2. GHANA

Journalists briefed on merits of VPA

A workshop organised by the Working Group on Forest Certification,

established to support the Voluntary Partnership Agreement (VPA) process,

has been held in Accra. The workshop was to educate journalist on the VPA as

it is expected to advance the interest of the timber industry in the

country.

The first workshop was one of a series planned to create awareness of the

requirements of the EUTR for the implementation of the VPA which Ghana plans

to finalise in 2014.

The Director of the Timber Validation Division of the Forestry Commission,

Mr. Chris Beeko, talked journalist through the nuances of the VPA

emphasising that illegal logging had caused considerable damage to the

forest cover.

Mr. Beeko said the primary objective of Ghana¡¯s involvement in the VPA is

the strengthening of in-country regulatory systems and to move the country

closer to achieving its national forest policy.

Delayed decision on removing subsidy costing millions

Proposals for an increase in power and water tariffs have been frozen for

almost two years as the regulator has yet to make a decision on the request

from the utility companies, despite the intention of the government to

remove subsidies. The delay in adjusting the tariffs is costing the

government a great deal of money.

In 2012 GH¢809million was spent on utility and fuel

subsidies - and payment of an additional GH¢955.8million was deferred to

2013. The combined obligation is GH¢1.76billion, or 2.4 percent of GDP.

While petroleum subsidies have been removed

outstanding subsidies on electricity and water remain a threat to plans to

lower the current account deficit to 9 percent of GDP this year. The

International Monetary Fund (IMF) has cast doubts that a reduction of the

deficit to 9 percent of GDP can be achieved.

Because of the impact of fiscal rebalancing on inflation the Bank of Ghana

has had to raise interest rates this year to 16 percent.

Forest Management Course Held in Kumasi

A course on bio-economy and sustainable forest management to promote

efficiency in the control and utilisation of the country¡¯s forest resources

has been held bringing together forest managers, researchers, academics and

students.

The workshop was arranged by the University of Eastern Finland (UEF) and the

Forestry Research Institute of Ghana (FORIG) graduate school.

Topics discussed included ecosystems management, forest landscape

restoration, watershed management, multiple use of forest resources,

strategy-based sustainable management and forest pathology.

The Director of FORIG, Dr Victor Agyeman, said the course provided forest

managers with skills and to protect the forest and other natural resources.

Professor Ari Pappinen of the UEF, said bio-economy offered an opportunity

for a paradigm shift in forest resources management and sustainability. He

added that Ghana was the first African country to offer such course at the

graduate level.

¡¡

3. MALAYSIA

Expansion of wood processing should be

based on plantation resources

The Chief Minister of Sarawak, Abdul Taib Mahmud, wants companies in Sarawak

to utilise the available planted forests in the State. He made this call

during the Sarawak Forestry Corporation (SFC) tenth anniversary dinner, as

reported by domestic newspaper, The Star.

The Chief Minister pointed out that for the timber industry to expand there

must be an alternative log supply other than the natural forest because

sustainable harvests are limited and there is no opportunity for expansion.

He has asked SFC to support research and management of tree plantations in

the state, saying the next challenge for the industry in Sarawak is to shift

sourcing raw materials from natural forest to plantations.

Last year, Sarawak harvested 9.45 million cubic metres of logs and in 2011

production was 9.61 million cubic metres.

An ITTO Mission to Sarawak in 1989/1990, made several recommendations for

sustainable management in Sarawak, one of which was to target annual log

production at 9.2 million cubic metres.

SFC Chairman, Dr Yusoff Hanifah, announced the creation of a ¡®planted forest

research and development division¡¯ in the restructured SFC. He further said,

¡°Seeing that there may be gaps in expertise and techniques, there is a need

to collaborate with institutions of higher learning to build capacity in our

own experts¡±.

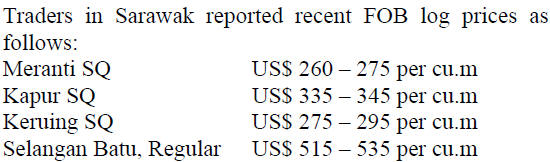

Higher log prices reverse declines in profitability for Sarawak companies

Research by the RHB Research Institute suggests that profitability in the

timber sector in Sarawak is improving due to the recent strong recovery in

log prices. Improvement in the Japanese economic outlook is also encouraging

plywood exporters.

Hoe Lee Leng, a RHB analyst, pointed out that

Malaysian log prices have been rising steadily since April due to a global

tropical hardwood log shortage. Currently, some log prices are up 20 ¨C 30%

year-on-year.

Analysts are of the opinion that the current price

levels will remain firm for the second half of the year and into early 2014.

