2. GHANA

Value of Ghana¡¯s informal timber sector

massive

compared to exports

During a recent forum organised by the Editors Forum,

Ghana and Friends of the Earth, calls were made for action

to address the dwindling forest resources in the country.

The Forum heard that, while the forestry sector provides

employment to over a quarter of a million workers, the

security of the forest resource is at risk.

It was stated that the forest area in Ghana has

fallen from

8.6 million hectares at the beginning of this century to

below 2 million hectares today.

Mr. Kingsley Bekoe Ansah of Civic Response, a civil

society organization, stated that ¡°while timber exports

provided 10% of annual foreign exchange earnings up to

2000 this had now fallen to below 2%.

According to Mr. Ansah, the contribution of chainsaw

milling to the domestic market is estimated at over U$500

million, while formal sector timber exports provided less

than half of this.

Belgium promoted as EU import hub for Ghana

During a recent information session on business

opportunities in the country for a delegation from Belgium

and Greece led by the Flanders Investment and Trade

Agency, Peter Huyghebaert, Belgium‟s Ambassador to

Ghana, Cote d‟Ivoire and Liberia, said Belgium as an

entry hub offers an opportunity to Ghanaian exporters to

tap millions of consumers in the EU. Antwerp is the

second busiest European port.

Ghana‟s main exports to Belgium include sawnwood,

veneer sheets and plywood and a wide range of agriproducts.

3. MALAYSIA

Focus on finished products for better

profits says

MTIB

The Malaysian Timber Industry Board (MTIB) Director

General, Dr. Jalaluddin Harun, has said wood product

exports are likely to expand to RM21 billion this year,

mainly due to more exports of processed products.

He said the MTIB will continue to promote exports of

finished products as profit margins are higher and the

markets for such products more stable than those for

commodities such as logs, sawnwood and even plywood.

In related news the MTIB wants to see an expansion of oil

palm plywood production and export to take advantage of

the abundant availability of oil palm logs.

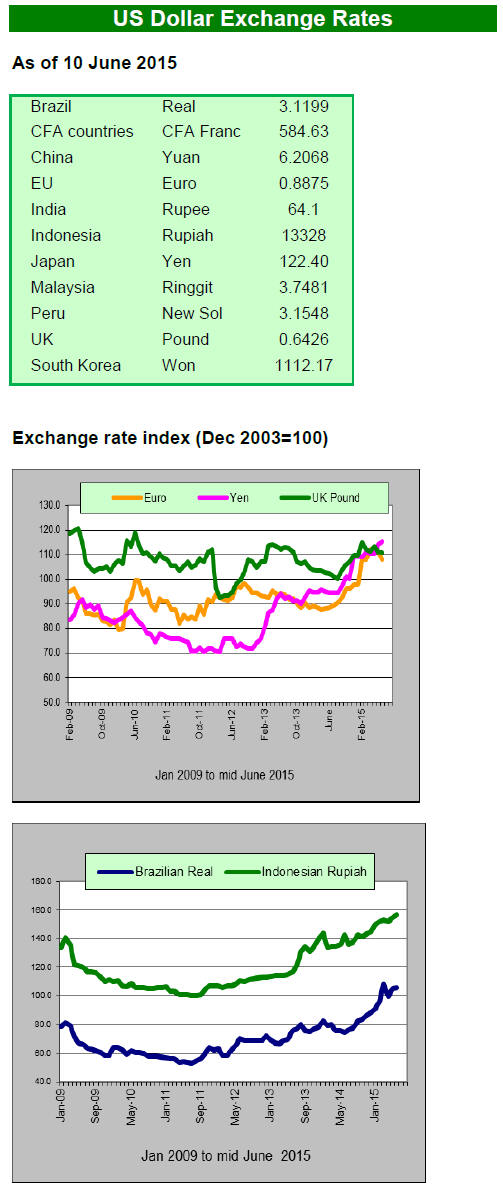

Exports to get boost from weaker ringgit

A sustained outflow of foreign funds from Malaysia‟s

equity market drove the ringgit to a nine-year low of RM

3.80 to the US dollar, making the local currency the

region‟s second worst-performing currency after the

Indonesian rupiah.

