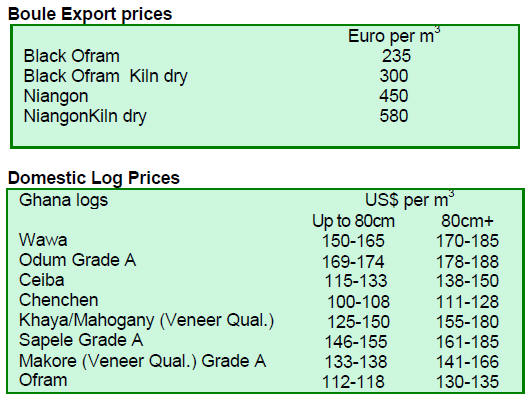

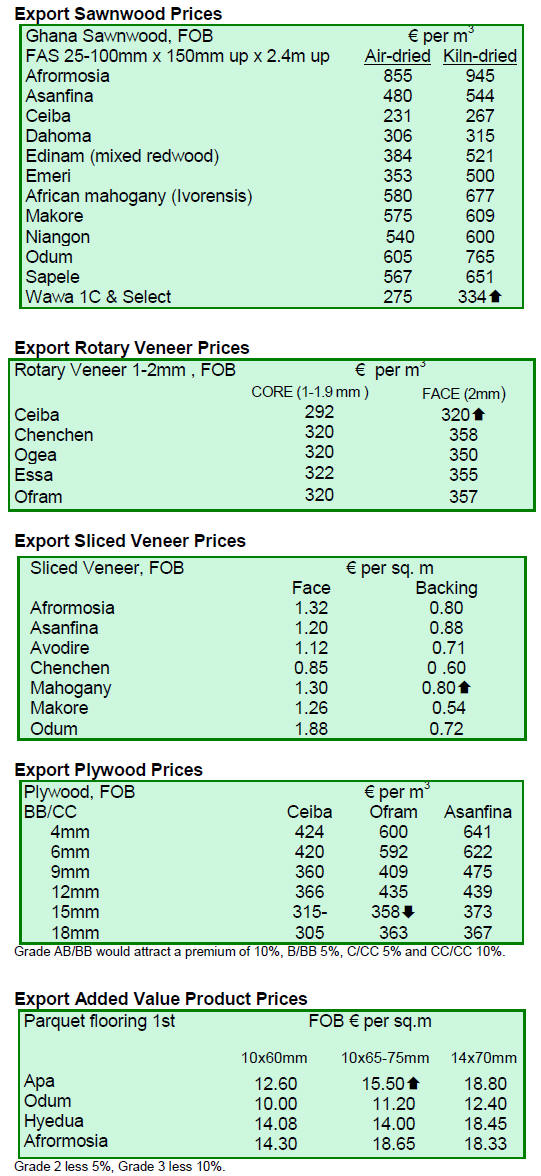

2. GHANA

Woodworkers Association fears VPA means

job losses

Members of the Takoradi Wood Workers Association are

concerned that there may be job losses when the VPA is

implemented in 2014 even though its supporters claim it

will provide new market opportunities. The Ghana

Forestry Commission is now working to allay the fears of

association members saying they appear to have

misconstrued the concept of the VPA.

At a stakeholders meeting in Takoradi, the Trade and

Industry Manager at the Timber Industry Development

Division (TIDD), Mr. Peter Zormelo, explained the VPA

is to improve transparency and accountability by ensuring

that timber products exported to the EU from Ghana have

been legally acquired, harvested, transported and shipped

in compliance with local laws.

He advised association members to ensure they register

their operations in order to acquire vendor licences to do

legitimise their businesses.

To protect members from possible loses that might be

associated with the VPA implementation the National

Secretary of the Domestic Lumber Trade Association of

Ghana (DOLTA), Mr. Afreh Boakye, suggested there is a

need for the GFC to ensure a regular supply of legal

timber to the local market from established sawmills and

artisan millers.

New team of specialised prosecutors for forest

offenders

The GFC and the Attorney General‟s Department has

provided specialist training on forest and wildlife laws to

more than 25 public prosecutors so quick and tough legal

action can be taken on those breaking the country‟s forest

and wildlife laws.

The trainees were taken through 8-weeks of intensive

training in criminal law and procedure, introduction to the

Forestry/Wildlife laws common offences and courtroom

procedures.

The mandate granted the new prosecutors by the Ministry

of Justice and Attorney General forms part of measures to

combat illegal exploitation of forest and wildlife

resources.

At the trainees passing out ceremony the Chief Justice,

Mrs. Justice Georgina Wood, commended the Forestry

Commission for this bold initiative and said the move was

necessary to protect the environment and save the country

huge financial loses.