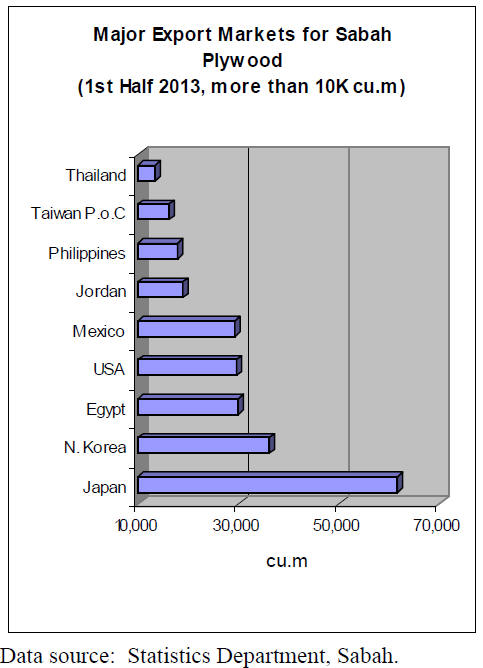

Sabah plywood trade in first half 2013

Sabah plywood exports totaled 274,981 cu.m worth around RM 430 mil. in the

first half of this year. In addition to exports around 53,000 cu.m was sold

to buyers in Peninsular Malaysia and just over 2,000 cu.m was sold to

Sarawak.

Export markets taking more than 10,000 cu.m in the first half of the year

are shown in the figure below. Japan is the main export market for plywood

from Sabah followed by N. Korea.

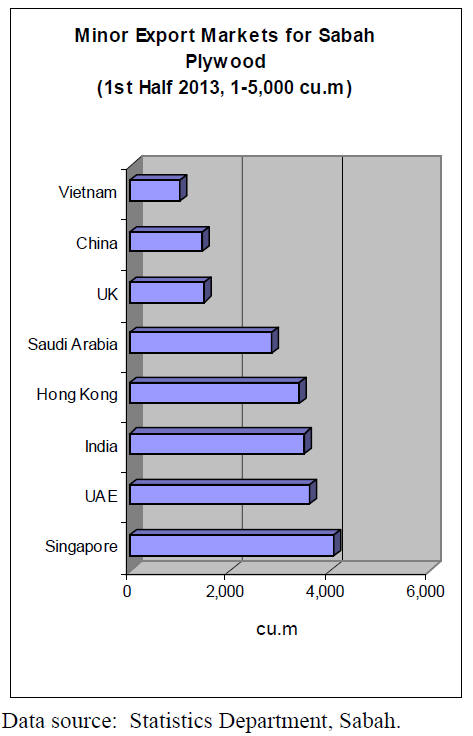

Markets taking up to 5,000 cu.m in the first half

of this year are shown in the following graphic. Other minor markets include

Syria, Australia and Mauritius.

4. INDONESIA

Cash pours in for conservation projects

External funds for conservation projects continue to pour into Indonesia

with Germany being latest country to offer money and expertise to help

rehabilitate national parks.

Forestry Minister Zulkifli Hasan said that Germany had granted Indonesia

euro 8 million to restore parks in Jambi and natural forests in Gorontalo as

these are in a poor condition due to encroachment.

The German funds along with Indonesian investment will restore the national

parks and efforts will be made to empower local communities for the long

term protection of the areas.

Government prepared for second high fire risk season

The government has put in place emergency measures to tackle further forest

fires as second peak in the dry season was forecast for August because the

weather pattern is very irregular this year.

Experts say that because of changes in the dry season weather fires may

occur and smoke may be blown towards Singapore and Malaysia.

The government has introduced new response measures for fire risk areas in

Sumatra and Kalimantan. The measures include preparations for water bombing

and creating artificial rain.

The Environment Minister has said Indonesia will quickly ratify the ASEAN

agreement on Trans-boundary Haze Pollution (AATHP) allowing it to take

action against companies deliberately using fire to clear land.

Indonesia seeks deals with countries need verified legal timber

Indonesia and the European Union (EU) will soon finalise the VPA and

Forestry Minister Zulkifli Hasan said the country is in a position to

penetrate global markets that require verified legal wood products

Indonesia adopted a timber legality certification scheme (SVLK) in 2003 and

this is now mandatory for forest concession holders and industries.

The SVLK was made mandatory to facilitate uninterrupted trade in wood

products with the EU and Indonesia was one of the first countries to

conclude negotiations on a VPA.

Indonesia now aims to conclude bilateral agreements with other countries so

that its trade in wood products can be expanded.

SVLK better than FSC certification in meeting demands for proof of

legality

The Forestry Ministry has said that local wood products companies have seen

little benefit from FSC certification. The ministry¡¯s secretary general Hadi

Daryanto said ¡°Rather than struggling to get certification from voluntary

organisation, firms are better off obtaining the SVLK because they are

unable to export without it.¡±

Hadi made this comment in response to a recent decision by FSC to end all

association with the Asia Pacific Resources International Limited (APRIL)

Group.

Environmental NGOs have criticised APRIL for what they see as the group¡¯s

avoidance of enquiries into alleged deforestation.

Korean company to develop bio-energy resource production in Indonesia

A S. Korean firm, Depian Co. Ltd, is reportedly ready to invest in a wood

pellet production plant in South Kalimantan in cooperation with a local

investor PT Inhutani III, a state firm.