Local economists put the ringgit‟s slide down to the

outlook for crude oil prices and the prospect of an interest

rate rise in the US but were quick to point to the positive

impact a weaker currency has on exports.

Log harvests down in first four months

In response to rising log production costs companies in

Sarawak are busy establishing plantations to ensure future

mill supplies. WTK Holdings, for example, is expanding

its forest plantation area by 12% this year and the

company plans to eventually replace natural forest logs

with plantation resources.

Log availability is a growing issue in Sarawak. In the first

four months of this year WTK harvested almost 20% less

than in the same period last year. Another timber

company, Jaya Tiasa Holdings, also reported a decline in

log production this year while Ta Ann Holdings reported a

25% decline in log production in the year to April.

It was reported that Sarawak‟s log supply fell after the

state government launched a campaign to curb illegal

logging activities and unauthorised logs exports. However,

none of the main timber companies were implicated in the

campaign.

Statistics released by the Sarawak Timber Association

(STA) show that total log production in the state for the

first four months of the year dropped by 6.2% year on

year.

EU confident of VPA negotiations

Malaysia and the EU continue their VPA negotiations and

in late May the EU Delegation and EU's chief negotiator

organised a public consultation with Malaysian

stakeholders to share information on the VPA negotiation

process.

Stakeholders from industry, NGOs and indigenous

groups

received the latest information and discussed a wide range

of topics regarding the VPA negotiation process,

including:

• the benefits and scope of a VPA

• the role of consultations in negotiating and implementing

a VPA

• the roles of Malaysian and voluntary legality licensing

and certification schemes

• complaints procedures once the VPA is implemented

• the treatment of timber from Sarawak under the VPA

The EU expressed optimism that an agreement would be

signed with the Federal Government and also informed

that negotiations would explore clear and time-bound

commitments for Sarawak to develop its timber legality

assurance system.

For more see: http://www.euflegt.efi.int/malaysia-news/-

/asset_publisher/FWJBfN3Zu1f6/content/malaysia-andeu-

advance-vpa-process

4. INDONESIA

New forest management index

The Ministry of Environment and Forestry has launched a

forest management index for the Bali and Nusa Tenggara

ecoregions. This index provides a framework for practical

management assessments by stakeholders. The index

depicts aspects of forest monitoring, the status of forest

resources, and transparency in management law

enforcement.

Novrizal Tahar, the head of the Management Center for

Bali and Nusa Tenggara, commented that the forest

management index is a new tool for forest managers in

Indonesia.

Protected area extended

An updated map of the areas covered by the felling

moratorium has been released by the Ministry of

Environment and Forestry. The area now covered by the

moratorium has been extended and the areas covered by

the moratorium will be updated every six months.

All governors, regents and mayors across Indonesia have

been advised to refer to the latest revision before

approving land conversion or felling.

Pulp mill to source wood from plantations

Asia Pacific Resources International Holdings Ltd.

(APRIL) has announced that its subsidiary, PT Riau

Andalan Pulp and Paper (RAPP), will no longer source

raw materials from the natural forest. The company had

planned to switch to plantation resources by 2020 but has

advanced the date for the change after assessing the raw

material availability situation.

The company will now secure all of its wood raw

materials from its own plantations and those of its

suppliers.

The 480,000 hectares of plantations are sufficient

to

supply the 2.8 mil. ton capacity pulp mill according to

RAPP president Tony Wenas.

Assistance on TLAS for furniture SMEs

The Furniture and Handicraft Industry Association of

Indonesia (ASMINDO) will cooperate with FAO and the

EU FLEGT programme to help small medium sized

furniture makers satisfy the requirements of the national

timber legality assurance system (TLAS).

Indonesian furniture and handicrafts have a ready market

in the EU but recently demand has fallen. However,

despite the weaker market exports grew by around 4% as

of the end of April.

The Secretary General of ASMINDO said exports are

expected to increase by around 15% for the year as sales to

the EU are expected to pick up in the second half of the

year.

5. MYANMAR

Currency depreciation pushing up log

costs

Analyst report that mills in the country are experiencing a

weaker market but, with the continually weakening

currency, log auction prices in kyat are rising. Some

sawmillers claim they are experiencing problems in

running their mills due to rising raw material costs and

demands for higher wages.

