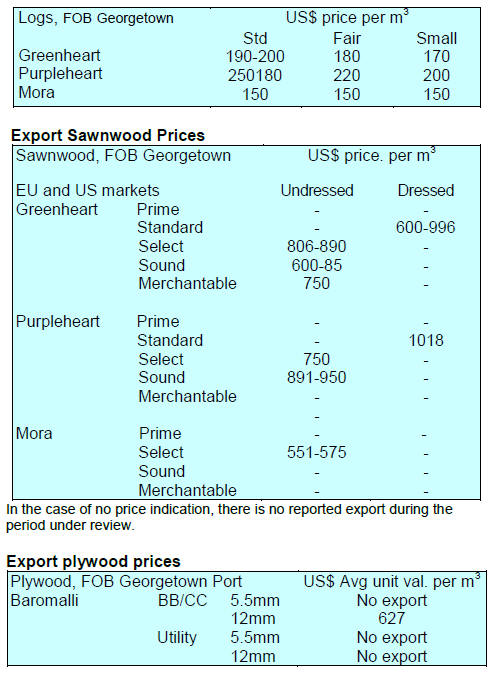

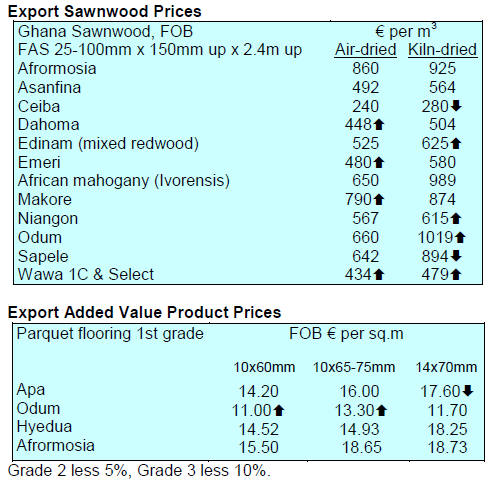

2. GHANA

Sawnwood accounts for 50% of first half

exports

Air and kiln dried sawnwood exports in the first half year

of 2015 accounted for more than 50% of Ghana‟s total

wood export volumes. The top export species were

plantation teak, wawa, ceiba, plantation gmelina and

mahogany. The main markets in the first half of the year

were India, China, the U S, Nigeria and Niger.

According to data from the Timber Industry

Development

Division (TIDD) of the Ghana Forestry Commission

(GFC), first half 2015 exports of wood products totalled

174,409 cu.m, a 21.5% rise on first half 2014 exports. First

half export earnings totalled euro 88.71 million.

Four products topped the export list in the first

half of this

year : sawnwood (air and kiln dry), plywood ( for regional

markets), poles and billets. These products accounted for a

volume of 151,679 cu.m, worth euro 73.28 million or 83%

of total earnings.

In summary, the breakdown of export destinations was as

follows: Europe 12.5%, Asia/Far East 58.5%, Africa 20%,

USA 6% and Middle East countries 3%.

Legality verification mechanism in place

Ghana has made progress on the system to verify the

legality of wood products and this could pave the way for

the issuance of FLEGT licenses as early as 2016.

According to Dr. Richard Gyimah, Manager of the

Verification and Audit Timber Validation Department at

the Forestry Commission (FC), just a few issues need to be

addressed before the country can secure approval to issue

FLEGT licenses.

Over the years, the GFC has been working with the EU to

put in place the systems and reforms necessary to

implement the Voluntary Partnership Agreement (VPA), a

legally binding agreement between the European Union

and timber exporting countries.

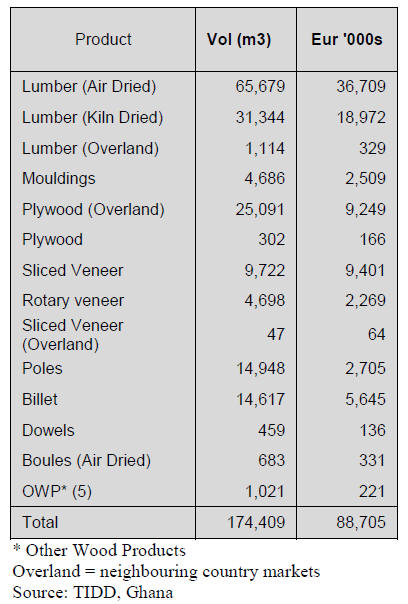

3. MALAYSIA

Ringgit under extreme pressure

In the midst of falling global stocks and currencies the

Malaysian ringgit is at a 17-year low against the US dollar,

trading at 4.2630 to one dollar on 26 August.

