view to

expanding the India-Canada timber trade.

Indian importers and specifiers were introduced to

certified timber products available from British Columbia

such as sawn hemlock, douglas-fir, western red cedar and

yellow-cedar. The delegation aimed to promote the use of

Canadian timbers for the manufacture of doors and

windows, furniture and paneling.

India Wood 2016 deemed a success

This year India Wood was held in Bangaluru (previously

known as Bangalore) 26 to 29 February and a wide range

of raw materials, finished products and processing

equipment was on display.

Analysts note that there was particular interest in

technologies for manufacturing plywood, flooring and

reconstituted boards. There was also noticeable interest in

process technologies for WPC and PVC, doors, windows

and furniture.

As living standards improve in India domestic

consumption of wood products is increasing. This is

opening the way for investment in upgrading processing

equipment. Several major Indian manufacturers are

preparing to replace labour intensive processes.

Imported plantation teak prices

The supply and demand level for plantation teak remains

balanced such that, except for price changes reflecting log

dimensions, the market and prices are stable.

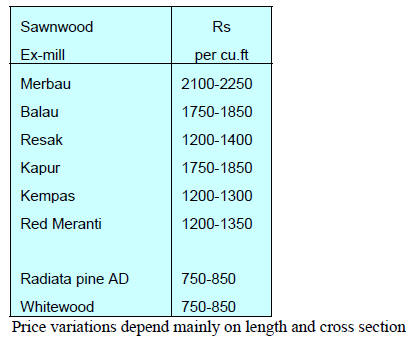

Prices for locally sawn hardwoods

No price rises have yet been reported but landed costs are

rising and an upward adjustment in price is expected if the

rupee continues to weaken.

Myanmar teak flitches resawn in India

Imports of sawnwood and flitches from Myanmar are

helping maintain stocks. Analysts report rising landed

costs for certain specifications and this has translated into

higher on-selling prices.

Prices for imported sawnwood

Some price increases have been reported the result of the

depreciation of rupee.

Plywood

Landed costs of imported plywood are rising due to the

weakening rupee but prices for locally manufactured

plywood remain unchanged. It has been reported that

plymills in southern India have been on improving the

quality of production which has lifted demand for their

shuttering plywood.

7.

BRAZIL

Domestic furniture retail sector

contracts in 2015

The Institute IEMI- Inteligência de Mercado recently

released data on the performance of the domestic furniture

market in 2015. This shows there was an almost 12% fall

in the value of retail sales compared to 2014.

An indicator for Industry Employment and Productivity

produced by IEMI showed that employment in the

furniture industry dropped by around 4% in December

alone and for 2015 productivity fell.

Brazilian furniture exports in 2015 were worth US$601.6

million, a 12.7% drop compared to 2014. Imports totalled

US$734.6 million in 2015, down 12.4% year on year.

Promotion of legal and certified timber in civil

construction

The Brazilian ‘Programa Madeira é Legal’ (Wood is

Legal) began 2009 with the aim of promoting the use of

legal and certified timber in private and public works in

the state of São Paulo.

A recent publication records the six-year history of the

initiative and claims that in the past a large volume of

timber came from deforested or illegally and unsustainably

logged areas and that the state and the city of São Paulo

were the largest consumers of tropical timber in the

country because of their huge construction sector.

To tackle issue of illegal timber being utilised the

programme promoted synergy between and improved

transparency in the different segments of the forest sector

to promote legal and certified timber in the state of São

Paulo. Through this the programme contributed to raising

awareness on the importance of procuring timber from

verified legal sources.

Increase in timber exports from Brazil to Mexico

Exports of Brazilian wood products to Mexico increased

55%, from US$18 million in 2010 to US$139 million in

2015. Amongst the top four countries exporting timber to

Mexico (United States, Chile, China and Brazil), Mexico’s

imports from Brazil achieved the highest growth rate.

According to the Mexican Association of Timber

Importers (IMEXFOR), the country needs to import

softwoods and tropical timber such as cedar, mahogany

and caobilla.

Mexico consumes around 20 million cubic metres of wood

annually but local production is less than 7 million cubic

metres. Mexico imports about mainly from the United

States and Chile and imports account for an estimated 90%

of plywood consumption while sawnwood accounts for

50%.

Growth of planted forest sector´s export

Despite the disappointing economic news from Brazil the

forest plantation sector had a good year in 2015.

Exports of pulp, wood panels and paper increased due to

the depreciation of the Brazilian currency against the

American dollar. Revenue from exports in 2015 totalled

US$7.8 billion compared to US$ 7.4 billion in 2014.