The proposed plant will produce up to 30,000 tons of wood pellets annually

all of which will be imported by S. Korea. At present renewable energy

sources provide less than 1% of Korea¡¯s energy requirements with most being

generated from oil, coal and natural gas.

¡¡

5. MYANMAR

Corporate future for Myanmar Timber

Enterprise

At a gathering on 20th August, MOECAF Minister U Win Tun and Presidential

Adviser Professor Dr. Aung Tun Thet presented their vision for

corporatisation of the Myanmar Timber Enterprise (MTE). Officials from MTE,

Forest Department, and related organisations were present.

Minister Win Tun explained that the planned corporatisation of MTE is not

just a change in name but will require a complete restructuring to keep pace

with the political, economic and social reforms taking place in the country.

Analysts say this is the biggest overhaul ever in the sixty-five year old

history of MTE, which started as the State Timber Board in 1948.

Adviser Aung Tun Thet spoke in detail on what corporatisation was and how it

must be implemented by the MTE, how it would be a challenge for the MTE

staff to adjust and what support various stakeholders could provide during

the difficult transition period.

The emphasis in the presentation was on ¡®why¡¯ and ¡®how¡¯ this change could be

achieved.

The main message was that MTE would remain a state enterprise but be

restructured to run efficiently, generating its own income by introducing

good corporate governance and a sound business management approach.

The concept of corporatisation that was presented is ideally suited to the

changing times in the country. Analysts are of the opinion that the

proponents should plan the transition careful so the concept laid out by the

government adviser is not lost.

Even though no timeframe or strategies through which the change can be

effected have been announced, the MTE will face an upheaval as it may be

asked to effect the change just at the time when the log export ban is due

to come into effect. Managing the log export ban will be a great enough

challenge for the MTE.

Analysts say that while change is welcome it seems ironic that, MTE, a State

Owned Enterprise which has the sole authority for log harvesting in the

country since 1948 could come to a grinding halt not long after the

introduction of the log export ban.

Analysts feel that a big challenge lies ahead for MTE. It is anticipated

that MTE revenue from log sales will drop sharply when the log export ban is

implemented.

Trade deficit climbs sharply

The state run newspaper the New Light of Myanmar quoting the Central

Statistical Organisation reported that Myanmar¡¯s trade deficit reached

US$572 million over the four months April to July in fiscal 2013-14.

Imports were valued at US$3536 million and exports US$2965 million.

However Myanmar posted a trade surplus of 8.65 million U.S. dollars in July.

Total export for July were US$ 798 million while import were US$789 million.

These figures include border trade transactions.

The main export items include natural gas, jade, beans and pulses, rice,

fish, rubber and teak while the main imports were of oil and gas, auto spare

parts, iron and steel, palm oil, pharmaceutical products, plastics,

fertilizer, cement and electronic equipment.

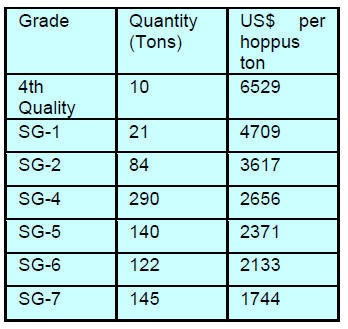

Teak tender prices

The following prices were recorded for teak log sales during competitive

bidding on 23rd and 26th August during the MTE tender. The next sale will be

held in late August.

¡¡

6.

