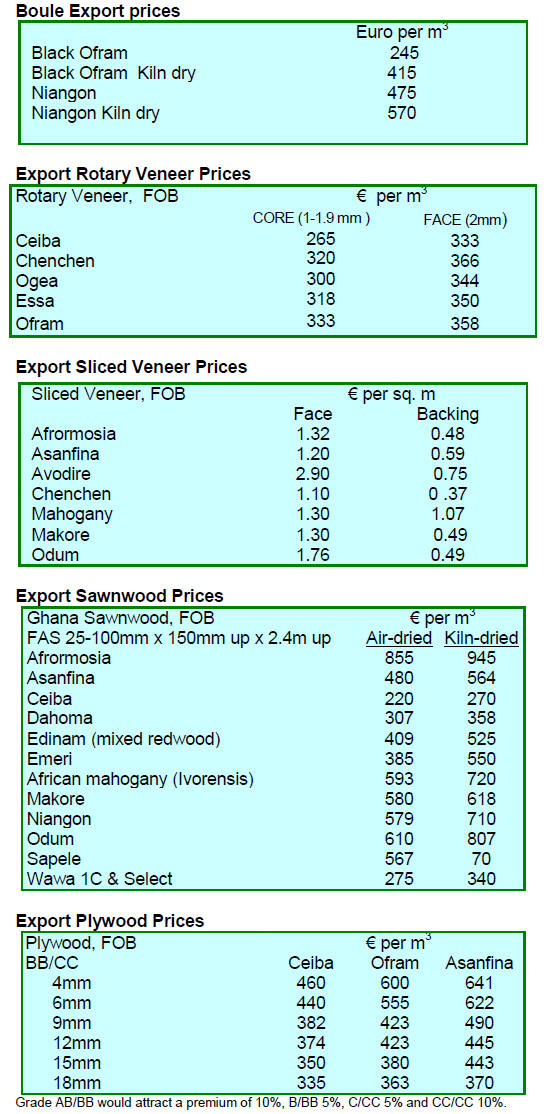

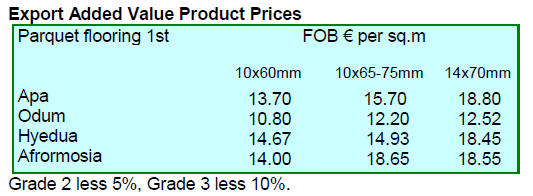

2. GHANA

Exporters seek permission to conclude

rosewood

export contracts

The Importers and Exporters Association of Ghana has

urged the Ministry of Lands and Natural Resources to

amend the regulation putting a stop to rosewood exports.

This is because several companies had concluded contracts

prior to the ban on rosewood exports but now find their

containers have been seized.

The Customs Division of the Ghana Revenue Authority

said in August it had intercepted more than 50 containers

of rosewood set for export.

GFC cracks down on contractors

The Forestry Commission has ordered six timber

contractors to temporary halt logging in the Kwahu Afram

Plains North and South districts for failing to sign a social

responsibility agreement with the local communities as

called for in the concession agreement.

3. MALAYSIA

New tax to affect timber exports

Malaysia plans to introduce a Goods and Service tax

(GST) in April next year. Businesses with an annual

turnover above RM 500,000 will have to register and levy

the new GST on customers. The GST has been proposed at

a rate of 6% and will replace the current Sales and Service

Tax.

Several basic items such as rice, poultry, meat, vegetables,

flour, cooking oil, sugar, residential and agriculture

properties, education and health services will be zero-rated

and exempt from the GST. Some form of rebate is

expected for small and medium enterprises.

Officials from the Finance Ministry fear the biggest hurdle

in implementation is public acceptance of the tax as many

remain concerned that prices will rise once the GST is

implemented.

The Malaysian Timber Council (MTC) recently organised

a briefing for timber and furniture companies on the key

essentials of the GST so as to improve their understanding

of the new taxation scheme how it will affect the timber

and furniture sectors.

Among the concerns raised by participants were queries

on the mechanics of issuing tax invoices and grace periods

for contracts that have already been signed.