The Minister of Lands and Natural Resources, Mr. Alhaji

Inusah Fuseini, said the successful training of specialised

prosecutors was timely to arrest the threat to the

sustainability of the country‟s forest and wildlife

resources.

¡¡

3. MALAYSIA

Reduced fuel subsidy will push up

production costs

The Malaysian government has announced a reduction in

fuel subsidies. From 2 September the subsidy will be

reduced by 20 sen a litre on the most popular grade of

petrol (RON 95) which, say analysts, will push up prices

by around 10.5%.

Subsidies on diesel will also be reduced by 20 to 80 sen a

litre which is expected to push up industry transport costs.

Most analysts in Malaysia say that the increase in fuel

prices could push inflation up to 2.2% for the year from

the projected 2.0%.

The Malaysian government has justified the change on the

grounds that it needs to rationalise subsidies and that

failure to do so could push the country into financial

difficulties.

Researchers at AmResearch said ¡°in 2013 the government

has set aside a staggering RM24.8 billion or approximately

11.9% of total revenue to fuel subsidies¡±. At current

exchange rate, this works out to roughly US$7.5 billion for

2013. The budget deficit was 4.5% of the country‟s Gross

Domestic product (GDP) last year.

Malaysia‟s high budget deficit was cited as one of the

reasons why last year the international rating agency,

Fitch, lowered Malaysia‟s rating to negative from stable.

While most Malaysians understand the need to cut

subsidies for better fiscal management they are also

bracing themselves for a series of price hikes ranging from

transportation to food costs.

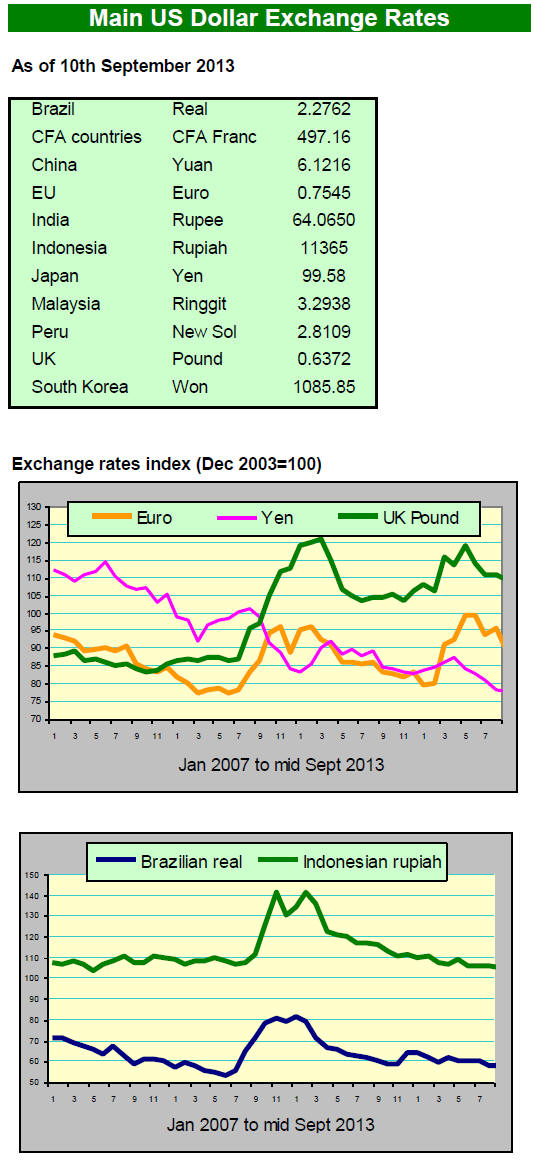

Making matters worse for consumers is the weakening

ringgit against the US dollar (as much as 9% in the last

two months) making imports more expensive.

Industry analysts suggested the changes will result in

higher logging and production costs in the timber industry

but it is too early to foresee if the increase can be absorbed

or whether they will try and pass on the extra cost to

buyers.

Speedier export license issuance with new online

system

The Sarawak Timber Industry Development Corporation

(STIDC) has launched an improved version of its online

licensing system in an effort improve the efficiency in

issuance of export and import licenses.

At the ceremony launching the new online system, Awang

Tengah Ali Hasan, Minister of Resource Planning and

Environment, said that exports for the first half of 2013

dropped by 2.7% compared to the same period last year.

He further said, ¡°Sarawak recorded exports worth RM.606

billion (approximately US$ 1.1 billion) in the first six

months of this year as compared to RM.705 billion last

year¡±.