INDIA

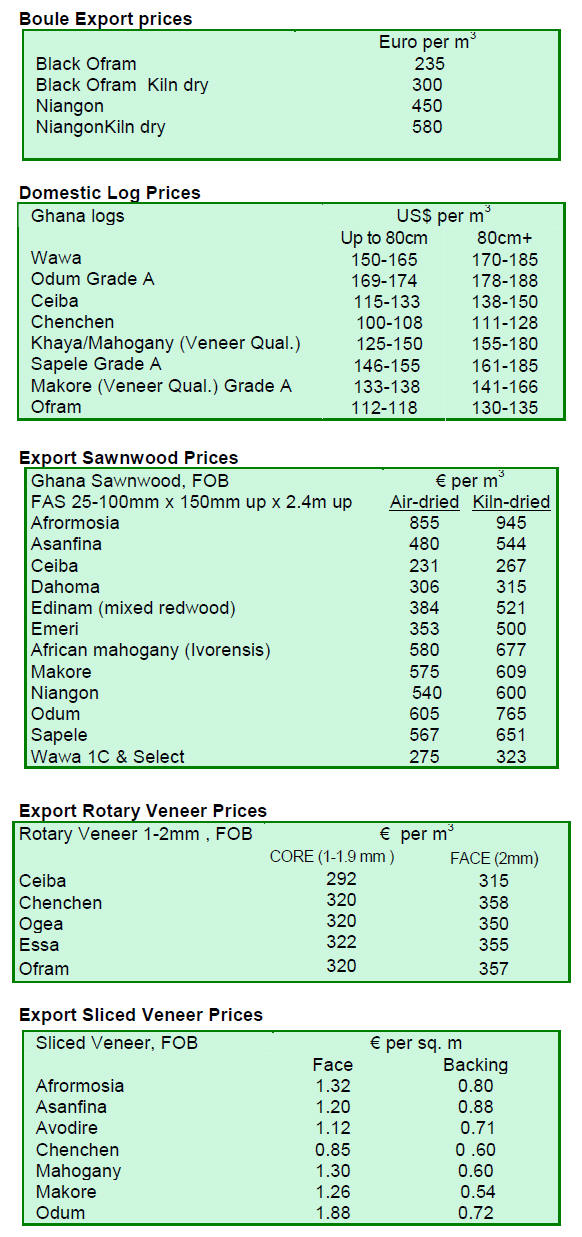

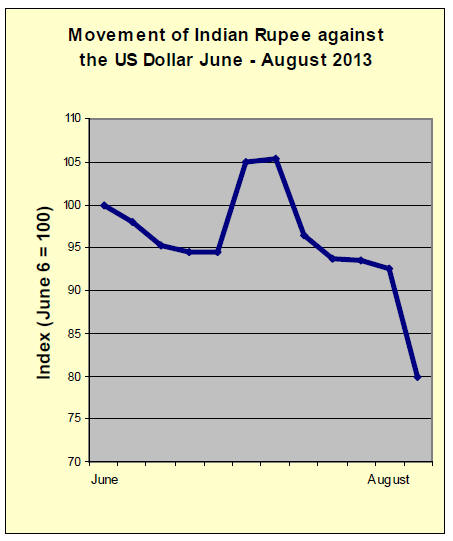

Pace of rupee depreciation catches

everyone by surprise

The rupee has fallen around 13% against the US dollar since mid June and

analysts say, while the depreciation of the rupee is no surprise, the rate

of the current decline was unexpected.

Importers and traders have been actively buying US dollars in anticipation

of further declines in the exchange rate despite the efforts of the central

bank to prop up the rupee.

Since the middle of July, the Reserve Bank of India (RBI) has acted to

support the rupee but these have so far failed instead sending bond yields

surging which adds another risk to the economy.

The rupee fell below Rs67 to the US dollar on 29 August.

Inflation worries as price index soars

The Wholesale Price Index in India rose 5.8% during July 2013 compared to

the 4.9% rise in June 2013 this reflects higher food and fuel prices and the

impact of the rapidly depreciating rupee.

In an attempt to control price inflation import duties on gold and silver

have been raised. Also, the outflow of foreign exchange is being carefully

monitored as part of the RBI efforts to reduce the current account deficit.

Indian exports rose by 11.6% to US$25.83 billion in July and imports were

down by over 6%. Analysts say the monsoon weather has been favourable for

agricultural production which is good news for the economies in rural areas

of the country.

For a full analysis of the current views of the RBI

please see:

http://www.rbi.org.in/scripts/BS_PressReleaseDisplay.aspx?prid=29356

Ambitious plans for processing zone exclusively for imported timber

Plans for a timber processing zone in Paradip on the east coast are being

discussed by the State Government of Odisha, location in red shown below.

The plan for the Paradip zone is modelled on the

Kandla zone. If this project goes ahead it will support expansion of wood

based industries using imported timber to manufacture for the domestic and

international markets.

The indications are that the state government will provide around 200 ha.of

land near Paradip port as well as related infrastructure.

In the first phase it is proposed that the zone will accommodate five large

sawmills, twenty small sawmills, ten plywood mills, ten large processing

factories for furniture, doors, windows and joinery items and around one

hundred small and medium sized enterprises. To facilitate timber supplies

five timber trading centres are also planned.

Paradip port is convenient for cargo arrivals from Myanmar, ASEAN countries

and New Zealand which will result in a cost advantage.

Many local and overseas entrepreneurs are showing an interest in

participating in this wood industry cluster which is expected to provide

direct employment to 12,000 people and bring in investments worth about Rs.6

billion.

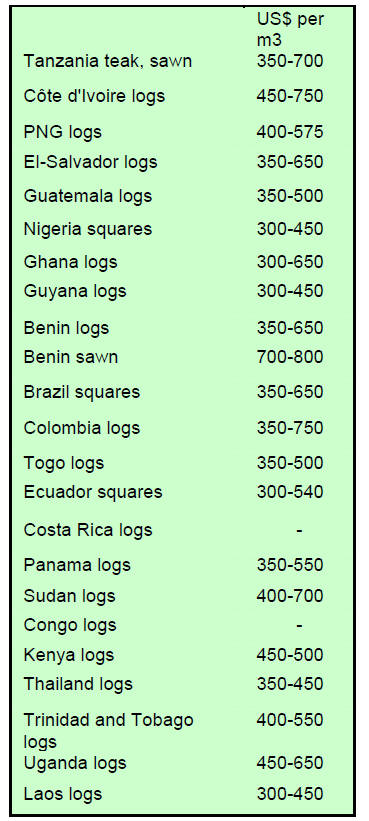

Prices for imported plantation teak

Fluctuations in the rupee exchange rate continue to worry importers but

plantation teak import volumes are virtually unchanged as India¡¯s

requirement for teak is remarkably consistent.

