| Home: Global Wood | Industry News & Markets |

| Home: Global Wood | Industry News & Markets |

Japan Wood Products Prices |

||||||||||||||||||||||||||||||||||

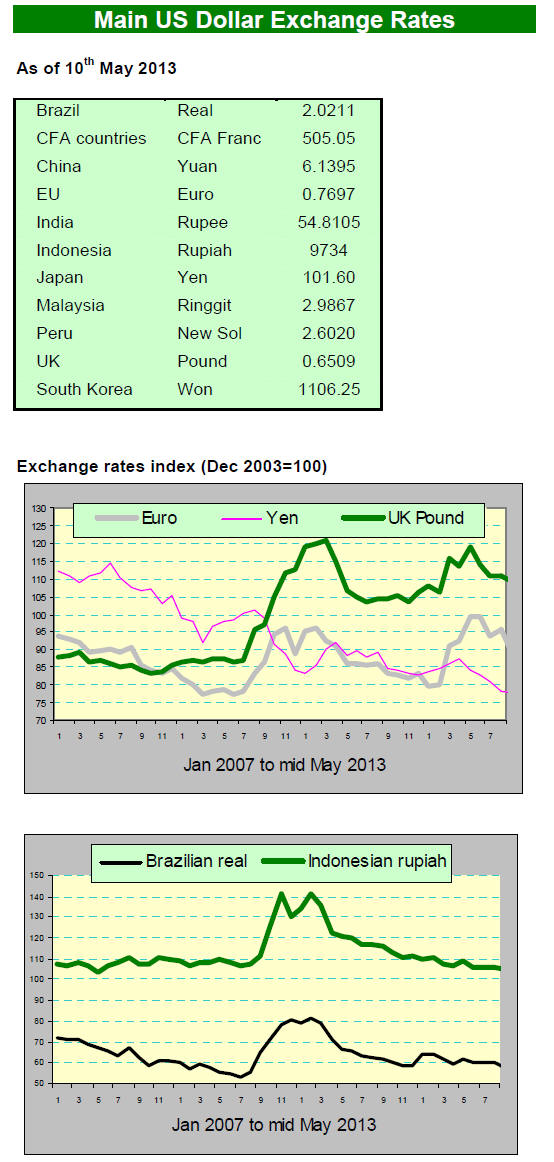

Japan Wood Products Prices Dollar Exchange Rates of 10th May 2013 Japan Yen 101.60 Reports From Japan

Consumer confidence unexpectedly slides

At the recent G7 meeting of representatives from members - the U.S., Germany, France, Italy, Japan, Canada and the U.K steered clear of discussions of ‘currency wars’ instead focused on how each member should put in place policies balancing austerity measures with growth-enhancing measures.

Meantime, in units built for sale, condominium starts were down because of high starts in February but detached units increased for seven consecutive months and maintained more than 10,000 units level since last June.

Movement of plywood is getting stable after excitement is fading. Inquiries in domestic softwood plywood are slowing by dealers. In the first quarter, wholesalers and retailers built up inventories in speculation but actual demand did not appear as expected so the inventory depletion is not progressing.

On imported plywood, supplying mills suffer log shortage and high log cost in Malaysia and Indonesia so that export prices continue climbing but the market in Japan is slow to follow by lack of demand. Dealers’ inventories are still high so that they are not able to buy future cargoes.

In Tokyo market, the prices of 3x6 JAS concrete forming panel are 1,100 yen per sheet delivered, 20 yen up from April. 12 mm structural panel are 1,150 yen, 50 yen up. JAS 3x6 coated concrete forming panel are1,200 yen, 20 yen up.

|

||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||

Source: ITTO' Tropical Timber Market Report |

CopyRight (C) Global Wood Trade Network. All rights

reserved.

hief minister of Tamil Nadu Ms.Jayalalithaa, has announced the establishment of a Rs.12 billion project for the annual manufacture of 200,000 tonnes of multi-layer double coated packaging board.

This new plant will be built in Tiruchi by Tamil Nadu Newsprint and Papers

Ltd and is expected to provide additional employment for 2,000 people. At

present around 40% of the demand for coated paper is met through imports.

The new plant will produce high end white liner boards for folding boxes,

the fastest growing segment in the paper industry.

