2. GHANA

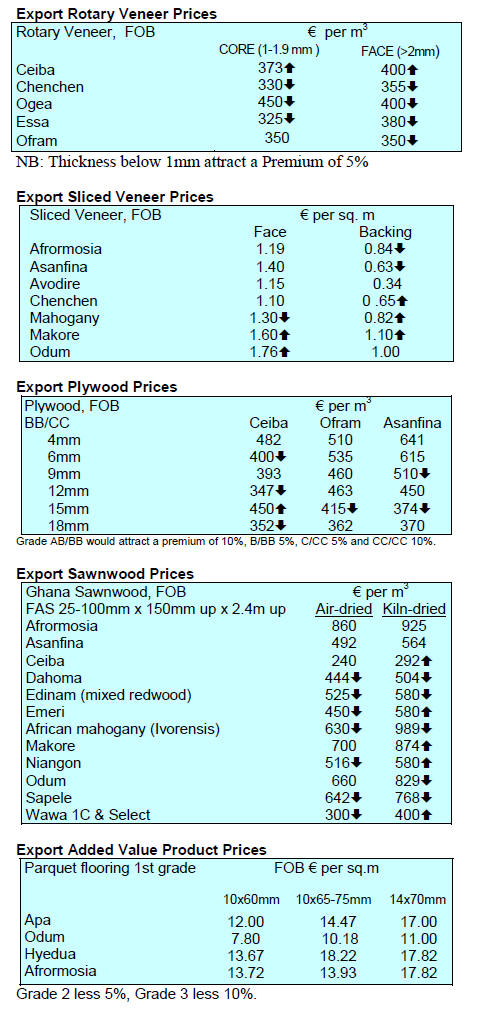

Air dry sawnwood tops exports

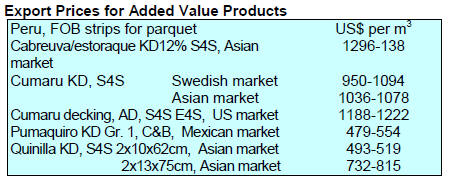

The Timber Industry Development Division (TIDD) of the

Ghana Forestry Commission has released its August 2015

timber export report.

The report shows that Ghana earned Euro120.93 million

from the export of 237,004 cubic metres of wood products

during the period January to August this year.

This represents an increase of around 43% in volume and

a 13% increase in value compared to the same period in

2014.

The top species exported during the period reported

were;

teak, wawa, ceiba, gmelima and papao/apa. The leading

companies amongst the total 103 exporters were Logs and

Lumber Ltd, Samartex Timber and Plywood Company

Ltd, John Bitar and Company Ltd, Regent Industries

Ghana Ltd and Ayum Forest Products Ltd.

Ghana’s major export markets in the year to August

included India, China, Germany, Nigeria and Burkina

Faso. Wood product exports to regional African markets

were valued at Euro18.49 million and included air and

kiln-dried sawnwood, sliced and rotary veneers and

plywood with over 70% of plywood going to Nigeria.

Weaker demand in Nigerian construction and housing

markets

The construction industry represents one of Nigeria’s main

economic growth drivers and much of Ghana’s timber

exports to Nigeria are destined for the construction and

housing sectors.

However, growth in these sectors is slowing. Falling crude

oil prices and the impact of this on the economy is

resulting in lower capital expenditure. This, in addition to

persistent power supply constraints, is adding pressure to

the construction industry and is affecting imports of wood

products.

Nigeria’s wood product imports dropped sharply from

N4.4 billion in the first quarter 2015 to N3 billion in the

second, the lowest level of wood product imports since the

first quarter of 2013. This decline reflects weak domestic

demand but factors such as a devalued local currency and

tight foreign exchange liquidity have also had an impact.