Current C & F prices, Indian ports per cubic metre

are shown below.

Variations are based on quality, length of logs and

the average girth.

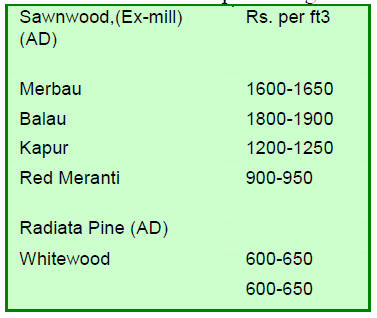

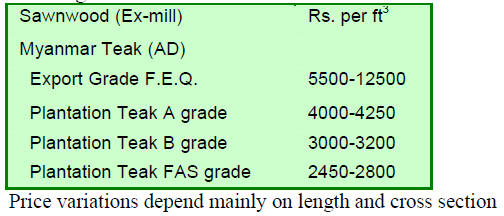

Ex-mill prices for sawnwood

Domestic ex-sawmill prices per cubic foot for air dried sawnwood cut from

imported logs are shown below.

Domestic prices for Myanmar teak processed in

India

Demand continues to weaken but prices remain unchanged.

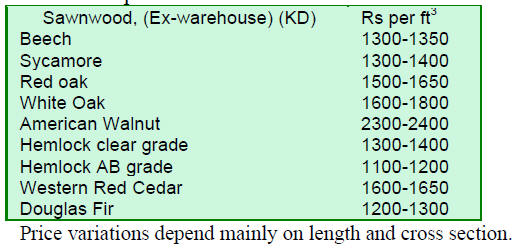

Prices for imported sawnwood

Ex-warehouse prices for imported kiln dry (12% mc.) sawnwood per cu.ft are

shown below.

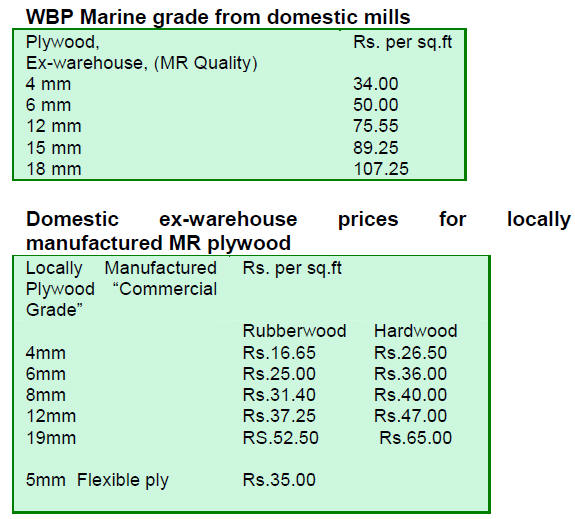

Plywood prices

The shortage of raw material for the manufacture of plywood is becoming

rather acute say analysts. Imported logs are now more expensive because of

the weakened rupee however, despite the higher costs, demand remains firm.

¡¡

7.

BRAZIL

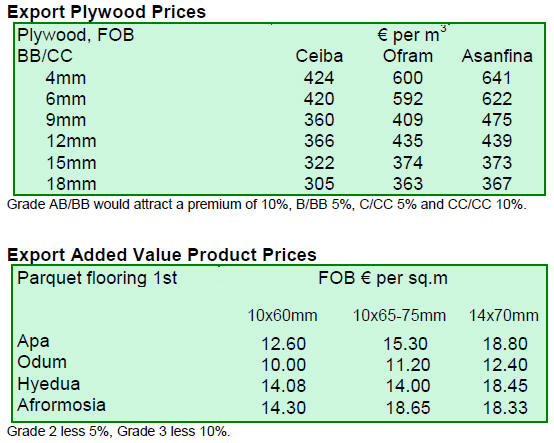

Real hit by exchange market volatility

Unsettled global financial markets are impacting many economies including

Brazil¡¯s and Finance Minister Guido Mantega said recently that volatility is

likely to continue until the US Federal reserve makes clear when stimulus

measures will be withdrawn.

The minister said this during a meeting of business leaders after which the

ministry released a statement, see:

http://www.fazenda.gov.br/portugues/documentos/2013/apresentacao_ministro_lide_26082013.pdf

The most immediate impact of the market turbulence has been felt in foreign

exchange markets where the real dropped to a four-year low against the

dollar in August prompting the central bank to intervene to stem the pace of

real depreciation.

Many analysts are expecting the Brazilian economy

to remain weak despite the efforts of the government to boost investment and

bring infrastructure projects on-stream.

Inflation at the high end of government target

Brazil¡¯s Consumer Price Index (IPCA) fell 0.26% in June to 0.03% in July,

the lowest since July 2010 when it was 0.01%. With the July figure the

accumulated IPCA for the year to-date is 3.18%. Over the past 12 months the

corresponding figure is 6.27%, at the high end of the federal government¡¯s

target of allowing the IPCA to move in a range of between 2.5% and 6.5%.

