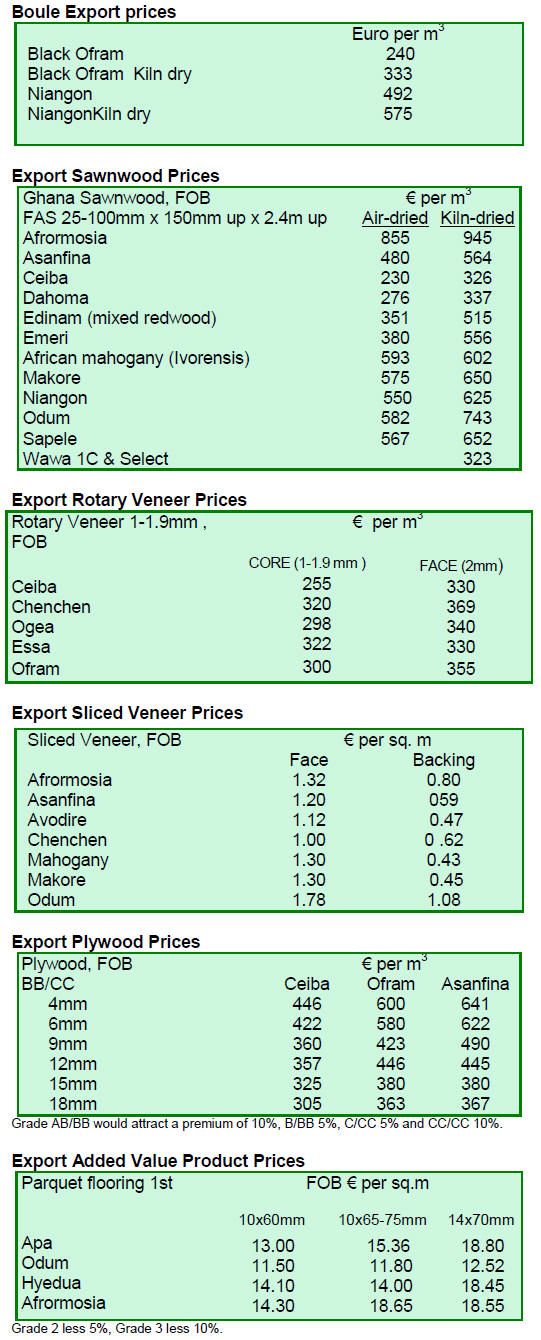

2. GHANA

Surprising increase in gmelina log exports

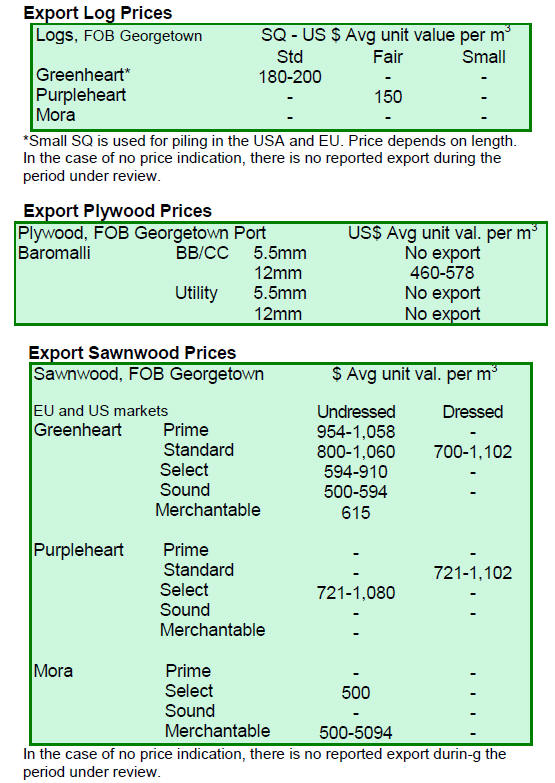

According to data from the Timber Industry Development

Division (TIDD) of the Forestry Commission (FC), export

contracts approved in the fourth quarter of 2013 totalled

78,855 cubic metres, a slight increase on third quarter

2013 levels. The table below shows the breakdown by

product category.

Exports of primary products fell over 15% to 6,339

cu.m

in the fourth quarter of 2013 compared to the previous

quarter. This, say analysts, was because of the sharp fall in

teak log exports.

The decline in teak log export volumes was partially

compensated for by an increase in gmelina log exports to

India which jumped to 6000 cu.m in the fourth quarter.

Exports of product categorised as secondary in TIDD

statistics (mainly sawnwood) increased by 3.6% compared

to the previous quarter and amounted to 69,792 cu.m.

However, exports of tertiary products fell sharply (down

16%) to just 2,724 cu.m in the fourth quarter.

Rosewood and teak sawnwood exports increased in the

fourth quarter. Rosewood exports amounted to 16,125

cu.m, up 30% on levels in the third quarter, mainly for the

Chinese and Indian markets, while sawn teak exports rose

11% to 8,130 cu.m.

Ghana’s plywood exported mainly to regional

markets

Rotary cut veneer exports in the fourth quarter fell a

massive 79% but exports of sliced veneer improved and

were up 14%. In the final quarter of 2013 exports of

plywood to neighbouring countries fell by 3% but, despite

the fall, the regional markets continued to be the main

markets for Ghana‟s plywood.