The company is producing 400,000 tonnes of printing and writing papers and

has recently started a 600 tonnes per day cement plant using paper mill

waste and fly ash as raw material.

Scouting raw materials in Myanmar and Vietnam

To meet the rising demand for quality paper across India JK Paper is looking

to develop new facilities in Myanmar and Vietnam to source pulp so as to

increase output.

The company recognizes that in the short to medium term at least sourcing

domestic wood raw materials will remain a challenge. Because of this the

company says it is imperative to find new sources of quality raw materials.

The focus on Myanmar and Vietnam is due to their proximity and also their

policies for attracting inward investment.

The demand in India for paper continues to be strong. It is estimated at

around 11.5 million tonnes is currently required to meet domestic demand and

this could grow to 20 million tonnes by 2020.

The company has added close to 290,000 tonnes of production capacity over

the last few years and its total production capacity stands at 455,000

tonnes at the moment.

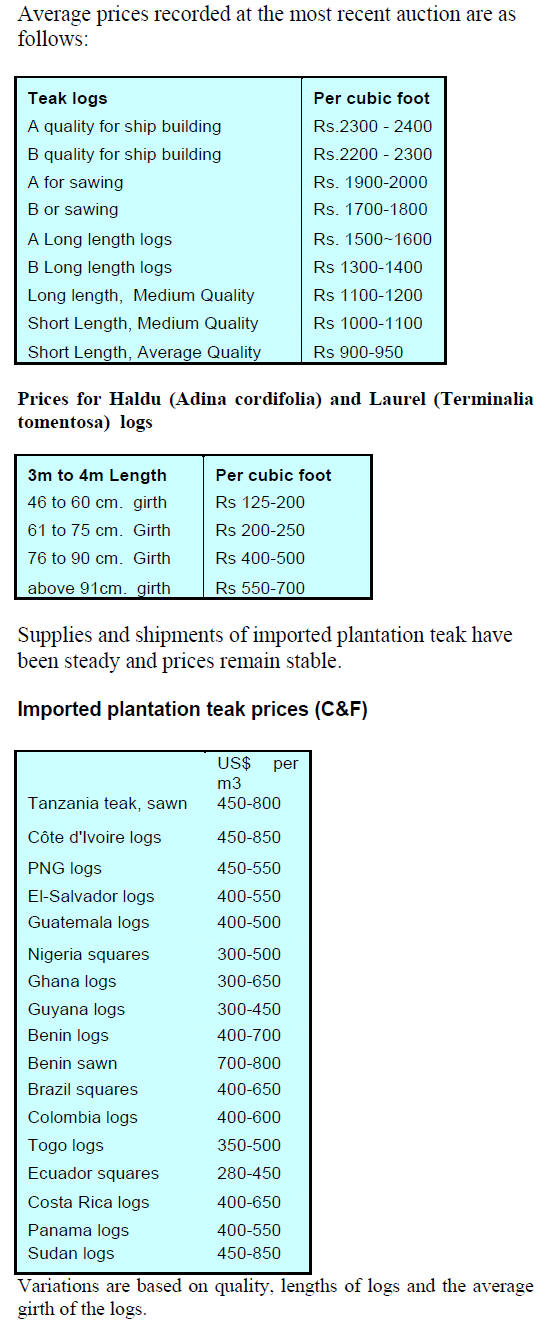

Sales of teak and other hardwoods at Western

forest Depots

During the last two to three auctions in south Gujarat depots the quality as

well as quantity of logs offered for sale were very good such that prices

improved on the back of strong buyer interest.

During the most recent auction a correction in prices was observed as buyers

limited purchases to their immediate requirements only.

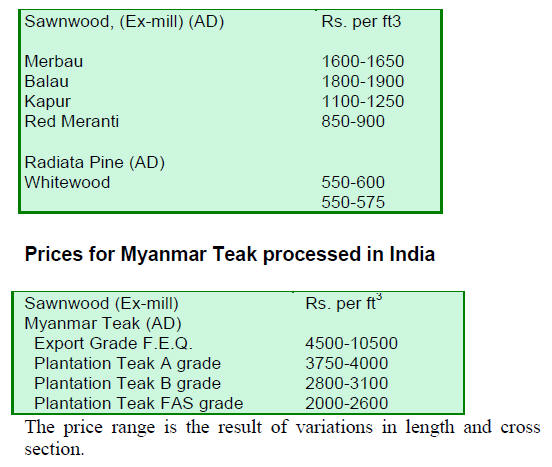

Ex-sawmill prices for imported hardwoods

Prices for air dried sawnwood per cubic foot, ex-sawmill are shown below.