Malaysia‟s foreign currency reserves have fallen almost

20% since January. Malaysia‟s reserves have now dropped

at a pace four times as fast as in Indonesia where the

rupiah is under strong downward pressure.

The Malaysian government has cut its 2015 GDP growth

forecast by over 1% mainly due to continuing low oil

prices. Malaysia is the largest net exporter of oil and gas in

Southeast Asia, with energy exports accounting for

roughly 30% of national revenues.

Oil Palm stems, 10 million cubic metres available

The latest issue of MASKAYU, the official publication of

the Malaysian Timber Industry Board, reported on a

seminar on conversion of oil palm trunk (OPT) into

sawntimber and plywood.

The seminar provided a platform for local entrepreneurs in

the wood-based industry to obtain the latest information

and R&D findings in manufacturing OPT products.

Data from the Ministry of Plantation Industries and

Commodities shows that Malaysia‟s oil palm resources

extend over 5.3 million hectares or about 70% of all

agriculture land.

Yields from oil palm drop after 25 years so replanting is

necessary. Assuming annual replanting of 130,000

hectares, between 2015-2032 the annual availability of

OPT is estimated at 10 million cubic metres a resource

that must be utilised.

Platform for international collaborative

research

ĄŽRimba SarawakĄŻ launched

In another step signaling Sarawak‟s move towards

improving accountability and transparency in forestry

governance the State government has launched „RIMBA

SARAWAK‟ an initiative to provide a platform for

international collaborative research to develop practical

conservation management procedures for bio-rich areas.

Initially the research will be based in three field stations in

Ulu Sebuyau National Park, Batang Ai National Park and

Lanjak Entimau Wildlife Sanctuary (LEWS) which

extends over an area of 169,000 hectares and was

developed after an ITTO project in 1993.

LEWS is contiguous with Betung Kerihun National Park

(BKNP) in Kalimantan, Indonesia. Together, they formed

the world‟s first trans-boundary nature reserve in the wet

tropics for inter-regional collaboration.

The organsations which signed up for RIMBA

SARAWAK were: the Smithsonian Conservation Biology

Institute, Royal Botanic Garden Edinburgh, National

University of Singapore, and Wildlife Conservation

Society.

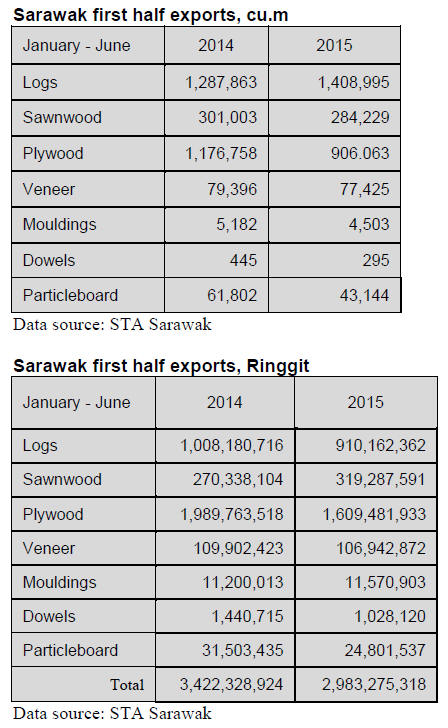

Sarawak first half exports fall 13 percent

Statistics compiled by Sarawak Timber Association (STA)

show a drop of 13% in value of timber and timber product

exports in the first half of the year. The product categories

ares shown below.

Sarawak export plywood prices

Plywood traders in Sarawak reported the following FOB

export prices:

FB (11.5 mm) US$600 per cu.m

South Korea (9 mm and above) US$435 per cu.m

Taiwan (9 mm and above) US$435 per cu.m

Hong Kong US$450 per cu.m

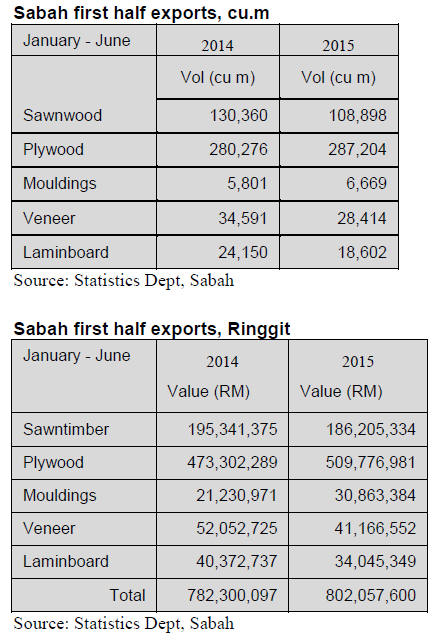

Sabah exports drop 16%

The Sabah Department of Statistics data for first half

exports reveal an almost 16% decline in the value of

timber and timber product exports. Product categories are

shown below.