Of the 13,664 cu.m of plywood contracts approved, 94%

in terms of volume was shipped to countries in the West

Africa sub region with Nigeria being the major

destination.

Most exports of the tertiary products, such as sliced veneer

and kiln dried lumber were for the European markets. The

United States continues to be the major market for

mahogany and cedrella sawnwood as wel as for rotary

veneer. The Middle East and Egyptian markets emerged

as major importers of Ghana‟ „backing grade‟ veneer.

Hong Kong business mission to Ghana

A Delegation from the Hong Kong‟s Trade Development

Council (HKTDC) visited Ghana in early April to meet

and discuss investment potential with local businesses.

The delegation expressed interest in business partnerships,

distributorships and wholesaling. The mission was

endorsed by the Association of Ghana Industries (AGI)

and the Ghana Chamber of Commerce of Industry (GCCI).

The Hong Kong Trade Development Council (HKDTC) is

a statutory body established in 1966 to help create

opportunities for Hong Kong companies, especially small

and medium-sized enterprises (SMEs), by promoting trade

in goods and services worldwide.

Ghana President to head ECOWAS

Ghana President John Mahama has been elected Chairman

of the Economic Community of West African States

(ECOWAS).

President Mahama, who takes over from Ivorian President

Allasane Ouattara, was elected in Yamoussoukro, Ivory

Coast, during the 44th Session of the ECOWAS Authority

of Heads of State and Government.

For the full story see:

http://graphic.com.gh/business/business-news/20099-

ghana-s-maritime-hub-concept-gets-us-35m-boost.html

3. MALAYSIA

Furniture makers report better earnings

The recent stabilisation of the EU and US economies,

along with the weaker ringgit, has boosted export sales of

furniture and this has improved the share prices of listed

furniture makers.

Those companies that sell into the Japanese market have

seen orders rise as the Japanese housing market expanded

and as consumers purchased furniture in advance of the

consumption tax increase. 2013 furniture exports were

worth RM7.4 bil., slightly lower than in 2012.

HeveaBoard Bhd, which specialises in high-quality

particle boards and ready-to-assemble furniture saw

earning rise in 2013. Homeritz Corp Bhd reported better

earnings as did Latitude Tree Holdings Bhd and Poh Huat

Resources Holdings Bhd.

SFIA wants support for furniture village

The president of the Sarawak Furniture Industry

Association (SFIA) has said competition from exporters in

China and Vietnam is holding back growth in the domestic

industry and has called on the government for support.

Sim Lee Beng said the Malaysian domestic market is

flooded with imported furniture.

Adding to the problems in the sector is the lack of skilled

workers, inadequate research and the high cost of raw

materials and fixtures. Sim pointed out that young people

are not interested in jobs in the furniture industry despite

the sector having a bright

The association is calling on the government to assist with

the creation of a furniture village in the state so that the

benefits of integration can be enjoyed.

According to the Sarawak Timber Industry Development

Corporation, there around 400 registered furniture

manufacturers in Sarawak and that most produce wooden

furniture.

For more see: http://www.sfia.org.my/

Clarification on domestic log processing quotas

Sarawak Timber Association (STA) general manager Peter

Kho has reiterated that the policy in Sarawak is that 60%

of total log production in the state must be processed

domestically. Kho was responding to some confusion

caused by recent reports which stated Sarawak had

changed the log export quota. Kho reconfirmed that

Sarawak does not apply a log export quota.

Philippines and Thailand major buyers of Sabah

sawnwood

The Sabah Department of Statistics has released timber

export data revealed that for the first two months of 2014,

Sabah exported 35,482 cu.m of sawntimber worth RM

53,011,149 (approximately US$ 16.3 million).

During this period reported the biggest importer of Sabah

sawntimber was Philippines at 6,626 cu.m (or 18.7% of

total exports), followed by Thailand 5,522 cu.m (15.6%)

and China 5,245 cu.m (14.8%).

Exports of sawnwood to Japan amounted to 4,538 cu.m

(12.8%) and exports to Taiwan P.o.C 3,918 cu.m (11.0%).

The main species groups exported were “dark and

light red

meranti and meranti bakau” totaling 10,024 cu.m (or

28.3% of all sawnwood). The next species group of

“Keruing, Ramin, Kapur, Teak, Jelutong,

Kempas,Mengkulang, Balau (Selangan batu)” accounted

for 5,835 cu.m (16.4%). The following are average export

prices (FOB).

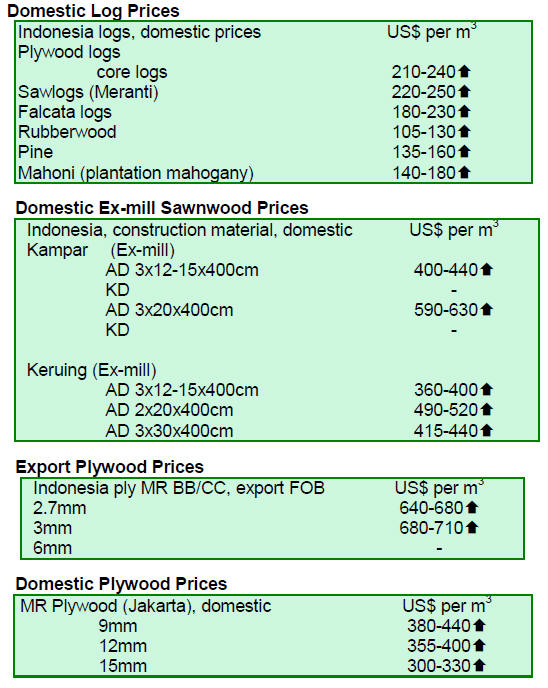

4. INDONESIA

Wood industry relocates to Java to access

plantation

logs

Zulkifli Hasan, Indonesia‟s Forestry Minister recently

highlighted some changes that are taking place in the

sector in relation to where companies are now being

established. He said that in recent years around 400 new

wood processing mills have been established in Java.