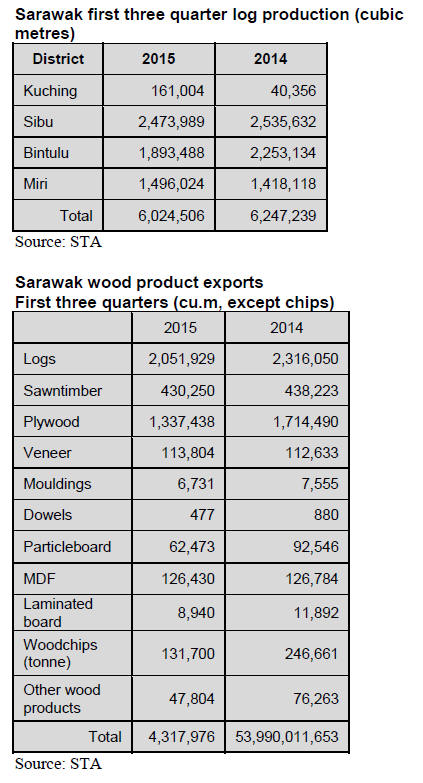

3. MALAYSIA

Industry sees competitive advantage in TPP

Details of the TPP agreement have just been released in all

the signatory countries and analysts are having their first

looks at the official documents.

The impact on the timber sector in Malaysia can now be

assessed. Initial reaction from manufacturers is that

Malaysian exporters may have an advantage over

Indonesia, Thailand and Philippines who are not part of

the TPPA.

On the other hand, Vietnam is is a participant in

the TPP

and a major competitor of Malaysian furniture exporters.

This trade deal should be advantageous for companies

shipping to other TPP countries as tariffs will be

eliminated over time and other trade barriers should be

dismantled.

Malaysia’s export performance

Malaysia’s Statistics Department has said September

exports rose 8.8% to RM70.2 billion (approx. US$ 16.1

billion) from RM64.5bil a year ago, supported by

continued demand in China and the European Union. For

September a trade surplus of RM9.7 bil. was recorded.

The main export products were electronic goods, wood

products and natural rubber.

Port Klang upgrading

Malaysia has developed a Shipping Master Plan which

includes port refurbishment to address efficiency,

pollution control and protection of the surrounding

environment. A priority is addressing improving the

transport infrastructure serving Port Klang.

Expansion of conservation area in Sarawak

It has been revealed that the Malaysia/Indonesia transboundary

conservation area (Lanjak Entimau/Betung

Kerihun) will be expanded and new Totally Protected

Areas (TPA) will be established within the area called the

Heart of Borneo in Sarawak which extends to almost 20

million ha.

The Sarawak State Chief Minister commented that the

Heart of Borneo project will be integrated into State policy

in support of sustainable forest management and

conservation of nature. Concession holders operating in

the Heart of Boneo are have been advised to secure forest

management certification by 2017.

Plywood export prices

Plywood traders in Sarawak reported export prices:

Floor base FB (11.5mm) US$ 570/cu.m FOB

Concrete formboard panels CP (3’ x 6’)

US$ 520/cu.m FOB

Coated formboard panels UCP (3’ x 6’) US$ 600/cu.m

FOB

Standard panels

S Korea (9mm and up) US$ 400 – 410/cu.m FOB

Taiwan (9mm and up) US$ 410/cu.m FOB

Hong Kong US$ 420 FOB/cu.m

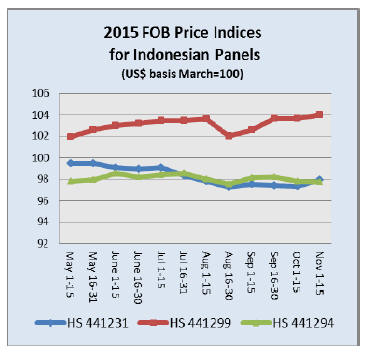

4. INDONESIA

Third quarter growth set to hold at 4.7%

The latest forecasts from the World Bank indicates that

economic growth in Indonesian during the third quarter

was just below target at 4.7% and is likely to remain at this

level for the final quarter of the year.

External factors such as falling commodity prices and

weakening global trade are having a major impact on

growth prospects.

For 2016, the World Bank expects growth to rise to just

over 5% provided factors such as an interest rate hike in

the US, further weakness in the Chinese economy

economic slowdown and the falling rupiah/dollar

exchange rate do not have any greater impact than is being

felt at present.

SVLK saga continues

The Indonesian Ministry of Trade has reiterated that the

SVLK is a heavy burden for small and medium sized

companies and continues to seek an agreement for easing

the regulations on a range of products.

The Ministry argues that even if companies are not SVLK

certified they must still ensure and be ready to offer proof

of the legal source of their raw materials. However,

Arlinda, a trade specialist in the Ministry of Trade said her

Ministry totally supports the SVLK but suggests means

must be found to assist the SMEs.

