Japan

Wood Products Prices

Dollar Exchange Rates

of

25th

August 2015

Japan Yen 119.22

Reports From Japan

Japan's Economy – BoJ Governor on beating deflation

The Governor of the Bank of Japan (BoJ), Haruhiko

Kuroda, recently spoke to the Japan Society in New York

and a copy of the speech „Moving Forward: Japan's

Economy under Quantitative and Qualitative Monetary

Easing‟ (QQE) was made available at:

https://www.boj.or.jp/en/announcements/release_2015/rel

150827b.htm/

The Governor maintains his optimism that the efforts of

the government and the Bank will pull Japan out of its

recessionary cycle. The speech provides a useful analysis

of the impact of monetary easing over the past two years

and the text of the opening remarks are provided below.

“More than two years have passed since the Bank of Japan

introduced Quantitative and Qualitative Monetary Easing

(QQE) to achieve the price stability target of 2 percent. Let

me briefly look back at these two years.

In the first year, Japan's economy improved impressively,

registering both rising growth and inflation. Real GDP

growth in fiscal 2013 exceeded 2 percent and annual CPI

inflation (consumer price index, all items less fresh food)

increased from minus 0.5 percent just before the

introduction of QQE to 1.5 percent in April 2014.

In contrast, in fiscal 2014, the second year after the

introduction of QQE, Japan's economic performance was a

little disappointing. One reason is that the negative impact

of the consumption tax hike in April 2014 was larger than

expected.

The tax hike brought about swings in demand and a

decrease in real income, both of which resulted in sluggish

private consumption, in particular of durable goods such

as automobiles. On the inflation front, crude oil prices

declined substantially from the beginning of autumn.

Although the oil price decline should have a favorable

impact on economic activity in the longer term, in the

short term it has a downward impact on inflation through

the decline in energy prices such as gasoline and

electricity prices. As a result, annual CPI inflation rapidly

declined toward the end of last year and has been about

zero percent this year so far.

Against this background, it is not surprising that some

wonder whether the Bank's price stability target of 2

percent can really be achieved. Has the trend toward

overcoming deflation come to an end? This is far from the

case.

Two factors -- the consumption tax hike and the

substantial decline in oil prices -- only temporally have a

downward impact on inflation.

The growth and inflation figures were strongly affected by

these factors and were indeed disappointing, but if we take

a closer look at the underlying trends, we find that

significant changes that were not observed during the

deflationary period are taking place.”

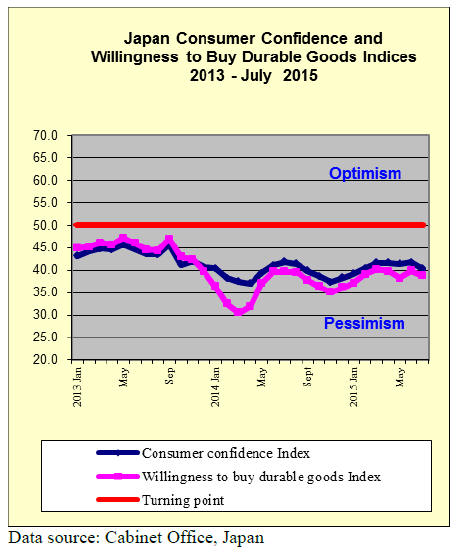

Economic indicators trending in different directions

The Japanese government‟s assessment of the state of the

economy in August says the moderate recovery continues

but that there are wide variations between the various

indicators. In summary the Cabinet Office assessment

says:

Private consumption is holding firm Private consumption is holding firm

Private sector investment continues upwards

Corporate profits are improving

Employment levels are improving Employment levels are improving

Consumer prices are rising moderately

but

Exports are weakening Exports are weakening

Industrial production is flat Industrial production is flat

Current business conditions are neutral Current business conditions are neutral

In the short-term the Cabinet office report for August says

“The economy is expected to recover supported by the

effects of the policies while employment and income

situation show a trend toward improvement.

However, attention should be given to the downside risks

of the Japanese economy including slowing down of

overseas economies including the Chinese economy and

fluctuations in the financial and capital markets.”

For more see: http://www5.cao.go.jp/keizai3/getsureie/

2015aug.html

Japan’s robust investment in ASEAN

A recent report from the Japan External Trade

Organization (JETRO) „JETRO Global Trade and

Investment Report 2015 - New efforts aimed at developing

global business‟ shows that more and more Japanese

companies are investing in new overseas markets.