Previously it was Papua, Sumatra and Kalimantan that

attracted investment by timber companies. The Minister

attributed the change to the availability of log raw

materials such as sengon, gabon, gmelina and albizia in

Java.

Anggoro Ratmodiputro, Chairman of Asmindo for Central

Java, said that Indonesia could manufacture more high

quality furniture for export if the government was more

supportive of the country‟s labour intensive wood

processing industries.

First International Furniture Expo deemed a success

The first International Furniture Expo (IFEX) ended on 14

March and the organisers say that exhibition stands were

fully booked.

According to UBM, the London based organisers, the

three-day exhibition attracted over 6,000 trade visitors, of

which 2,021 were overseas buyers sourcing Indonesian

furniture for sale in Europe, China, the US and

Australasia.

In a press release UBM says, “ exhibits covered a wide

range of products, from contemporary furniture and massmarket

offerings to traditional, hand-crafted furniture. The

materials used reflected Indonesia's abundant supply of

sustainably-sourced woods, as well as rattan and textiles.

The exhibition also included a rich selection of home

furnishings, decorations and handicraft items.

The international buyers who attended IFEX came from a

total of 108 countries. In descending order, the top 10

countries were: Australia, China, the US, Malaysia,

Singapore, India, the Netherlands, France, Germany and

the UK. Several official buyer delegations visited the

exhibition, including groups from Belgium and Turkey.”

Developing a ‘green economy’

The Center for International Forestry Research (CIFOR)

and the Indonesian Forestry Ministry will host a „Forests

Asia Summit‟ in May which organisers say will attract

Ministers from across Southeast Asia, the private sector,

civil society and development specialists. The aim is to

share experiences on developing a „green

economy‟through better management of forests and

landscapes.

This summit is billed as the largest gathering of its kind in

Asia in recent years.

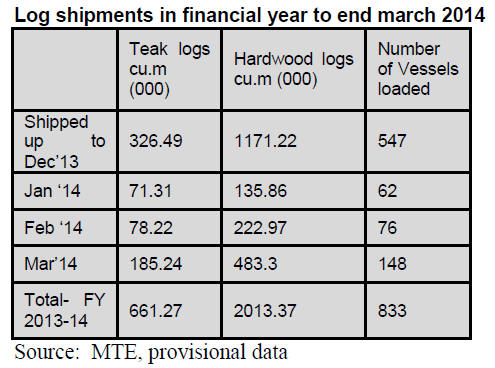

5. MYANMAR

Last minute rush to beat log ban deadline

As anticipated, the level of March log export shipments

were remarkable as exporters rushed to ship as much logs

as possible before the log export ban became effectiveat

midnight 31 March 2014.

Local observers say that 148 vessels were loaded with

timber in March, double the number in February. It has

been reported that several vessels were only partially full

when they left the port just prior to the deadline.

Up to the midnight deadline trucks were arriving at the

port but many failed to beat the deadline and had to return

with unshipped logs.

It has been reported that the Myanmar authorities stopped

loading operations some 30 minutes before the midnight

deadline and that this caused consternation among some

buyers who had paid for the logs awaiting loading.

The Myanma Timber Enterprise (MTE) had to contend

with loading some 22 vessels simultaneously; about 5 in

mid-stream and 17 alongside the wharves.

Most buyers reported logistical problems during the final

days of March as they attempted to clear and ship cargoes.

At one point there were more than twenty vessels trying to

load at the same time but there were not enough loaders,

cranes and trucks. In addition, because of the intense

demand, trucking and loading charges went up threefold.

Local observers say that after the log export ban was

announced the MTE had urged buyers to quickly arrange

shipping but many buyers either thought that the ban

would be rescinded or the deadline would be extended and

were caught with too many logs to ship as the deadline

approached.

Analysts estimated that as much as 90,000 cu.m of export

logs may remain unshipped but it is still too early to have

accurate figures.

The log export ban was the most drastic action ever taken

by the Myanma Timber Enterprise during its 66 years of

operation. The government had wanted to stop exporting

logs and promote the export of value added items since the

late 1990‟s, but the need to earn foreign exchange meant

the log export trade was allowed to continue.

But as forest resources declined the government had no

choice but to call an end to log exports.

The following table shows the shipments made during the

fiscal year from April 2013 to March 2014.

Businesses to close for New Year holidays

April is the beginning of the new fiscal year in Myanmar

as well as the month in which the Myanmar New Year is

celebrated. This year the New Year holidays will last

about 10 days from 12 April.

The MTE is expected to hold a tender and open tender sale

around 28 April. Tender sales are usually conducted on the

last Monday of every month with open tender sales

interspersed during the month.