Sarawak exported RM 7.5 billion worth of timber products

last year (approximately US$ 2.27 billion).

The drop in export value for this year was attributed to the

economic slowdown in importing countries, particularly in

the Middle East where political uncertainties lowered the

demand for timber.

Major buyers for Sarawak timbers remain as Japan, South

Korea, India, China, Thailand and the Philippines.

Market preferences clearly reflected in average export

prices

The Sabah Department of Statistics has released

sawnwood export data showing that exports from January

to July 2013 were 149 157 cu.m worth RM 217 mil.

(approximately US$ 65.74 million).

The main importer was Thailand taking almost 25%

(37,329 cu.m). China was the second largest importer

accounting for 22,501 cu.m of sawnwood exports. The

third ranked importer was Taiwan P.o.C where January to

July exports totaled 18,866 cu.m worth RM24.0 million.

Average prices in the different markets vary and reflect

preferences for species and grades. In Thailand the

average price was RM1,228 per cu.m, China RM1,484 per

cu.m and Taiwan P.o.C RM1,270 per cu.m.

In contrast, sawnwood exports to Belgium at 3,256 cu.m

were at an average price of RM2,249 per cu.m while the

average price of sawnwood exports to the UK was

RM2,556 per cu.m.

The comparable figure for Netherlands sawnwood imports

was RM2,822 per cu.m indicating that European importers

are buying higher grades.

In the first seven months, Sabah‟s exports of sawnwood

were mainly of two species groups: dark and light red

meranti, meranti bakau (29.6%) and keruing, ramin, kapur,

teak, jelutong, kempas, mengkulang, balau (29.6%).

The data revealed the most expensive sawnwood exported

was kayu malam at an average price of RM3, 346 per cu.m

or about US$ 1,014 per cu.m.

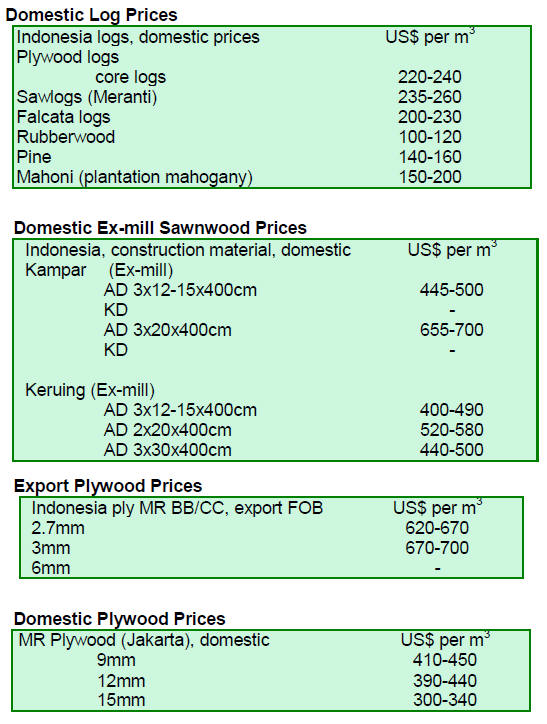

4. INDONESIA

EU report on import procedures for FLEGT-licensed

timber

The EU FLEGT newsletter says that a report on the testing

of export and import procedures for Indonesia‟s timber

and timber products is now available.

The report is titled „V-Legal/FLEGT shipment test ¨C

Lessons learned from the EU visits‟ this and related

documents can be downloaded from:

http://www.euflegt.efi.int/portal/newsletter/

Indonesia and the EU organised a trial shipment of SVLK

certified timber to identify issues hindering the efficient

processing of export and import documents and the future

flow of FLEGT-licensed timber products to EU member

states.

The authors of the report note several significant findings

and the EU FLEGT newsletter provides an example

saying: ¡°for example, a ship will often change

destinations en route or a shipment will change ownership

while at sea.

When this happens, some information in the FLEGT

license no longer matches the actual shipment, which

could lead to delays in customs clearance¡±.

Rampant inflation and falling rupiah hits consumers

Indonesia is gripped by surging in inflation which is now

at its highest level the global financial crisis in 2009.

Adding to the woes of consumers is the weakening rupiah

which had fallen to a low of 11,365 (around -14%) against

the US dollar by mid September.

The combined effect of an outflow of foreign capital

because of uncertain domestic growth prospects and the

inevitable slowing of the US domestic economic stimulus

programme has focused attention on Indonesia‟s

expanding trade deficit.

Expansion of trade finance key to market

diversification

The Indonesian ministry of finance has announced plans to

expand the trade financing scheme to encourage more

exporters to adventure into new markets.