Decline in furniture production and consumption

An Institute of Industrial Marketing (IEMI) report on the furniture sector

in Brazil presented consolidated data on the furniture sectors in Rio Grande

do Sul state, one of major furniture manufacturing states.

The report notes that furniture production and consumption throughout Brazil

fell in May, production fell 8.5% to 41.4 million pieces. In the state of

Rio Grande do Sul production also dropped but by 9% in the same month to 7.2

million pieces. Production in Rio Grande do Sul accounts for around 17% of

all furniture production in Brazil.

Furniture consumption also fell in May and in Rio Grande do Sul consumption

was 6.9 million pieces, down almost 11% according to the IEMI report.

However, the IEMI reported that the number of workers in the timber and

furniture sector increased by around 1% in May from a month earlier but was

down almost 5% compared to May 2012.

Productivity in the sector also declined says IEMI falling 4.3% in May, but

for the year it has improved some 11%, considerably better than the 3.3% for

the overall manufacturing sector.

Despite the falling output furniture retail sales increased 10.6% in number

of pieces and by 11% terms of value which is considered well above the

average for general retail sales.

Forest concession bids open in Par¨¢ State

The Brazilian Forest Service has called for bids for forest concessions in

the Crepori National Forest (FLONA) located in Jacareacanga, state of Par¨¢.

According to the Ministry of Environment (MMA), granting the harvesting

concession will stimulate the local economy through creating jobs. The

delimitation of the concession areas was made according to management plans

prepared by the Chico Mendes Institute for Biodiversity Conservation (ICMBio).

The concession area is divided into four forest management units (FMUs),

ranging from 29,157 ha to 219,219 ha.

The successful bidders will have the right to manage the areas for

sustainable production of timber and non-timber forest products for 40

years. Public forests are part of the national heritage and are administered

to maintain environmental services that provide and generate socio-economic

benefits.

The call for bids will be open until November, 2013 and interested parties

are required to submit documentation related to capacity and technologies to

be applied as well as pricing proposals.

A minimum US$16.38 is to be offered per cubic metre, a value determined on

the basis of market studies and forecast production costs taking into

account the minimum should be attractive enough to mobilise investment.

Pine plywood big loser in league of export products

In July 2013, timber products exports (excluding pulp and paper) increased

3.1% compared to values in July 2012, from US$ 197.9 million to US$ 204.0

million.

Pine sawnwood exports increased 16.0% in value in July 2013 compared to July

2012, from US$12.5 million to US$14.5 million. In terms of volume exports

increased 16.7%, from 55,200 cu.m to 64,400 cu.m over the same period.

Tropical sawnwood exports fell 12.0% in volume, from 28,400 cu.m in July

2012 to 25,000 cu.m in June 2013 but the value of exports increased 5.9%

from US$13.6 million to US$14.4 million in the same period.

Pine plywood exports declined a massive 21.0% in terms of value in July 2013

compared to July 2012, from US$31.0 million to US$24.5 million. Export

volume dropped 16% from 79,100 cu.m to 66,400 cu.m. during the same period.

Tropical plywood exports remained unchanged at an insignificant 3,900 cu.m

in July.

Mexico one of the fastest growing markets for Brazilian furniture

Companies participating in the ¡®Brazilian Furniture Project¡±, a project

supported by Apex-Brazil, achieved positive results in the first half of

2013.

Exports to target countries reached US$ 40.2 million, a 3% increase over the

same period in 2012. The fastest growing markets this year were Mexico (up

66%) and Peru (up 32%).

A market report published in July this year said the main export markets in

the first half year were Peru (US$11.4 million), the United States (US$9.7

million), Angola (US$6.9 million), Chile (US$5.3 million) and Colombia

(US$5.0 million). In the first half of 2013 furniture exports to target

markets grew 1.3% to US$98.3 million.

Improvement in US housing starts a boost to Brazilian plywood exporters

The timber industry of Paran¨¢ is showing signs of recovery due mainly to

increased US imports because of the increased pace of residential

construction in the United States. Wood product exports from Paran¨¢ grew 11%

to US$391.8 million in the first half of 2013. Sales of pine plywood, the

main product exported to the US, increased 19% in the half of 2013 to

581,200 cubic metres.

Brazilian exports have picked up and the US market absorbs a sizeable amount

of Brazilian pine plywood exports. However it is the markets in the EU which

are most dominate taking more than 70% of Brazil¡¯s pine plywood exports.

The housing market in the US is recovering and last year around 900,000

houses were built. This year it is forecast that more than 1 million houses

may be completed. However, analysts say it will be difficult for the

American market to get back to 2005¡¯s levels, overall the signs are

positive.