MIFF furniture design competition

Preparations are well underway for next year‟s Malaysian

International Furniture Fair (MIFF) with the launch of the

annual furniture design competition. In its sixth year, the

industry‟s leading competition is poised to top last year‟s

record of 244 entries.

Malaysians, foreigners and students residing in Malaysia

under the age of 30 are eligible to compete. In an attempt

to highlight the uniqueness of Malaysian wooden

furniture, this year‟s competition requires the product

designs to be centred on wood as the primary material.

“By setting wood as the main material for the entries, we

hope that it will enhance awareness among the younger

generation on the eco-friendliness, versatility and beauty

of wood, a material that has helped propel the growth of

the Malaysian furniture industry,” said MIFF chairman

Tan Chin Huat. MIFF 2015 is scheduled for 3 to 7 March

next year in Kuala Lumpur.

See: http://www.miff.com.my/mifffdc/

Log export prices lifted by Myanmar ban

The log export ban in Myanmar appears to be lifting the

price of export logs from Sarawak. The Star newspaper in

Malaysia reported comments from local logging

companies.

According to Ta Ann Holdings Bhd, prices for keruing

and mixed light hardwood (MLH) logs have increased

since Myanmar stopped exporting logs on 1 April this

year. Ta Ann said the group increased log sales by 30% in

the April-June quarter.

WTK Holdings Bhd reported an almost 7% rise in average

round log prices in the April-June quarter and it took

advantage of the firm price to increase sales. The news of

price increases continued with Jaya Tiasa Holdings Bhd

saying the average price of its logs improved by 18% in

the 12 months to 30 June.

See: http://www.thestar.com.my/Business/Business-

News/2014/09/04/Tropical-log-prices-surge-Myanmarexport-

ban-a-boon-to-Sarawak-timber-companies/

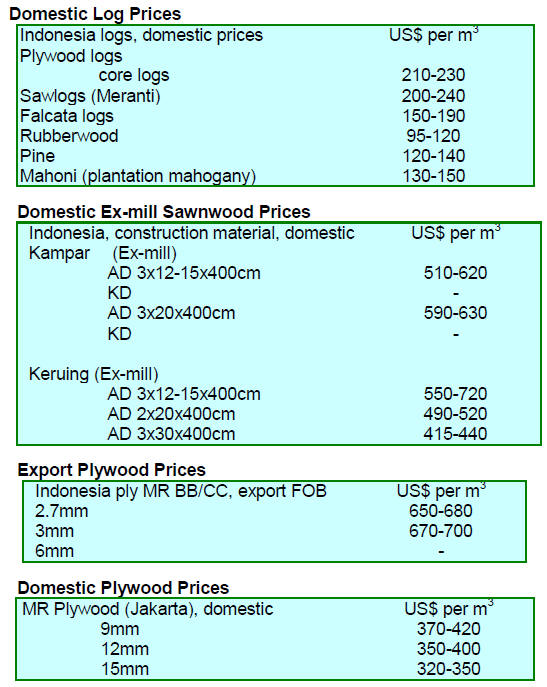

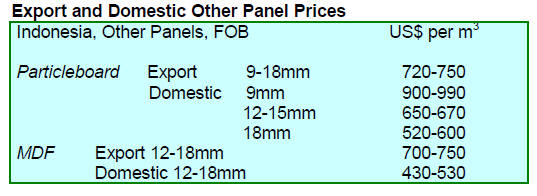

Plywood traders based in Sarawak reported the following

FOB export prices:

Floor base FB (11.5mm) US$ 630-635

Concrete formboard panels CP (3‟ x 6‟) US$530

Coated formboard panels UCP (3‟ x 6‟) US$610

Standard boards

Middle East (9-18 mm) US$465

South Korea (8.5 – 17.5 mm) US$470

Taiwan P.o.C (8.5 – 17.5 mm) US$ 465

Hong Kong US$ 475

4. INDONESIA

Imported timber must be verified legal

Indonesia is proceeding with plans to require imported

wood products to meet the same strict legality standards as

the domestic legality-certification scheme (SVLK) and

expects to begin implementation in 2015.

The Director General of the Foreign Trade Section of the

Ministry of Trade, Partogi Pangaribuan, said official

documents would be finalised by the end of September so

that all timber entering Indonesia shall be verified legal.

