Japan Wood Products

Prices

Dollar Exchange Rates of

25th April 2014

Japan Yen 102.42

Reports From Japan

Tax reform could spur growth

Japan‟s Ministry of Economy, Trade and Industry (METI)

has suggested that GDP could grow by an additional

forecast that yen 7 trillion if corporate tax rates are cut by

10 percent from the current level of around 35 percent.

One of the measures being considered by the government

is an overhaul of company taxes to spur growth but the

idea of a reduction in corporate tax is being resisted by the

Ministry of Finance and some members of a tax review

panel.

After surveying some 1,000 leading companies METI

reported that a 10% cut in corporate taxes would improve

competitiveness in the domestic market and would lead to

greater earnings and investment. This may attract back to

Japan some companies which relocated production

overseas.

In contrast, says the METI report, if business taxes are

unchanged then domestic and international sales are likely

to fall.

In Japan the corporate tax comprises both national and

local taxes and, at around 35%, exceeds equivalent taxes

in China by 10%; by 11% in South Korea and a massive

18% in Singapore.

Japanese economy on a moderate recovery path

Japan‟s Cabinet Office has released its April assessment of

the state of the economy and is confident the economy is,

in their words “on a moderate recovery path, while some

weak movements are seen lately due to a reaction after a

last-minute rise in demand before a consumption tax

increase.”

In summary the press release from the Cabinet Office

notes:

Private consumption exhibited weakness, a

reaction after the last-minute rise in demand

before the 1 April consumption tax increase.

Business investment is picking up.

Exports are flat.

Industrial production is almost flat, a reaction

after the rise in demand before a consumption tax

increase.

Corporate profits are improving and enterprises

judge current business conditions to be broadly

improving but firms are cautious about the

immediate future.

The employment situation is improving steadily.

Consumer prices are rising moderately.

The press release says, although weakness in the economy

will remain in the short term as consumers adjust to the tax

increase, the economy is expected to recover as the effect

gradually lessens.

However, the slowing of overseas demand is still a

downside risk to the Japanese economy.

One of the major problems facing the government is

energy. According to data provided by the Ministry of

Finance, Japan‟s trade deficit has quadrupled since April

2012 as imports have increased 17% but exports only grew

by 11%.

The main reason for the increasing trade deficit is because

Japan now needs to imports almost all of its energy

requirements. After the Fukushima nuclear disaster in

March 2011 the Japanese government ordered a shutdown

of almost all nuclear plants in the country pending safety

inspections to new tighter rules.

Business leaders urge agreement on TPP

Despite continuing negotiations even while the leaders of

the US and Japan were meeting no agreement was reached

on the Trans-pacific Partnership (TPP) largely because of

disagreement over the issue of market access for

agricultural products and automobiles.

The TPP is strongly supported by businesses on both sides

of the Pacific and the U.S. Chamber of Commerce, the

Japanese Business Federation (Keidanren), the U.S.-Japan

Business Council (USJBC) and Japan-U.S. Business

Council issued a press statement urging agreement.

The press release notes; “The U.S. and Japan stand to gain

substantially from the establishment of high standard rules

in areas such as intellectual property protection,

investment, SOEs, digital commerce, regulatory coherence

and transparency.

Concluding a strong TPP agreement requires the long-term

vision and commitment of both governments to prioritize

21st Century strategic economic interests that support

trade and investment expansion, job creation, and

innovation. It is important for political leaders in both

countries to focus on the broader economic interests.

Ultimately, this will increase U.S. and Japanese economic

growth, integrate the two economies further, and solidify

the strategic alliance at a critical time.”

See: https://www.uschamber.com/press-release/jointstatement-

tpp-us-chamber-commerce-us-japan-businesscouncil-

keidanren-and-japan

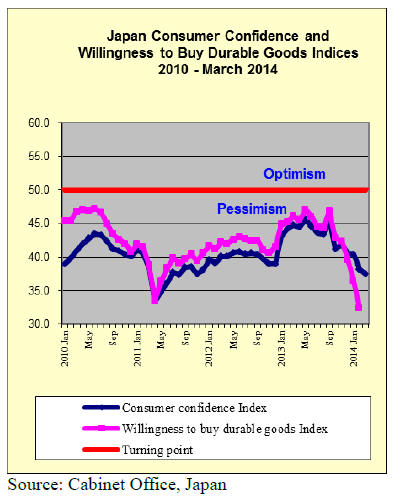

Consumer confidence down for fourth month

Japan‟s Cabinet Office has released the results of the

March 2014 consumer confidence survey and reports the

consumer confidence index fell to 37.5 in March, down

from the 38.3 in February and the fourth month of

consecutive decline.