Logs purchased during the April 2014 tenders will be only

for local manufacturing and as usual will be priced in US

Dollars.

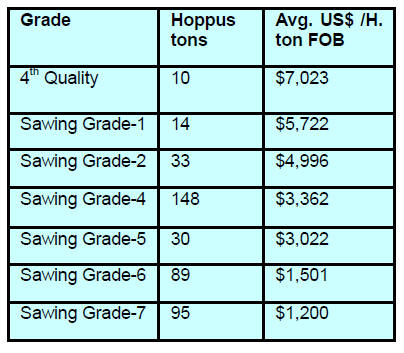

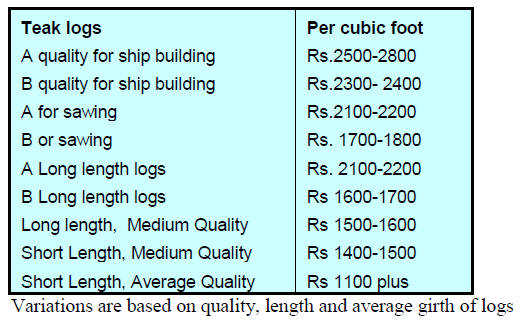

Past log tender prices

The following regular items were sold by competitive

bidding on 10 and 21 March 2014 at the Myanma Timber

Enterprise (MTE) tender hall. April auctions for domestic

endusers will open at month end.

Teak sales

The following grades were sold by competitive bidding on

10 and 21 March 2014 at the Myanma Timber Enterprise

(MTE) tender hall.

Another Singaporean company commissions mill

An early April issue of the New Light of Myanmar, the

state-run English daily has reported that Concord

Industries Ltd. has commissioned and opened a wood

processing industry in Yangon.

Singapore based Concorde Industries is planning to mill

10,000 tons of wood annually for export to Europe. The

opening ceremony on 30 March was attended by the

Union Minister for Environment Conservation and

Forestry.

6.

INDIA

Rupee firmer against the US dollar

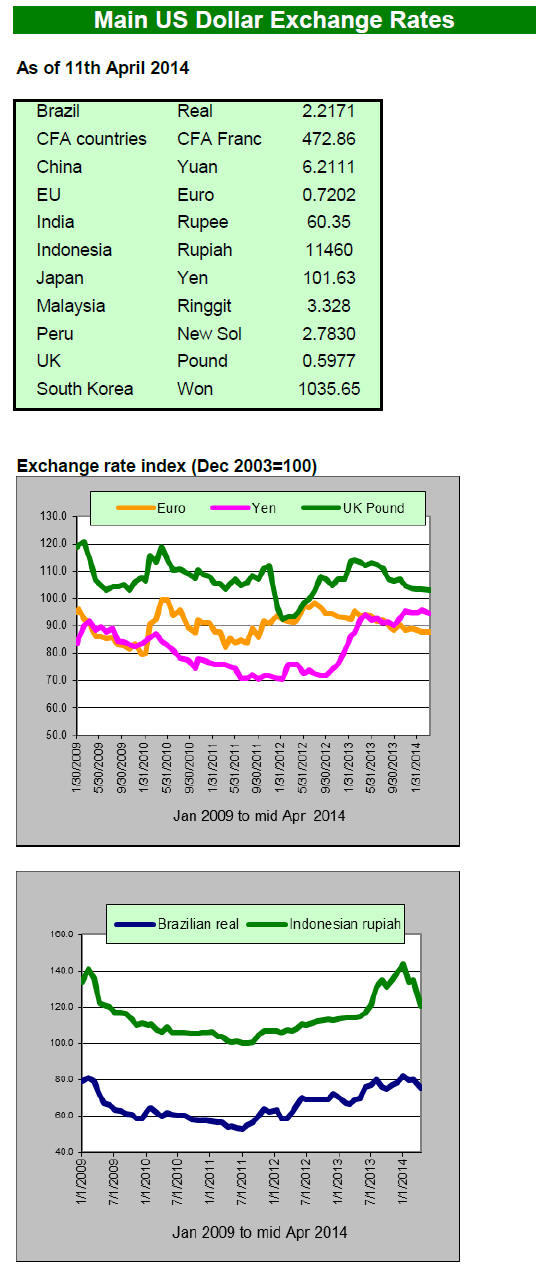

The rupee strengthened more than 3% in the first quarter

of this year, the biggest gain since the third quarter of

2012. To the surprise of analysts the exchange rate hit an

eighth month high of 59.60 per dollar on April 2 on the

back of moves by the Reserve Bank of India to stem the

rate of inflation and correct the current account deficit.

The recent optimistic IMF report on the Indian economy

along with prospects for an increase in investment after the

election is likely to further stimulate capital inflows.

Economic growth forecasts from the IMF

In its latest World Economic Outlook (WEO), the IMF

says it expects the Indian economy to expand by 5.4% in

the 2014-15 financial year and that the pace of growth

could improve to 6.4% in the following year.

India‟s recovery will be supported by a stronger world

economy, improving export competitiveness and policies

encouraging investment says the IMF.

Efforts by the Reserve bank of India to slow the pace of

consumer price inflation are likely to have a lasting effect

and could bring inflation down to 8% in 2014-15 and to

7.5% in 2015-16. For the past fiscal year inflation came in

at 9.5%.