The depreciation of the kyat is now a major factor in the

trade since the exchange rate against the dollar has fallen

from MMK 856 in Dec 2012 to MMK 983 in Dec 2013

and to MMK 1041in Dec 2014. The exchange rates on 9

Jun was MMK 1230 to the US dollar.

Teak traders are saying that market demand in Singapore,

Thailand and China has slowed considerably and similar

complaints have been heard from those trading with India.

It is likely that demand in India will remain weak for some

time as Indian stocks of teak logs purchased before the log

export ban are still substantial.

Illegal logging continues in Kachin and Shan States

The local press (Eleven media) has reported a Forest

Department statement to the effect that illegal logging has

taken a heavy toll on the ecosystem especially in the in

Kachin and Shan States.

Kachin State, Shan States and the Sagaing Division are

areas where serious timber smuggling is taking place. The

Forest Department has estimated 100,000 hoppus tons of

timber is being smuggled out annually.

Highly efficient harvesting and transportation by

smugglers and the slow progress of cooperation between

the governments of China and Myanmar is not helping the

situation say local analysts. Some 9,000 tons of timber was

seized during the first two months of this fiscal year.

MTE May tender results

The following timber was sold by Myanma Timber

Enterprise (MTE) by tender on 22 and 25 May 2015. Log

volumes are expressed in hoppus tons (H.tons) and

conversions or sawn teak (including hewn timber) are

shown in cubic tons (C.tons). Average US$ prices are

shown below.

Wide price variations of concern to local

analysts

Analysts point out that there was a significant change in

the average log prices for the various grades at the recent

sale.

A sharp drop is evident in the average price of SG-4 logs

and an upward climb in the price of SG-6 and SG-7

grades. SG-2 and SG-5 prices are more or less stable. The

inconsistencies could reflect the need for log graders to

pay attention to consistency in grading.

Another issue in log pricing is the prices obtained for sales

of seized timber graded as Form-8. While the price of

Form-8 sawn teak was only about MMK 1.5million per

c.ton while Form-8 Tamalan can be about MMK 3 million

and Padauk slabs about MMK 9 million.

These timbers will be reprocessed to marketable sizes and

exported at substantially higher prices and local analysts

find the price for Form-8 logs low compared to the prices

obtained for exports.

Next MTE tender sales

MTE will conduct tender sales on 26th and 29th June. Over

ten thousand hoppus tons of non-teak hardwoods and

about 1500 hoppus tons of teak logs will be up for sale.

The quantity may be increased during the week according

to availability.

6.

INDIA

Strong growth forecast from OECD

The OECD Economic Outlook for the Indian economy

suggests growth will remain strong and stable in 2015 and

will deliver a 7.3% growth for the year. The OECD says

¡°Economic growth will remain high, supported by a

revival in investment.

The 2015-16 fiscal consolidation target has been relaxed

to allow for increased infrastructure investment while

structural reforms to improve the ease of doing business

and the Make in India initiative should boost corporate

investment. Export growth may be held back by any

currency appreciation.¡±

Infrastructure status for housing sector pushed by

MPs

Progress on the „Housing For All‟ scheme, the centrepiece

of the new Indian government‟s plan for the housing

sector, can only advance if the proposed amendment to the

Land Acquisition Act is passed according to Union

Minister for Housing and Urban Poverty Alleviation M.

Venkaiah Naidu. This would pave the way for creating 20

mil. affordable homes in urban areas by 2022.

The plan for housing has four elements namely: Slum Redevelopment,

Affordable Housing in Partnership with

Private or Public Sector, Affordable Housing through

Credit-Linked Subsidy and Subsidy for Beneficiary-led

individual house construction/enhancement.

During debate on the housing issue Indian MPs demanded

„infrastructure‟ status for the housing sector as a way to

facilitate the flow of credit to consumers, especially those

on lower income.

Illegal sawmill and plywood factories closed

During checks by the Forest Department several illegal

mills in the Yamuna Nagar district in Haryana have been

forced to shut down. In another raid 24 sawmills and 4

plywood factories in Hoshiyarpur, Punjab were closed by

the Forest Department.

