|

Report from

Europe

European wood flooring imports slow to recover

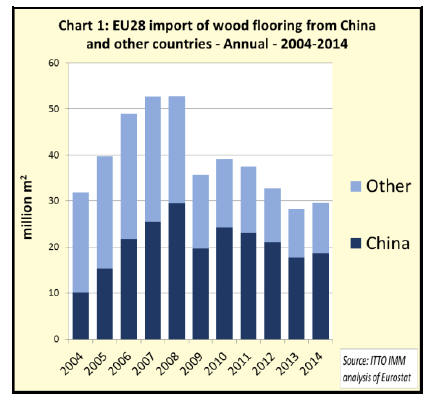

Imports of wood flooring into the European Union

increased 4.9% to 29.7 million sq.m last year after

declining steadily between 2010 and 2013. In 2014, woodflooring

deliveries from China, the single largest supplier,

increased by 4.9% to 18.6 million sq.m.

China accounted for 63% of total EU imports in 2014,

exactly the same proportion as the previous year (Chart 1).

In spite of the recent growth, imports in 2014 were still

well below the record levels achieved between 2005 and

2008. There has been no significant recovery from the

slump during the financial crisis when imports plummeted

from 52.8 million sq.m in 2008 to just 35.6 million sq.m in

2009.

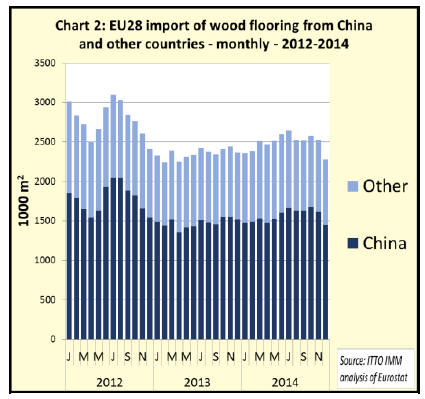

While European wood flooring imports were up for the

whole of 2014, they slowed towards the end of 2014,

particularly from China (Chart 2).

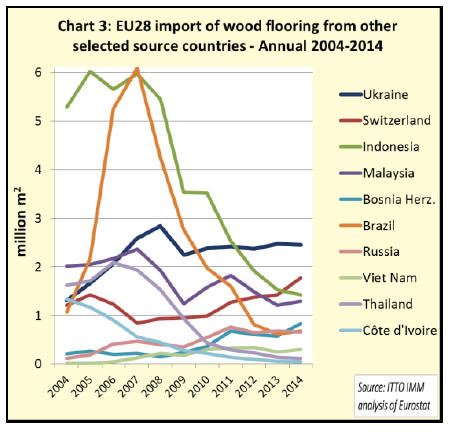

Over the long term, EU imports of wood flooring from

China have been more stable than from other countries

(Chart 3). Of major tropical supplying countries, imports

from Brazil, Indonesia, Thailand and Ivory Coast have

fallen considerably in the last 5 years.

Last year imports from Brazil recovered slightly (+9.2% to

678,000 sq.m), while imports continued to decline from

Indonesia (-6.6% to 1.4 million sq.m) and Thailand (-17%

to 111,000 sq.m). Imports from Ivory Coast fell a further

15% in 2014 and are now negligible.

In contrast, EU imports from Malaysia have been rising in

the last five years and increased again in 2014 (+6.5% to

1.3 million sq.m). Imports also increased by 20% from

Vietnam in 2014, but from a small base.

Of temperate countries, EU imports from Switzerland and

Bosnia-Herzegovina have been rising in recent years, and

this trend continued in 2014. Imports from Switzerland

were up 25% at 1.8 million sq.m, while imports Bosnia-

Herzegovina increased 44% to 0.8 million sq.m

respectively.

On the other hand, imports from the Ukraine were down

by 0.8% to 2.4 million sq.m. Imports from Russia fell

2.6% to 680,000 sq.m.

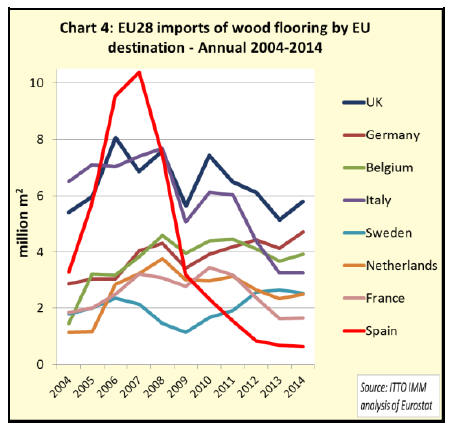

Trends in wood flooring imports by individual EU

Member States varied widely depending on economic

conditions (Chart 4).