In a press release the IMF said “Overall growth is

expected to firm up on policies supporting investment and

a confidence boost from recent policy actions, but will

remain below trend. Consumer price inflation is expected

to remain an important challenge, but should continue to

move onto a downward trajectory.”

Weak domestic and international demand, high interest

rates and the poor pace at which investments have

proceeded because of delays in government approvals

have added to the problems in the economy.

See:

http://www.imf.org/external/np/tr/2014/tr040814.htm

Launch of new housing market index

The Indian real estate market remains weak as consumers

are still anticipating residential property prices will

continue to fall.

It is difficult to judge trends in the Indian housing market

as statistics and analysis of the market are not widely

available.

Until recently the National Housing Board's RESIDEX

and RBI's Housing Price Index (HPI) were the only

available indexes. The fact that this segment of the

economy is so poorly researched is a surprise as

investment in private residential properties is estimated to

have contributed about 6% to GDP in recent years.

The Indian Institute of Management, Bangalore (IIMB)'s

Century Real Estate Research Initiative (CRERI) has

joined forces with MagicBricks (MB), a major online real

estate portal to fill the data gap on the Indian real estate

market through the publishing of a Housing Sentiment

Index (HSI).

For more see:

http://www.magicbricks.com/iimb-hsi/

The Magicbricks website says “The IIMB MB HSI is a

sentiment index of the Indian real estate market that aims

to capture buyer „mood‟ and serve as a leading indicator of

residential real estate market performance.

The first inaugural report was released in the month of

October 2013 and captured sentiments across eight cities.

The latest report covers 10 cities and includes a

comparative seller‟s survey as well.”

The latest HSI says “the pace of weakening sentiment is

slowing with consumers now understanding that prices

have reached the lowest values and are preparing to buy.

However, a stable political environment could be a trigger

for enhanced transactions.”

E-auction system requires further development

The efforts by the Forest Department to adopt an e-auction

system have run into difficulties and teak sales have been

delayed. Until the problems in the system are addressed to

the satisfaction of the Department and buyers the old

system of „physical‟ bidding was reintroduced for auctions

at the Dangs and Valsad Divisions where approximately

6,000 cu.m of teak and 2,000 cu.m of non-teak hardwoods

were offered for sale.

Average prices recorded at the most recent auction are as

follows:

Subdued demand in the domestic building industry

and a

pause in public works as well as private building projects

resulted in lower auction prices. However, almost all log

stocks were sold as sawmills needed to restock, having

utilised previous stocks during the monsoon period when

there are no auctions because harvesting is restricted.

Good quality non-teak hard wood logs such as Haldu

(Adina cordifolia), Laurel (Terminalia tomentosa), kalam

(Mitragyna parviflora) and Pterocarpus marsupium, of 3-4

m length and having girths of 91cms and above were

selling at Rs.600-900 per cu.ft. Medium quality logs

moved at around Rs300-600 per cu.ft.

Due to upcoming elections the next log auctions will be

after 16 May.

Teak sales in Central Indian forest depots

Approximately 3,000 cu.m of teak logs were sold at the

Timarni, Khirakia, Ashapur and Narmada nagar depots in

Central India. This year the monsoon was longer than

usual so logging was affected and the volumes for auction

were lower than normal.

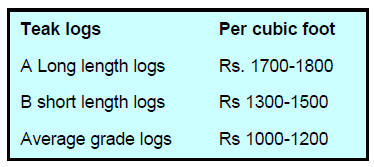

Prices at the recent auctions are shown below.

Imported teak prices

The flow of imported plantation teak logs and sawnwood

has been steady but sales of domestic plantation teak from

the Western region were delayed which helped importers

dispose of accumulated stocks of imported teak.

Current C & F prices for imported plantation teak are

shown below.

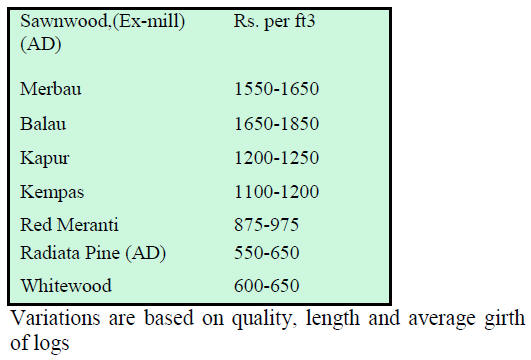

Enduses have to find alternatives to balau

As was reported earlier, demand for balau currently

exceeds the available supplies so that prices have risen.

To fill the gap in availability of balau, species such as

resak which is similar in appearance to balau, is in

demand. Analysts welcome this as a positive development

in utilisation of lesser used species. Red Meranti continues

to be popular with door and window manufacturers.

Prices for air dry sawnwood per cubic foot, ex-sawmill are

shown below.

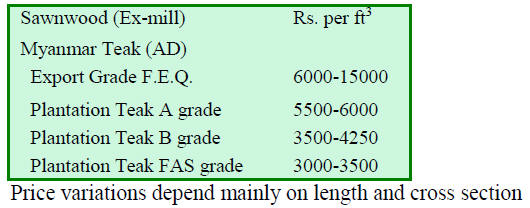

Myanmar teak processed in India

Export demand for teak products is firm but domestic

demand is still slow and prices remain unchanged as far as

sawn teak is concerned.