In 1997 the India Supreme Court determined that

applications for investment in wood based industries must

secure approval from a Central Empowered Committee

(CEC) in the respective state. This measure was taken to

prevent illegal felling. Approval is only granted if the

investor can provide an assurance of a sustained supply of

raw material. The CEC determines the numbers and type

of machines that can be installed.

After the Supreme Court decision mills within a 10 mile

radius of government forests were forced to move and

prove they had sucure supplies before being allowed to

reopen.

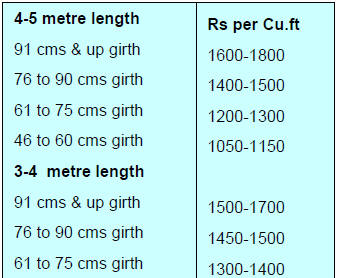

Teak sales in Central India forest depots

Log auctions were held at the Jabalpur, Timarni, khirakia,

Narmada Nagar and Raipur depots of Central India and

sales were reported brisk as the quality of logs was good.

Around 5,000 cubic metres of logs were sold.

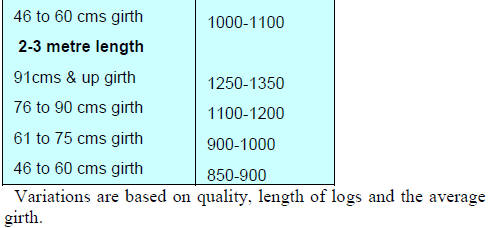

The latest ex-depot auction prices for natural forest teak

logs are shown below.