For the Cabinet Office consumer confidence survey data

see: http://www.esri.cao.go.jp/en/stat/shouhi/shouhie.

html#data

The latest survey was conducted on March 15th, 2014

around two weeks before the consumption tax was raised.

The survey covered 8,400 households and the response

rate was 67.5%.

The survey assess sentiment in several categories and the

recorded perceptions were as follows; Overall livelihood:

35.0 (down 1.0 from previous month), Income growth:

38.2 (down 0.1 from previous month), Employment:45.9

(down 0.9 from previous month) and Willingness to buy

durable goods:30.8 (down 2.0 from previous month).

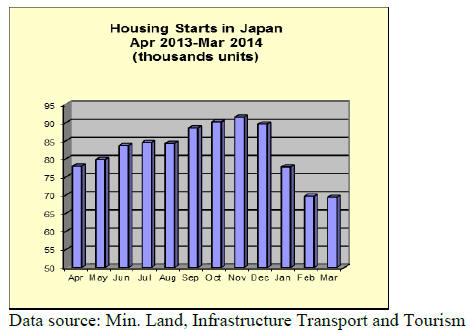

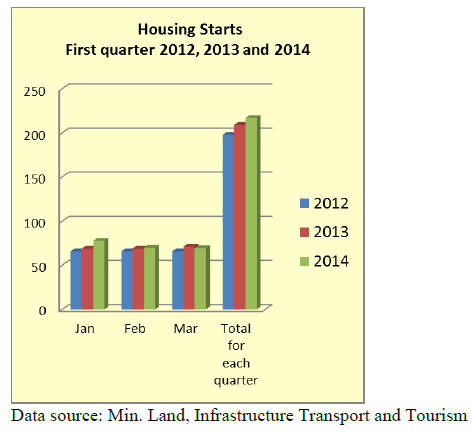

Japan housing starts

The latest figures from Japan‟s Ministry of Land,

Infrastructure and Transport shows that first quarter 2014

housing starts fell to 69,400 marking three consecutive

months of decline. The first quarter figures came as no

surprise to analysts who had factored in the impact of the

rise in consumption tax on investment in housing.

While the consistent decline in housing starts from

December 2013 appears to signal a weakening in demand,

a quarter on quarter comparison with 2012 and 2013

shows that the performance of the housing market in 2014

was actually an improvement as illustrated in the

following graphic.

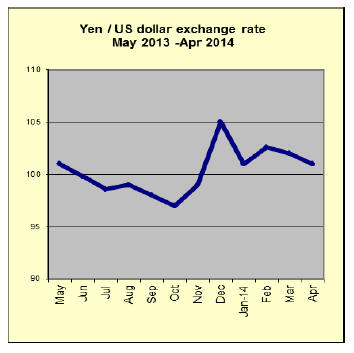

Yen surge short lived

In mid-April the yen strengthened slightly against the

dollar rising to yen 98 to the dollar but subsequently

weakened and stood at yen 102.50 during the latter part of

the month.

For the JLR report please see:

http://www.nmokuzai.