Prices for logs from Myanmar have risen sharply in recent

weeks as Indian mills accumulated stocks in advance of

the log export ban in Myanmar.

US hardwoods finding wider acceptance

The American Hardwood Export Council has reported an

improvement of 8% in exports of American hardwoods

last year.

American tulipwood logs for production of face veneers

have found a ready market in India as an alternative to the

popular gurjan from Myanmar. It is anticipated that Indian

demand for American hardwoods will rise as the local

millers become more aware of their suitability.

US hickory is being widely used by the Indian tool handle

industry and white oak, walnut, maple and ash are

becoming popular with furniture, door, interior joinery and

flooring manufacturers.

In the Indian market for thermally modified American ash

decking and cladding is expanding.

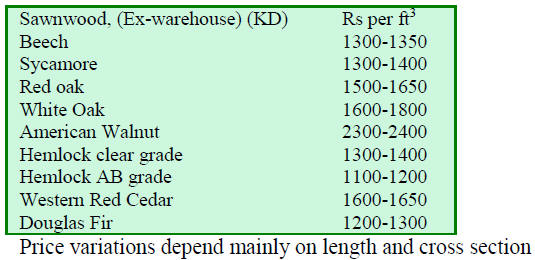

Imported sawnwood prices

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

Builders get a boost from rural housing demand

In recent years manufacturers of building materials have

extended their distribution networks in rural India. Access

to rural areas has become easier as the road networks are

improving and construction activity in the rural areas has

expanded.

This year agricultural production was good providing

farmers with more disposable income much of which is

being spent on housing. Rural housing growth has been

given a boost by the rise in Government spending on its

„Indira Awas Yojana project‟ which helps people own

their own home through subsidies.

Expansion in the rural housing market is also good for the

plywood sector which anticipates improvement in the

housing market after the general election.

7.

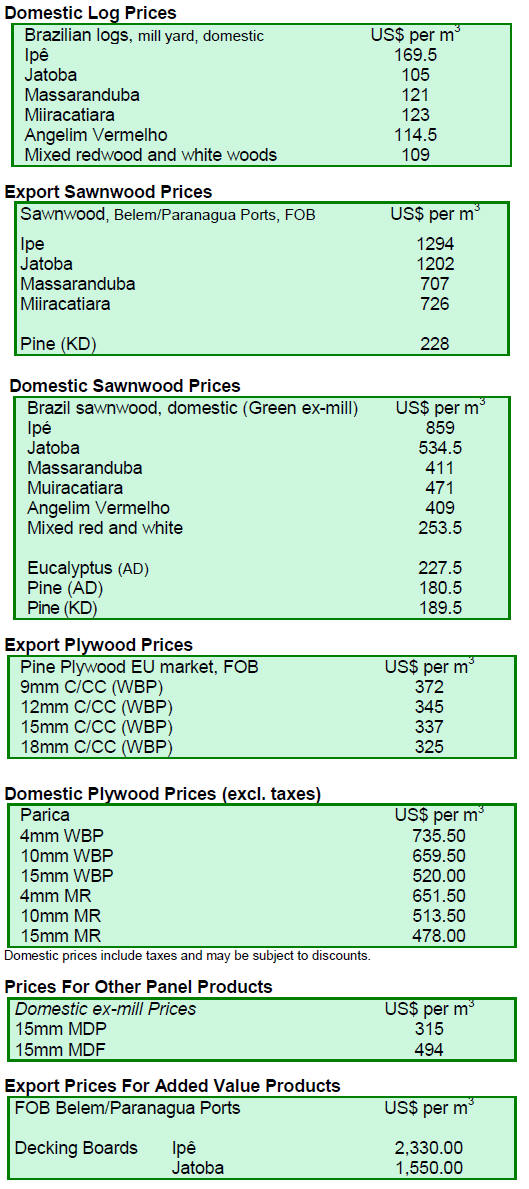

BRAZIL

New timber enterprise in Acre

In late March the Acre government opened a joint publicprivate

sawmill facility. The new plant is located in Cruzeiro

do Sul municipality and cost around R$ 6.5 million. At full

capacity the mill will be capable of processing 80,000 cu.m of

wood per year and will provide jobs for 350 workers.

Initially logs will be sourced from the Havaí Forest

Settlement Project (PAF-Havaí), located in the municipalities

of Rodrigues Alves and Mâncio Lima. About 80 families in

the PAF settlement have licenses to utilise plots for

agriculture and logs will be sourced from these areas when

cleared.

The company managing the new enterprise is Soar Forest of

Juruá S/A in partnership with the government, through the

Business Agency of Acre (ANAC).

Monitoring of forests under management in Amapá State

Forests under management in the state of Amapá will be

monitored to assess the impact of logging and this will be

supported by the Guiamaflor project. The goal is to monitor

the forest in the area around Porto Grande (102 km from the

capital Macapá).

Staff of the Guiamaflor project will record and

analyse pre

and post-logging activities using methodologies developed in

French Guyana, Amapá and Amazonas.

The Guiamaflor project includes researchers from the

Brazilian states of Amazonas and Amapá, French Guyana

and France, all members of the International Tropical

Managed Forests Observatory. This organization has

conducted similar studies in Africa and Asia.