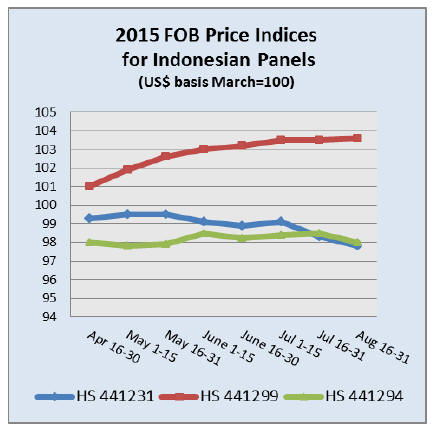

4. INDONESIA

Once again - haze from forest fires a

health hazard

Thick smog is blanketing much of Indonesia and Malaysia

as forest fires spread.

Satellite images show hundreds of „hotspot‟ forest fires in

Sumatra and Kalimantan according to statements from

Indonesia‟s National Disaster Management Agency.

Smoke from these fires is drifting across Indonesia and has

reached Malaysia.

A haze emergency was declared in Central Kalimantan

province in late August as the air pollution index (API)

rose to dangerous levels and ground level visibility was

bad enough to disrupt air traffic.

Malaysia's Natural Resources and Environment

Minister is

set to meet Indonesian officials to discuss joint action on

transboundary haze.

New tax incentives, timber sector included

Indonesian Finance Minister, Bambang Brodjonegoro, has

outlined plans for new tax incentives aimed at boosting

both domestic and foreign investment in manufacturing to

lower the country‟s dependence on commodity exports.

A new regulation, known as Finance Ministry Regulation

No. 159/2015, will target investment in industries that

support economic growth. The new regulation, which

replaces regulation PMK 192/2014, expands the list of

eligible industries and includes the forestry and wood

processing sectors.

Industrial forest plantation target missed

The Ministry of Environment and Forestry aims to have 2

million ha. of industrial plantations established by 2019

but progress has been slow as few companies are prepared

to invest. As of the end of June only 10-15 companies had

shown an interest and submitted applications to the

Ministry.

The Director General of Sustainable Production Forest

Management in the Ministry of Environment and Forestry,

Ida Bagus Putra Parthama, said the number of applications

was far below expectations. The main reason cited for the

poor response was the regulations banning plantation log

exports. Ida said that the Ministry will consult with the

Ministry of Trade to discuss a possible revision of the

export ban.

5. MYANMAR

High volume of teak veneer flitch exports

raises

questions

Photographs of partially processed logs being readied for

export have appeared in the Myanmar press (Daily Eleven

16 August) the accompanying report says teak logs which

had been debarked and had been roughly „shaved‟ with a

chainsaw were seen being loaded into containers for

export.

Myanmar introduced a log export ban in 2014 which

prohibits the export of timber classified within HS code

44.03 (wood in the rough whether or not stripped of bark

or sapwood). However, the logs being shipped were said

to have been classified as HS code 44.07 i.e. teak veneer

flitches.

One industrialist commented that it appeared the logs were

„clear-shaved‟ of knots and bumps and debarked for

export under an incorrect HS code in order to circumvent

the log export ban.

It came to light that some 3500 tons of teak veneer flitches

were shipped last year. Veneer quality teak logs make up a

very small proportion of total log harvests such that local

millers are amazed that such a high volume of veneer

quality logs could be secured. Harvested logs are mostly

of sawmill grades and analysts comment that it is

surprising that such a high volume of veneer flitches could

be obtained.

The domestic industry is calling on the authorities to

tighten checks on export shipments. Currently the

inspection process involves Forestry Department mill

inspections and the Myanma Timber Merchants

Association normally gives price recommendations for

export documentation.

While the log export regulations prohibit shipment of

baulks, squares and boules, veneer flitches fall under a

different HS code so, technically, can still be exported.

To eliminate the risk that exporters fall foul of the export

ban the industry has suggested teams of qualified

inspectors be deployed to check grades and specifications

prior to export.