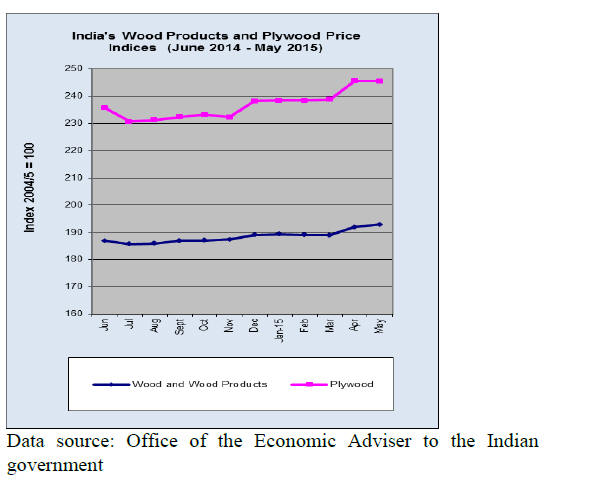

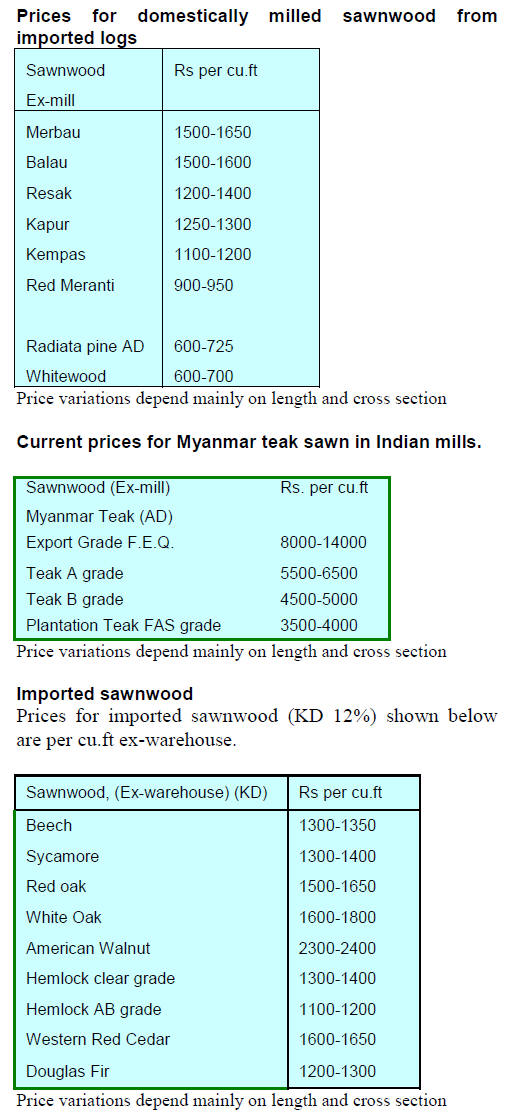

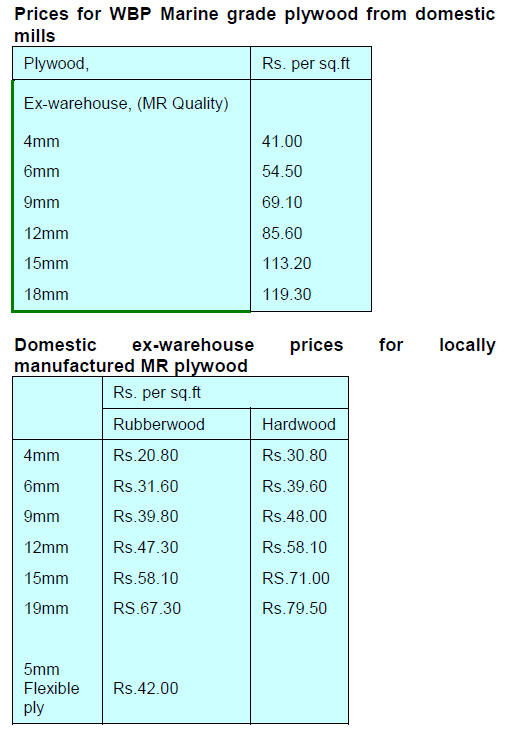

Domestic plywood prices

Analysts report the domestic demand for plywood as

„lukewarm‟ offering manufacturers no opportunity to

increase prices to compensate for rising raw material

costs.

¡¡

7.

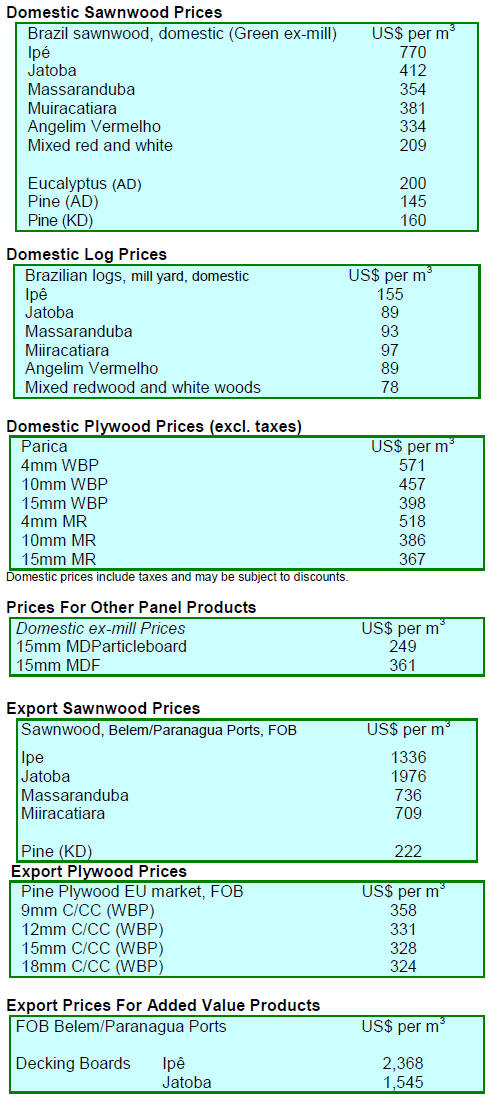

BRAZIL

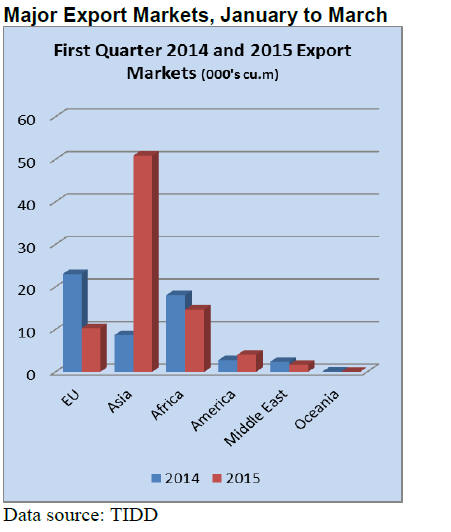

Exports increase in the first quarter

2015

The volume of Brazilian timber exports expanded 20%

between January and April this year mainly due to the

effect of the weaker currency against the US dollar and

because domestic consumption was weak.