Imports from outside of the EU into the UK, where there

was a robust recovery in construction sector activity last

year, recorded double-digit growth of 13% to 5.79 million

sq.m in 2014. Imports into Germany also increased

strongly, by 14% to 4.72 million sq.m, while imports into

Belgium rose 7% to 3.92 million sq.m.

Imports into the Netherlands recovered to some degree in

2014 from the previous year‟s low, increasing 7% to 2.49

million sq.m. Imports into France also increased slightly in

2014, up 0.6% at 1.64 million sq.m. Imports into Italy

were unchanged in 2014 at 3.25 million sq.m.

On the other hand, deliveries of wood flooring from

outside the EU into Spain, which as recently as 2007 was

the largest EU destination, fell again by 8% to just

630,000 sq.m in 2014. This compares to Spanish imports

of over 10 million sq.m of wood flooring from outside the

EU in 2007.

Although construction activity is just beginning to pick up

again in Spain, consumers are extremely cost conscious

and are showing strong preference for cheaper laminate

and other non-wood alternatives to real wood products.

Deliveries from wood flooring from outside the EU into

Sweden also declined last year, by 5% to 2.53 million

sq.m. However the decline was mainly due to a sharp fall

in Swedish imports from Ukraine. Sweden‟s imports from

China increased in 2014.

Wood flooring consumption falls again

While total EU wood flooring imports increased in 2014,

the European Wood Flooring Federation (FEP) reports that

consumption probably declined last year in many

European countries.

According to an FEP estimate published by the

international parquet federation Global Flooring Alliance

(GFA), European wood flooring consumption fell 3.8% in

2014, after slipping 2.6% the year before. Consumption

was 82.7 million sq.m in 2013 and is believed to have

been around 80 million sq.m in 2014.

Considering the various European countries, the negative

trend identified by FEP in France and Italy in its

September market review has apparently continued

through the final quarter of the year.

Wood flooring consumption in Germany and Austria was

also slightly down from 2013 levels, after Germany had

shown a positive trend in the early months of 2014. Swiss

consumption was static last year, whereas Sweden and

Hungary showed slight increases.

When it comes to wood species, the FEP sees a continuing

dominance of oak in the overall sales mix, while the share

of exotic woods has declined further. Wider boards and

“natural look” flooring remains very popular, according to

the FEP.

Looking forward, the FEP expects “a stabilisation in the

European parquet business during 2015.

Much oak on display at Domotex

The lasting trend towards oak flooring was also apparent

at the Domotex flooring show in Germany during January.

The show attracted 1.323 exhibitors from 63 countries,

covering all sectors of the flooring industry. With a total of

around 40,000, visitor numbers were slightly higher this

year than at the comparable Domotex in 2013.

According to the American Hardwood Export Council

(AHEC), oak accounted for around 80-90% of most

Domotex wood flooring exhibitors‟ product sales. During

its visit to the show, AHEC also found that the “rustic oak

look is still very much in fashion, and European oak is the

preferred supply”. American white oak would primarily be

used in the architectural sector. AHEC also witnessed a

trend towards dark “smoked” oak.

In terms of product specifications AHEC noted that

Europe seemed to continue to move more towards using

engineered flooring instead of solid wood flooring.

Exhibitors also told AHEC that European wood flooring

sales were not improving much, as Europe‟s economy,

especially in the Eurozone, remained very fragile. To

compensate, many European flooring manufacturers are

now seeking to expand export sales outside Europe.

Domotex organiser Deutsche Messe reported similar

trends for wood and laminate flooring noting the emphasis

on rough-sawn, brushed and used-look surfaces. In

laminate flooring grey or blends of grey and beige –

"greige" – surfaces are expected to remain the top sellers,

while dark laminate floorings were less popular with

buyers. Some companies also displayed a new generation

of waterproof laminate flooring at Domotex.