President - No more projects on peatland

Indonesian President, Joko Widodo, has instructed the

Minister of Environment and Forestry to stop issuing

licenses for agricultural use of peatland. The Minister is

also charged with undertaking a review licenses on

peatland as part of the government’s efforts to address the

issue of peatland fires.

It has been reported that the President wants to

put a stop

to the conversion of forests and peatland to agricultural or

tree crops.

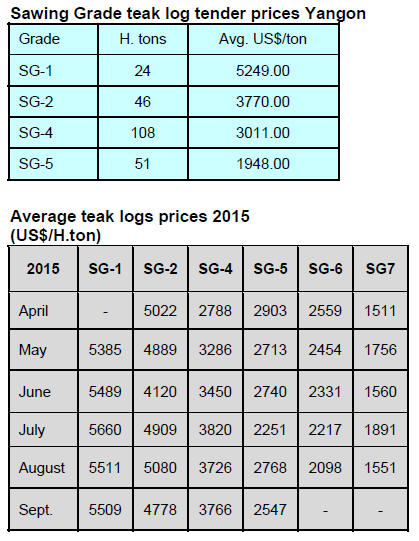

5. MYANMAR

Business look forward to a new era in

Myanmar

National elections were held in Myanmar on 8 November

and timber trade news paled as the nation focused on

election campaigning. The National League for

Democracy (NLD) is set to form a new government and

the private sector is optimistic that a positive new chapter

will begin for businesses in the country.

Foreign investment inflows continue

The domestic newspaper, Daily Eleven, quoting the

Ministry of Commerce, reported that inflows of foreign

investment amounted to US$3.2 billion in the first six

months of this fiscal year (i.e. up to September).

Investments were directed towards the energy (gas and oil)

sectors, manufacturing, mining, transport, and

communications, hotel and tourism, real estate, livestock

fisheries and agriculture, services and construction.

EU–Myanmar trade expands

The Ministry of Commerce has reported that in the first

six months of the 2015-16 fiscal year trade between

Myanmar and the EU was worth around US$328 million.

Myanmar’s imports in the same period totaled US$185

million while exports to the EU were US$143 million. Dr

Maung Aung, Adviser to the Ministry of Commerce in a

statement said “Myanmar now has a lot of trade

opportunities but even though nine countries have given us

permission, such as Russia, Turkey, Norway and

Australia, we have not yet the capacity to properly supply

the demands of those markets.”

A trader commented that Myanmar has a long way to go to

match international production standards.

Special Open Tender

The following timber was sold by Myanma Timber

Enterprise (MTE) by special open tender on 26 October

2015. Log volumes are expressed in hoppus tons (H.tons)

and volumes for ‘conversions’ and sawn teak (including

hewn timber) are shown in cubic tons (C.tons).

6.

INDIA

RBI identifies challenges to growth

Shri S. S. Mundra, Deputy Governor, Reserve Bank of

India (RBI), recently addressed the challenges to growth in

the country and the text has been provided in a press

release.

See:

https://www.rbi.org.in/Scripts/BS_SpeechesView.aspx?Id=975

The key challenges were identified as

lack of

investment in infrastructure- both physical

lack of

investment in infrastructure- both physical

and financial

high level of

Financial Exclusion

high level of

Financial Exclusion

skill gap, which has implications

for

skill gap, which has implications

for

employability

decline in gross capital formation and

a

decline in gross capital formation and

a

dwindling domestic savings rate

The Government and the RBI have been taking steps to

address these issues bearing in mind there needs to be a

balance struck between promoting investment in ‘capital

intensive’ or ‘labour intensive’ companies in the

manufacturing and service sectors.

This, says Mundra, is necessary because of the sheer size

of the educated workforce in the country for which jobs

must be provided.

Currently, the contribution of the service sector to growth

has grown to around 57 % of GDP. The growth in output

in the services sector can largely be attributed to rapid

development of skill intensive services such as

information technologies. However, questions have been

raised about the quality and sustainability of this servicesector

growth but the thrust of the government on ‘digital

India’ and skill development will support continued

expansion in this area.

Mundra continues “A crucial piece of the growth

continuum would emerge from continued migration of

people to urban areas. This would fuel demand for

housing, transportation, electricity, education, healthcare

facilities, etc.

