2. GHANA

Rules on VPA rules of arbitration and

procedure agreed

Ghana¡¯s Minister of Lands and Natural Resources Alhaji Fuseini has said the

country¡¯s cooperation with the EU and others will continue until illegal

logging and trade in illegally sourced and manufactured wood products is

eliminated.

Mr Alhaji Fuseini made the remarks at a ceremony in

Accra where a new Aide Memoire was signed with the European Union. The

signing of the Aide Memoire took place after the fifth meeting of the Joint

Monitoring Review Mechanism (JMRM) from28-31 May. At this meeting the

discussion centred on mechanisms for supervision and review of the

implementation of the VPA.

The outcome of the JMRM was agreement on the

development of a joint framework to monitor the impact of VPA implementation

and finalise the rules of arbitration and procedure. The agreement on these

issues was included in the Aide Memoire.

Increasing sawnwood availability in the domestic market will help

eliminate illegally cut timber

In another development, the Wood Workers Association of Ghana (WWAG) has

appealed to government to find ways to increase the supply of sawnwood to

the local market to satisfy demand and make it unnecessary for consumers to

have to turn to illegally processed sawnwood.

Ghana has developed policy that seeks to improve the supply of legal timber

demand by the domestic market. Under the policy, sawmills are required to

supply at least 40% of their production to the domestic market but even with

the new policy domestic demand cannot be satisfied.

Providing competitive financing for small and medium sized companies

In a recent press release the African Development Bank (AfDB) reported

approval of a USS 20 million line of credit for UT Bank Ghana to support the

commercial activities of Small and Medium Enterprises (SMEs) and local

corporations.

As the Ghanaian economy continues to grow and

diversify, there is increasing need to address unsatisfied demand for

competitive financing for small and medium sized companies in key economic

sectors such as agriculture and light manufacturing.

This new facility aims to support financial sector development, enhance

regional integration through intra-African trade and contribute to

government revenue generation.

The financing being made available is expected to facilitate trade in

essential raw materials, intermediate and finished goods, and equipment

worth around US$ 140 million.

See:

http://www.afdb.org/en/news-and-events/article/afdb-approves-a-usd-20-million-trade-finance-line-of-credit-for-ut-bank-ghana-to-support-smes-and-local-corporates-11813/

Positive medium term growth forecast for Ghana

The African Development Bank (AfDB) has just released it African Economic

Outlook (AEO) (May 27, 2013) which says Ghana¡¯s economy is expected to grow

a further 8% by end of 2013. The AfDB report also forecast an 8.7% growth of

the Ghanaian economy in 2014.

Ghana¡¯s medium term growth outlook remains positive due largely to

investments in extractives sector industries, public infrastructure and

commercial agriculture.

Ghana¡¯s GDP growth slowed from 14.4% in 2011 to 7.1% in 2012. However, the

report notes that a 7.1% growth, when the world economies were in serious

trouble, was encouraging despite lower cocoa and oil production during the

year.

The AfDB Outlook maintained a focus on the high level of unemployment and

urged the government of Ghana to create the right investment environment to

stimulate growth in labour intensive industries.

See: http://www.afdb.org/en/knowledge/publications/african-economic-outlook/

¡¡

3. MALAYSIA

Export demand remains subdued

Analysts report that demand in the main export markets remains weak but that

there are signs of increased buyer interest in Europe and that, after a

quiet spell, Indian buyers have become more active.

First quarter furniture export performance set to be one of the worst in

recent years

The Malaysian Furniture Entrepreneurs Association (MFEA) has said Malaysian

furniture exports fell in the first quarter of this year.

The Star newspaper reported the association president Lor Lean Seng saying

the first quarter performance is one of the worst for the furniture industry

in recent years.

According to a Malaysian External Trade Corporation report, furniture

exports for January and February 2013 amounted to RM1.088 billion (approx.

US$357 million) representing a 9.3% decline from the same period last year.

Exports to the US were worth RM323 million (approx. US$106 million), down 5%

compared to the same period in 2012.

Exports to other major buyers of Malaysian furniture such as Japan,

Australia and United Kingdom also fell in the first two months of 2013.

Japan imported RM119.9 million (approx. US$ 39 million), down 13.7% over the

same period last year while Australia imported 7% less at RM72.9 million

(approx. US$24 million).

Malaysian furniture exports to the UK fell by a massive 23% in the first two

months of the year to RM55.2 million (approx. US$ 18 million).

The MFEA president said the level of orders reported during the second

quarter are not encouraging so export sales are expected to continue to be

on the low side.

Depressing news on furniture sales in the domestic market, where first

quarter business was down 20-30%, is adding to the pessimistic outlook for

the furniture industry.