JETRO says Japan‟s outward investment has exceeded

US$100 billion for four consecutive years and much of

this is directed to ASEAN countries where investments

grew three-fold to US$20.4 billion compared to the

US$6.7 billion invested in China.

The JETRO report mentions that the weakening of the yen

is encouraging Japanese firms to invest at home rather

than in riskier overseas ventures.

Japanese investment in ASEAN could get a boost when

the ASEAN Economic Community (AEC) is finalized as

this will eliminate tariffs on a very wide range of products

by 2018 bringing benefits to ASEAN countries as well as

Japan.

For more see:

https://www.jetro.go.jp/en/news/2015/ea96c87efd06f226.h

tml

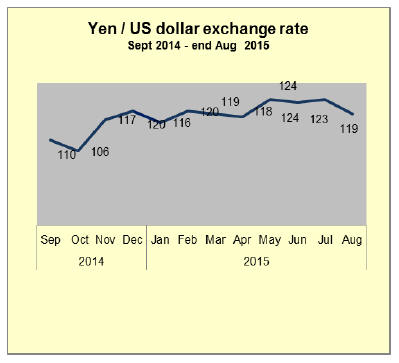

Growth strategy takes a double hit

The devaluation of China‟s currency will impact Japan as

Japanese exports will face even stronger completion from

Chinese exports. At the same time Chinese consumers will

find Japanese products have become more expensive.

Normally any risk to Japan‟s exporters would lead to a

weakening of the yen but in the current unsettled currency

markets there has been a rush to by yen which has pushed

the yen/dollar exchange rate to 119 to the dollar, a far cry

from the 124 of early August.

Despite strengthening yen the signals from the Bank of

Japan suggest it has no immediate plan to bring down the

exchange rate. Over the past three years the yen has been

forcefully devalued to make Japanese products cheaper in

world markets and this worked until the yuan was driven

down.

If the yen continues to rise against the US dollar and if

exports to China fall sharply the Japanese economy would

be dealt a serious blow since it depends on global exports

and in particular, exports to China.

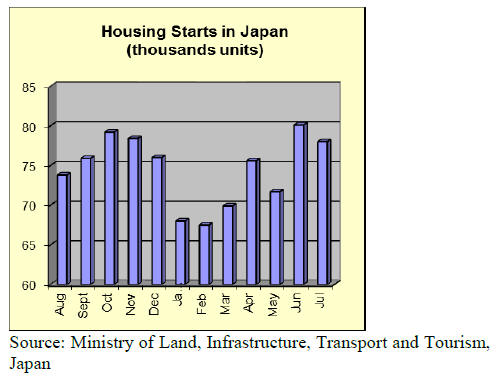

July housing starts

Japan's Ministry of Land, Infrastructure, Transport and

Tourism released July housing starts at the end of August

showing a sharp fall from the previous month. On an

annualized basis the uly figures push down 2015

projections to 914.000 from the 1 million plus based on

figures up to June.

Compounding the negative news is that orders received by

the top house builders reversed the gains made in June.