com/modules/general/index.php?id=7

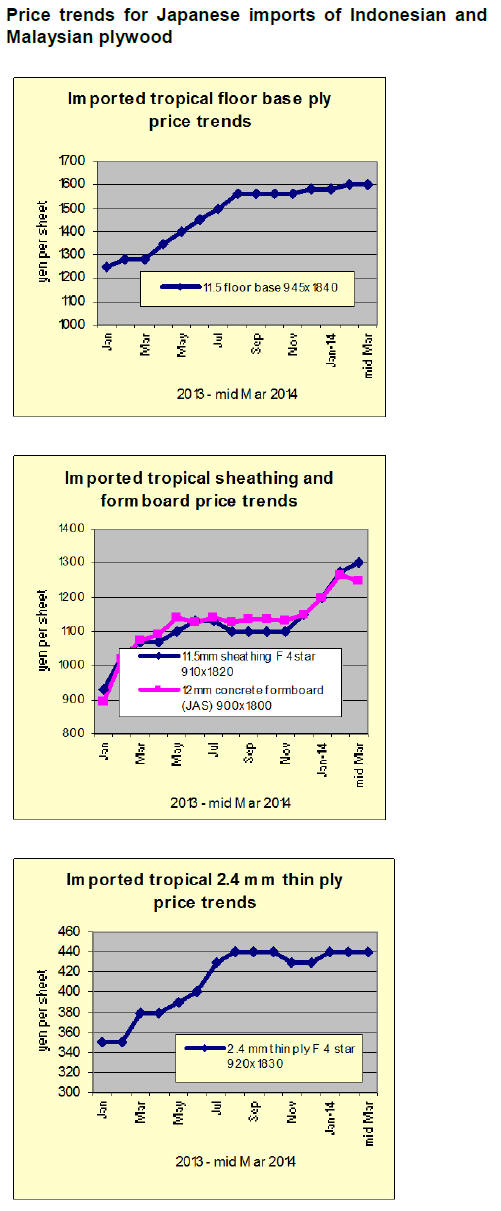

Imported South Sea hardwood plywood market

Plywood suppliers in South Sea countries are becoming

bullish again. Indonesian suppliers propose sizable price

increase like about $30 per cbm after harvest tax hike

since March with strong currency of Rupiah and high log

prices.

Japanese buyers are now trying to buy more from

Malaysian suppliers but in Sarawak in Malaysia, log prices

are high and once Indonesian prices are up, Malaysian

suppliers are likely to follow suit.

Because of log supply shortage, plywood mills‟

production in Malaysia had been slow and delayed until

March and mills carry heavy order balance then log

production started recovering and mills‟ order balance is

now about a month or a month and half, which is normal.

Future purchases declined since last February as market

future is hard to see with consumption tax increase since

April, which helped reduce mills‟ order balance. Hot

market in Japan simmered down since late February and

now the market is quiet.

Port inventories are not little but the market prices remain

unchanged. Importers carry order balance with current

market prices and supplying mills are facing higher log

prices so both have no room to reduce the prices.

Importers comment that if May prices would be higher,

they need to accept April offers. Present market prices of

JAS coated concrete forming panel of 3x6 in Tokyo

market are about 1,350 yen per sheet delivered, unchanged

from March.

Export log prices are firm

In Sarawak, rainy season was over much earlier than usual

years and dry weather has been lasting for last two month

so that river water level dropped and log towing and

barging become difficult from interior mountain log yard

to log loading ports.

Log inventories at loading ports are down and the

suppliers are bullish and the log prices stay up high. Even

low grade log prices are up.

Low grade meranti prices for India are $270 per cbm FOB,

$5-10 higher than March. April proposals for Japan are

also up by $5-10 at about $300 on meranti regular and

$255 on small meranti, $235 on super small meranti.

In Sabah, after some dry weather, rain started again and

log harvest is hindered but hauling logs from the bush to

the ports in Sabah is mainly by trucks so transportation is

not as bad as Sarawak.

Weather in PNG recovered but heavy rain started in the

Solomon Islands, which flooded the rivers and carried

away bridges. Chinese purchase in PNG is brisk to

supplement shortage of the supply from the Solomon

Islands so that the log prices are very firm. Even

calophyllum for lumber is high in price so there has not

been any arrival into Japan for some time now. Taun is

less costly but the level stays up high and hard to buy.

Oshika establishes Indonesian subsidiary

Oshika Corporation (Tokyo), a major adhesive

manufacturer for wood products, announced to establish

joint venture company in Indonesia for marketing of

adhesive. With this, Oshika will have adhesive

manufacturing and marketing companies both in China

and Indonesia.

Oshika targets overseas sales of three billion yen in five

years. Newly established company is Oshika Indonesia,

which is joint venture with Indonesian adhesive

manufacturer, P.T.Polychemie Asia Pacific Permai.

Oshika has 80% share and Polychemie has 20% share.

Oshika established back in 1995 Poly-Oshika for

manufacturing adhesive with 50/50 investment with

Polychemie and it has been producing adhesives at its

Bogor plant and the products are marketed through

Polychemie.