ASMIDO chairman Ambar Tjahyono welcomed the plan

as it would ensure exported wood products do not face

market resistance and will eliminate doubts on the legality

of the materials in the manufactured products.

Geothermal development in conservation areas

Indonesia now has a Geothermal Law which opens the

way for development of geothermal resources, one of the

largest in the world.

Many of the geothermal resources are located in forest

conservation areas where development was restricted until

the coming into effect of the new Geo-thermal legislation.

Village forest expanded

The Forestry Ministry has designated 40,000 hectares of

state forest in West Sumatra as nagari (village) forests

over the past three years. Nagari forest is the lowest level

of state territory, overseen through a local communitybased

forest management scheme.

Forestry Minister Zulkifli Hasan officially handed over the

official allocation of nagari production forests to four

nagari, (total area of 18,985 ha) on the sidelines of a

meeting of governors from across Sumatra.

Three of the four nagari are located in Solok regency,

namely Nagari Sirukam (3,398 ha), Nagari Sungai Abu

(6,787 ha) and Nagari Sariak Alahan Tigo (4,300 ha).

Nagari Paru (4,500 hectares) is located in Sijunjung

regency.

Fuel subsidies to eventually go

The issue of fuel subsidies will be at the top of the agenda

of the new government when it takes over in October.

Because of the subsidy Indonesian petrol prices, at around

US$0.56 per litre, are close to being the cheapest in the

world.

Indonesia needs to begin removing the subsidies before

the end of the fiscal year to ease pressure on the current

account thus creating the opportunity for the Central Bank

to concentrate on boosting economic growth.

Fuel subsidies cost the government about US$20 billion a

year and their eventual removal will impact the

manufacturing sector and the competiveness of exports.

5. MYANMAR

Open tender sales due end September

Sales of logs by open tender for the local processing will

be held at Myanma Timber Enterprise on the 26 and 29

September where about 500 tons of logs will be sold.

For details see the MTE website:

www.myanmatimber.com.mm

The Myanmar Forest Products Joint Venture Corporation

(FJV) sold 2,171 tons of kanyin logs on the 22 August

2014. The average price for the kanyin logs was US$ 537

per H. ton.

Considering that the price for the same timber sold in July

was US$450 ( Myitkyina depot, northern Myanmar) the

latest prices are good. The logs sold recently were of

veneer quality which may explain the better than average

prices. The image below is of the kanyin logs recently

sold.

IWPA initiative welcomed but hurdles to trade

persist

The US government has lifted restrictions on US

companies trading with the Myanma Timber Enterprise

(MTE), but restrictions are still in place on certain

financial institutions in Myanmar.

The latest US rule allows for transactions with four banks

in Myanmar; Asia Green Development Bank, Ayeyarwady

Bank, Myanma Economic Bank, and Myanma Investment

and Commercial Bank.

Analysts in Myanmar report that the MTE is finding it

cannot conclude export contracts with US importers as

financial transactions with the bank it uses (not one of the

above four)are blocked. The result of this is that

companies in countries such as Thailand, India and

Vietnam which accumulated large stocks of Myanmar teak

logs before the log export ban in Myanmar can now

readily export Myanmar teak products to the US but the

MTE cannot.

When the US government eased sanctions a few years ago

it authorised the use of a series of general licenses for

financial transactions by US companies and individuals.

Recently, changes were made to the rules on sanctions

which replaced the general license scheme. Information

on this can be found at: www.treasury.gov/resourcecenter/

sanctions/Programs/Documents/fr79_37106.pdf.

This document explains that US individuals and entities

may engage in financial transactions with any non-blocked

Myanmar bank.

One year waiver too short

Companies in Myanmar are saying a one year waiver of

sanctions in the timber trade is too short to develop a

meaningful business as it takes about two to three months

to conclude a contract and another two to three months to

secure and mill the logs.

Even when the order has been processed domestic export

procedures add to the overall time required to ship an

export order. Analysts say a waiver of two or three years

would be more practical to test the efficacy of this

constructive US initiative.