Governments/ Municipal bodies would also need to invest

in creation of roads, sewage systems, water supply

facilities, etc. While focus on impending urbanization is

critical, the rural economy should continue to remain an

area of focus as more than 60% people would continue to

live in rural areas.”

‘Housing for all’ project gets boost from Canada

Indian officials have reported that the Canada Pension

Plan Investment Board (CPPIB) fund has established an

office in Mumbai and is planning to invest in the housing

sector in the country. In a press release CPPIB says they

are considering an initial investment of US$ 2 billion.

Continuing, a spokesperson for CPPIB said the Plan

already has significant investments in the country

involving infrastructure, real estate and financial services

and that the new office in Mumbai will allow CPPIB to

build important partnerships and access investment

opportunities that may not otherwise have been available.

See: http://www.cppib.com/en/public-media/newsreleases/

2015/cppib-india-office.html

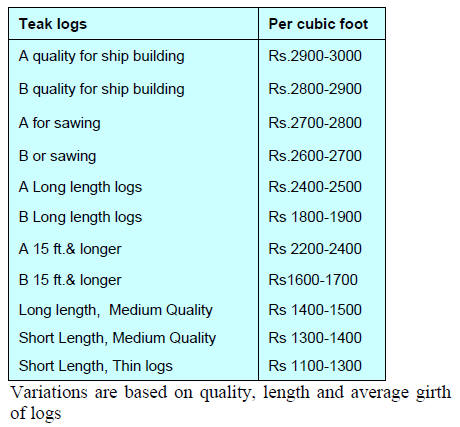

Auction of domestic teak and hardwoods

The second round of auctions for the current season has

been concluded at Forest Depart Depots in Surat and

Vyara. Around 12,000 cubic metres of good quality

domestically grown teak and some non-teak hardwoods

was on offer.

Despite prices for imported plantation teak easing auction

prices were firm. Locally grown teak is always preferred

by millers as the quality is higher, the sap is smaller, the

form is good and the girths are larger all of which

contribute to better recover rates in the mill.

Average prices recorded at the most recent auction were as

follows:

Good quality non-teak hardwood logs, 3 to 4 meters

long

having girths 91cms and up of haldu (Adina cordifolia),

Laurel (Terminalia tomentosa), kalam (Mitragyna

parviflora) and Pterocarpus marsupium fetched higher

prices than in the previous auction in the range of Rs.800-

900. Prices for medium quality logs were in the range of

Rs.300-400 per c.ft.

The next round of auctions will be held in the North and

South Dangs Divisions and the indications are that a large

volume of logs will be available.