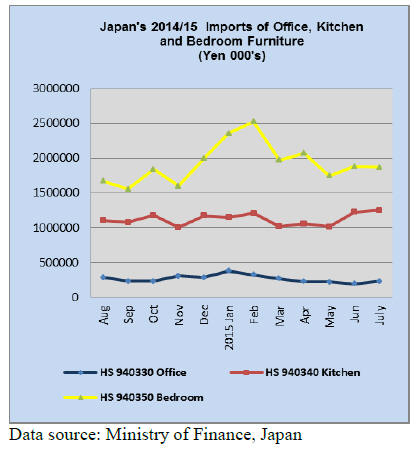

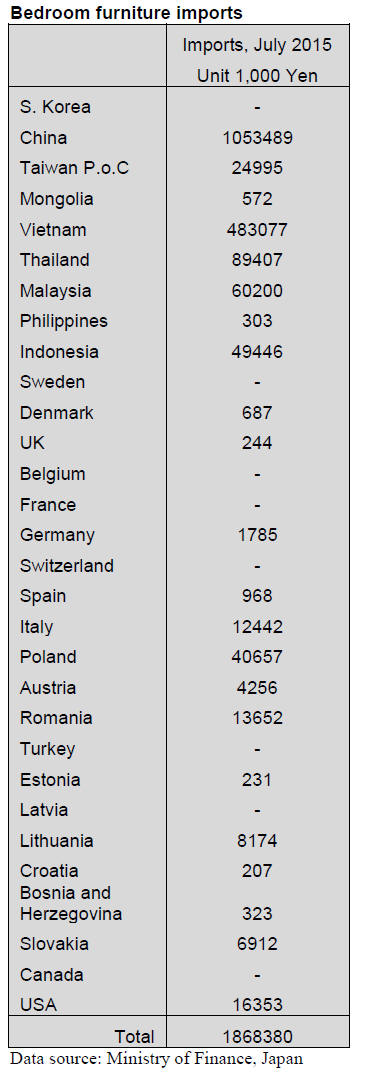

Japan’s furniture imports

Japan‟s imports of office furniture rose in July marking

the first increase in imports since January this year.

However, despite the rise, July imports are well down on

the avearge monthly imports in the first quarter of the

year.

Both kitchen and bedroom furniture imports rose in July

consolidating the monthly increase seen since the end of

the first quarter.

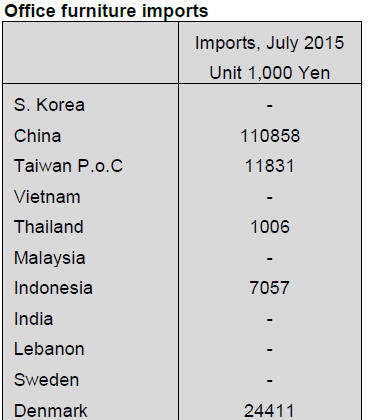

Office furniture imports (HS 940330)

July imports of office furniture jumped around 20% from a

month earlier. The top three suppliers in July were China

(47%), Portugal (17%) and Denmark (10%) which

together accounted for three quarters of all July office

furniture imports.

Office furniture imports from China were up 47% in July

and imports from Portugal also rose (+26%). Imports of

office furniture from Denmark over recent months have

been small so the rapid jump in the value of July sales (by

a factor of 10) suggests purchases of specialized items.

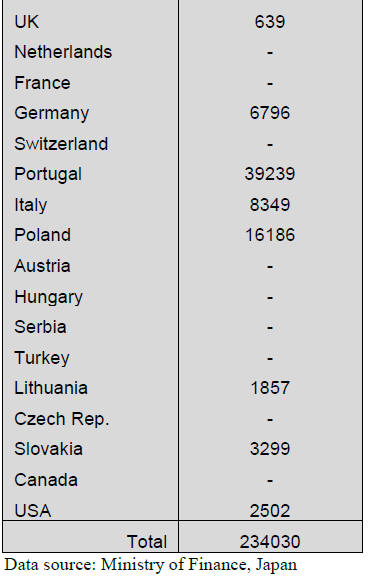

Kitchen furniture imports (HS 940340)

Once again, three countries dominate Japan‟s imports of

kitchen furniture.

The top supplier in July, by a wide margin, was Vietnam

(37% of all kitchen furniture HS 940340 imports)

followed by the Philippines (23%) and China (17%). If

imports from the 4th ranked supplier, Indonesia are

included then over 90% of Japan‟s kitchen furniture

imports are accounted for.

Overall, July imports were about the same as in June but

supplies from Vietnam fell slightly as they did for

Malaysia and Indonesia.

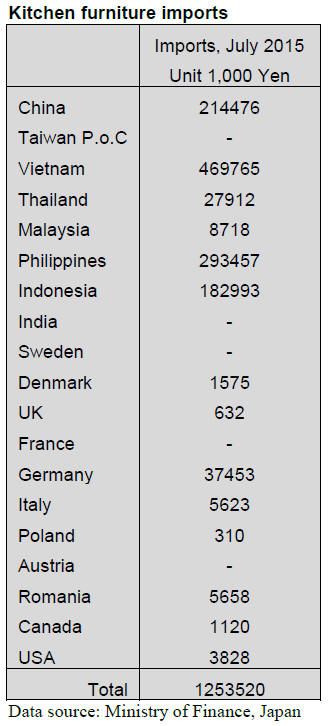

Bedroom furniture imports (HS 940350)

Japan‟s wooden bedroom furniture imports (HS 940350)

had shown signs of recovering in June but July figures

were once again a disappointing reflection on consumer

sentiment when it comes to big ticket purchases.

Until the housing market picks up significantly bedroom

furniture import levels will depend largely on replacement

demand.

Both China and Vietnam saw July exports of wooden

bedroom furniture to Japan decline. These two supply

countries account for over 80% of Japan‟s imports of these

products.

