|

Report from

North America

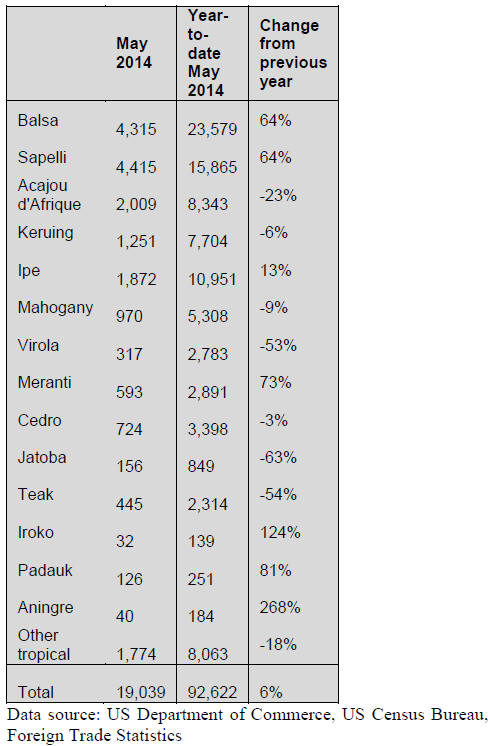

Sawnwood imports from Africa up, sapelli a winner

US imports of temperate sawn hardwood recovered in

May and total sawn hardwood imports grew by 77% from

the previous month. Temperate species accounted for

133,123 cu.m in May. Tropical imports were 19,039 cu.m,

down 4% from April. Year-to-date tropical imports were

6% higher than in May 2013.

The decline in tropical timber imports was almost entirely

due to lower balsa imports from Ecuador in May. Balsa

imports fell by 40% to 4,303 cu.m following very high

April import volumes.

Imports from Brazil declined by 5% in May to 2,399 cu.m.

There was only a slight decrease in ipe imports from

Brazil (1,790 cu.m), but jatoba and virola imports also fell.

Sawnwood imports from Malaysia, Indonesia and Peru

were down, but imports from Africa increased in May.

Imports from Cameroon grew by 32% to 2,832 cu.m. The

majority of Cameroon‟s shipments was sapelli (2,225

cu.m).

Imports from Congo/Brazzaville more than doubled in

May to 1,843 cu.m, again because higher sapelli shipments

(1,242 cu.m). Ghana shipped 905 cu.m of sawnwood to

the US in May, up 36% from the previous month.

Imports from Ghana were 498 cu.m of acajou d‟Afrique

and 370 cu.m of cedro, according to US trade statistis.

By species, sapelli overtook balsa as the large tropical

import in May (by volume). Sapelli sawnwood imports

were 4,415 cu.m and year-to-date imports were 64%

higher than in May 2013. Acajou d‟Afrique imports grew

to 2,009 cu.m in May, but year-to-date imports were 23%

lower than last year.

Much of the decline in tropical sawnwood imports in May

was in imports from Latin America and Asia: balsa,

keruing, ipe, virola, jatoba and teak.

Higher Canadian imports from Brazil in May

Canadian imports of tropical sawn hardwood were worth

US$2.47 million in May, up 11% from the previous

month. Year-to-date imports were 18% higher than in May

2013.

Three countries accounted for the bulk of import growth in

May: Brazil, the US and Congo/Brazzaville. Imports from

Brazil doubled to US$337,639. Tropical imports via the

US were worth US$376,881, up 118%. Importsfrom

Congo increased by 136% to US$199,104.

Ecuador shipped US$ 364,973 worth of sawnwood in

May, up 25% from the previous month. Canada‟s imports

from Cameroon, Congo/Zaire, Indonesia and Malaysia

were down in May.

By species, Canadian imports of virola, imbuia and balsa

combined increased by 23% in May to US$382,762.

Import of sapelli sawnwood declined, but at US$2.2

million year-to-date sapelli remains the most significant

tropical import species in Canada.

Analysis of N. American furniture market

Housing market affects furniture demand

Demand for furniture has slowly grown since the financial

crisis. At its lowest point in 2009, new furniture orders

were worth US$18.8 billion, according to Smith the

Leonhard data. Since 2009 new furniture orders have

increased 4-6% every year.

The growth in furniture demand has been steadier than the

housing market recovery, although homes sales play an

important role in the demand for furniture.

Furniture consumption has been supported by lower

unemployment and growing consumer confidence in the

US economy. In the first quarter of 2014 the GDP declined

mainly due to weather events, but positive economic

growth is expected for the rest of the year. If the housing

market recovery gains momentum, furniture sales will

greatly increase.

More positive outlook for domestic manufacturing

Over the past 10-15 years US furniture manufacturers

suffered, not only from shrinking demand during the

recession, but from competition from offshore

manufacturers and imports. Furniture supply chains,

technology and consumer trends changed dramatically.

Many US manufacturers outsourced production, while

others had to close or declared bankruptcy. Imports

dominate the US furniture market now.

Furniture industry analysts have recently been more

positive on the future of domestic furniture manufacturing.

Many US furniture companies have improved sales and

profit margins since the recession, even if there has not

been a significant shift away from overseas

manufacturing.

With labour costs in China and Vietnam on the rise and a

less favourable dollar-yuan exchange rate for exports from

China, it may become less cost-effective for US

manufacturers to produce in China and other East Asian

countries. Shipping costs and the logistics of far flung

supply chains also affect the location of manufacturing

plants.