The ministry recognizes that there are risks when

developing markets outside the traditional ones of the US,

EU and China so is seeking ways to support exporters.

An expanded trade financing scheme addressing up-front

finance and insurance for exporters could go a long way to

facilitate market diversification said Finance Minister

Chatib Basri.

¡¡

5. MYANMAR

Plunge in rupee exchange rate puts brake

on trade

Most buyers say the market for teak logs is weak and

almost at a standstill for the non-teak hardwood logs.

Myanmar‟s largest timber buyer, India, is beset by

economic problems and the volatile rupee exchange rate is

disrupting normal trade.

However, some analysts expect the rupee exchange rate to

stabilise and then appreciate again getting back to a rate of

60-61 rupee to the US dollar by year end.

Despite the exchange rate constraints the Myanma Timber

Enterprise (MTE) has issued a circular urging buyers to

promptly pay for and ship logs ready for despatch from

Yangon.

Teak and other hardwood log exports down

A comparison of shipment statistics show that from April

to August this year only 161,050 cubic metres of teak logs

were shipped compared to 208,500 cubic metres for the

same period last year.

Non-teak hardwood log shipments for the five months in

fiscal 2013/14 were 580,000 cubic metres in contrast to

the 650,300 cubic metres last year.

Flow of off-shore financing for loggers uncertain

With the onset of the rain season in Myanmar log

harvesting begins in earnest but some observers are of the

opinion that logging companies will proceed cautiously as

their usual off shore financing and commitments from

buyers may not be forthcoming.

This could mean that only the top quality logs will be

extracted and the lower grades left behind and that harvest

levels will be lower than planned.

To avoid logs being abandoned in the forest the Forest

Department and MTE will be closely supervising logging

operations,

UK trade magazine welcomes reorganisation of MTE

The UK Trade Times Journal (TTJ) recently commented

on the issue of corporatisation of MTE and it was

mentioned that this would require legislation, physical and

financial restructuring could involve staff retrenchment.

The author of the article in the TTJ said that it would be a

huge task for the MTE to adapt to the challenging times.

Myanmar¡¯s overland exports top US$1.9 billion in

just

five months

The Irrawaddy News Magazine has reported that

Myanmar‟s border trade stood at US$1.9 billion in the first

five months of fiscal 2013-14, a rise of US$391 million

over the same period last year.

Myanmar‟s exports to China, Thailand, Bangladesh and

India hit US$1.17 billion from April to August, compared

to US$710 million in imports according to the Xinhua

News Agency.

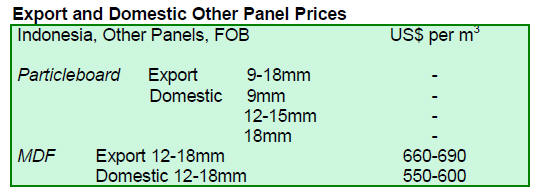

Teak tender prices

The following prices were recorded for teak log sales

during competitive bidding on 23rd and 26th August

during the MTE tender. The next sale will be held in late

September.

6.

INDIA

GDP growth battered

GDP growth in India has fallen to a four-year low. A

growth rate of 4.4% for the April-June 2013 quarter

indicates a sharp slowdown from the 5.4% GDP growth in

the same period last year and is below the 4.8% growth

achieved in the January-March 2013 period.

The weakened rupee has pushed up import costs and the

impact of higher oil prices and continued uncontrolled

imports of gold are beginning to bite. Adding to the deficit

problem are restrictions on mining because of

environmental concerns and because of objections from

people living in the mining areas. These restrictions have

lowered output and exports.

By the end of August the rupee had fallen about 16%

against the USD dollar driving up the cost of imports and

widening India's massive current account deficit. By early

September the slide of the rupee was arrested as the new

Reserve Bank of India governor took office but for how

long the exchange rate will hold is difficult to predict.

Volatile rupee drives up industry production costs

The volatility of the rupee became such a concern to

industry that in late August the Kerala Plywood

Manufacturers Association called a meeting to discuss the

risks to industry from the rapidly depreciating rupee.

A severe shortage of domestic logs has caused prices to

rise sharply and imported logs are becoming more

expensive. In addition, the cost of imported core and face

veneers and resins are rising. When added to rising labour

costs the increase in electricity tariffs and higher

transportation costs due to rising fuel plywood

manufacturers had little choice but the raise prices to

remain viable.

A rise of 15% in prices of all plywood products went into

effect on 1 September and mills in northern India and

other parts of the country have followed suit.

Kerala plymills depend on multiple sources for logs

Plywood manufacturers in Kerala depend on rubberwood

(from plantations which are being replaced), silver oak

logs and other domestic hardwoods to feed their mills.