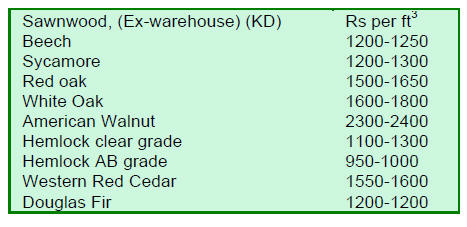

Imported KD 12% sawn wood

Prices are currently firm due to weak rupee.

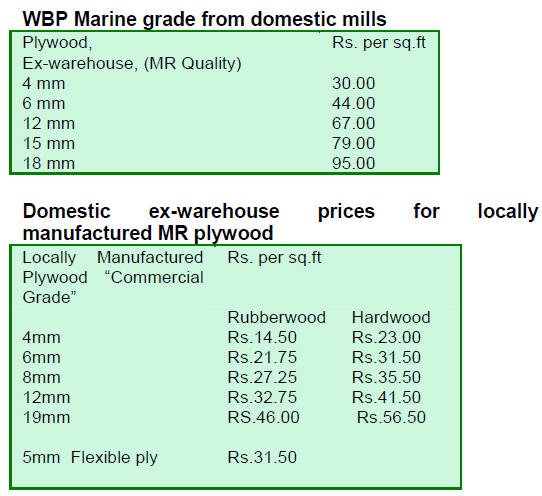

Plywood market prices

Prices remain unchanged as follows:

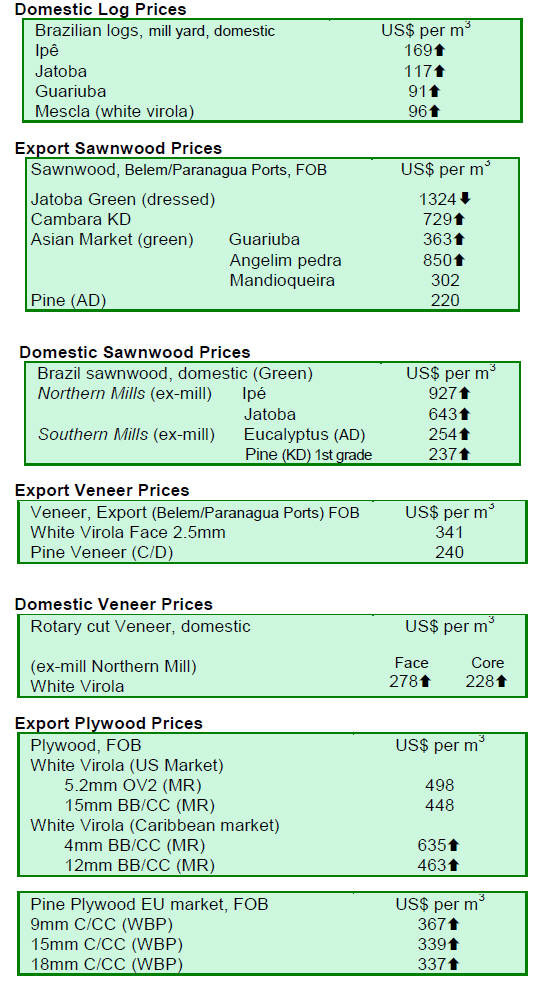

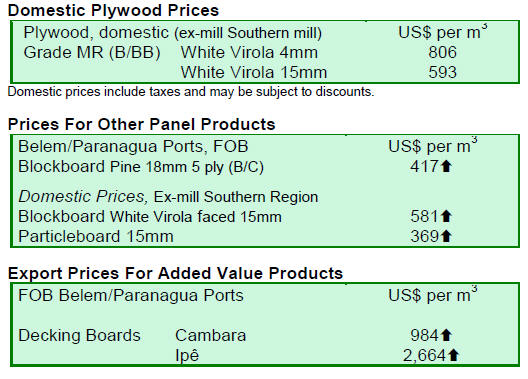

7. BRAZIL

Forest inventory to be updated by

2016

The first national forest inventory in Brazil was conducted in the 1980s and

the focus was on assessing timber stocks. A new inventory is planned and

will be broader in scope encompassing sustainability.