At present almost all export teak and hardwood shipments

from Myanmar are to the EU. One manufacturer in

Myanmar said that, while they can satisfy compliance with

the US Lacey Act, they find it difficult to meet the

stringent quality standards for US orders. At present local

observers say most exporters in Myanmar are more

interested in exporting to the EU than the US.

While there are more than 1,500 timber companies in

Myanmar the number that have the capacity to export is

limited. Moreover, export shipments must be paid for in

advance which is viewed as a major risk by importers.

To reduce the risks to overseas buyers, agents and dealers

have a role to play and may be the key to the reopening of

the US market for Myanmar teak and other hardwoods.

Good quality logs in short supply

Analysts in Myanmar have raised concerns on the quality

of teak logs now available and question if these can yield

sawnwood of a quality to meet international market

requirements.

There are few high quality logs coming onto the domestic

market at present and, say analysts, this is the result of

years of irresponsible harvesting practices and poor forest

management.

The logs now available for sawnwood production are

mainly Sawing Grade 1, 2 and 4 logs. The images below

show recently auctioned SG-2 and SG-4 logs.

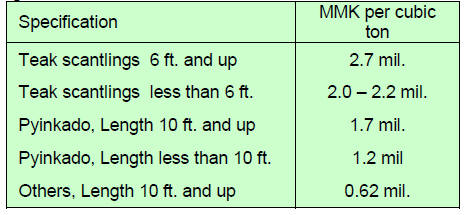

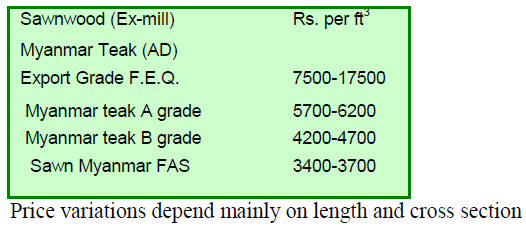

Domestic prices for sawn teak and hardwoods,

Yangon

The following prices per ton of 50 cubic feet and are

quoted for the construction sector.

6.

INDIA

Seized sandalwood to be sold for

export

The Andhra Pradesh government has begun the process of

disposing of some of its seized red sandalwood (red

sanders) in the international market.

The state has over 8,550 tonnes of sandalwood seized

from smugglers and around 4,000 tonnes will now be

auctioned to domestic and international buyers.

Red sanders is an endangered tree species found only in

Chittoor, Kadapa, Nellore and Kurnool districts of Andhra

Pradesh. It grows in about 200,000 hectares of forests in

the state.

There is a huge market for red sanders in countries such as

China and Japan where it is used for medicines, furniture,

musical instruments and sculptures.

A single tonne of red sanders can earn as much as Rs.25

lakh (approx. US$41,000) in international markets.

Because it is so valuable the state authorities face a

constant battle to protect trees from be felled illegally.

Incidents of illegal felling and smuggling have increased

in Andhra Pradesh over the past few years and in

December 2013 two forestry officials were allegedly killed

by a group of smugglers in Chittoor forests.

International buyers are showing a keen interest in the

upcoming sale and the state government expects to earn

over Rs.10 billion from the first sale.

The sale of seized red sanders confiscated from

Seshachalam forests will be conducted for six days from

19 September and some 4,160 tonnes in 177 lots will be

for sale through an e-auction.

Red sanders is endemic in Seshachalam, Veliganda,

Lankamala, and Palakonda hill ranges of the state and is

distributed in the Kadapa, Chittoor, and Kurnool districts

in Rayalaseema region and parts of Nellore and Prakasam.

The majority of illegal felling and smuggling of red

sanders takes place in Chittoor and Kadapa.

The Convention on International Trade in Endangered

Species (CITES) has approved India‟s request to export

11,806 tonnes of seized and confiscated red sanders and

the local media have reported that the Director General of

Foreign Trade has issued a notification permitting the state

government export 8,584 tonnes of red sanders wood in

log form by amending the foreign trade policy.

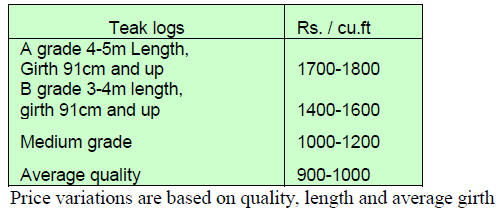

Auctions of domestic teak in Western India

Taking advantage of a spell of dry weather an auction of

2,114 cubic metres of teak and 1,071 cubic metres of other

hardwoods was conducted by the Surat and Vyara forestry

divisions of Western India. Buyers attending the sale

reported the logs offered were smaller than usual but of

good quality.