When domestic sources are insufficient mills use imported

eucalyptus veneers from Vietnam.

Plywood mills in northern India depend mainly on locally

grown poplar and eucalyptus logs and supplement supplies

with gurjan from Myanmar and keruing and other peeler

logs from Sarawak. It is interesting to note that the panel

industry imports eucalyptus logs from as far away as

Uruguay.

Paper industry raises prices in face of escalating

production costs

Rising input costs are eating in the margins of paper

industry and producers in India have announced price

increases of between 5-8% for many products.

Industry observers say domestic log raw material costs for

the pulp industry have increased 10-15%, adding that

imported pulp has also become more expensive because of

the depreciation of the rupee.

Overseas Indians taking advantage of exchange rate to

invest in property

The impact of the current economic crisis in the country is

now being felt by the construction industry as demand for

new homes has evaporated and some now talk of a glut of

houses and sliding property prices.

While this is a tough time for builders and real estate

companies, buyers can secure a bargain and there are

indications that non-resident Indians are taking advantage

of the exchange rate to transfer US dollars to India and

investing in property.

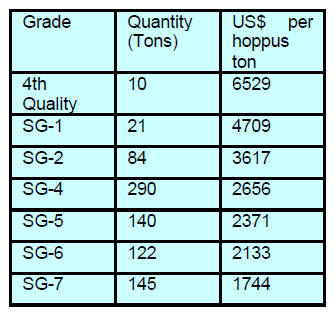

Prices for imported plantation teak

Fluctuations in Indian rupee continue to plague plantation

timber importers. When the rupee fell below Rs60 to the

US dollar importers were finding the landed costs were too

high and could not be passed on to domestic consumers.

Because of the uncertain exchange rate the teak import

business has virtually come to a halt as domestic endusers

cannot accept the higher prices. Analysts say some

companies cancelled orders but that there are still

shipments in the pipeline.

Current C & F prices, Indian ports per cubic metre

are

shown below.

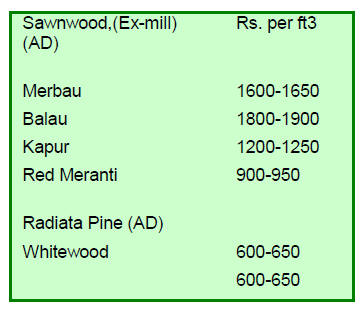

Ex-mill prices for sawnwood

Domestic ex-sawmill prices for air dried sawnwood cut

from imported logs. Prices per cubic foot are shown

below.

Domestic prices for Myanmar teak processed in

India

The effects of higher log landed costs are now reflected in

prices being quoted for Myanmar logs sawn by Indian

mills.

Current prices are shown below.

Prices for imported sawnwood

Ex-warehouse prices for imported kiln dry (12% mc.)

sawnwood per cu.ft are shown below.

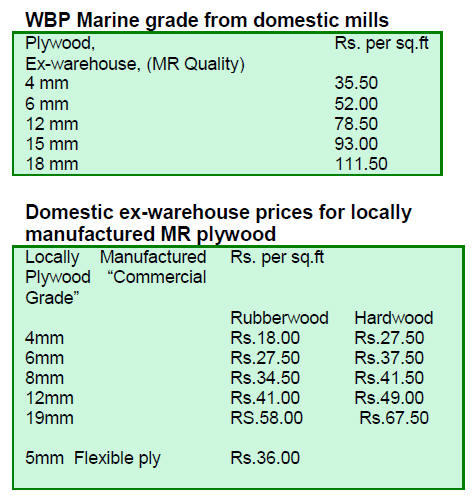

Plywood prices

Prices for imported logs and veneers are rising but

fortunately supplies of domestically grown eucalyptus and

poplar have improved because of investment in plantations

in northern India.

Under the present conditions mills have to revise prices

more often than in the past which is making it difficult for

endusers such as builders and construction companies to

plan ahead.

7.

BRAZIL

Forest Service recommends tax breaks

for industry

A study prepared by the Brazilian Forest Service (SFB)

has found that the tax burden levied on timber products in

the Amazon region is 32% along the entire value chain

from harvesting to final consumer.

The authors propose reconsideration of the tax levels and

even some exemptions to strengthen the Amazon region

forest economy and increase the competitiveness of

tropical timber products.

There are proposals for exemption of the tax on

Contribution to the Social Integration Program and Civil

Service Asset Formation Program (PIS/PASEP), the tax

on Contribution for Social Security Financing (COFINS)

and the tax on Industrialized Products (IPI).