European laminate flooring sales stagnate

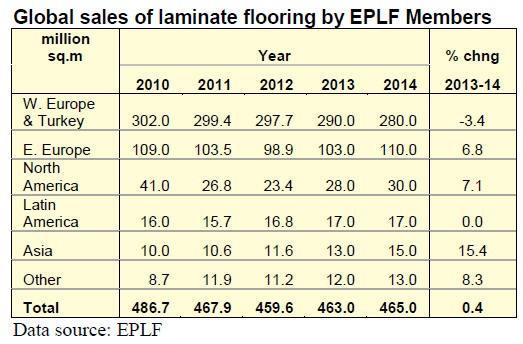

European producers of laminate flooring sold 465 million

sq.m worldwide in 2014, compared to 463 million sq.m

the year before, according to statistics compiled by the

European Producers of Laminate Flooring (EPLF) and

published by GFA. This is a rise of just 0.4% over 2013

(Table 1).

The regional markets showed contrasting trends in 2014,

according to EPLF. Within Europe, Western European

sales were slightly down compared to the previous year,

whereas sales in Eastern Europe experienced an upturn.

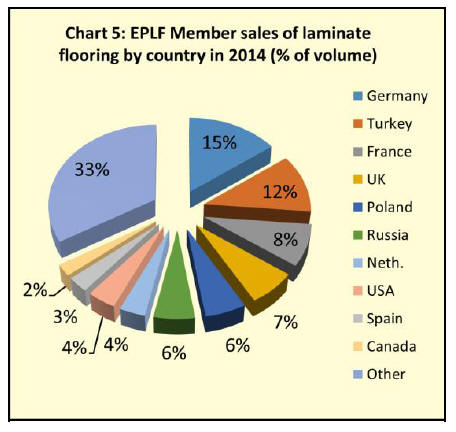

Sales in the core Western European markets (including

Turkey) declined by around 3.4% to 280 million sq.m in

2014. Germany, the single-largest market for European

laminated flooring, experienced renewed decline of around

4% to 69 million sq.m. EPLF believes that this was due to

a loss of market share to LVT floors.

Sales in Turkey were affected by the economic slow-down

combined with raw material shortages and temporary

production shutdowns for maintenance purposes. Overall,

sales in Turkey plummeted 18% to 54 million sq.m.

Sales in France remained stable at 39 million sq.m during

2014 in spite of the economic difficulties and rather

lacklustre building sector. The same is true for Spain,

where 14 million sq.m of laminate flooring were sold in

2014, the same as the previous year.

This seems to confirm reports from the wood flooring

sector that there is a growing preference for cheaper

laminates over real wood floors in those markets

particularly hard hit by the economic downturn.

Sales of laminate flooring in the UK increased by 10% to

32 million sq.m in 2014 on the back of a growing housing

sector and comparatively strong consumer confidence.

Rise in European laminate flooring exports

Total laminate flooring sales in Eastern Europe increased

by 7% to 110 million sq.m in 2014. Sales in Russia grew

by almost 13% to 27 million sq.m. in spite of the political

situation and adverse exchange rate trend.

This growth in the Russian market actually increased

towards the end of 2014.

The rise in sales meant that the Russian market for

European laminate flooring was as large as the Polish

market, which also 27 million sq.m last year, an increase

of 8%.

Sales in Romania and Hungary were also higher than the

year before, while sales in the Ukraine fell by 11%.

Most overseas markets for European laminate flooring

improved in 2014, with North America “showing

significant improvement” and Asia “even greater growth”,

according to EPLF. Turnover in North America had

started to rise as early as 2013 and this trend continued

through last year.

The market was particularly buoyant in the USA, where

EPLF members boosted their sales by almost 19% to 19

million sq.m. Sales in Canada were stable at 11 million

sq.m last year.

In the Asia-Pacific region, European producers achieved

sales growth of 15% to 15 million sq.m. Even stronger

growth of 25% to 5 million sq.m was witnessed in China,

where EPLF members supply primarily the high value

sector. In South America, EPLF members are reporting

stable sales of 17 million sq.m in 2014.

* The market information above has been generously provided

by the Chinese Forest Products Index Mechanism (FPI)

Correction

Our previous report said:

“the Swiss group Precious Woods Holding AG announced that

its business was in jeopardy”.

The company has advised that, while there was a concern raised

in their half-year report, a media release on 9 January, 2015

reported the successful refinancing and progress in their

business.

See:

http://www.preciouswoods.com/domains/preciouswoods_com/da

ta/free_docs/Media_Release_09_01_15_WDL_en_final.pdf

|