Good quality non-teak hard wood logs such as Haldu

(Adina cordifolia), Laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium 3 to 4

metres long having girths of 91cms and above attracted

prices ranging from Rs.650-850 per cu.ft.

Medium quality logs were sold at between Rs 500-600

per cu.ft. Lower quality logs fetched between Rs.350-450

per cu.ft.

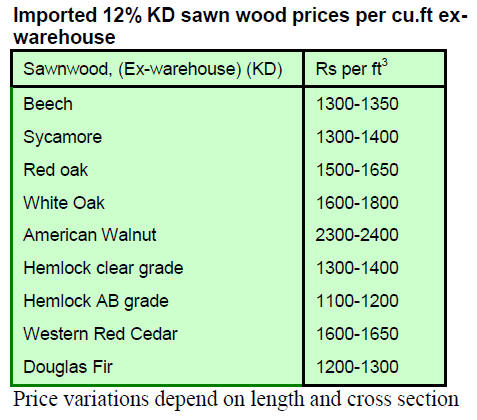

Local mills still have imported teak stocks

Indian sawmillers still have some stocks of Myanmar teak

and are able to satisfy demand at the moment so prices for

sawn Myanmar teak in the domestic market in India have

not changed since last month.

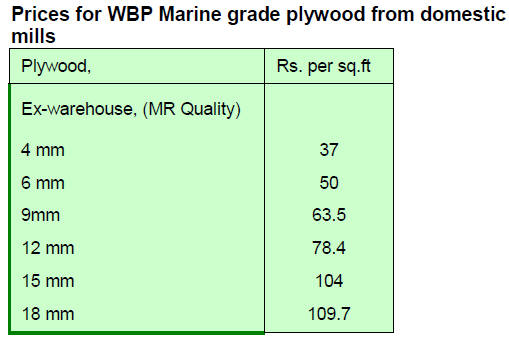

Laminated plywood prices driven up

Manufacturers of paper laminated plywood have increased

prices by 3-4% due to rising costs. Plywood manufacturers

across the country had hoped for an opportunity to raise

prices on the back of improved business sentiment

especially in the housing sector but this has not

materialised.

7.