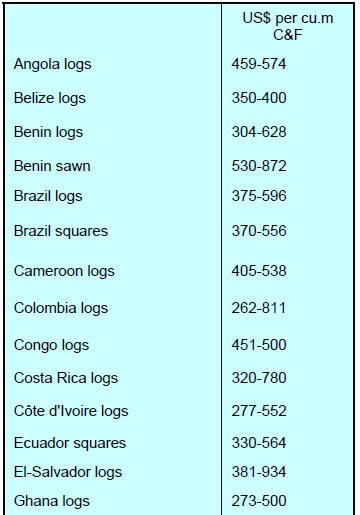

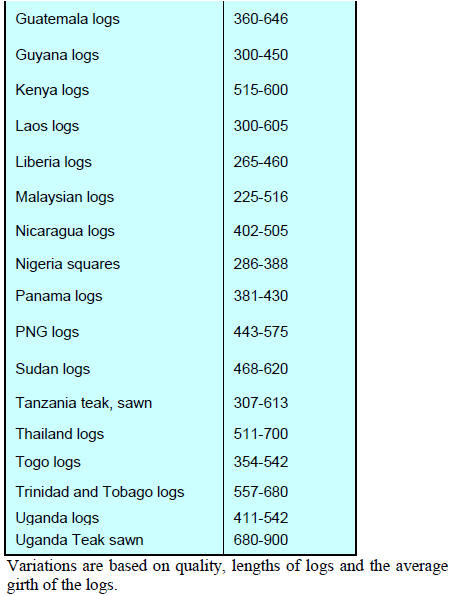

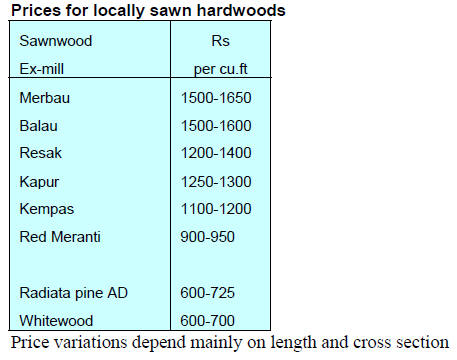

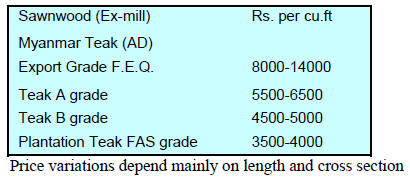

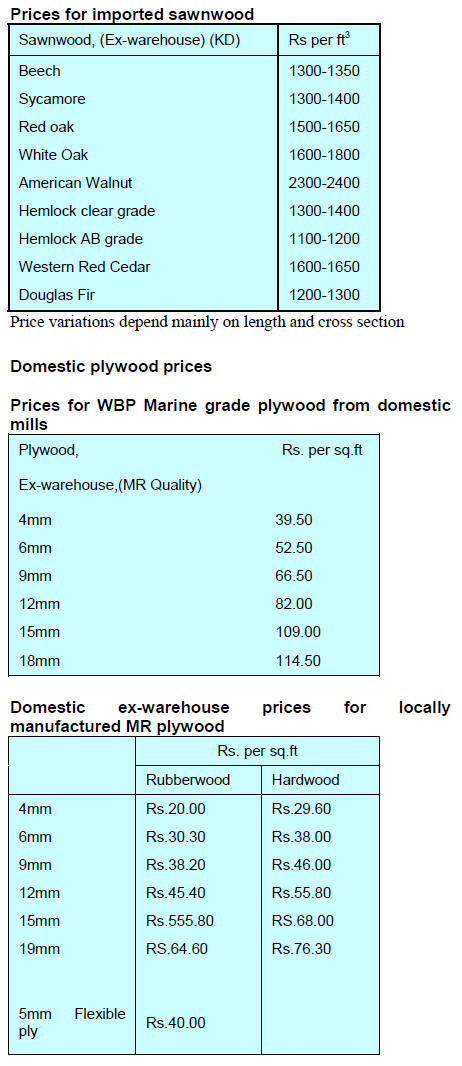

Prices for imported plantation teak, C&F Indian ports

Prices are unchanged from the end of September.

Myanmar teak logs sawn in India

Despite the decline in stocks purchased before the log

export ban there has been no change in price levels for

domestically milled Myanmar teak.

Expanding middle class driving up furniture

imports

The Indian furniture market is estimated to be worth

around US$18 billion annually and of this wooden

furniture accounts for about 30% and imports of wooden

furniture comprise a large proportion of this.

India is a significant importer of furniture and in 2014 had

an approximated 16% share of the global furniture market

with imports coming primarily from the EU (Italy,

Germany and Spain), China, South Korea, Malaysia,

Indonesia, Philippines and Japan.

Furniture imports in India have been growing over

50%

annually since 2009, the main driver being increasing

investment in housing and commercial properties. Higher

incomes and an expanding middle class residing in urban

areas has also resulted in demand for imported furniture.

7.