According to the Association of Mechanically-Processed

Timber Industry (ABIMCI) recovery in US demand

helped to boost Brazilian timber exports. However,

expansion of demand in the US was not enough to sustain

overall output because domestic timber consumption fell

sharply mainly because of lower investment in

construction.

ABIMCI is working with government agencies on a plan

to stimulate timber consumption in housing and has

proposed changes to the national housing financing

scheme and technical standards to encourage the building

of wooden houses in Brazil.

APEX provides new markets for furniture exporters

The furniture export promotion project implemented by

the Brazilian Furniture Industry Association

(ABIMÓVEL) and the Brazilian Trade and Investment

Promotion Agency (APEX-Brazil) aims to promote

Brazilian furniture in international markets.

Some Brazilian companies participated in the 27th

International Contemporary Furniture Fair (ICFF) and

INDEX DUBAI in May this year.

According to ABIMÓVEL, the furniture promotion

project is an important initiative for the furniture sector

providing new business opportunities. Participation at

INDEX DUBAI generated sales estimated at US$6.5

million.

Further business missions to the United States and the

United Arab Emirates are planned as part of the export

promotion strategy.

Trade in Illegal timber of concern in Mato Grosso

The forestry sector is important for the Mato Grosso state

economy as the sector delivers employment opportunities

for around 100,000 workers and produces approx. 3

million cubic metres of roundwood annually, the second

largest log output from natural forests.

In recent years the sector has grown and between August

2012 and July 2013 (the latest period for which data are

available) the harvestable area has expanded over 50%.

However, illegal felling remains a serious problem in the

state. Researchers have detected that illegal felling in the

period August 2012 and July 2013 extended over 140,000

hectares.

It has been determined that the majority of the illegal

timber comes from areas where logging is prohibited such

as protected areas and indigenous lands.

In about 35% of the areas where uncontrolled logging

occurs there are no land titles (official land registration) or

the areas are indigenous lands which have not yet been

demarcated. Under these circumstances the state

authorities have few means to exercise control of activities

in these areas.

A certificate of origin issued by the state is required for

transport and sale of logs but researchers claim the system

is being abused as some timber producers manipulate

forest management plans inflating the area supposedly to

be logged so as to secure certificates of origin for logs

obtained outside of the legal concession.

Forest Service discusses forest concessions in

Rondônia

A delegation from the Rondônia State Secretariat for

Environmental Development (SEDAM) participated in a

meeting at the Brazilian Forest Service (SFB) to discuss

policies on forest concessions and the forest inventory in

Rondônia state.

Experiences in managing forest concessions in the Jamari

National Forest and the Jacund¨¢ National Forest (both in

Rondônia) were shared during the meeting. According to

SEDAM, Rondônia‟s forest inventory is in its final phase.

At the meeting, the utilisation of funds from the

Brazilian

Development Bank (BNDES) for monitoring, control and

forest management activities was discussed and it was

announced that R$1.52 million will be allocated to assist

SEDAM in drafting legislation and management plans.