Work on testing the methodology for the new inventory started in Santa

Catarina and Brasilia in 2011 and full scale field work will begin this year

and will be completed by 2016.

The new inventory will provide authorities with more information enabling

them to plan and implement appropriate policies in areas such as forest

concession allocation and management and carbon stock assessments.

The inventory is expected to provide a greater knowledge of the potential of

the forests which represent about 62% of the 8.5 million square kilometers

of the country.

The new forest inventory will not only provide information for developing

conservation and environmental strategies but will also provide the means

for developing sound economic strategies for the sustainable management from

natural forest to ensure only legally sourced wood products enter the

domestic market.

The new forest inventory will be based on some 20,000 data points across the

country, 7,000 of which will be in the Amazon rainforest. The intention is

to update this new inventory every five years.

The cost of the new inventory is estimated at R$150 million, of which some

R$65 million will be provided from the Amazon Fund administered by the

Brazilian Development Bank.

São Paulo the largest domestic market for certified timber

The Institute of Agricultural and Forestry Management and Certification has

released a report on the consumption of certified Amazon timber entitled

"Unraveling the Brazilian market for FSC certified tropical timber".

The report addresses three main issues:

the relationship between producers and buyers of FSC certified wood

market opportunities for FSC certified wood

demand for products with the FSC community label

The report is based on interviews with companies and communities managing

forests as well as wood product manufacturers utilising timber from the

Amazon.

Brazil has a massive area of certified forest and is ranked the world’s

sixth largest in terms of certified forest.

The report mentions that the area of certified forest in Brazil amounts to

some 6.3 million hectares a figure which includes natural forests and forest

plantations.

The report further states that the share of certified natural forests is

approximately 20% of the total area of certified forest.

The report notes that around 70% of the available FSC certified timber is

exported but that a large volume of tropical timber sold in the domestic

market does not meet the social and environmental requirements of FSC

certification. São Paulo state is the largest national consumer of certified

timber (14%), followed by the Northeast region (9%).

The study highlights the potential for an increase in production of

certified tropical timber and estimates that output could grow by aabout 70%

over the next three years.

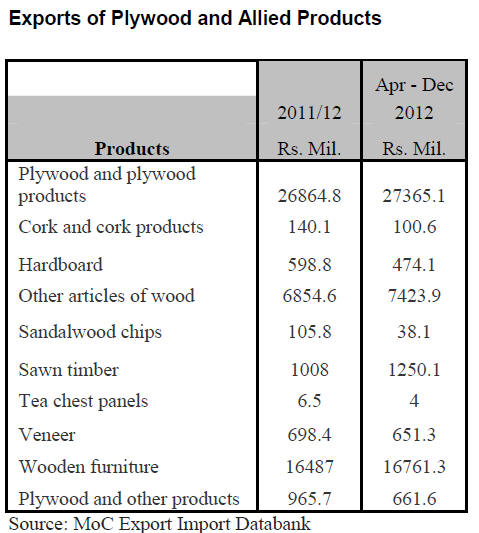

Developments in wood product exports

Between 2002 and 2012 wood product exports increased from US$3.8 billion to

US$8.5 billion however, exports of solid wood products, as a proportion of

the total, fell from 46% to 22% in the same period.

Between 2005 and 2012 plywood exports declined 87%, tropical sawnwood

exports declined 67% while exports of pine sawnwood fell 49%.

Other solid wood products exports also fell in the period 2005 to 2012 for

example, pine plywood exports were down by a third; there was also a 38%

reduction in exports of value-added products mainly furniture.

Data indicate that tropical timber exports were affected greater than

products from plantations.

Analysts suggest that the cause of the decline in tropical timber product

export was related to the increased costs involved in meeting more demanding

standards for forestry operations, the lack of a clear development policy

for the tropical wood products sector and environmental issues in importing

markets. These factors also resulted in a decline in investment in tropical

wood product manufacturing.

Another factor which contributed to the weaker exports was the strengthening

of the Brazilian currency such that Brazilian exporters lost competitiveness

in international markets.