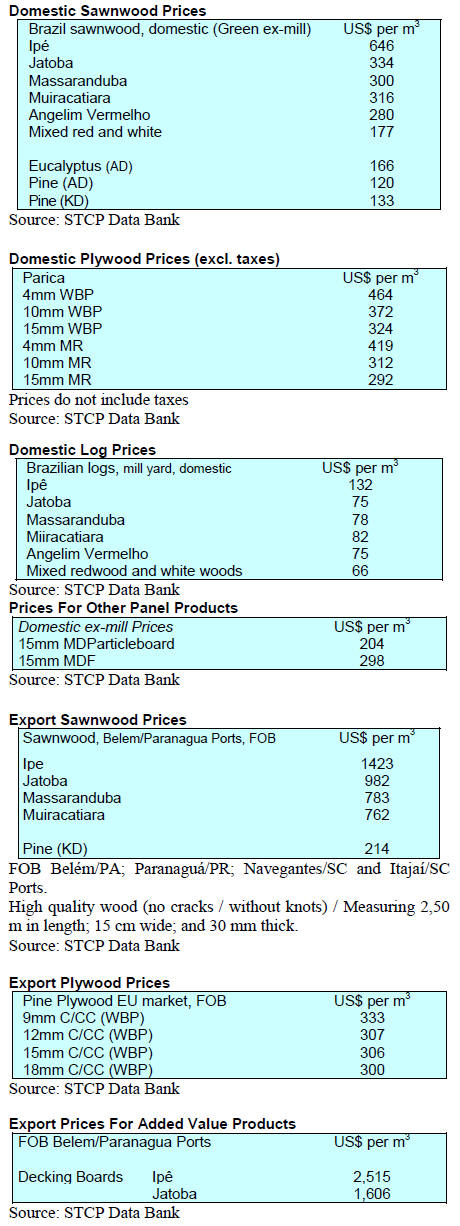

BRAZIL

Brazilian competitiveness in the world

trade

The Brazilian Association of Mechanically-Processed

Timber Industry (ABIMCI) recently reported on its

participation in the first Foreign Trade Forum – Southern

Region For Export, held in Florianopolis, Santa Catarina

State.

The objective of the Forum was to discuss issues related to

the international trade from Southern Region producers,

the impact of the current state of the global economy and

Brazil’s exchange rate policy. Leaders from the

production sector, exporters, logistics companies,

representatives of ports and other transport sectors

attended the Forum.

Participants from the production sector suggested

structural changes and policies were needed to achieve a

positive trade balance. They assessed the global market

situation and Brazil’s position in trade agreements and

innovation as drivers of a competitive national forest

industry.

Another topic discussed was "Opportunities and Barriers

for Exports", which listed the main obstacles and

potentials for improvement of Brazil's performance as a

world player.

Timber exports Improve, but production costs rise

Brazilian exports of processed wood products continue to

grow as manufacturers actively seek new markets as

domestic demand is poor. The export drive has been

helped by the appreciation of the US dollar.

Between January and September, exports increased 22%

compared to the same period in 2014. This was the largest

increase recorded since 2008, according to ABIMCI.

See: For more see: http://www.abimci.com.br/abimciparticipa-

do-forum-sul-for-export/

The new emphasis on exports can be gauged by the

proportion of total production that is exported. In the

plywood industry, for example, about 55% of processed

wood was exported in the first half of 2014. In the same

period in 2015, processed wood exports were around 60%

of total production.

For sawnwood the estimated increase was from 12% to

15%. Up to September this year sawnwood exports have

increased by over 30% year on year.

Despite the positive performance in international trade

profitability in the sector remains flat. The sharp rise in

production costs as energy prices rise, wages are driven up

and interest rates continue to climb is having a negative

impact on profits.

ABRAF and ABIMCI partnership

ABIMCI and Brazilian Association of Formaldehyde and

Derivatives Producers (ABRAF) have established a

partnership to exchange information on developing joint

action for the sector's growth.

The objective is for companies in the chemical sector

represented by ABRAF to become part of the Committee

called “Smart Home”, composed of various entities

representing the civil construction and timber sectors as

well as the Federation of Industries of Paraná State (FIEP)

which has been working to develop a wood frame

construction system in Brazil.

This partnership is considered an important step forward

in the search for joint solutions and to tackle the

profitability crisis in the timber sector.

The major hurdle holding back growth in wood product

manufacturing is the low level wood consumption in the

domestic market, especially for products such as plywood

for civil construction.

To address this problem ABIMCI is promoting the

National Program for Wood Quality (PNQM) and Sectoral

Quality Program of Wooden Door for Buildings (PSQPME)

which define the technical requirements for

products used in civil construction.

Research on forest regeneration and silviculture in

Brazil

The value of wood and non-wood products harvested in

both natural and plantation forests in the country

amounted to R$ 20.8 billion in 2014 according to research

published by the Brazilian Institute of Geography and

Statistics (IBGE).

In addition, economic activity as a result of forest

harvesting was estimated to be worth around R$ 16

billion. Of this harvesting of timber and non-timber

products from only Brazil’s natural forests alone generated

a value of R$ 4.6 billion.

IBGE´s research titled ‘Production, Extraction and

Silviculture’ indicates that the value of timber production

from forest plantations reached R$ 15.9 billion and timber

from natural forests reached R$ 3.2 billion. According to

IBGE, of the total 146.5 million cubic meters of

roundwood extracted in 2014, 91% originated from

planted forests.