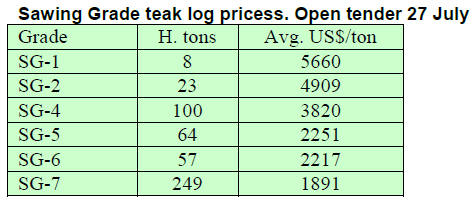

Prices at most recent tender sales

The following timber was sold by Myanma Timber

Enterprise (MTE) by tender on 24 and 27 July 2015. Log

volumes are expressed in hoppus tons (H.tons) and

conversions or sawn teak (including hewn timbers) are

reported in cubic tons (C.tons).

Sales of teak conversions (scantlings)

MTE sold 352 cubic tons of various sizes of teak

conversions produced from their own sawmills.

Average prices for Second Quality (110 tons)

Long Lengths(6ft. & up avg. 8ft.) US$1638

Short lengths (3 ft. to 5.5 f.t) US$1554

Ultra shorts- (1ft. to 2.5 ft.) US$1404

The average price for Third Quality(242 tons) was

US$564 per cubic ton.

6.

INDIA

Inflation rate trends down

The Office of the Economic Adviser (OEA) to the Indian

government provides trends in the Wholesale Price Index

(WPI).

The official Wholesale Price Index for All Commodities

(Base: 2004-05 = 100) for July declined by 0.6% to 177.5

from 178.6 in June. The year on year annual rate of

inflation, based on monthly WPI, stood at -4.05%

(provisional) for June 2015 compared to -2.4% for June.

For more see:

http://eaindustry.nic.in/cmonthly.pdf

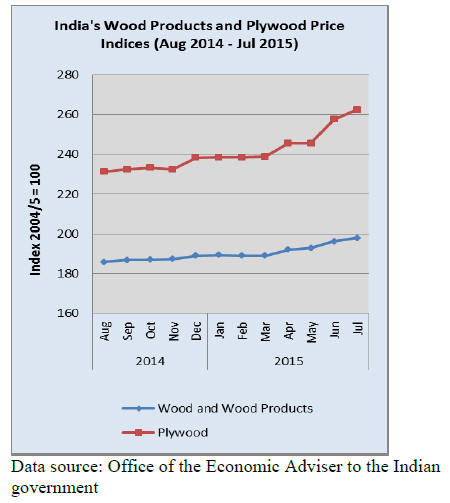

Timber and plywood price indices climb

The OEA also reports Wholesale Price Indices for a

variety of wood products. The Wholesale Price Indices for

Wood products and Plywood are shown below.

The July price indices for wood and wood products

and

plywood continue to show marked gains from a year

earlier but the signals are such that slowing demand will

weakened the pace of increases.

See

http://eaindustry.nic.in/display_data.asp

High prices holding back home sales ¨C ĄŽball now in

builders courtĄŻ

The Indian real estate sector has experienced a few tough

years and the problems continue with many homes priced

way above what people can afford.

A recent assessment says the unsold housing stock jumped

24% in Mumbai to just over 65,000 units, a record for the

city. Analysts write the situation is no better in the

Mumbai Metropolitan Region which includes Thane, New

Mumbai and Raigad, as well as Mumbai.

The latest estimate puts the number of unsold units at

around 176,000 a 20 % year on year increase. These

figures indicate a massive problem - buyer cannot afford

to purchase and builders are not ready to cut prices.

Energy saving programme to address over cutting of

fuelwood

The ministry of New and Renewable Energy (MNRE)

plans to distribute solar cookers and lamps in rural and

tribal areas in an effort to provide an alternative to

fuelwood and petroleum products.

The ministry has said "Under the programme devices such

as unnat chulhas (improved stoves), solar cookers, solar

lamps, solar home lighting systems and other energy

saving items will be distributed using the funds of

Compensatory Afforestation Fund Management and

Planning Authority (CAMPA). The scheme is managed

within the forest protection and conservation measures and

the MNRE has requested States and Union Territories to

indicate their needs for the alternative energy devices for

next five years.