Pará state to have new organization to monitor forest and milling

operations

To meet the requirement of the EU timber regulation European importers are

requesting documentation to prove the origin of wood products and

demonstrate legality throughout the supply chains.

This is a challenge for Brazilian exporters who say meeting the requirements

of imports in Europe is complex and requires Brazilian companies and

government institutions to work together to ensure trade is uninterrupted.

In the state of Pará, the biggest exporter of tropical timber in Brazil,

measures to improve monitoring and reporting of forest and processing

operations are being considered. Media reports suggest it is possible a new

organization will be established to provide monitoring services to industry.

It is estimated that the current forest concessions which were allocated

after 2010 can supply between 14 and 20 million cubic metres of which 85%

will be consumed in the domestic market and the remainder exported.

Analysts report that the pulp and paper sector has been able to adjust

quickly to the requirements of the EUTR as most operators were producing

certified products and had management processes in place which could be

adapted to meet the requirements of importers in Europe.

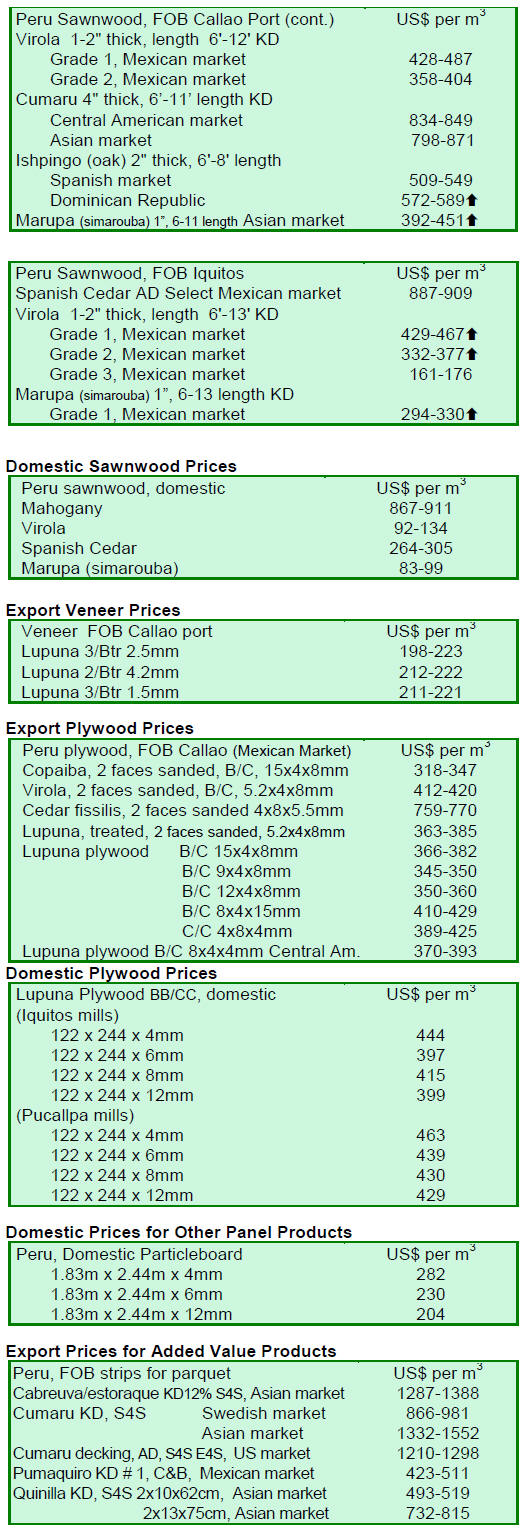

8. PERU

Industrial park planned for Pucallpa

In August this year work will begin on the construction of an industrial

park in Pucallpa. The park will be adjacent to the Federico Basadre road,

which runs from Pucallpa to Lima.

When complete the industrial park will extend over 288 hectares. The first

phase of the development will involve 44 hectares and will cost around US$12

million. Finance will be provided by the Development Finance Corporation (COFIDE).

The relocation of wood processing plants to the park is expected to

facilitate greater control over the flow of logs. All logs coming from

Loreto and Ucayali will enter the park making the monitoring and control of

log movements more efficient.

The concentration of processing plants in the park will also provide an

opportunity for efficient wood residue utilisation and disposal.