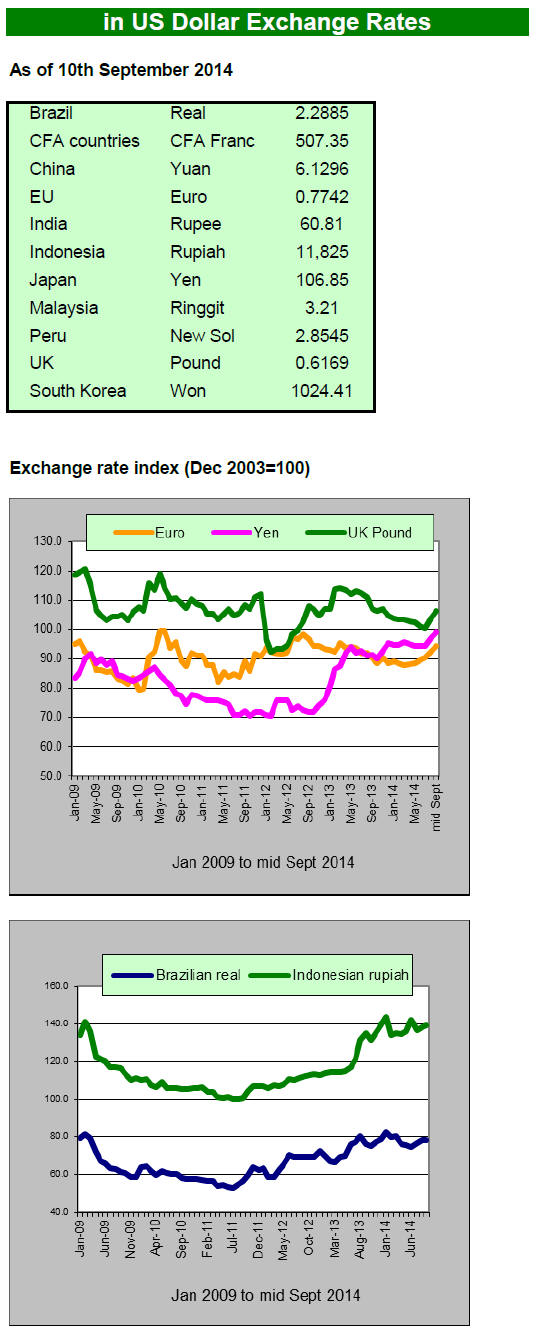

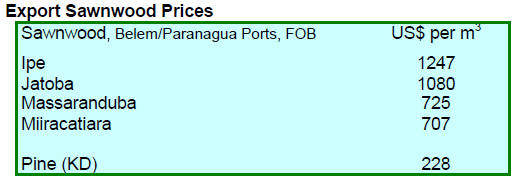

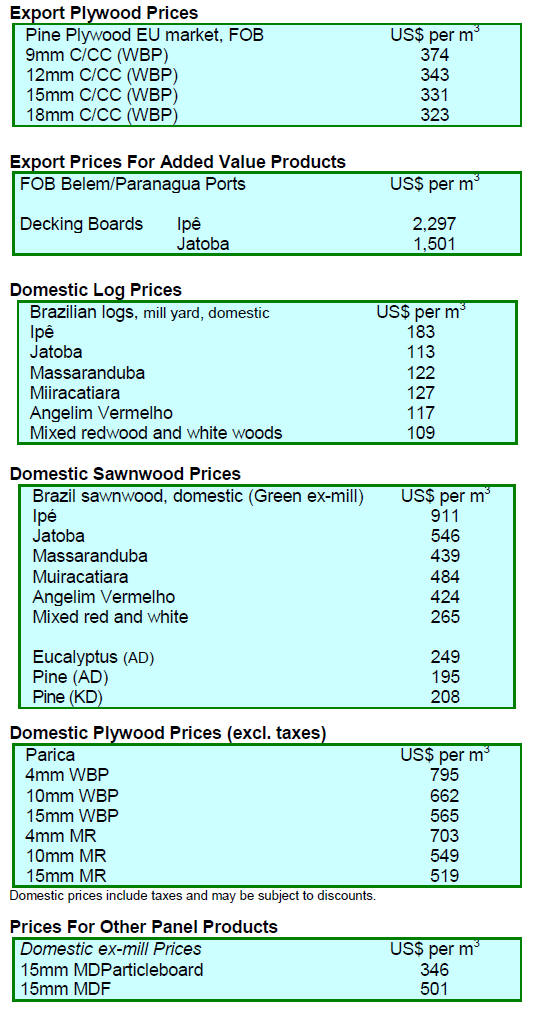

BRAZIL

Exports set to rise in second half 2014

Brazilian plywood manufacturers anticipate exports to the

US could increase in the second half of the year due to

higher spending on civil construction which increased

7.5% in the second quarter of this year.

According to the Brazilian Association of Mechanically-

Processed Timber Industry (ABIMCI), the Brazilian

industry´s optimism has its foundation in the tripling of

plywood exports to the US since March this year.

However, Brazil‟s fluctuating exchange rate is of concern

to entrepreneurs.

The dollar was around R$ 2.25 in April but the industry

would like to see a rate between R$ 2.70 and R$ 2.80.

According to ABIMCI, exports of plywood to other

markets such as Turkey have been falling but efforts are

being made to expand markets in Egypt and Saudi Arabia.

While prospects in international markets are improving

growth of sales in the domestic market is weak.

According to the Civil Construction Industry Union of São

Paulo State (SINDUSCON-SP) domestic civil

construction is expected to only grow between 1% and 2%

in 2014 against the 2.8% previously forecast. Weak

domestic demand will mean more wood products could be

made available for export which could affect price

stability.

ABIMCI will hold a national meeting with plywood

manufacturers in October to discuss market issues,

products standardisation, certification and to develop

strategies for the domestic and international markets.