Malaysian furniture exporters not suffering alone

The president of the MFEA has said furniture exporters in China and Vietnam

are also experiencing difficult times, although Vietnam¡¯s furniture

exporters have an advantage as the dong has not appreciated as much as in

other furniture exporting countries in the region.

The appreciation of the Malaysian ringgit against major currencies has

contributed to the decline in exports.

Peninsular Malaysian exports steady in first two months

Exports of other products by manufacturers located in Peninsular Malaysia

for the period Jan ¨C Feb 2013 were a little more encouraging.

Plywood exports were worth RM839 million (approx. US$ 275 million); sawnwood

exports were worth RM358.7 million (approx. US$ 118 million), and moulding

exports were worth RM125.7 million (approx. US$41 million).

Timber industry vital for continued socio-economic growth in Sarawak

The Borneo Post has reported Awang Tengah Ali, the state minister of

Resource Planning and Environment, saying the timber industry in Sarawak

plays a vital role in contributing to socio-economic growth in the state.

Awang Tengah said the Sarawak timber industry brought in RM7.455 billion

(approx. US$ 2.44 billion) to the state in 2012 compared to RM7.085 billion

(approx. US$ 2.32billion) in 2011. This 5.2% growth was due to strong demand

in markets in the Middle East, South Korea, Singapore, India and

Philippines.

Sarawak timber exports for the first quarter this year totalled RM1.85

billion (approx. US$ 607 million) a drop of 3.2% compared to last year.

The decline was due to an overall decline in demand except in the case of

plywood for which exports increased by 5.4% in the first quarter to RM1.057

billion (approx. US$347 million).

In terms of volume, plywood, which account for 40% of all timber exports by

the state, increased by 14% to 734,162 cu.m.

Sabah reports healthy but not exciting first quarter export performance

The Statistics Department of Sabah released export data for the first

quarter of 2013 showing that sawnwood exports, at 59,486 cu.m, were worth

RM87,2 million (approx. US$28.6 million). Thailand was the biggest buyer of

sawnwood (26%) followed by South Africa (11.9%), Taiwan (11.6%), China

(11.4%), and Japan (9.0%).

Sabah¡¯s exports of plywood for the first quarter totalled 165,205 cu.m

valued at RM 248.6 million (approx. US$81.5 million).

Japan was the main buyer of plywood from Sabah taking an 18% share followed

by Peninsular Malaysia (16%), North Korea (14.6%), Egypt (12.2%) and USA

(8.1%). Veneer exports (8,449 cu.m) from Sabah totalled RM11.8 million

(approx. US$3.9 million) while exports of mouldings totalled RM14.8 million

(approx. US$ 4.8 million). Exports of laminated boards earned RM 18.8

million (approx. US$6.1 million).

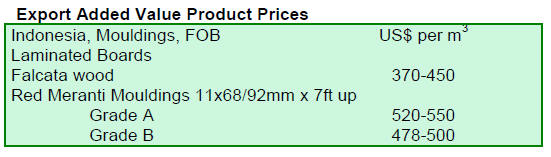

4. INDONESIA

Opening new markets the key to boosting

exports

Gusmardi Bustami, Director General of the national export development

division of the Ministry of Trade has said that Indonesian exports are

expected to be higher than last year because of growth in recently developed

new markets.

The ministry official said Indonesian exports could reach US$194-195 billion

in 2013 compared to the US$190 billion recorded in 2012. The ministry is

forecasting that exports to non-traditional markets will increase by around

15% and could earn as much as US$28 billion.

Indonesian exporters have had success in developing markets in Africa, Latin

America and Central Asian countries and efforts are underway to promote

exports in South Africa, Tanzania, Kenya, Nigeria, Madagascar, and

Mozambique.

Until the VPA is ratified Indonesian exports to EU must be accompanied by

evidence of legality

Until the Indonesia and the EU ratify the recently concluded Voluntary

Partnership Agreement, Indonesian wood products entering EU member states

must meet the due diligence requirements of the EU Timber Regulation said

Multi-stakeholder Forestry Program co-director Andy Roby.

Mr. Roby said that, even though Indonesian wood products have been certified

under the national Timber Legality Verification System Certificate (SVLK),

Indonesian exporters still have to provide information on the legality of

the wood products when they are shipped to the EU.

Mr. Roby said only after Indonesia and the EU ratify the Forestry Law

Enforcement, Governance and Trade-Voluntary Partnership Agreement (FLEGT-VPA)

will the EU recognize Indonesia¡¯s SVLK certification as the basis for the

issuance of a FLEGT license.

Exporters of FLEGT licensed wood products will not be required to provide

any further evidence to support the legality of their products.