According to SFB, the entire production chain for

Amazonian timber generates some R$7 billion, of which it

is estimated R$2 billion is paid in taxes.

The exemption proposals will involve a loss of revenue for

the government, for example the tax on circulation of

goods and services (ICMS), estimated loss R$ 40 million.

The COFINS tax loss would be R$19 million and the IPI

tax loss would be an estimated R$28 million.

The SFB study says the tax reductions will result in

increased competitiveness of tropical wood products.

IBAMA operation results in huge fines on operators

In August this year IBAMA started operation "Hil¨¦ia

Patria" in Buriticupu, Eastern Amazon, he aim of which is

to combat trade in illegal timber.

In less than a month more than 4,000 cubic metres of

illegally harvested timber was seized in indigenous

reservation areas in the Western region of Maranhão state.

The amount of wood seized in the operation is said to be

equivalent to 110 truck loads. Fines amounting to R$2.3

million were levied on those handling and transporting the

illegal timber and equipment was seized.

IBAMA conducted the August operation in several

municipalities in the indigenous reserves of Auto Turiaçu,

Aw¨¢ and Caru.

In Buriticupu municipality 95 sawmills are registered by

the federal environmental agency but in fact only 25

sawmills were operational of which 22 sawmills had

inadequate administrative procedures involving such

issues as, timber of unknown legal origin, invalid or

expired operating licenses.

Furniture industry seeks to expand Middle East market

opportunities

Some furniture manufacturers in Paran¨¢ state have been

exporting to Egypt since 2007 and this year started to

export to the United Arab Emirates (UAE), Oman and

Algeria. The companies in Brazil are aiming to expand

exports to other countries in the Middle East and will try

to find new markets through participation in the „Index

Dubai‟, one of the largest international furniture

exhibitions.

Furniture sales to UAE started after participation by

furniture manufacturers in the Movelpar Fair in Paran¨¢

state held in March 2013.

A furniture company located in Arapongas municipality,

one of the largest centres for furniture production in

Paran¨¢ State, produces around 36,000 pieces of furniture

per month and generates around 12% of its turnover from

exports.

This company sells to about 20 countries, including Chile,

Peru, Paraguay, Uruguay, France, French Guyana,

Namibia, Angola, South Africa, and Mozambique. Chile

and Peru are the largest markets. The products for export

are wide-ranging, such as home theater, racks, shelves,

countertops, and other furniture for living room and home

office.

Brazil, the exciting emerging consumer market

¡°After a remarkable decade of steady growth and

economic stability, Brazil has emerged as one of the

world‟s most important new consumer markets¡± says a

new report from The Boston Consulting Group‟s Center

for Consumer and Customer Insight.

See:

https://www.bcgperspectives.com/content/articles/center_c

onsumer_customer_insight_globalization_redefining_braz

ils_emerging_middle_class/

The report continues; ¡°Millions of families that not long

ago struggled for subsistence can now afford such basics

as kitchen appliances and mobile phone service. Millions

more now earn enough to pay for private school and a

second car. And in the years ahead, the ranks of such

consumers will swell enormously. By 2020, Brazilian

households will represent an annual market of around $1.6

trillion (3.2 trillion Brazilian real).

The Boston Consulting Group report says, ¡°While the

decade from 2000 to 2010 in Brazil was marked by the

ascent of millions of households out of poverty, the

current decade will be characterised by a massive shift into

the ranks of the middle class and affluent.

Some 5.3 million households will rise from the restricted

to the emergent middle-class segment. An additional 1.6

million and 1.9 million will enjoy established middle-class

and affluent lifestyles, respectively.

Families in the emergent, established, and affluent

segments will make up 37 percent of Brazilian households

by 2020, compared with 29 percent in 2010 and just 24

percent in 2000. These households will account for more

than 85 percent of incremental spending from 2010 to

2020¡±.

The report goes on to suggest strategies that

companies

could take to gain a foothold in the Brazilian market.