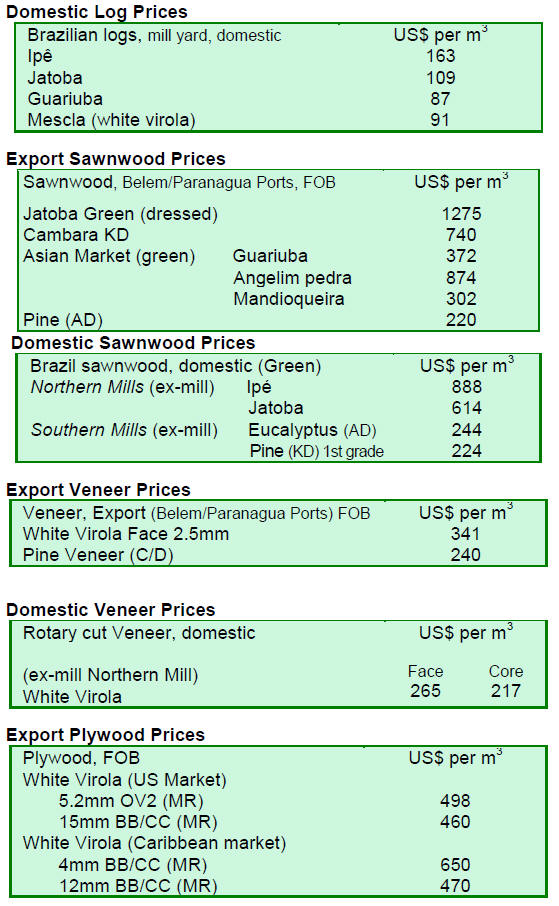

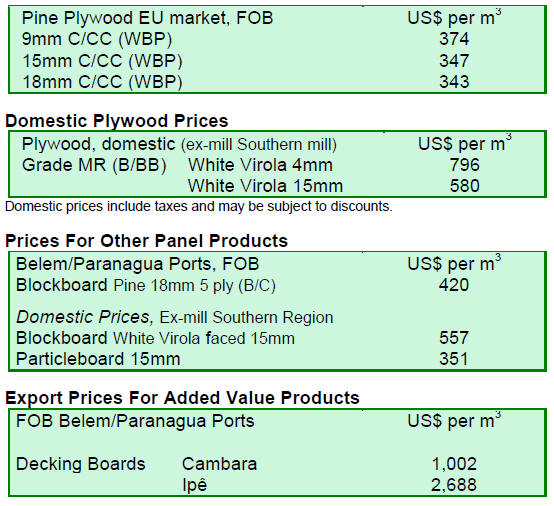

Prices

Average prices for wood products remain unchanged.

¡¡

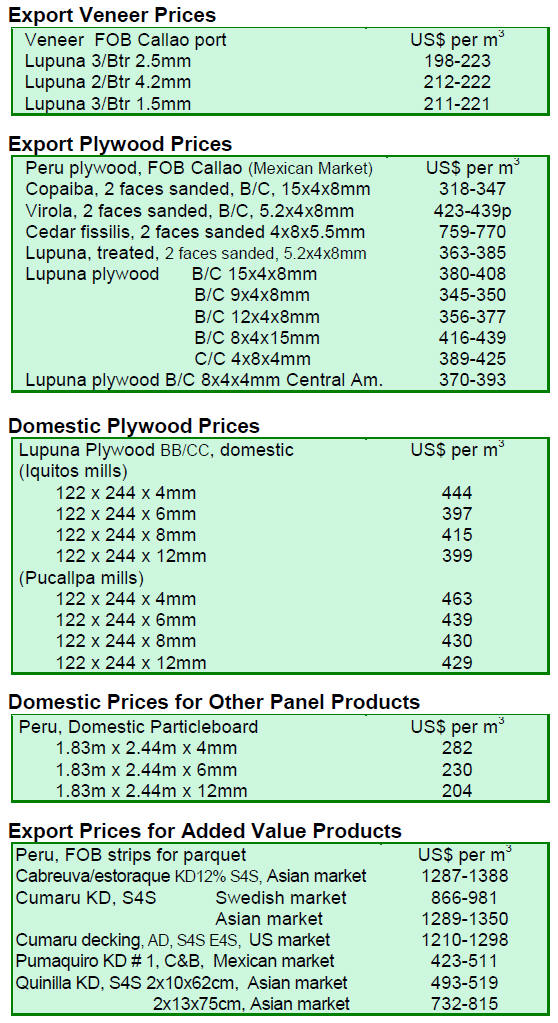

8. PERU

First eco-industrial park

established

The country's first eco-industrial park will be established in the city of

Pucallpa in the Ucayali region. Already some 166 companies are committed to

participate providing for the development of an industry cluster for wood

product manufacturers. The main objective is to produce added value wood

products.

The Deputy Industry Minister, Francisco Grippa, said this park is a model

for joint initiatives between the business sector and regional governments.

Functions of Forestry and Wildlife to be absorbed by the SERFOR

The National Forestry and Wildlife (SERFOR), created in July 2012, will

absorb the functions of the Forestry and Wildlife (DGFFS) of the Ministry of

Agriculture and Irrigation (MINAGRI).

The Ministry of Agriculture (Minagr) will set up a committee to finalise the

transfer of resources, obligations and rights of DGFFS to the management

board of SERFOR.

SERFOR will be guided by a board of directors consisting of members

representing the government ministries and public agencies and institutions

involved in forest management and wildlife at the central, regional and

local levels.