Ministry of Forestry enlists support to stamp out corruption

The Ministry of Forestry (MoF) recently concluded an agreement with the

Corruption Eradication Commission (KPK) to extend efforts to eliminate

corruption in the forestry sector.

The Minister of Forestry, Zulkifli Hasan said ¡°This effort has been made to

improve the ministry's administration and that the corrupt 'selling' of

concession permits will not be tolerated¡±.

The Secretary-General of MoF, Hadi Daryanto, said further efforts are

necessary as there have been claims that mining and plantation companies are

still involved in corrupt practices.

A recent report has estimated that losses in state revenues from corrupt

practices in the sector were around US$9 million in 2011.

The report identified three patterns of violations in the forestry sector:

operations in protected forests or operations without a concession agreement

from the MoF, undertaking forest-clearance without permission and illegal

logging.

The MoF has said it is overwhelmed with complaints of corruption so needs

the assistance of the KPK to combat corruption complaints.

Plans for forest clearance in Aceh results in public outcry

The Jakarta Post has reported that more than a million people signed a

petition calling for President Susilo Bambang Yudhoyono to block the Aceh

administration¡¯s plan to open protected forests for commercial exploitation.

The petition was begun after changes were proposed to the Aceh planning

bylaw which, say activists, would put the province¡¯s 1.2 million protected

forests at risk from clearing.

The Coalition of Aceh Rainforest Movements, an NGO, has claimed that the new

planning rules could provide for the conversion of a huge part of the 3.5

million hectares of protected forests in Aceh.

However, the Minister of Forestry has said his ministry has only approved

the conversion of 80,000 hectares of forests so that the infrastructure in

the province can be upgraded.

CIFOR spots rare leopard only 100 km from

Jakarta

Researchers from CIFOR have reported sightings of one of the world's most

endangered big cats, the Java leopard (Panthera pardus melas) less than 100

km from Jakarta.

The video footage and photographs released by the CIFOR research project in

Gunung Halimun-Salak National Park show a leopard relaxing in dense forest.

See: http://news.mongabay.com/2013/0521-hance-javan-leopard.html

5. MYANMAR

High log stocks in importing countries

Until this month teak sales were brisk but now some dealers are saying that,

because many buyers have accumulated high levels of stocks, the market for

teak logs is now rather quiet.

Analysts say that buyers in India and Thailand are overstocked with teak

logs and that companies in China can get a steady supply of teak overland

and are not keen to purchase teak logs brought in by sea because of the

addition of shipping freight costs lower profit margins.

During the second half of May teak log shipment were slow and vessels were

waiting for cargo. Analysts say to slow market is partly because buyers had

over extended purchases to increase stocks and that this had created a

financial strain for them.

Analysts do not expect the current situation to persist because buyers are

confident that stocking teak, unlike stocking less durable species, poses

little risk since teak is very durable and can be held in stock for a long

time.

Buyers are anticipating that the value of their teak log stocks will

increase after the log export ban is introduced in April next year.

Timber exports to the EU and the US

The May 17 issue of the domestic newspaper Daily Eleven News reported that,

according to Barber Cho of the Myanmar Timber Merchants Association (MTMA),

Myanmar may be able to start shipping timber that conforms to the EU timber

regulations from 2015.

In the interim the MTMA will publish guidelines to help standardise export

documentation and enable exporters to provide the necessary paperwork

required by importers in the EU and the US to verify the legality of timber

exports.

The MTMA will publish a document 'The Official Compilation of the Export

Documentation in Compliance with the National Rule and Regulation of the

Timber Trade in Myanmar'.

Procedures for clearing export containers to be streamlined

It has been reported that the procedures for

checking export containers of wood products will be streamlined.

At present every container of wood products is inspected twice, once by the

Forest Department when stuffing is complete and again by Customs officials

prior to the loading of the container onto a vessel at the container

terminal.

Exporters have frequently complained that this double check is unnecessary.

News that the Customs inspection at the container terminal will be

eliminated starting June 1, 2013 has been welcomed by the industry.

Under the new system a container inspected and sealed by the Forest

Department and will be cleared for shipping after passing through scanners

at the container terminal. These changes will eliminate delays and expedite

shipments.

Myanmar¡¯s GDP expected to grow

Myanmar's economy expanded 6.5% last year and is

set for further modest growth of 6.75% this year driven mainly by production

and sales of natural gas according to the IMF. The IMF also expects

increases in foreign investment to help narrow the widening current account

deficit.