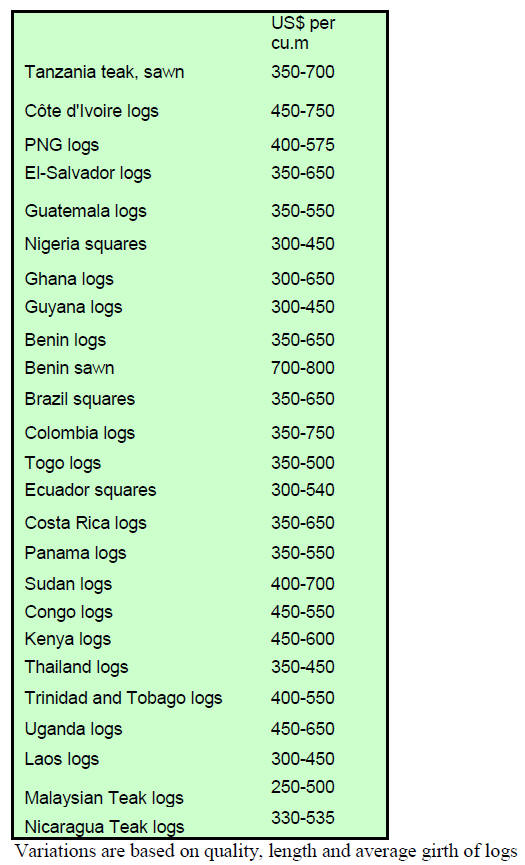

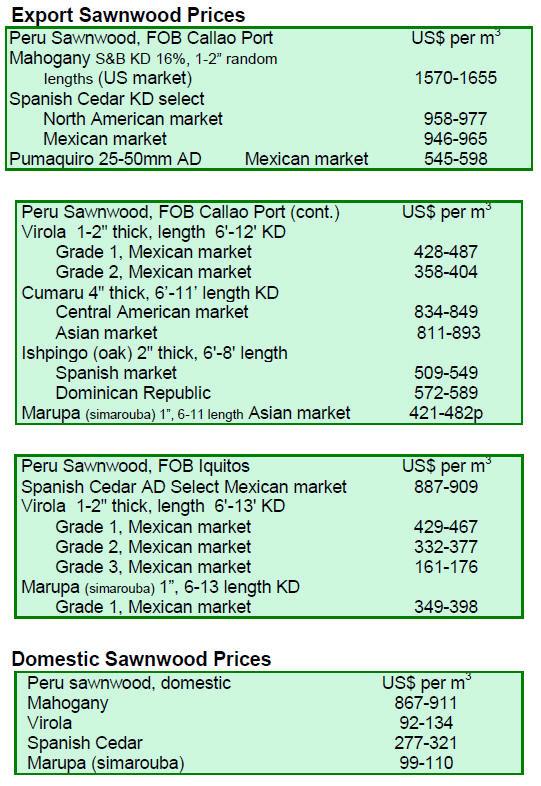

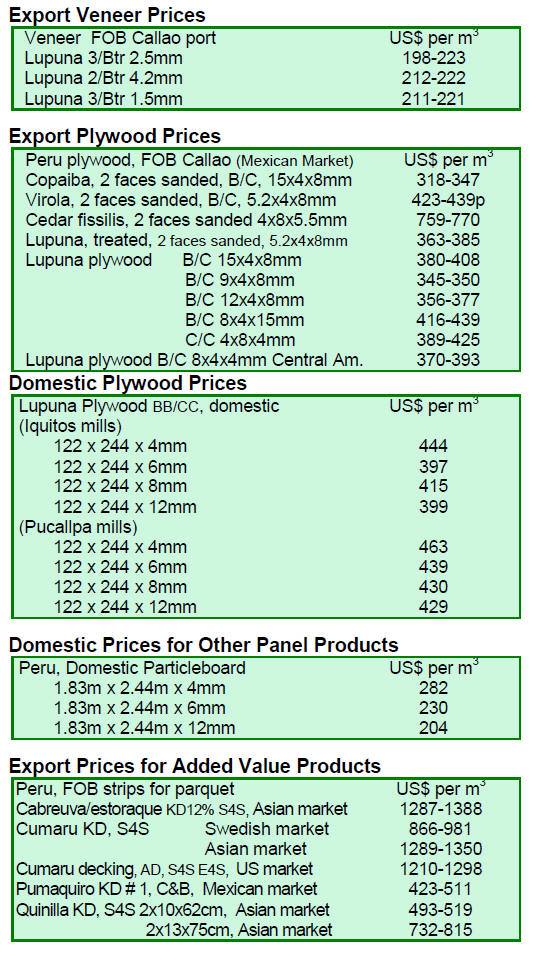

Domestic and export price movements

In US dollar terms many prices fell over the past weeks

dropping an average of around 8% due to exchange rate

movements.

8. PERU

Good news on Chinese economy a boost

new sol

The national currency the new sol strengthened recently

buoyed by the turn-around in the Chinese economy. China

is the biggest market for commodities from Peru. The new

sol exchange rate against the US dollar was 2.7970 on 11

September the highest level for months.

The strong performance of the Chinese economy and

action by the central bank to support the new sol

encouraged buyers to snap up the new sol.