While the US may remain the location of choice for highend

furniture producers, lower end products may

increasingly be made in Mexico instead of East Asia.

Mexico has the advantage of low wages, close proximity

to the US market and duty free shipping under the North

American Free Trade Agreement (NAFTA).

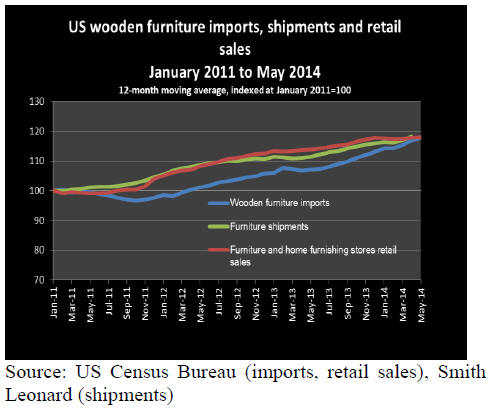

Furniture imports accelerating

2013 US wooden furniture imports were worth US$13.6

billion, up 7% from 2012. The 12-month moving average

in May 2014 was US$1.25 million, almost 10% higher

than in May 2013. The 12-month moving average

eliminates seasonal and other variability in monthly data,

allowing for a more meaningful analysis.

When comparing wooden furniture imports with retail

sales and estimated shipments of furniture (including nonwood

materials) the trends are similar. Furniture

shipments estimated by Smith Leonard followed retail

sales of furniture and home furnishing very closely

between 2011 and May 2014.

Wooden furniture imports trailed retail sales until the

spring 2014, suggests US domestic manufacturers

increased their market share between 2011 and 2013.

However, by April 2014 import growth surpassed the

growth in retail sales, and it is difficult to tell from the data

whether US furniture companies producing domestically

have been able to maintain any market share gains.

China’s imports share declines to under 49%

China dominates the US furniture market with an import

share of around 50%. Imports from China totaled $6.6

billion in 2013, up 6% from the previous year. On a

monthly, 12-month moving average basis, China‟s imports

share has declined from 51% at the start of 2011 to under

49% in May 2014.

It is too early to tell whether China will lose its preeminent

position in the US furniture market or whether the decline

remains a relatively small shift towards more imports from

Vietnam, other Asian countries and Mexico.

The growth in US imports is expected to continue, as

suppliers such as India and Russia expand their export

markets.

Vietnam is the US market‟s second-largest supplier with

imports worth $2.0 billion in 2013. Vietnam‟s import

share grew steadily from 13.5% in January 2011 to 16.4%

in May 2014.

Furniture imports from NAFTA partners Mexico and

Canada grew in recent years. The increase was mainly in

imports from Mexico (US$521 million in 2013), but

Canada is still a larger furniture exporter to the US at

US$1.1 billion in 2013.

The NAFTA countries‟ import share increased slightly

from 11.9% in January 2011 12.6% in May 2014.

Furniture imports from Malaysia declined by 16% in 2013

to $543.7 million, but in 2014 imports from both Malaysia

and Indonesia are up by over 20% compared to the same

time last year.

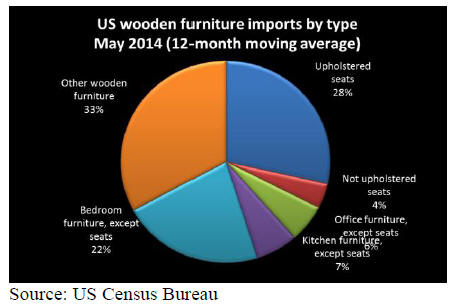

Imports by type of furniture

The largest change in the type of wooden furniture

imported over the past three years has been in upholstered

furniture. The share of upholstered seats in total imports

grew from 25% in 2011 to 28% in May 2014 (12-month

moving average).

The share of wooden bedroom furniture fell by one

percentage point over the same time, while kitchen

furniture import shares grew from 6% to 7%.

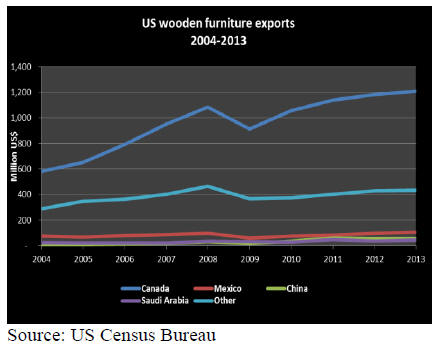

Higher US wood furniture exports

With a wooden furniture trade balance of US$-11.7 billion

in 2013 the US remains the world‟s largest importer of

furniture. In the past few US manufacturers troubled

themselves with developing international markets, but

exports have grown over the last decade.

Growing demand for high-end furniture in China, India,

Latin America and the Middle East created opportunities

for US companies willing to deal with style and cultural

differences, ocean shipping and language barriers.

Between 2004 and 2013 annual growth in wooden

furniture exports was close to 10%. The rise in exports

was only briefly interrupted in 2009 by the financial crisis.

The strongest growth was in shipments to China, but

Canada is by far the largest market for US manufacturers

at US$1.2 billion in 2013, including re-exports from other

countries.

Exports to the Middle East have grown significantly.

Saudi Arabia is the largest market at US$43.7 million in

2013, followed by the United Arab Emirates (US$27.1

million) and Qatar (US$19.0 million).

|