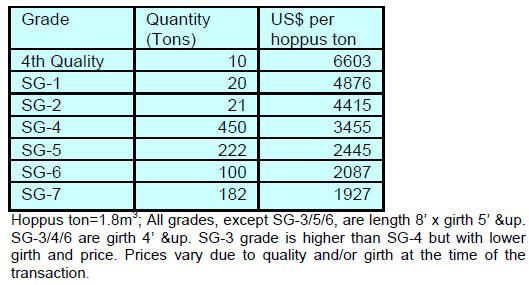

End May teak auction prices

The following prices were reported from competitive bidding for teak logs on

23rd and 27th May at the most recent Myanma Timber Enterprise tender.

¡¡

6.

INDIA

Industrial output growth points to

¡®green¡¯ shoots in economy

India¡¯s industrial output climbed 2.5 per cent in March, the fastest pace of

expansion in five months. Rising output has raised hopes that the worst of

the decline in the economy may be over and the slowdown may have bottomed

out.

Official data released in mid May show that March industrial output growth

was up from the 0.5 per cent increase in February however, analysts suggest

interest rates need to be further eased to stimulate industrial activity.

The Reserve Bank of India has so far this year cut interest rates by 0.75

percent in three steps to help revive the economy.

Inflation eases to a 41 month low

Inflation, based on the Wholesale Price Index, eased to 4.89 percent in

April, down from the 5.96% in March and 7.5% in April 2012. This is the

lowest level of inflation since November 2009 when it was 4.78%. The outlook

is that inflation will remain at ¡®comfortable¡¯ levels for next few months.

Exports continue to positive trend

India¡¯s exports, battered by weak international demand for most of last

year, grew by 1.6 per cent in April, the fourth successive monthly growth.

April export figures stood at US$24.16 billion against US$23.70 billion in

the same month last year. However, as the economy shows signs of improvement

imports of gold have increased and oil imports continue to drive the trade

deficit higher.

With an improvement in the US economy and a rise in exports to new markets

such as Latin America, Africa and CIS countries, the Commerce Ministry has

set an export target of US$325 billion for 2013-14 which is about 8 percent

higher than US$300.60 billion in 2012-13.

Mangroves along 720 Km coastline in Maharashtra now protected

The Government of Maharashtra has transferred the responsibility for the

protection of mangroves to a specially constituted unit including the Asst.

Conservator of Forests, Divisional Forest Officers, Forest Rangers and

Forest guards and other stakeholders.

This unit will manage and protect the 18,600 hectares of vulnerable mangrove

forests along the state¡¯s 720 km. coastline.

The mangrove forests have been re-designated as Protected Forests by a High

Court order and all development within the newly protected forest is

forbidden.

Mangrove habitats act as a buffer zone between land and sea protecting the

coast during tsunamis, cyclones and flash floods and also help protecting

coastal erosion.

Expanded farm forestry a win - win for farmers and woodbased panel makers

The wood based panel and paper industries in India have been making progress

in developing dependable and sustainable sources of raw material for their

factories.

Andhra Pradesh Paper Mills Ltd has recently celebrated the planting of the

one billionth tree in their farm forestry initiative.

Similar initiatives on resource establishment have been taken by other paper

companies through successfully convincing farmers to plant superior clones

of eucalyptus and casuarinas on marginal, degraded and unutilized land.

These initiatives are a win - win situation for the farmers and the

industries.

Similar initiatives have been taken by panel industries in northern India

which has encouraged expansion of plantations of poplar and eucalyptus to

meet their requirements for veneer.

However, panel production has expanded so fast that it is outstripping raw

material supplies. Because of the firm demand log prices for panel and pulp

manufactures have increased sharply.

Several panel manufacturers using agri-residues as raw material are also

facing shortages and this is putting expansion plans in jeopardy. Panel

demand has grown by over 25% in recent years but the supply of raw material,

mainly baggase, cannot keep pace.

Baggase raw materials were once priced at around Rs.1000 per ton but now

cost as much as Rs.3000 per ton, all within the span of just two years.

Unfortunately, consumers are not willing to pay higher prices for the

finished products to off-set rising raw material, chemicals and energy

costs.

In addition the industry is facing growing competition , from cheaper

imported alternatives. Government intervention through levying anti-dumping

duties and increased import tariffs on imports of fibreboard, for example,

has not had any significant effect.

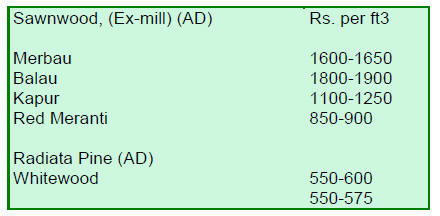

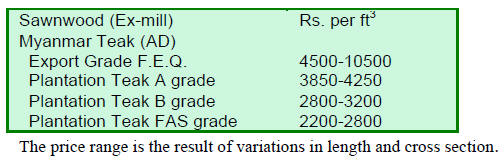

Imported plantation teak prices (C&F)

Import shipments of plantation teak have increase by around 5% recently so

there have been some changes in prices however, generally prices are steady.