Trade news from the Japan Lumber Reports (JLR)

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

Plywood supply for the first half year

Total plywood supply for the first six months of the year is

2,859,600 cbms, 14% less than the same period of last

year. Domestic supply is only 5.2% less but imported

plywood decreased by 20.7%. Deliveries from the three

major supplying countries (Malaysia, Indonesia and

China) all declined by about 20%.

Total imports for the first six months were 1,499,000

cbms. Average monthly imports were 248,400 cbms and if

this level continues for next six months, total 2015 imports

would be less than three million cubic metres, the lowest

since 2009.

For the first half of 2014, imports increased to meet rising

demand before the consumption tax increase in April then

the volume declined in the second half as the demand

slowed down then since last August, the yen started

depreciating rapidly.

Meantime, harvest control in Sarawak, Malaysia tightened

and the log supply dropped so that future plywood prices

have kept climbing. Consequently, the monthly import for

last May and June dropped down to about 216,000 cbms.

The supply from Malaysia has kept dropping so the first

six months supply is 631,700 cbms, 21.2% less than the

same period of last year. Total year supply would be less

than 1.3 million cbms.

Indonesian supply for the first six months is 436,200

cbms, 19.5% less. Total year supply would be less than

one million cbms, the lowest since 2010. Chinese supply is

also down by18.6% with 335,200 cbms.

Crating plywood demand of about 10,000 cbms a month

shifted to Vietnamese plywood from Chinese plywood.

Domestic production is 1,368,600 cbms, 5.2% less out of

which softwood plywood is 1,281,800 cbms, 5% less.

Average monthly production is 213,600 cbms while the

domestic shipment for the first six months is 1,269,900

cbms. June end inventory was 228,400 cbms.

First FSC certified logs from Sabah

Itochu Corporation took delivery of about 2,900 cbms of

FSC certified logs from Sabah, Malaysia from Sabah

Forestry managed timberland in Sandakan, Sabah for two

plywood mills in Niigata.

Itochu looked for FSC certified timber from beginning of

the year and urged local shippers, which handle certified

logs to have COC certificate. After COC certificate was

acquired, Itochu participated in FSC log auction through

local shippers and became successful bidder. Species are

red, white and yellow serayah. There are more FSC

certified timber in Sabah but species are mainly planted

species like acacia and falcata.

Two plywood mills have been using FSC certified

kamerere from PNG but purchase became difficult so

Itochu looked for substitution and found virgin forest of

serayah, which is suitable to make plywood.

Two plywood mills in Niigata have been using more FSC

certified wood like Indonesian veneer for face and back,

Russian veneer and PNG‟s kamerere so they give priority

for FSC certified wood in manufacturing.

South Sea (tropical) logs

Export log prices stay up high although weather continues

dry with occasional shower so weather is no factor for

reduction of the supply.

Harvest control is the largest factor in Sarawak so the

Japanese log buyers focus on Sabah logs, where there is no

legal control. Sizable harvest reduction in Sarawak will

continue then rainy season will start. Even supply of

Sabah logs will decrease when rainy season starts.

With this background, log suppliers remain bullish.

However, main buyer, India imported about 250-300 M

cbms in July, which is nearly double of normal monthly

import then monsoon season will arrive India shortly,

which reduces log consumption so that log purchase will

slow down.

If India slows down, the suppliers are not able to stick to

bullishness. Present export prices of Sarawak meranti

regular are $285-295 per cbm FOB, small meranti $265-

275 and super small $250.

Plywood markets

Domestic softwood plywood market is firming. After the

manufacturers announced production curtailment and

refused to accept low offers, the market prices sharply

reacted.

Dealers carried very little inventories in prolonging down

market then they started speculative purchases so that June

shipment was 248,500 cbms, the highest ever recorded,

about 20% higher than normal month. The inventory

dropped down by 33 M cbms.

Dealers continue ordering in July as the manufacturers

started 20-30% production curtailment since July so in last

week of July, the inventory held by the manufacturers

sharply dropped and delivery period is now uncertain.

Since this much volume shifted from the manufacturers to

distribution channels, supply shortage should not occur for

some time. Supply shortage is on all the items for the

manufacturers.

Market prices of 12 mm 3x6 panel prices are 800 yen per

sheet delivered but some demand 850 yen.

Import plywood market is not making any progress.

Malaysian plywood mills struggle to secure logs with tight

supply as a result of illegal harvest control and some mills

are forced to reduce the production. The largest supplying

mill reduces the production by half. They continue bullish.

|