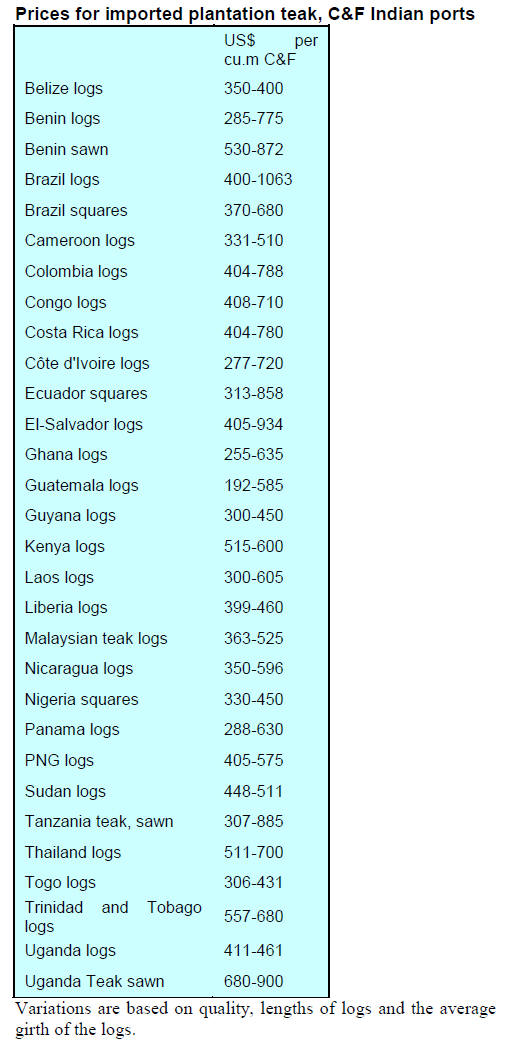

Teak import prices slip as log dimensions fall

Demand for teak has fallen reflecting end-users concern

for the economy and due to the annual monsoon during

which time sales regularly slip. Because of this importers

cut back on plantation teak purchases.

Over the past month a new plantation teak supplier has

emerged, Angola which recently shipped a small

consignment (357 cu.m) of plantation teak logs worth

US4,461.

Importers say some traditional suppliers are now shipping

shorter billets and smaller girth logs and that this has

impacted the prices. Also, in recent weeks the supply of

large girth logs from those suppliers traditionally shipping

larger logs has fallen.

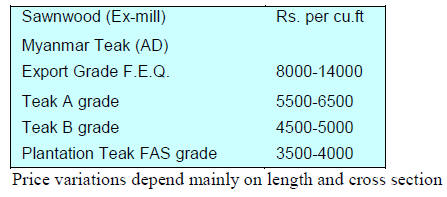

Growing interest in alternatives timbers holds

down

teak prices

Continuing strong resistance to price increases for

Myanmar teak sawnwood stems from consumers growing

acceptance of alternative species.

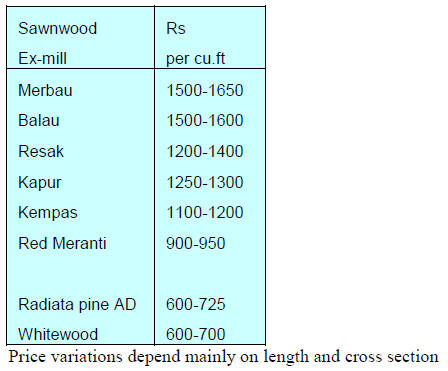

Prices for domestically milled sawnwood from

imported logs

Overall, supply and demand remains steady.

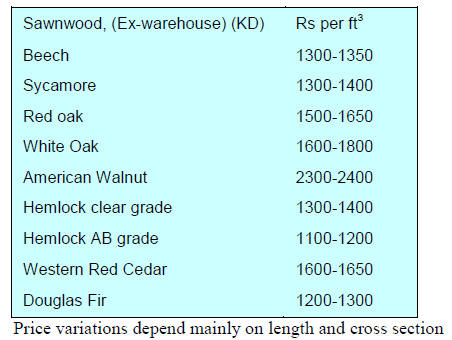

Imported sawnwood

Prices for imported sawnwood (KD 12%) shown below.

No significant price movements have been reported.

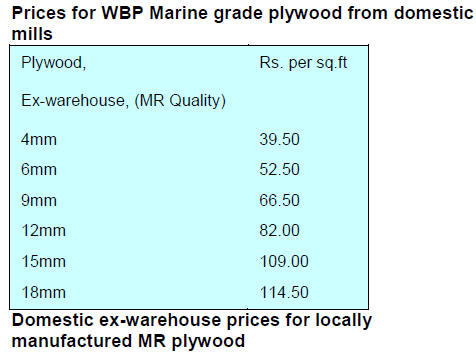

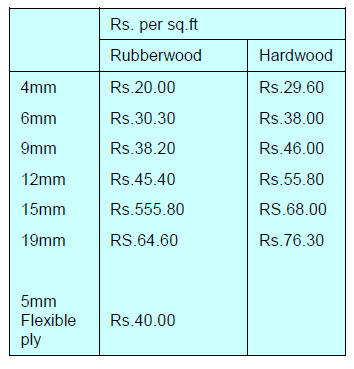

Lower phenol price but still plywood prices fall

Plywood manufacturers are benefitting from the recent

decline in phenol prices and this is providing some relief

to mills as they struggle to contain production costs.