Ex-sawmill prices for imported hardwoods

Domestic prices for air dried sawnwood per cubic foot, ex-sawmill remain

unchanged and are shown below.

Prices for Myanmar Teak processed in India

Despite higher import costs teak prices remain fairly stable. This is

because teak stocks are adequate as importers had steadily accumulated

stocks when prices were favorable and because there is intense price

competition in the Indian teak market. Some price increases are beginning to

be reported and current prices are shown below.

Prices for imported KD 12% sawn wood

The use of imported KD sawnwood is steadily increasing but at the moment

prices remain unchanged as supplies are adequate and there is strong

competition in the domestic market.

Can engineered woodbased panels capture greater

market share?

The total demand for woodbased panels in India is estimated at around 20

million cubic metres out of which plywood accounts for an 80~85 percent

share.

Engineered panels such as particleboard and MDF have not been able to

capture a significant share of the market to change the pattern of

consumption as has happened in other countries.

To expand consumption of engineered panels it is necessary for producers in

Indian to improve the overall quality of their products as end-users such as

carpenter complain about the mechanical properties and water resistance of

domestically manufactured panels. Only when quality improves will engineered

panel makers be able to capture a greater market share.

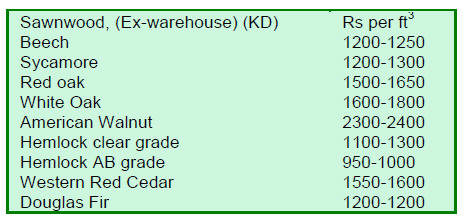

Plywood market prices

Prices remain unchanged as follows:

7.

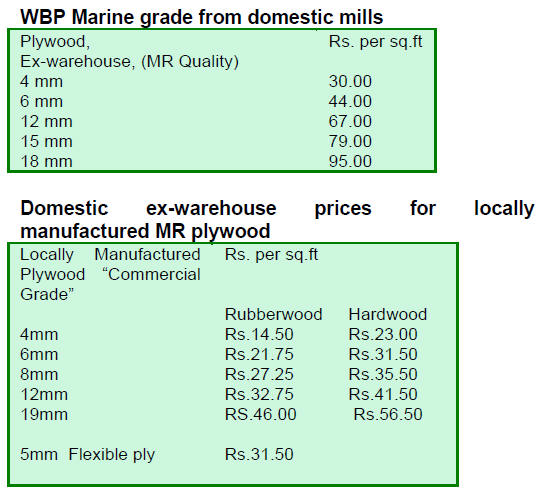

BRAZIL

First interest rate hike since July 2011

Brazil’s Consumer Price Index (IPCA) in April was marginally above the rate

of 0.47% recorded in March. The accumulated change so far this year is

2.50%, significantly up on the 1.87% for the same period in 2012.

In March the average exchange rate of the real to the US dollar was BRL

2.00/US$ compared to BRL1.85/US$ in March 2012, signalling a slight

depreciation of the Brazilian currency.

For the first time since July 2011 the Monetary Policy Committee (Copom) of

the Brazilian Central Bank (CB) raised the prime interest rate (Selic) by

0.25 percent bringing the basic interest rate to an annualized 7.5% per

year.

Low cost chip technology for logging operations

The State Secretariat for the Environment (SEMA) has introduced a new

control mechanism called the “System for Commercialization and Transport of

Forest Products? (SISFLORA 2). The aim is to improve the process of

monitoring and control of production and transport of forest products.

The new system provides the means for greater control to combat

environmental degradation and is based on information chips attached to the

base of trees that will be felled as well as logs that are harvested.

This allows for better digital control of logging activities so that SEMA

will be in a position to monitor log movements through designated chip

codes.

SISFLORA 2 has been introduced to meet international market requirements for

evidence that logs have been legally sourced and to prevent illegally

harvested timber entering the supply chain.

The cost of the chip is almost negligible and a good investment considering

that it will provide the means to certify the legality of logs and wood

products. The major cost centre for enterprises will be management costs

from implementation.

In 2012, SEMA authorized harvesting of 3 million cubic metres of wood. Until

the end of May this year harvesting of some 6-700,000 cubic metres had been

authorized a rate which, if it continues, will result in higher harvests in

2013.

SEMA is discussing the possibility of implementing an improved tracking

system in the first half of 2014. This will provide for better traceability

of forest products commercialised in the state.