Around 700 thousand hectares are certified in Peru

There are said to be 547,450 hectares of FSC certified

forests in Peru distributed over eight companies and two

forest communities. Six of the certified forest is in Madre

de Dios. Others are Ucayali and Loreto, the native

community of Puerto Esperanza in Ucayali and Belgium

in Madre de Dios.

Legal action taken over deforestation

A company in the Yurimaguas district, Alto Amazonas,

Loreto faces prosecution over alleged clearing of 500

hectares of forest to expand its production of palm oil used

as biofuel.

9.

GUYANA

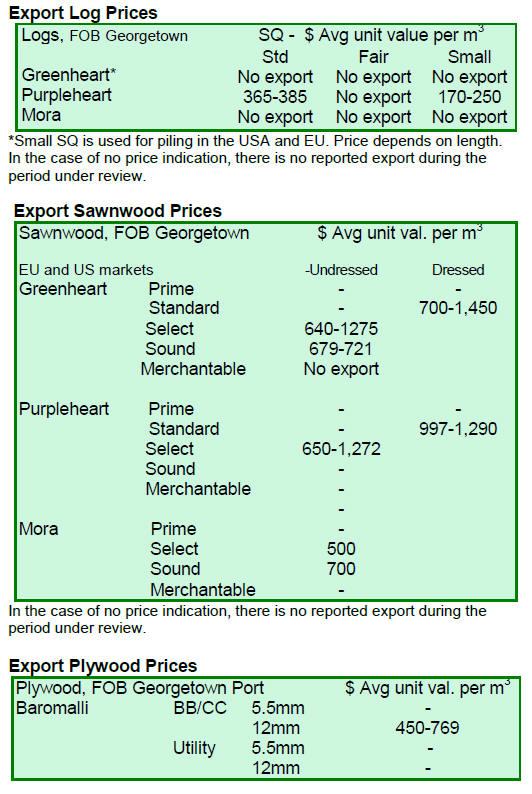

Firm demand for purpleheart lifts prices

During the period reviewed only purpleheart logs were

exported and prices secured were significantly higher for

all categories.

Standard sawmill quality purpleheart logs attracted prices

as high as US$385 per cubic metre FOB, Fair quality logs

were traded at US$300 per cubic metre FOB while Small

quality purpleheart logs were priced at US$250 per cubic

metre FOB.

Some other lesser used species were traded in log form

and these timbers attracted favourable prices in Asian

markets.

Exporter¡¯s confidence returns as demand firms for

sawnwood

Sawnwood exports were positive and favourable prices

were secured in all markets, signalling some improvement

in demand.

Undressed sawn greenheart prices for Select qualities

attracted top end prices of around US$1,275 per cubic

metre FOB, while Merchantable qualities were traded at as

much as US$721 per cubic metre FOB.

The major markets for Undressed greenheart include Asia,

Caribbean, Europe and North America.

Undressed purpleheart sawnwood exports were only of

Select quality and top end prices were US$1,272 per cubic

metre FOB. Caribbean countries such as Trinidad and

Barbados are the main markets for this popular category of

sawnwood.

Undressed mora sawnwood secured fair prices on the

export market with Select quality timber earning US$500

per cubic metre FOB. Sound category mora sawnwood

achieved prices of US$700 per cubic metre FOB and the

main markets for this commercial timber were Asia and

Europe.

Dressed greenheart sawnwood prices remained firm

during the period reviewed holding steady at US$1,450

per cubic metre FOB in the Caribbean market.

In contrast, dressed purpleheart sawnwood export prices

climbed from US$1,124 to US$1,290 per cubic metre

FOB. This species and quality is popular in the Caribbean

and European markets.

Hububalli products feature in added value export sales

Value added products featured in recent export sales with

products such as doors and indoor furniture utilising

Guyana‟s hububalli (Loxopterygium sagotii) proving

popular in the Caribbean and regional markets.

Splitwood (wallaba shingles) earned attractive prices of

US$1,099 per cubic metre FOB in Caribbean markets.

Guyana plywood prices improved in the period reviewed

with top end prices moving from US$615 to US$769 per

cubic metre FOB. The main export markets for Guyana

plywood are the Caribbean and other regional markets.

Regioan meeting urged to provide new input to FAO¡¯s

regional programme

In mid September Guyana hosted the 28th Session of the

Latin American and Caribbean Forestry Commission.

Addressing the gathering the FAO representative in

Guyana, Dr. Lystra Fletcher-Paul urged the participants to

suggest how the FAO work programme in the region can

best be structured to respond to regional priorities.

Governance and sustainable were the main issues

discussed along with measures to address illegal logging.

Guyana has benefited significantly from UN support in

capacity building within the forestry sector to meet

international forestry requirements.