Agreement to conserve more than 36 million hectares of forests

On August 16, the Ministry of Environment (MINAM), through the National

Forest Conservation and the Regional Government of Loreto (GOREL) signed a

cooperation agreement that will protect and conserve more than 36 million

hectares of forests.

The agreement includes a commitment to develop the

area and prepare annual work plans for the conservation of tropical forests

of Loreto.

Capacity building activities in forest conservation management and

assistance in formulation and implementation of conservation projects within

the framework of the National System of Public Investment (PIP) will be

supported. The Agreement also provides for training for sustainable

production systems.

Maynas Province is the biggest producer of lumber in the Loreto region

According to information provided by the Regional Forest Management and

Wildlife in Loreto, production of processed wood products during the second

quarter of this year was 84.812 cubic metres.

Harvesting of twelve species accounted over 90 percent of total production

of which the Cumala species (Virola sp) contributed around 24% (20,300 cubic

metres).

The 12 most harvested species were: Cumala (24%), Bolt (23%), Capinuri

(11%), Bolaina (10%), Lupuna (9%), Cedar (8%), Capirona (4%), Marupa (20%)

as well as Anis Moena, Huayruro, Moena, Copaiba, and other species (5%).

9.

GUYANA

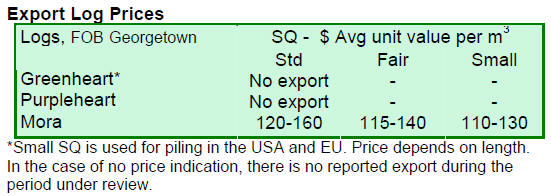

Increased mora export prices celebrated

In the two weeks reviewed there were no exports of greenheart and

purpleheart logs. However, mora logs were traded and secured better prices

in the international markets for all categories.

The top end prices for Standard quality was US$160 per cu.m FOB, Fair

quality mora logs earned US$140 per cu.m FOB and Small quality prices were

US$130 per cu.m FOB. Guyana¡¯s log export market continues to be supported by

the Asian market.

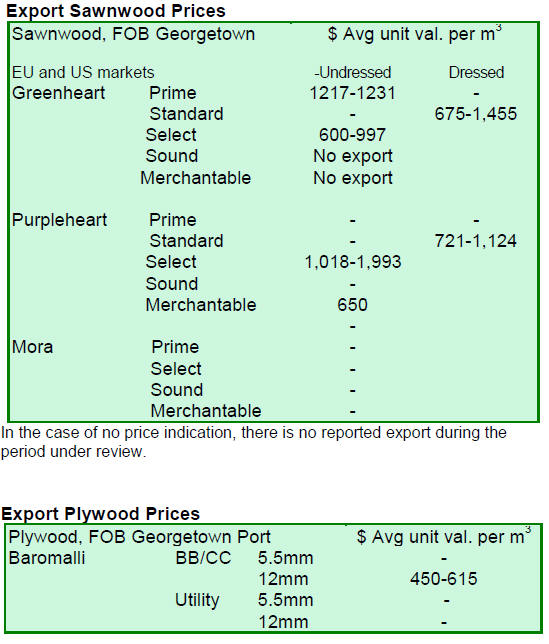

UAE re-enters the market for sawn greenheart

Exports of both dressed and undressed sawnwood made a notable contribution

to overall export earnings during the period reviewed. After a long absence

in the trade Undressed greenheart (Prime category) attracted buyers in the

United Arab Emirates and earned a price of US$1,231 per cu.m FOB.

Undressed greenheart (select) was also traded at

prices as high as US$997 per cu.m FOB with the main destinations being the

Caribbean, Europe and North America.

Undressed purpleheart (select) export prices improved and the top end price

increased from US$1,230 to US$1,993 per cu.m FOB in some major market such

as the Caribbean, Europe and North America.

However the price for Undressed purpleheart (merchantable) remained at

US$650 per cu.m FOB. There was no export of Undressed mora during the period

reviewed.

Jump in price for dressed hardwoods in Caribbean markets

Dressed greenheart FOB prices moved from US$1,166 to US$1,455 per cu.m. In

contrast Dressed purpleheart export prices recorded decline in its top end

price from US$1,272 to US$1,124 per cu.m FOB. The main market for dressed

greenheart and purpleheart was the Caribbean.

Prices for BB/CC quality plywood increased from US$584 to US$615 per cu.m

FOB in Caribbean and South America markets.

Splitwood prices remained stable of US$1,023 per cu.m FOB while roundwood (wallaba

posts) earned prices as much as US$658 per cu.m FOB in the Caribbean.

Similarly, greenheart piles also attracted a favourable export market price

of US$472 per cu.m FOB with Europe being the main market.

Assistance for value added manufacturers

The Guyana Forestry Commission (GFC) is seeking funds from the ¡®Compete

Caribbean, Support for Cluster Initiatives¡¯ (SCI) a collaborative effort

among a number of partners including IDB, UK Aid and Canada.

The GFC¡¯s request is for support for a project Building Capacity for

Exporting Value Added Products in Forestry.

This project seeks to assist the value added wood sector of Guyana to

address constraints to production and exports.

¡¡