New standards for concession audits in State of Amapa

Discussions have been held between the private sector and local governmental

agencies in the State of Amap?as well as representatives from other states

on standards for forest concession allocation in Amapa.

The objective was to establish new rules for concession bidding involving

the State Forestry Institute (IEF) and the State Secretariat of Environment

(SEMA).

It is recognised that forest concession allocations generate direct social

benefits such as creation of jobs, investment in infrastructure and services

to the local community and they add value to a resource and services derived

from natural forests.

The aim of the authorities in Amap?is to minimise the risk of illegal

activities through regular control and audits.

The initial estimate is that the first concession bidding process will

generate around R$ 30 million in terms of civil construction, shipbuilding

and manufacturing and this will generate a revenue of around R$ 5 million

for the state. It is planned that the first concession bidding process will

begin before the end of the year.

The representatives of the Brazilian Forest Service, the Brazilian

Agricultural Research Corporation of Amap? the Secretariat of Rural

Development, Social Inclusion and Mobilization, the State Secretariat for

the Environment, and the Ministry of Industry, Commerce and Mining, and the

Union of Timber Workers of Amap?(Sindmadeira) and community representatives

attended the meeting at which the new proposals were discussed.

Pine sawnwood exports post sharp gains

In April 2013, the value of wood product exports (except pulp and paper)

increased 13.6% compared to values in April 2012, from US$191.4 million to

US$217.4 million.

Pine sawnwood exports fell 12.5% in value in April 2013 compared to April

2012, from US$16.0 million to US$14.0 million. In volume terms exports

dropped 11.9%, from 73,100 cu.m to 64,400 cu.m over the same period.

Tropical sawnwood exports also fell dropping 8.7% in volume, from 28,700

cu.m in April 2012 to 26,200 cu.m in April 2013. The value of tropical

sawnwood exports also declined 8.5% from US$15.3 million to US$14.0 million

in the same period.

Pine plywood exports increased substantially (+20.9%) in value in April 2013

compared to April 2012, from US$30.1 million to US$36.4 million. The volume

of exports also rose 24.9% from 76,800 cu.m to 95,900 cu.m. during the same

period.

April 2013 tropical plywood export volumes remained the same as in April

2012 at 4,100 cu.m.

Exports of Brazilian made wooden furniture rose from US$35.6 million in

April 2012 to US$39.2 million in April 2013, a 10.1% increase.

Project Orchestra Brazil?delivers firm results for furniture exporters

Between January and March 2013, companies participating in the project “Brazil

Orchestra? a partnership between the Union of Furniture Companies of Bento

Gonçalves (Sindmóveis) and the Brazilian Trade and Investment Promotion Agency

Apex-Brazil), recorded a 10.3% increase in exports over the same period last

year.

However, Brazilian exports of accessories, components, chemicals, technology

and design services for the furniture industry dropped 8.3% in the first

quarter and overall Brazilian exports fell 7.7% which signals the success of

the Brazil Orchestra?initiative.

According to Sindmoveis, the good export performance of companies

participating in the ‘Brazil Orchestra?is the result of joint efforts and

strong support of Apex-Brazil.

Currently, more than 100 companies participate in the project. The target

markets in 2013 are Argentina, Colombia, the United States, Mexico,

Paraguay, Peru and Uruguay. In all these countries growth in sales was

reported in the first quarter of the year except in Mexico (-18%). In the

United States, the main export market, exports increased 34%.

After a long period of falling exports to Argentina demand has increased and

was up 8.9% in the first quarter. In addition, purchases by importers in

Colombia and Peru from ‘Brazil Orchestra?participating companies increased

17% and 100.8%, respectively. Furthermore, demand from Chile (+9.8%),

Paraguay (+3.1%) and Uruguay (+9.6%) provided significant growth.

Mato Grosso timber exports hampered by poor road conditions

The revenue generated from forest product exports by companies in Mato

Grosso state dropped 16.4% in the first quarter, compared to the same period

of last year.

According to the Ministry of Development, Industry and Foreign Trade (MDIC)

from January to March 2013, trade amounted to US$22.5 million against

US$26.9 million in the same period last year.

Export volumes in the first three months of 2013 reached 28,127 tonnes,

5.33% above levels in the same period last year (26,702 tonnes).

Exports of sawnwood accounted for the largest shipments totaling 14,235

tonnes, sufficient to generate US$9.5 million. Compared to 2012, there was a

decline of 7.8% in the volume exported and a 16.8% drop in revenue.

According to analysts, exports by the timber sector this year were hampered

by bad road conditions especially in the north of Mato Grosso. From December

2012 to April 2013 export totaled US$80,000 but this figure should have been

in the region of US$ 4-500,000. China is the main export destination for

current production.

