US Dollar Exchange Rates of 24th

July 2013

China Yuan 6.1357

Report from China

Prices for newly constructed homes continue to rise

The National Bureau of Statistics of China in a press release has

updated the trends in house prices, see

http://www.stats.gov.cn/english/pressrelease/t20130718_402912311.htm

The report says compared to the previous month prices for newly

constructed residential buildings in the cities surveyed fell in 5

locations, remained at the same in 2 but increased in 63. The highest

month-on-month increase was 2.4 percent.

Compared to levels in May, prices of second-hand residential buildings

fell in 8 cities, remained at the same in 7 and increased in 55 where

the highest month on month increase was 1.3 percent.

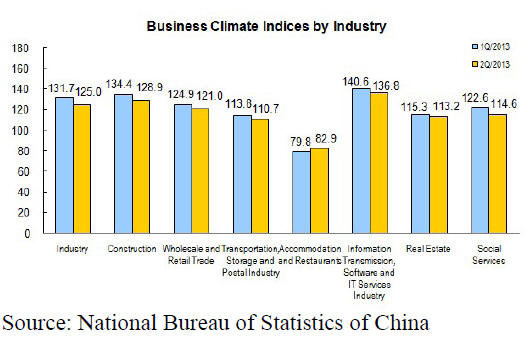

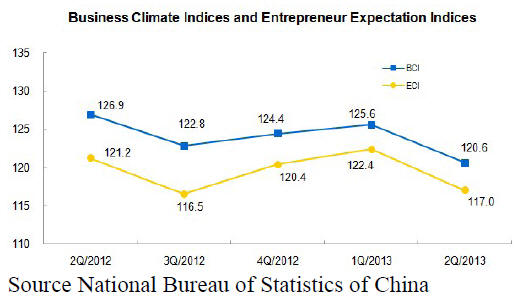

Business climate index drops in second quarter

The recent National Business Climate Survey shows that the business

climate index (BCI) was 120.6 in the second quarter, down 5.0 points

quarter-on-quarter, but still significantly higher than the critical

value 100. See:

www.stats.gov.cn/english/pressrelease/t20130716_402911467.htm

In the second quarter, the entrepreneur expectation index (ECI) also

fell to 117.0, or 5.4 points down on the previous quarter.

However, the Bureau reports that, in terms of enterprises profit level,

74% of enterprises indicated that their second quarter í«profit statusí»

was "normal" or "better than normal" slightly better than in the first

quarter.

Income growth spurs domestic consumption

The average disposable income of urban Chinese residents was yuan 13,650

(approx. US$2,200) in the first half of the year, up 9 percent from a

year earlier. The disposable income of rural residents rose to yuan

4,170, up 13 percent year-on-year, according to the National Bureau of

Statistics.

Retail sales of consumer goods rose by 12.7 percent in the first six

months to yuan 11.08 trillion compared to the 12.4 percent growth in the

first quarter. Beijing, Shanghai and Guangzhou, with around 10 percent

of China's population, account for almost a quarter of all consumer

spending.

Eight years on from currency reforms

Currency traders in China recently celebrated the eigth anniversary of

the China exchange rate reform. In the period after the exchange rate

regime was loosened the Chinese currency has strengthened about 35

percent against the US dollar and some 20 percent against the euro.

The People's Bank of China (Central Bank) has said that the current

exchange rate is close to what it terms í░the equilibrium levelí» or the

level where currency demand and supply are balanced.

China loosened the peg of the yuan to the US dollar in mid 2005

allowing a managed floating exchange rate mechanism within prescribed

limits with reference to a basket of currencies.

This change from a fixed exchange rate is helping the yuan become an

international currency.

Changes to transport license regulations to eliminate miss-use

On June 18, the State Forestry Administration (SFA) issued

regulations for supervision and management of timber transport which

goes further in standardising the management of timber transportation.

In the new regulations the transport of plywood, fibreboard, particle

and flake boards, furniture and bamboo furniture as well as wooden

handcrafts should not be included in certificated transport regulations.

Further, imported wood products transported to the final destination

needs no timber transport certificate but if it is to be off-loaded and

re-loaded a transport certificate is required and this will be issued on

presentation of the import permit.

The purpose of the change in regulation is to stop the uncontrolled

expansion in the scope of timber transport certificate issuance as well

as to eliminate unauthorized collection of fees for transportation.

Kunshan wood product exports recover in first half 2013

Statistics from the Inspection and Quarantine Bureau of Kunshan City

indicate that value of first half year wood product and furniture

exports from manufacturers was US$330 million increased.

In the first quarter exports expanded by 15% and by 22% in the second

quarter compared with the same quarters last year, a performance, much

better than in most other parts of China.

Analysts say this accomplishment is impressive given the tough foreign

trade environment in the first half of 2013. In March this year the EU,

the second largest market for wood products from Kunshan, introduced the

EUTR and issued new environmental design requirements for timber and

wood products.

All companies exporting to the EU must now submit evidence of the

legality of the timber used in manufacturing.

The new EU regulation has increased the cost of exporting wood products

and has reduced the competitive price advantage previously enjoyed by

Chinese manufacturers.

Despite the improvement in exports there are risks for the Kunshan

manufacturers as they have been relying on the business of producing

products to importers designs. Such a business model places these

manufacturers at the low end of the production chain and delivers very

slim profit margins.

As global demand for furniture remains stagnant and production costs

rise companies are realising they are at risk.

The authorities in Kunshan have recommended that manufacturers should

make more efforts to diversify their international markets by developing

a trade with African and South American countries.

In addition the Chinese manufacturers are being encouraged to make good

use of local policies to increase competitiveness and reduce reliance on

American and European markets.

Companies are being encouraged to establish their own brands and improve

their quality, develop higher added value products and increase the core

competitiveness of wood product and abandon reliance on low prices.

Imports through Zhangjiagang Port fall in first half 2013

From January to June 2013 timber imports through Zhangjiagang Port

totaled 1,471,200 cubic metres (logs and sawnwood) with a value of

US$346 million. This represents a decline of 9% in volumes handled and a

drop of 12% in the value of imports compared to the same period in 2012.

Log imports were 1,441,200 cubic metres or 98% of the total but down 9%.

Sawnwood imports were 288,000 cubic metres import of which fell 24% from

the same period in 2012. Of the imported timber, 98% was by bulk

carriers and only 2% containerised.

In the first half the number of supply countries was 27, down by 11. In

terms of volumes import volumes fell for all suppliers except for

Equatorial Guinea and Malaysia.

Imports from Oceania amounted to 952,600 cubic meters, from Southeast

Asia 111,000 cubic metres and from Africa 401,300 cubic metres.

Zhangjiagang Port is currently the largest port for imported timber but

it is loosing competitiveness while other ports such as Taizhou, Taicang

and Changshu business are developing rapidly.

Linden market is weak while Korean pine is in short supply

Analysts report that demand for linden or basswood is weak saying

that demand in the home decoration market and by shoe manufacturers has

fallen . Traders are reporting that monthly sales have fallen sharply

and prices have eased considerably.

On the other hand the news in the market is that red pine is in short

supply where in Guangdong prices for 2-4m length, 2.5-5cm thickness red

pine are at yuan 2800-3200 per cubic metre.

Timber markets in NE China face a further tough six months

The timber markets in northeast China have reported very slow

business over past months and sales of most products were much lower

than last year. Traders are saying that even when they lowered prices

there no interest from manufacturers, particularly those supplying

export markets.

It is generally agreed that timber demand in Northeast China will not

recover in the second half of the year.

|