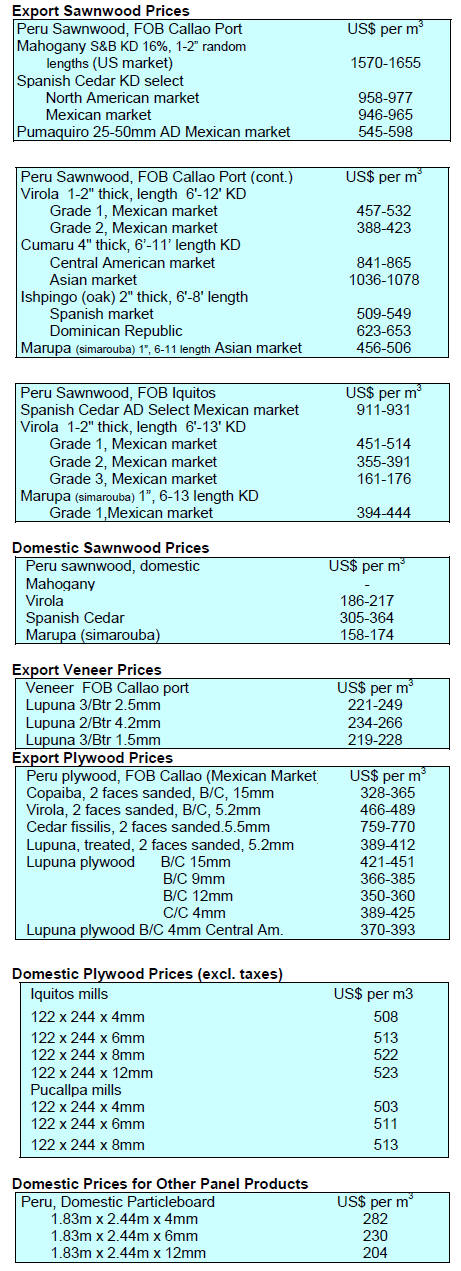

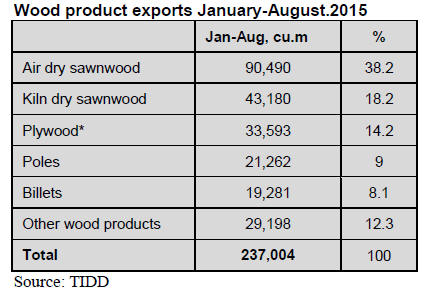

8. PERU

Forestry sector growth to generate

thousands of jobs

The development of the forest sector in Peru could create

one million direct and indirect jobs according to the head

of the Ministry of Production (Produce), Piero Ghezzi.

He said that in Peru there are about two million hectares of

land suitable for plantation forestry and this offers a great

potential. This was made known when Ghezzi participated

in an international forum "Investment Promotion in

Commercial Forest Plantations in Peru".

The potential of the plantation industry is attracting a lot

of interest from investors and could become one of the

new engines of growth for Peru.

Enforcing illegal logging laws

Legislative Decree No. 1220, which authorises action

against illegal logging, reflects the determination of the

Government of Peru to combat and eradicate illegal

harvesting and protect the forest resources.

The call for tough enforcement was made by Cesar

Paredes Fourment, the High Commissioner on Combating

illegal logging within the Council of Ministers (PCM). He

reiterated that the Decree states that the Special Prosecutor

for Environmental Matters (FEMA) is the entity

responsible for interdicting illegal logging.

The High Commissioner further confirmed that under the

Forestry and Wildlife Law (Law No. 29763) the authority

responsible for combating illegal logging has been

transferred from regional governors to the forestry

authority.

Advancing cooperation in forestry between Peru and

Colombia

During the Presidential Meeting between Peru and

Colombia in Medellin cooperation between the two on

forestry was highlighted.

In the First Bi-national meeting the Agency for

Supervision of Forest Resources and Wildlife (OSINFOR)

signed an agreement with the Ministry of Environment,

Housing and Territorial Development (MADS) in

Colombia to establish a Plan of Action set to contribute to

sustainable forest management and legal timber trade.

In this regard, the Presidential Declaration after the

Medellin meeting has, in paragraph 9, highlights on

adoption of a Plan of Action 2015-2016 for the sustainable

use of forest resources and wildlife.

The annexes to the declaration set new commitments for

concrete actions to continue joint work in coordination

between the Peruvian and Colombian forestry sector.