Because of the weak housing market demand for panel

products is stalled causing millers to lower prices.

7.

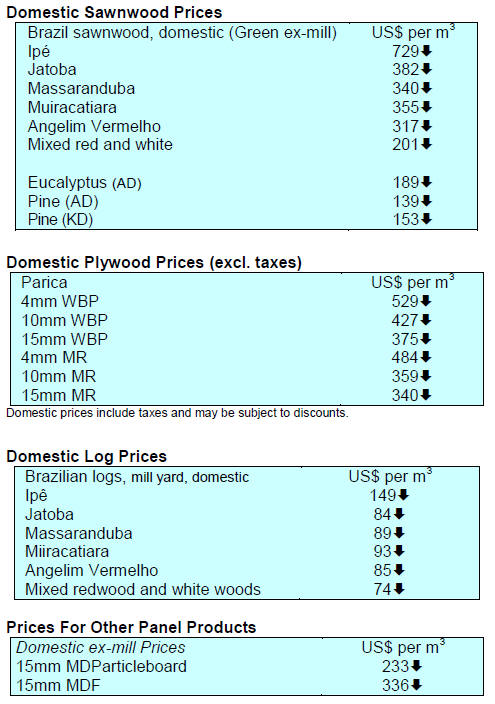

BRAZIL

Interest rates continue upwards

The Consumer Price Index (IPCA) for July 2015 rose by

0.62% bringing it just below the recorded in June 2015.

The year-to-date IPCA stands at 6.83%, up from the

3.76% in the same period of 2014.

The average exchange rate in July was BRL 3.22/US$, a

significant drop on the July 2014 figure of BRL 2.22/USD.

The Brazilian currency has depreciated around 45%

against the US dollar in twelve months.

In July the Monetary Policy Committee (COPOM) of the

Central Bank of Brazil increased the basic interest rate

(Selic) by another 0.5% bringing it to an annual rate of

14.25% per year. This is the seventh consecutive rate

increase and rates are now at the highest since August

2006.

ĄŽGreenbuilding BrazilĄŻ expo proposes measures to

stem illegal timber flows

The „Greenbuilding Brazil‟ expo, the largest trade fair for

sustainable construction in Latin America, was held

between August 11-13 2015 in São Paulo and brought

together industry experts to discuss ways to increase

sustainable timber production in the Amazon.

Illegal practices in the region are still problematic and

involve non-payment of taxes, lack of consideration for

native rights, failure to protect biodiversity, over

harvesting and harvesting in protected areas.

The meeting proposed some measures to improve controls

in the supply chain. These include: creating corporate

agreements and commitments, carrying out land planning

and environmental compliance on Amazon land; creation

of timber production clusters to eliminate illegal timber

and increasing awareness on responsible wood utilisation

in the construction industry.

The concept of production clusters aims at stimulating best

practices and participants could be provided with tax

incentives and credit lines to promote the responsible

timber production.

Federal Government to release more forest

concessions

The Brazilian Forest Service (SFB) announced in early

August that the Federal government would make available

2.11 million hectares of forest concessions from 2016. In

proposing this the authorities point out that forest

concession management models facilitate forest

maintenance and protection.

It is considered that the forest concession model provides

for legal controls which may not be provided under other

land management models. In addition, such management

systems provide for dialogue between the government and

the private sector in support of rational exploitation of

forest resources.

Currently, the SFB maintains forest concession contracts

in five National Forests in the Amazonian states of Par¨˘

and Rondônia. They have set aside the total of 842,000

hectares of natural forest that will be sustainably managed

by eight companies for the next 40 years.

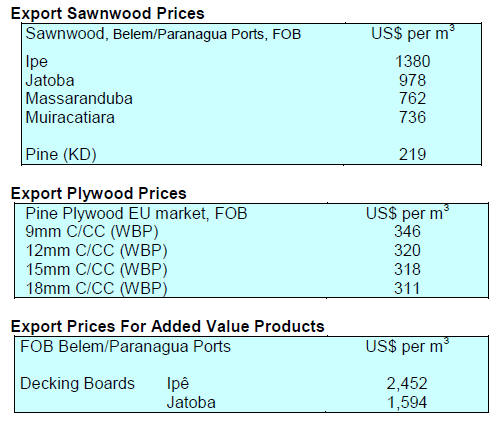

Export round-up

In July 2015, exports of wood-based products (except pulp

and paper) rose 3.7% in value to US$ 237.4 million

compared to US$ 228.9 million in July 2014.