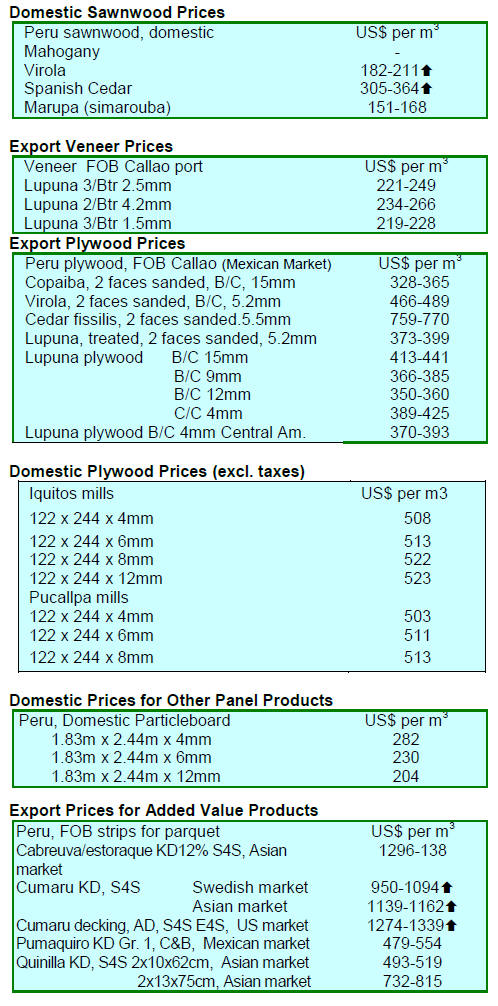

8. PERU

Multi-sectoral approach to address

hurdles to

expansion of forestry

The Minister of Production, Piero Ghezzi, said the

government is promoting the diversification of production

in the country through a multi-sectoral strategy focused on

the aquaculture and forestry sectors.

He said that technical committees have been established

within the National Productive Diversification Plan

(PNDP) to implement the startegy.

Ghezzi said the Forestry Bureau has identified many

hurdles to expansion of the forestry sector related to

inadequate regulation, cumbersome bureaucratic

processes, land titling and property registration, skilled

labour and limited access to finance all of which will be

addressed by the relevant committee.

Peruvian entrepreneurs attended Interzum Guangzhou

2015

A delegation of 23 Peruvian businessmen participated in

the fair INTERZUM- GUANGZHOU 2015. The event

took place in Guangzhou, China and is considered the

most important sector in Asia.

This was the tenth Peruvian delegation traveling to China

to participate in trade fairs and comprised of executives

representing manufacturers of furniture, machinery

importers and marketers of wood-based panels.

The delegation met with Chinese companies to examine

the technologies applied in furniture factories, to observe

distribution and sales centres and exploer business

opportunities.

In related news Peru‟s Minister of Foreign Trade and

Tourism, Magali Silva, and Thailand‟s Deputy Minister of

Commerce, Apiradi Tantraporn, recently met to advance

the signing of a Free Trade Agreement between the two

countries.

The Thai minister visited Peru with a delegation of trade

officers, representatives of private sector unions and a

group of 21 businessmen. Peru‟s exports to Thailand

include a wide variety of agricultural products.

9.

GUYANA

Promoting best practices in the timber

industry

The Forest Products Development and Marketing Council

has been working to upgrade the sawmill and downstream

processing industries. Currently the focus is on a

promotional video for best practices in timber processing

in sawmill and lumberyards.

Additionally the Council continues to work with

stakeholders to improve the quality of processed forest

products for the domestic and export market through

targeted industry development initiatives and provides

appropriate market information to the stakeholders.

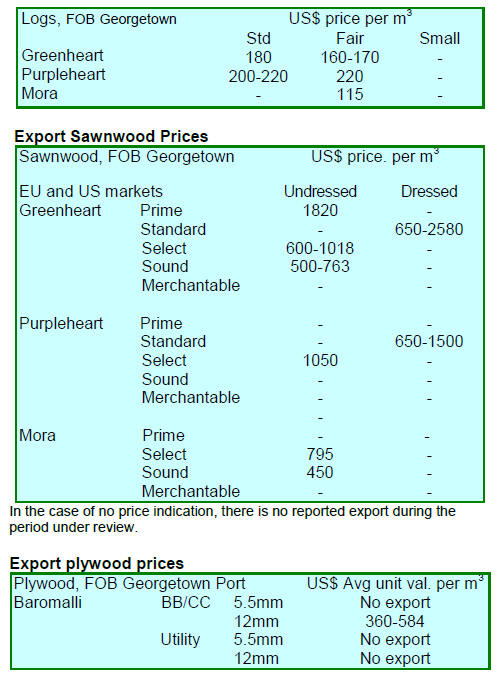

Export prices

There were exports of greenheart, purpleheart or mora logs

in the period reviewed.