8. PERU

Deforestation, the result of planned

agriculture and illegal intrusions

Gustavo Suarez de Freitas, a forestry expert has reported that most of the

deforestation in the country is the result of a deliberate change in land

use from forest to agriculture.

He has also reported that most of the forest clearance is of small plots of

less than half a hectare for small-scale agriculture and that most of the

clearance is undertaken by immigrants moving into forested areas.

Following on from this assertion de Freitas lamented the failure to better

utilise the extensive forest wealth of the country to alleviate poverty as

well as for economic development.

Adex appeals for re-launch of concession allocations

The Exporters Association (Adex) has called on authorities to re-launch the

Amazon forest concession strategy to provide for expanded development of the

wood processing sector and increased exports. Adex recalled that in 2012

wood product exports declined.

The chairman of the Timber and Wood Industry section of Adex, Erik Fischer,

has said that this request stems from the desire of companies to continue

investing in the sector to improve competitiveness and implement sustainable

projects that have a positive social and environmental impact.

Without a clear direction and a stable policy framework investors are

reluctant to implement long term plans which will consolidated the benefits

from a viable forestry sector in terms of social inclusiveness, wealth

creation and environmental sustainability.

US$7.7 million for forestry development

The Agricultural Bank (Agrobanco) plans to offer US$7.7 million to finance

forestry activities in Madre de Dios, Huanuco, Loreto and Ucayali.

These funds will be allocated to projects for forest rehabilitation and for

forest industry development in areas dominated by the informal timber sector

and where forest degradation from illegal logging is a serious problem.

Agrobanco is the only financial institution in the country to offer a line

of credit for the forest sector.

The bank will consider projects initiatives that promote reforestation with

native species, conservation of forests and wildlife and job creation in

addition to wood product industry development.

To date, the Agrobanco has disbursed loans totalling US$2.7 million to

companies engaged in sawmilling, trading, mining and added value timber

industries.

Some of these funds have been used by entrepreneurs and small scale timber

producers to purchase machinery and equipment that allows them to fully

comply with the recommendations and requirements of the Forest and Wildlife

Act.

The bank also promotes training activities in partnership with public and

private agencies.

New entrepreneurs are offered training in organizational management, market

access and business management. Business management workshops were managed

by timber specialists from ESAN University and the Ministry of Agriculture.

A spokesperson from Agrobanco said the timber sector in Peru has potential

because of the high value commercial species that are available but this

potential can only be released through a process of rational use within the

framework of national and international standards.

The key to releasing the potential of the forestry and wood processing

sectors says Agrobanco is private sector participation in promoting

sustainable forestry development, protection of wildlife and industrial

development.

¡¡

9.

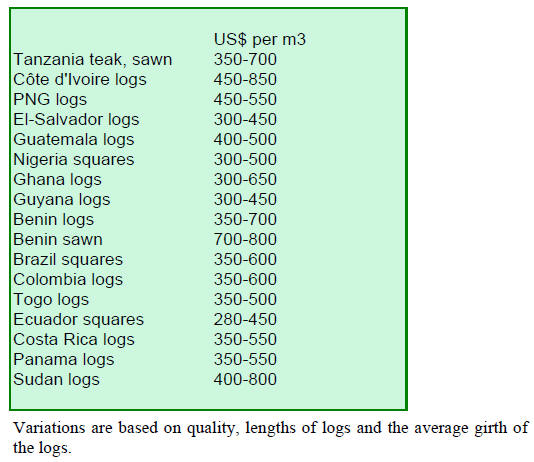

GUYANA

Asian buyers seeking newly commercialised

timbers

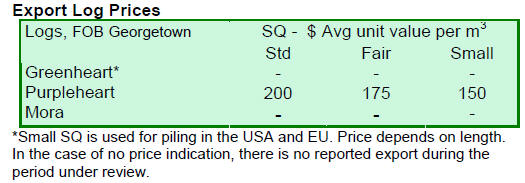

During the period of review there were few log shipments and none of the

major commercial species, greenheart and mora. Only purpleheart logs were

exported and prices weakened slightly.

However, some of Guyana¡¯s newly commercialized species such as wamara (Swartzia

leiocalycina) and kabukalli (Goupia glabra) were sought after by buyers in

Asian markets.