Investors see opportunities in plantation expansion

Brazil‟s forest sector has developed in the last two years

helped by a National Policy for Planted Forests and also

by the creation of a new broad based association, the

Brazilian Tree Industry (IBA).

According to IBA, the area of planted forests in Brazil is

expected to double by 2020 a target questioned by foreign

investors given the complex legal issues involved.

A recent conference provided a good opportunity for

discussions on expanding pine and teak plantations. A

report from the largest private teak plantation project in

Brazil attracted the attention of potential investors.

Rio de Janeiro the main market for teak furniture

Rio de Janeiro State is the main market for teak furniture

manufactured in Mato Grosso State taking around 40% of

the teak furniture from the state.

The first teak furniture manufacturer in Mato Grosso

began work in 2006 and produced souvenir items as well

as napkin and pencil holders to hand out as gifts to

business partners and customers.

In Brazil sawn and kiln dry plantation teak is sold for

between R$3,500 to R$ 4,000 per cubic metre and is now

used to produce a wide range of products.

Teak sawnwood is produced mainly in the municipalities

of São José do Rio Claro and Alta Floresta, both in Mato

Grosso state.

Deforestation increases in the Amazon

According to the Brazilian National Institute for Space

Research (INPE) the deforestation rate in the Amazon

amounted to was 3,036 sq. km between August 2013 and

July 2014, an increase of 9.8% year on year.

The deforested area was assessed through the Real Time

Deforestation Detection System (DETER), a technology

managed by INPE to analyse forest degradation and clear

cutting in the the Amazonian states of Acre, Amapá, Pará,

Amazonas, Mato Grosso, Rondônia, Roraima, Tocantins

and part of Maranhão.

To calculate the annual deforestation rate from clear

cutting INPE uses the Amazon Deforestation Monitoring

Project (PRODES) system which provides high resolution

satellite images showing even small deforested areas.

The deforestation data released by INPE shows a forest

loss of 535 sq. km in June and 729 sq. km in July. Pará

state had the highest rate of deforestation followed by the

states of Mato Grosso and Rondônia.