Pine sawnwood export values increased almost 33%

between July 2014 (US$ 20.8 million) and July 2015 (US$

27.6 million). In terms of volume, exports increased 40%

over the same period (from 88,600 cu.m to 124,000 cu.m).

On the other hand, tropical sawnwood exports fell

marginally from 27,300 cu.m in July 2014 to 27,100 cu.m

in July 2015 (from US$ 14.8 million in July 2104 to US$

13.6 million this July)

Brazil‟s pine plywood exports fell around 4% in value in

July 2015 compared with a yeat earlier despite an increase

in the volume of exports (from 96,000 cu.m in July 2014

to 102,900 cu.m this July).

Tropical plywood are now very small but in July the

volume of tropical plywood exports rose from 3,800 cu.m

in July 2014 to 9,700 cu.m this year.

Weak regional demand for wooden furniture drove down

July export values from US$ 41.8 million in July 2014 to

US$ 38.4 million this year, a 8% decline.

ABIMCI forecast 30% rise in 2015 exports

The value of Brazilian wood products exports (including

timber, wood chips, sawnwood, plywood, door,

mouldings, and flooring) is expected to reach US$3 billion

in 2015, 30% above 2014 exports.

So far this year exports of the two main products, pine

sawnwood and plywood, increased 21% and 16%

respectively as a direct result of the appreciation of the US

dollar against the Brazilian real.

According to the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI), pine sawnwood

went mainly to the USA, Mexico, Saudi Arabia and China.

These four countries accounted for nearly 70% exports of

pine sawnwood. Between January and July this year

exports pine sawnwood amounted to 721,000 cu.m, a 35%

year on year increase.

Pine plywood exports in July 2015 were destined mainly

to the UK, USA, Germany and Belgium which together

accounted for slightly over 50% of the total volume

exported.

Petition lodged with USTR for suspension of plywood

tax

In other news ABIMCI has filed a formal petition (July

2015) with the Office of The United States Trade

Representative (USTR), requesting a revision of the US

plywood import duty.

Since 2005 Brazilian plywood has been subject to an

import duty of 8% in the US. The import duty kicks-in

when Brazil‟s exports of plywood reach a predetermined

ceiling.

Brazilian plywood exporters surpassed the softwood

plywood quota of US$ 115 million but find that the system

is hindering the competitiveness of Brazilian products

compared to other countries.