Sawnwood export earnings compensate for slack log exports

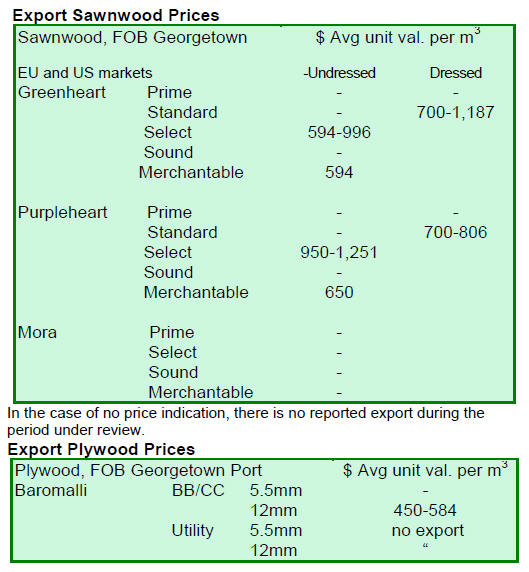

Sawnwood exports made a favourable contribution to export earnings. FOB

prices for Undressed greenheart (select) climbed from US$975 to US$996 per

cubic metre, while Undressed greenheart (merchantable) quality FOB prices

only secured fair prices of US$594 per cubic metre.

Undressed purpleheart FOB top end prices increased to US$1,251 in comparison

to levels in the previous fortnight which stood at US$1,100 per cubic metre.

On the other hand Undressed purpleheart (merchantable) FOB prices only held

on to recent gains. There were no exports of Undressed mora sawnwood during

the period reported.

Dressed greenheart top end FOB prices moved up from US$1,166 to US$1,187 per

cubic metre during the period under review. On the other hand Dressed

purpleheart top end price fell from US$1,102 to US$806 per cubic metre FOB

for this period. Plywood FOB prices were maintained at US$584 per cubic

metre FOB.

Guyana¡¯s wamaradan is French Guiana¡¯s angelique

One of Guyana¡¯s newly commercialized species wamaradan (Dicorynia paraensis),

known as tapaiuna in Brazil and angelique in French Guiana, was traded and

made a favourable contribution to export earnings.

Wamaradan attracted prices as high as US$1,060 per cubic metre FOB in the US

market. This species can be used for building and construction as it is a

very durable timber.

Also, Guyana¡¯s ipe (washiba) was traded at US$2,550 per cubic metre FOB to

buyers in North America.

¡¡

FLEGT support programme launched

FAO, in collaboration with the EU and the Guyana Forestry Commission (GFC),

launched a US$65,000 Forest Law Enforcement Governance and Trade Programme (FLEGT)

support programme which could enable timber traders to expand to new

international markets.

The programme, which is being funded by the EU and implemented through the

FAO, is intended to support an eight month project ¡°Executing Initial

Aspects of the Guyana Roadmap for the EU Forest Law Enforcement Governance

and Trade Programme (FLEGT) Voluntary Partnership Agreement (VPA) through

developing a Communication Strategy and scoping impact of an EU FLEGT VPA

for Guyana¡±.

GFC Commissioner, James Singh, said the negotiations for the programme

concluded last December include plans for dissemination of information to

stakeholders as well as the assessment of impacts which result from the

implementation of the VPA.

FAO Country Representative Dr. Lystra Paul explained that the project is an

important step in helping exporters meet new international requirements.

In 2003 the EU adopted FLEGT Action Plan to address the issue of illegal

timber and prevent such timber entering the EU market. The United States and

Australia also have new regulations affecting the trade.

Guyana¡¯s continued ability to sell to these markets will be determined by

how well its stakeholders address the new market requirements. The FAO

representative mentioned that two companies in Guyana are already able to

satisfy the requirements of the EUTR.

FLEGT roadmap on track in Guyana

The VPA process in Guyana is proceeding according to the timelines

stipulated in the ¡®Roadmap in Guyana¡¯. A technical team from the European

Forest Institute (EFI) visited Guyana with the aim of gaining a better

understanding of the current legality systems within Guyana¡¯s forest sector.

The team was also given the opportunity to interact with the National

Technical Working Group (NTWG) selected at a national workshop to lead the

FLEGT process with the European Union. Representatives of indigenous

Amerindian NGO¡¯s and other stakeholder groups were given the opportunity to

interact with the team.

Launch of communication project

With funding from the EU and with technical support from FAO Guyana has

initiated a project aimed at developing a communication strategy. The

project will also design a scoping impact assessment of the EU FLEGT VPA in

Guyana.

The recent launch of this project was attended by members of the NTWG, the

Ministry of Natural Resources and the Environment, a representative of the

EU and members of the Indigenous NGOs.

The FAO country representative reaffirmed FAO¡¯s commitment to this process

and expressed their appreciation for the manner in which Guyana has executed

FAO projects in the past.

Consultant terms of reference for various elements in the new project have

been published and invitations extended to consultants.