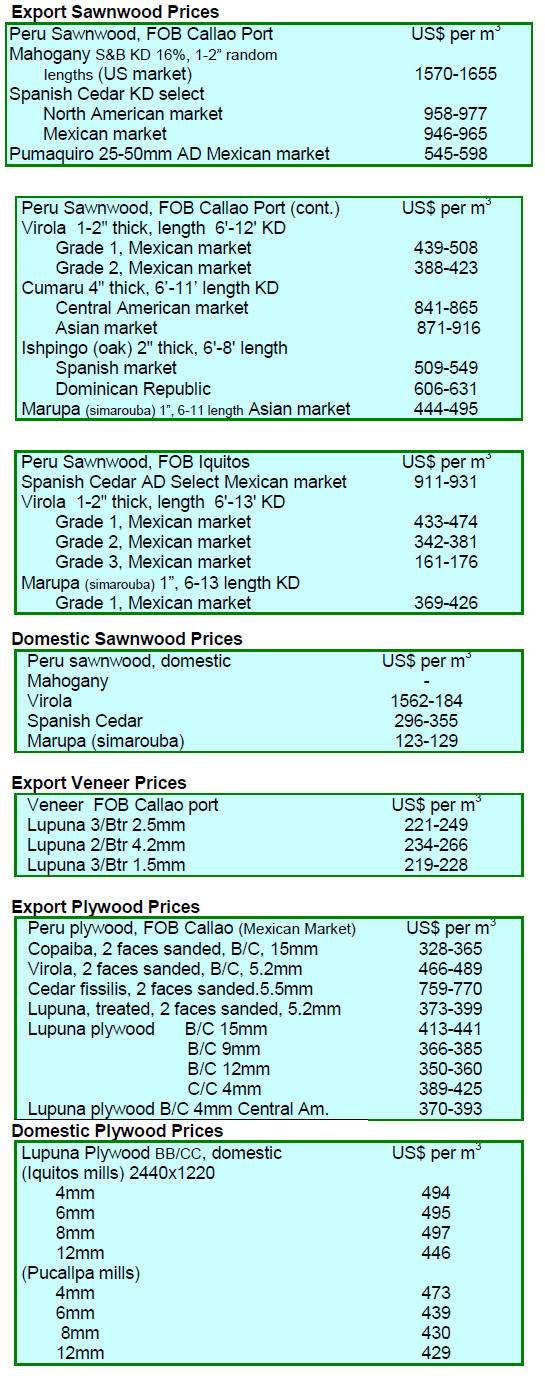

8. PERU

Tax benefits mulled for forestry

Minister of Production, Piero Ghezzi, has revealed that his

Ministry and the Ministry of Agriculture and Irrigation are

planning to offer the forestry sector the same benefits

provided to agriculture under the Agricultural Promotion

Act.

The Ministry of Production will select a consultant to

identify the competiveness of Peruvian wood product

exports since the wood processing industries have the

potential to contribute more to the countrry‟s finaces and

overall economic growth.

SERFOR begins evaluation of contribution to economy

The National Forest and Wildlife Service (SERFOR) has

initiated a review of the contribution of forestry to the

economy. Various agencies have been brought together to

assess the economic resources and services of the forest.

Visit of Finnish forest sector entrepreneurs

A delegation of Finnish businessmen and forestry sector

academics met with the Minister of Agriculture during a

recently concluded Peru-Finland Forestry Seminar. The

Finnish forestry companies introduced the latest

technology in, and Finnish experience of, sustainable

forest management and forestry education.

9.

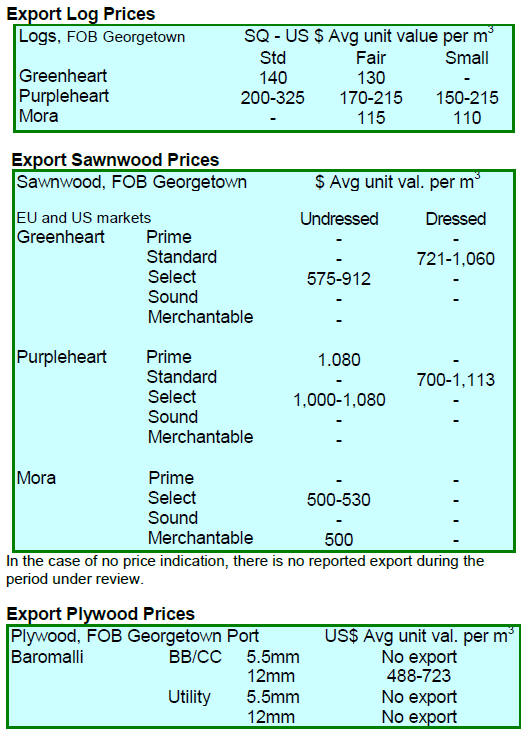

GUYANA

Encouraging first half 2014 production

In the first half of 2014 the performance of Guyana‟s

forestry sector improved compared to the first half of 2013

due mainly to a good performance of the sawnwood and

plywood industries according to the review conducted by

the Ministry of Finance and the Guyana Forestry

Commission.

See:

http://www.nre.gov.gy/PDF/Setting%20the%20Record%20Strai

ght%20on%20the%20Forestry%20Sector/Forest%20Sector%20P

erformance%20Improve%20over%202013%20half%20year%20

owing%20to%20Timber%20and%20Plywood%20Sub%20Categ

ory%20Increase.pdf

The review says production logs, sawnwood and

roundwood (piles and posts ) increased from 151,151

cubic metres in the first half of 2013 to 238,411 cubic

metres in the first half of 2014.

Log production rose 77%, driven by an increase in output

of prime such as greenheart and wamara as well as lesser

utilised species.

Plywood and veneer production accounted most of the

increased output with the timber and plywood sub sectors

recording a 53% increase in export volumes in the first

half of this year.

The report on the forestry sector says: “The forest sector

has shown a strong performance so far in 2014. As

reported by the Ministry of Finance in the half year

summary, this provides strong basis for revising the

projected increase in forest sector growth for 2014.

Further, as noted in the Ministry of Finance half yearly

report, plywood production is one of the main drivers of

the growth in the sector with a 65% increase in production

recorded in the first half of 2014.”