Now newly established company will market the products

not only in Indonesia but for other markets like Vietnam

and Thailand. Indonesian market of adhesive is for

laminated lumber and free board of rubber wood and

merkusii pine.

Oshika established adhesive manufacturing company

jointly with Chinese company in 2003 then to expand the

market, it established adhesive marketing company in

Dalien, China.

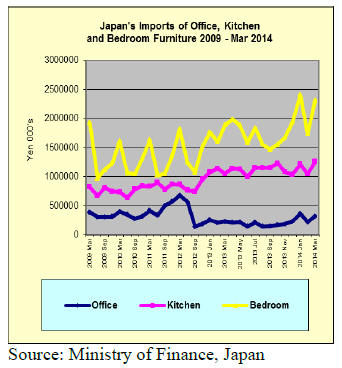

Trends in office, kitchen and bedroom furniture

imports

Japan‟s office kitchen and bedroom furniture imports from

2009 to the end of March 2014 are shown below.

Japanese imports of furniture exhibited a cyclical trend

between 2009 and 2012. However, from 2012 bedroom

furniture imports began to increase and have continued

upwards since.

March furniture imports rose after the sharp fall in

February as Japanese furniture companies prepared for the

last minute purchases by consumers wishing to avoid

paying the higher consumption tax of 8% from 1 April

2014.

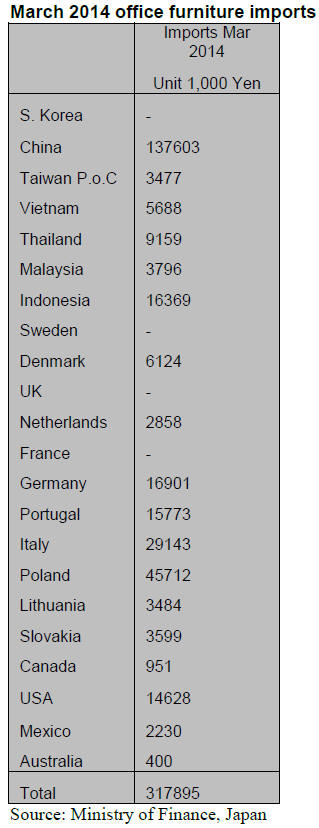

Office furniture imports (HS 9403.30)

March 2014 imports of office furniture into Japan rose

sharply from yen 217 mil. In February to yen 318 mil., an

increase of 46% month on month.

The three main suppliers accounted for 69% of all office

furniture imports in March 2014. Of interest was the entry

of Vietnam as a small supplier of office furniture. Vietnam

is better known as a supplier of kitchen and bedroom

furniture to Japan but it could be that shipments of office

furniture will expand.

In March Japan‟s imports of office furniture from the EU

increased to around 35% of total office furniture imports

significantly up on levels in February.

Kitchen furniture imports (HS 9403.40)

The downward trend in imports of kitchen furniture

extended from February to March. Japan‟s kitchen

furniture imports in March were 27% less than a month

earlier.

The big losers were China, down yen 50 mil., Indonesia,

down 30% and Poland, the fifth ranked supplier in

February shipped nothing to Japan in March.

The top three suppliers Vietnam (33%), Indonesia (24%)

and Philippines (16%) accounted for 73% of all kitchen

furniture imports in March. China‟s rank in terms of value

of imports for March fell to fourth place, down from the

number one spot in February.

Of the EU suppliers of kitchen furniture to Japan

Germany, once again, shipped a significant value of

kitchen furniture in March and this was valued at yen 57

mil.

Bedroom furniture imports (HS 9403.50)

Japan‟s bedroom furniture imports increased throughout

2013 and reached a record high in January 2014. February

2014 imports fell but March 2014 imports rose by around

34%to yen 2,311mil.

Most of the March increase can be explained by the 60%

rise in bedroom furniture from China as well as the 30%

increase in imports from Vietnam. The top three suppliers

in January, February and now March remain China,

Vietnam and Malaysia.

Other winners in March were shippers in Thailand (up

around 30%), Indonesia (+25%) and Italy which, although

only shipping yen 22 mil. Saw March imports by Japan

rise fivefold.

Italy and Poland dominated shipments of bedroom

furniture to Japan during March but, overall, EU suppliers

account for less than 5% of total bedroom furniture

imports.

|