According to the Brazilian Agricultural Research Corporation

(Embrapa), the monitoring exercise aims to assess the

recovery of logged areas so as to design the most appropriate

forest management practices.

Previous studies in South America indicate that forests in the

Amazon recover well from logging and this is put down to

the high rainfall according to Embrapa.

Furniture exports to Argentina decline

According to the Bento Gonçalves Union of Real Estate

Brokers (SINDIMÓVEIS) Argentina was the main export

market for furniture from the state.

However, exports in 2013 were, once again, lower than a year

earlier and at R$ 9.79 million were down almost 60% on

levels in 2010.

In contrast, furniture exporters in the State of Rio Grande do

Sul are diversifying markets and have had success in new

markets in Latin America such as Colombia, Bolivia and

Peru; in Africa, such as Namibia and Angola; and in the

United Kingdom.

Furniture exports from Rio Grande do Sul account for around

30% of total furniture exports from Brazil which totalled

about US$ 211 million in 2013.

Furniture imports into the state of Rio Grande do Sul in 2013

grew 23% in contrast to the 13% growth for the country as a

whole. China accounted for around a third of all Brazil‟s

furniture imports.

Rondônia will increase planted forest areas

The Secretariat of Environmental Development (SEDAM) in

the State of Rondônia is strengthening the forest sector to

secure an important energy and timber resource for the State.

According to SEDAM, the plan is to increase the forest area

by 75% over three years beginning in 2014.

In 2003 the Rondônia‟s forest sector traded approximately

54,000 cu.m of roundwood from natural forests including

cuiabano pine (Schizolobium amazonicum) and caroba

(Jacaranda cuspidifolia).

Eucalyptus and teak plantations are extensive in the state and

have caught the eye of foreign companies. A Swedish

company already has a contract for the purchase of 6,000

cu.m of teak from Rondônia.

Analysts say the ports in the state (Manaus and Itacoatiara)

have advantages compared to ports in other states mainly in

terms of easy access, fast truck turn-around, efficient loading

and good shipping services to the United States, Europe and

Asia.

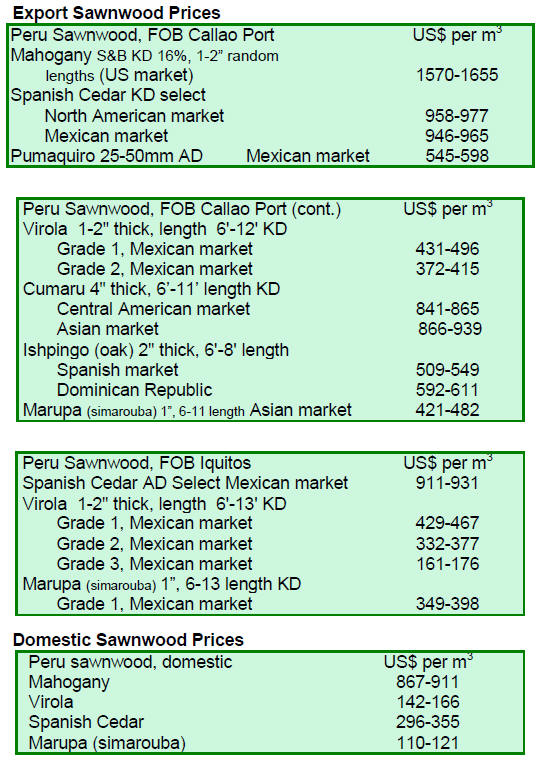

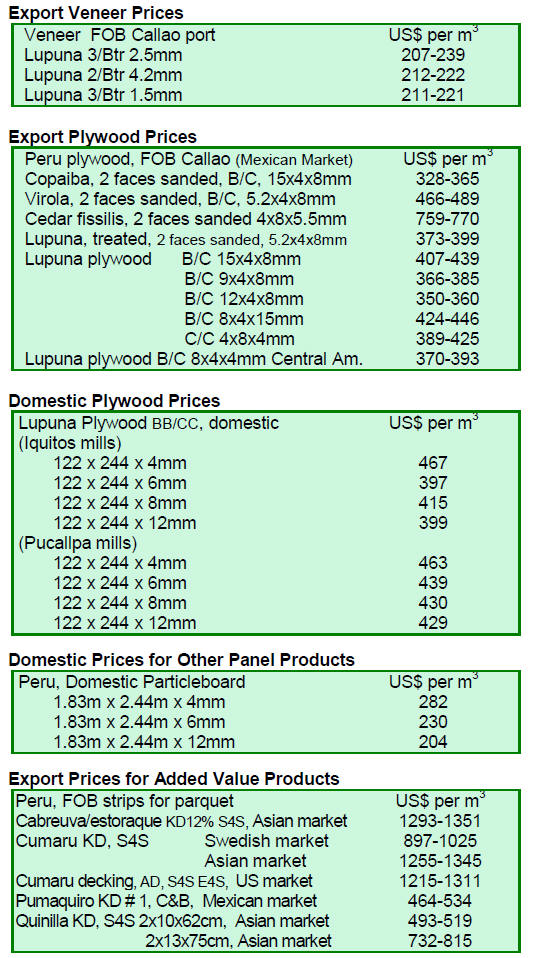

8. PERU

Forestry should contribute more to GDP

The head of the General Directorate of Forestry and

Wildlife (DGFFS), Fabiola Muñoz, said the Peruvian

wood products and forestry sector could contribute more

to the economy noting that currently the sector contributes

less than 1% toGDP.