Native communities contribute to National Forest and Wildlife Policy

The Association for the Development of the Peruvian Rainforest (AIDESEP), an

organization that brings together native communities from around the

country, has contributed to the draft National Forestry and Wildlife Policy

(PNFFS).

During a recent workshop to discuss the Forestry and Wildlife Policy draft

Alberto Pizango Chota, president of the AIDESEP, highlighted the importance

of open and honest communication between indigenous peoples and the state.

The workshop concluded with approval of the contributions from AIDESEP.

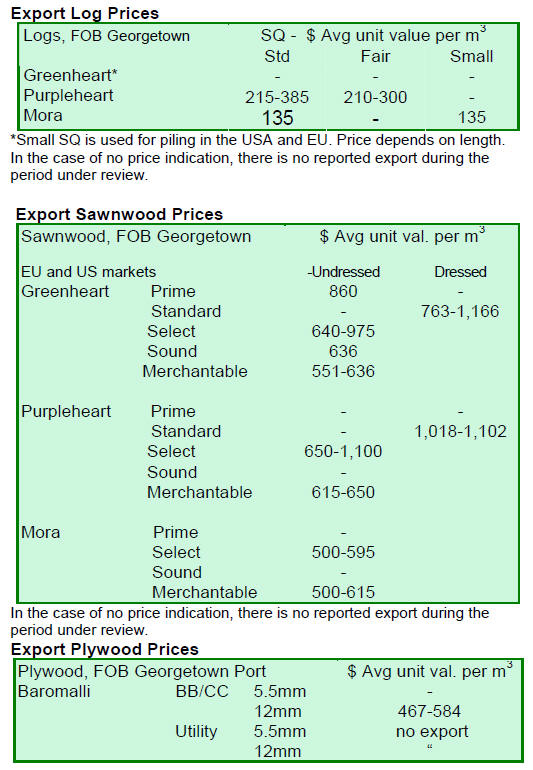

9. GUYANA

India a major market for Guyana logs

For almost a month there has been no export of greenheart logs however,

purpleheart logs were exported in both Standard and Fair sawmill qualities.

Purpleheart standard quality log FOB prices remain largely unchanged at

US$385 per cubic metre while FOB prices for Fair sawmill quality logs were

at US$300 per cubic metre.

Mora logs were exported in the period under review and prices firmed

slightly. Both Standard and Small sawmill quality logs were exported at an

average of US$135 per cubic metre. The main market for logs for the period

of review was India.

Firm demand spurs improved prices

The export market for sawnwood was active and favourable prices were

secured.

Undressed greenheart sawnwood was traded at prices ranging from US$636 to

US$975 per cubic metre FOB.

Undressed purpleheart (select) sawnwood say top end prices move from US$950

to US$1,100 per cubic metre FOB. On the other hand Undressed purpleheart

(merchantable) sawnwood prices remained stable at US$650 per cubic metre

FOB.

Undressed mora (select) sawnwood export FOB prices also recorded gains,

moving from US$575 to US$595 per cubic metre.

Undressed mora (merchantable) also attracted favourable prices earning as

much as US$615 per cubic metre FOB.

Dressed greenheart sawnwood export prices improved from US$1,102 just two

weeks ago to US$1,166 per cubic metre FOB, but Dressed purpleheart sawnwood

prices remained unchanged at US$1,102 per cubic metre FOB.

Plywood export FOB prices were largely unchanged at US$584 per cubic metre.

Roundwood (Piles and Posts) attracted favourable prices on the export

market. Greenheart Piles earned as much US$634 per cubic metre with main

market being North America. Posts also secured favourable prices on the

export market with US$530 per cubic metre.

Primary and value added industries to benefit from development

initiatives

The forest industry recorded a stable performance in 2012 in comparison to

2011. The Guyana Forestry Commission is working with operators to encourage

optimal utilisation of the forest and to widen the range of species

harvested.

A number of initiatives are being undertaken by Government of Guyana and the

Guyana Forestry Commission to improve the performance of the sector at the

primary and value added levels. In addition a number of other initiatives in

the area of sustainable forestry management, REDD+ and climate change will

continue during 2013.

Source:ITTO' Tropical Timber Market Report

CopyRight(C) Global Wood Trade Network. All

rights reserved.