According to the Brazilian Tree Industry Association

(IBA), the sector’s trade balance in 2015 was US$6.5

billion, representing an increase of 17% compared to

2014. In 2016, the sector will continue to face the same

challenges as in 2015. In January 2016 revenue from pulp,

wood panels and paper exports totalled US$646 million, a

9.9% increase over the same period of last year.

In a web announcement Moody's global paper and forest

products industry outlook says ”the global paper and forest

products industry is stable and operating earnings growth

for publication producers in Latin America will remain as

last year.”

The announcement continues to point out that “depreciated

currencies will continue to mitigate weak international

prices and support local operating margins but that weak

economic expansion in Latin America will limit domestic

paper demand.”

See:

https://www.moodys.com/research/Moodys-Global-paperand-

forest-products-industry-outlook-stable--PR_345249

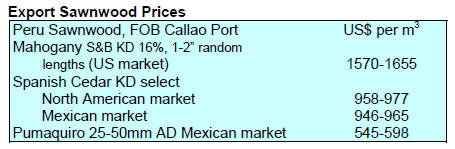

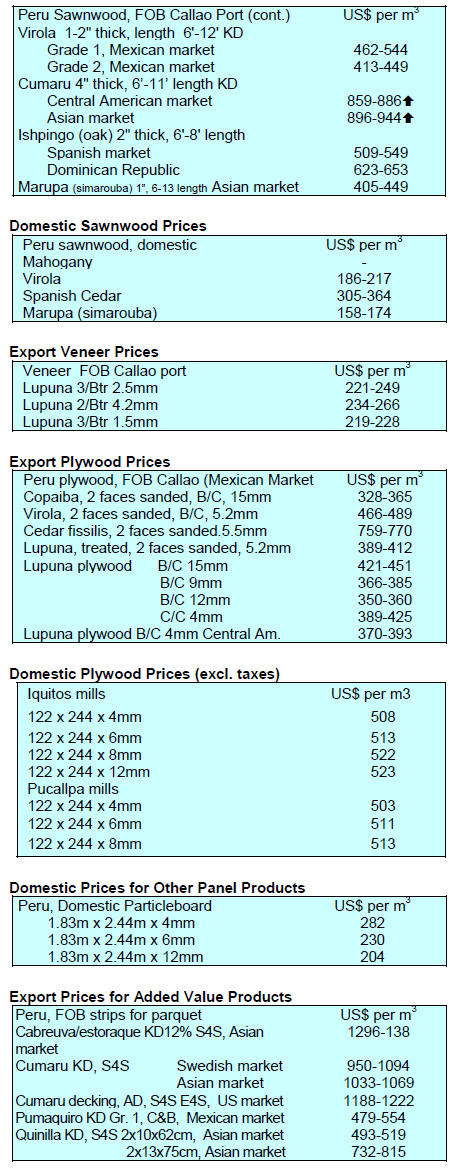

8. PERU

2015 exports fall 11.5 percent

2015 export data released by the Association of Exporters

(ADEX) shows that at US$151.31 million FOB there was

an 11.5% decline in wood product exports compared to

2014. Much of the decline, says ADEX, was the result of a

drop in sawnwood exports.

The top export products were mouldings, strips and

friezes, accounting for around 32% of the total. However,

2015 exports of these items were down almost 3% from a

year earlier.

Sawnwood exports came in as the second ranked item in

terms of value and accounted for 19% of exports. There

was a 40% drop in exports of sawnwood to China in 2015

compared to 2014. Despite purchasing less sawnwood,

China remained the main market for wood products from

Peru in 2015.

Exports to the Dominican Republic were encouraging in

2015 as was the level of exports to Mexico which was the

main market for sawnwood. The export of semimanufactured

wood in 2015 totalled US$70.84 million

FOB with China accounting for most at almost 70% of all

exports of this category of product.

Exports of veneer and plywood in 2015 were worth

US$15.29 million FOB, down almost 9% on 2014. The

main export markets were Mexico and the United States

but imports by Mexico were down over 7%.

Exports of furniture and parts were valued at US$6.72

million FOB in 2015, falling 14% compared to a year

earlier. The US was the main market for Peru’s furniture

and accounted for over 57% of all wooden furniture

exports. The second main market was Italy which

accounted for 15% of all furniture exports.

Higher market opportunities for legal timber

In the first week of March an event was held to discuss

opportunities for expanding trade in verified legal timber.

This event was organised by the National Forest and

Wildlife Service (SERFOR), and the Commission for the

Promotion of Exports and Tourism (PromPeru). The event

had the backing of GIZ under its ProAmbiente

Programme.

See:

https://www.giz.de/en/worldwide/13376.html

The topics addressed included market opportunities for

certified legal products and trade opportunities for

underutilised timber species. The meeting was attended by

representatives from those public institutions involved in

monitoring the chain of custody.

ANA

ANA