He said "there are 9 million hectares of deforested

land

and 10 million hectares suitable for reforestation and in

each high value timber plantations can be established.

The potential native species for planting were identified as

mahogany, cedar, capirona bolaina, pashaco, and marupa.

Among the exotic species highlighted as having potential

are teak, pine and eucalyptus.

Forest law should be approved by November

The head of the Directorate of Forestry and Wildlife

Ucayali, Marcial Pezo has announced that the forthcoming

concession bidding process will involve new forest areas.

He also mentioned that the forestry law should be

approved in November this year. Issues of concern to

indigenous communities are currently being discussed.

Greater utilisation of Amazon forest resources could

aid war on drug trafficking

On March 27 , the Governing Board of the Association of

Exporters (ADEX), was invited by the President of the

Council of Ministers, René Cornejo, to provide a brief on

the activities of ADEX committees where immediate

government action is required to improve the

competitiveness of different export sectors.

ADEX Chairman, Erik Fischer, welcomed this opportunity

and emphasized that sustainable utilization of the

country‟s Amazon forest could generate 400,000 skilled

and unskilled jobs and that exports could be increased. He

noted that job creation in the Amazon regions of Peru

would combat drug trafficking and illegal mining.

9.

GUYANA

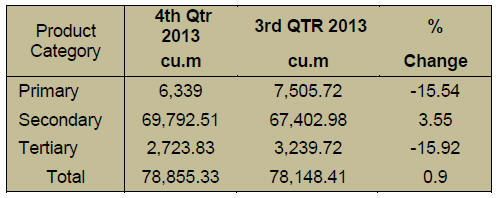

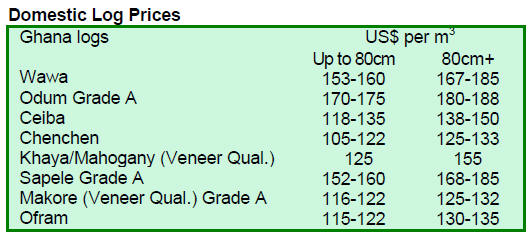

Firm demand in Asian markets

Demand for logs in Asian countries remained strong in the

period reviewed export prices for greenheart and

purpleheart logs were satisfactory.

Greenheart Standard Sawmill quality logs attracted prices

of US$200 per cu.m FOB, up from the US$140 in

previous contracts. Purpleheart Fair Sawmill quality logs

earned US$150 per c.m FOB. There were no exports of

mora logs during the period reviewed.

However exports of wamara (Swartzia leiocalycina) logs

increased and FOB prices ranged from US$120 to US$150

per cu.m.

Sawnwood exports have been encouraging and prices have

been favourable, making a valuable contribution to overall

export earnings. Undressed greenheart (Prime quality)

FOB prices moved from US$954 to US$1,058 per cu.m

and the Middle East and New Zealand were prominent

markets for this product.

Undressed Select quality greenheart FOB prices also

improved from US$910 to US$1,060 per cu.m. Europe

and North America supported Select quality greenheart

exports.

Demand in Caribbean markets lifted the price of

Merchantable Undressed greenheart and prices moved to

as much as US$615 per cu.m FOB. However, in the same

markets prices for Sound quality sawnwood fell from the

US$783 in March to US$594 per cu.m FOB.

Undressed purpleheart Select quality sawnwood prices

ranged from US$721 to US$1,080 per cu.m depending on

the particular market.

Sharp decline in FOB prices for mora

Demand for mora recently weakened. Undressed mora

Select quality sawnwood FOB prices fell sharply from

US$954 to US$500 and Merchantable quality prices

dropped from US$594 to US$509 per cu.m. Australia, the

Caribbean and Europe were the major markets for

Guyana‟s mora sawnwood. In Addition to sawnwood

sales, mora Sleepers/Crossings were exported to the

Caribbean attracting prices as much as US$570 per cu.m

FOB.

Dressed greenheart FOB export prices moved up slightly

in recent contracts from US$1,060 to US$1,102 per cu.m.

Dressed Purpleheart price were unchanged from the

previous period. Dressed greenheart is popular in the

Caribbean markets.

Construction Piling and Transmission Pole prices

climb

Plywood FOB prices eased slightly from US$ 584 to US$

578 per cu.m but continued to maintain a footing in

Central and South American markets.

Greenheart Piling Select category commanded a fair FOB

price in recent contracts, earning US$390 per cu.m, while

in the Sound category attracted a price of US$ 388 per

cu.m. North America was the major market for this robust

timber product.

The Caribbean was the major export destination for Poles

and Posts during the period reviewed. Wallaba Poles

attracted FOB price of US$833 per cu.m. while wallaba

Posts earned US$667 per cu.m FOB.

Marketing Council promoting Guyana’s andiroba

Crabwood (Carapa guianensis) commonly known as

Guyana‟s mahogany is available in commercial quantities

in Guyana. The international trade name for this species is

andiroba.

Crabwood is one of Guyana‟s prime furniture species

being appreciated for its natural rich aesthetic properties. It

is an excellent alternative for Mahogany and can also be

used for interior applications. This highly durable timber is

in great demand on the local market and is being promoted

in international markets.