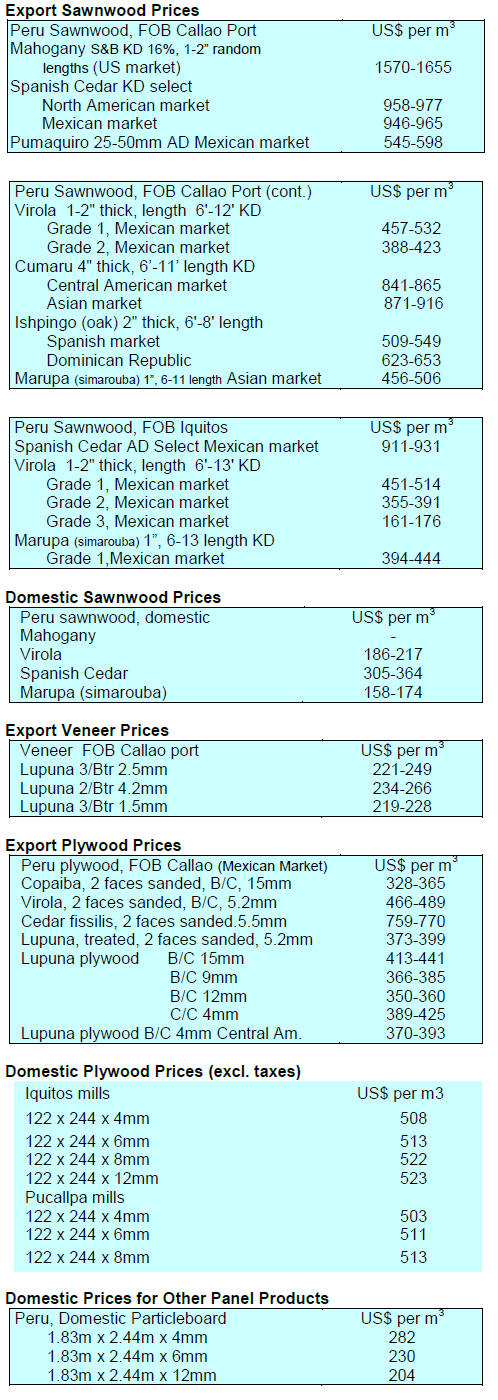

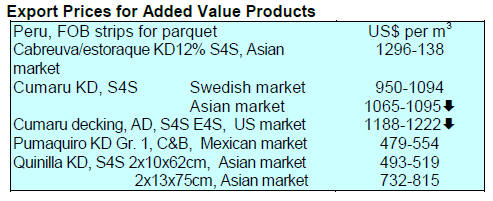

8. PERU

Falling purchase by China hits first half

year export

performance

Peruvian wood product exports in the first six months of

the year earned US$79.3 million but this was down almost

3% on earnings in the same period in 2014. The decline in

earnings from wood product exports is attributed to

slowing economic growth in China, Peru‟s main market.

According to figures from the ADEX Trade Database,

shipments to China totalled US$ 28.9 million in the first

half of the year a fall of 16%. However, in the same period

China accounted for 36% of total timber exports.

After China, the significant markets were Mexico

(US$15.5 million) and the US (US$13.1 million) but

purchases of Peru‟s wood products by both Mexico and

the US declined. Peru‟s wood product exports to Mexico

dropped 27%.

Other markets included France, Dominican Republic,

Belgium, Denmark, Australia, Ecuador, Panama, Chile,

Republic of Korea, Bolivia, Netherlands, Puerto Rico,

Sweden, Spain, Italy, amongst a total of 55 export

destinations for wood products.

Expansion of Technological Innovation Centres

An official in the Ministry of Production, Piero Ghezzi,

said work will begin in the final quarter of this year on

modernizing the country‟s Technological Innovation

Centers (CITE). The plan includes further development of

the forestry and wood processing sectors.

At the same time work will begin on development of

modern industrial parks, one in Lima (Ancon) and one

each in La Libertad, Piura, Tacna and Moquegua.

9.

GUYANA

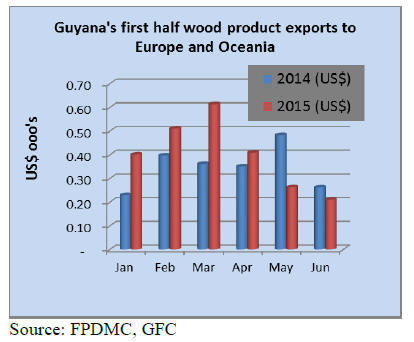

Markets in EU and Oceania dominate first

half exports

Strong demand in Europe and Oceania for Guyana‟s

timber and wood products resulted in satisfactory first half

2015 export earnings of US$2.41 million, up 15% on the

US$2.09 million in the first half of 2014.

Demand was particularly firm for sawnwood and finished

products such as doors and indoor and garden furniture.

Despite the good exports performance in the first

four

months of 2015 export sales dipped in May and June the

combined effect of global economic issues and a drop in

domestic output because of national elections.

The Forest Products Development and Marketing Council

along with the Guyana Forestry Commission is promoting

the benefits of the Voluntary Partnership Agreement

(VPA) being negotiated with the EU.

When the VPA is concluded it is expected the EU market

will be absorbing more of Guyana‟s wood products there

by improving the profitability of domestic industry and

contributing more to the economic development of

Guyana.

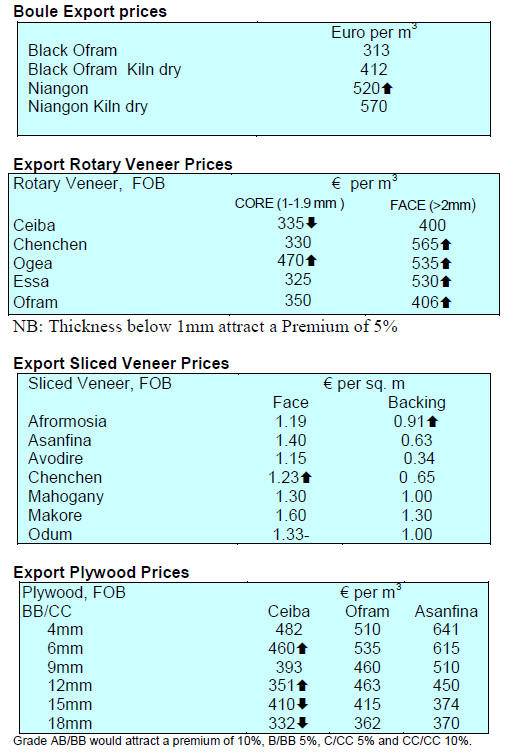

Export prices

There were exports of greenheart, purpleheart and mora

logs in the period reviewed.