Japan Wood Products

Prices

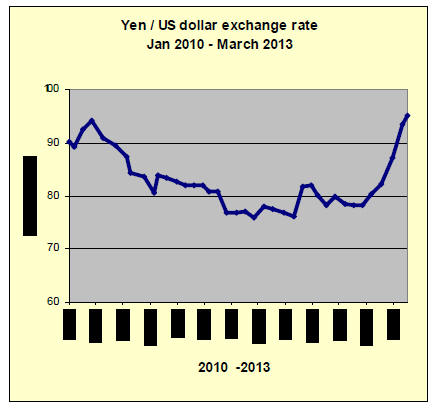

Dollar Exchange Rates of

12th March 2013

Japan Yen

96.04

Reports From Japan

Bank of Japan maintains aggressive stance

The Bank of Japan (BoJ) issued a press release after the Monetary Policy

Meeting held March 7.

http://www.boj.or.jp/en/announcements/release_2013/k130307a.pdf

The BoJ noted that while overseas economies remain weak they are showing

some signs of improvement. The BoJ further noted that Japan's economy has

stopped weakening.

The decline in Japan’s exports has been halted and, while fixed investment

in the private sector continues to be subdued, there are some positive signs

in the non-manufacturing sector.

In contrast, public investment has continued to increase and housing

investment has grown. Private consumption continues to be positive and this

is supporting an improving business outlook.

Reflecting on these developments in demand both at home and abroad the BoJ

press release said Japan's economy is expected to level off and to return to

a moderate recovery path driven mainly by domestic demand and improvements

in overseas economies.

In terms of risks, there remains a high degree of uncertainty concerning

Japan's economy. Of particular concern is the European debt problem, the

momentum in the US economy and the negative effects of the strained

relationship between Japan and China.

The BoJ press release emphasised that the Bank will pursue aggressive

monetary easing aimed at achieving price stability through a virtually zero

interest rate policy and purchases of financial assets.

In addition, the Bank will provide support for financial institutions'

efforts to strengthen the foundations for economic growth and to increase

their lending.

These measures, says the bank, will continue as long as the Bank judges it

necessary to achieve its policy goals.

The next meeting of the BoJ will be in early April by which time the new

bank governor will be in office. At the April meeting analysts expect to see

the Bank announce further aggressive monetary easing.

The BoJ has already doubled its inflation target to 2 percent and pledged

unlimited asset purchases to revive the economy.

Assessment of the Japanese economy:

The Japanese government recently released its assessment of prospects for

the year.

http://www5.cao.go.jp/keizai3/getsurei-e/2013feb.html

This assessment was derived from the report "Fiscal 2013 Economic Outlook

and Basic Stance for Economic and Fiscal Management". This document was the

basis for the 2013 budget and supplementary budget approved on February

26th.

The cornerstone of the government’s fiscal plan is to have the BoJ pursue

aggressive monetary easing in order to achieve a two percent rate of

inflation at the earliest possible time.

The current state of the Japanese economy was assessed as follows:

the economy is bottoming out but weakness is seen in some areas

exports are falling but at a slower rate

industrial production is bottoming out

corporate profits show signs of bottoming out but small companies continue

to face difficulties

business investment is weak

improvement in employment has slowed and some severe aspects remain

private consumption is still firm

Overall the Japanese economy is still in a mild deflationary phase.

In the short-term, weakness in the economy will persist but recovery is

expected supported by improvement in business confidence, improvements in

exports, the result of the weaker yen, and the effect of the government’s

monetary policy. However, slowing overseas demand is still a downside risk

for the Japanese economy.

When overseas demand begins to strengthen Japan’s export performance will

start to improve. In the short-term it will be domestic demand and public

investment that supports the economy. Business investment, says the BoJ is

projected to remain weak especially in the manufacturing sector.

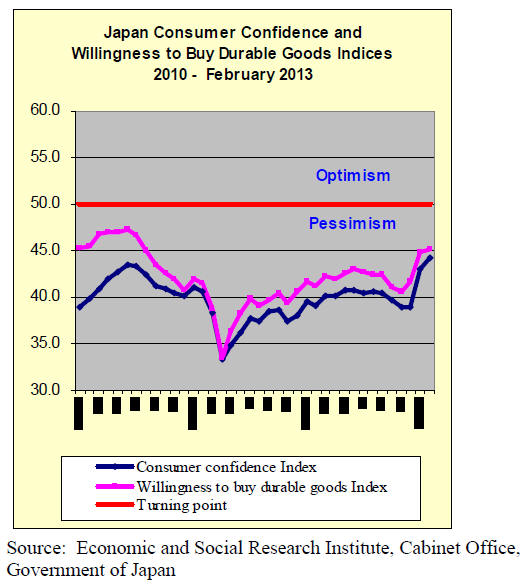

Consumer confidence improves but still below 50 points indicating

‘pessimism’

Japan's February Consumer Confidence Index (CCI) rose to 44.3 in February

2013, the highest level in more than five years. While analysts are

encouraged by the upward trend in the index, it must be remembered that a

reading below 50 indicates overall consumer pessimism.

The CCI survey reports that over 69% of the 6700+ households surveyed

believe prices are going to increase over the next twelve months.

The February survey confirmed analyst’s forecasts that the economic outlook

in Japan is improving. Confidence rose in all of the categories assessed

i.e. overall economic well-being, income growth, durable goods purchases and

job security.

The success of the government in getting some companies to raise workers

bonuses is clearly impacting consumer sentiment.

While households have been impressed by moves by the government and Bank of

Japan to boost inflation over the next few years, sentiment in the

manufacturing sector is lagging behind that of consumers.

Energy imports drive up trade deficit

The weaker yen has adversely affected Japan’s trade deficit which rose to a

record US$17 billion in January 2013.

The rise was not wholly unexpected as the weaker yen had a big impact on

import bills plus the fact that January is, traditionally, a slow month for

exports.

The impact of the weaker currency was most apparent for energy imports which

have soared since the shutdown of almost all the nuclear reactors in the

country.

Power generation is now almost entirely dependant on oil and gas, both of

which have to be imported. Recent data show that imports of natural gas

increased by around 12% while oil imports increased over 30%.

Japan’s export performance in January was encouraging, growing 6.5% from

levels in 2012; however this was the first increase in eight months. This

good news was tempered however by the 7% plus rise in the cost of imports.

Many observers expect the Japanese government to push to restart some

nuclear reactors to cushion the impact of the weaker yen on energy import

bills.

2013 Japan/China trade prospects

Japan's total trade with China dropped 3.3% to US$333.664 billion in 2012,

marking the first drop since 2009. Imports from China rose 3.0% to

US$188.955 billion, setting a record high while exports to China fell 10.4%

to US$144.794 billion

As a result, Japan's balance of trade recorded a deficit of over US$44.246

billion. This was the first deficit exceeding US$40 billion.

Also, Japan's exports worldwide fell 2.4% from a year earlier to US$801.3

billion, a total decrease of US$19.5 billion, of which the drop in value of

exports to China reached US$16.8 billion.

The Chinese economy is strengthening from the decline in the third quarter

of 2012 and Japan's exports to China are showing signs of recovery.

However, the impact of the Chinese government emphasis on structural reform

could slow growth and Japanese analysts do not foresee the Chinese

government introducing large-scale stimulus measures to boost domestic

demand.

It is projected that, even if Japan’s exports to China improve, the rate of

improvement will be modest.

Japan’s imports from China are expected to continue upwards fueled by

development of Chinese production of machine parts and raw materials as well

as production and export of finished goods. On the basis of the assessment

made Japan-China trade throughout 2013 is expected to improve.

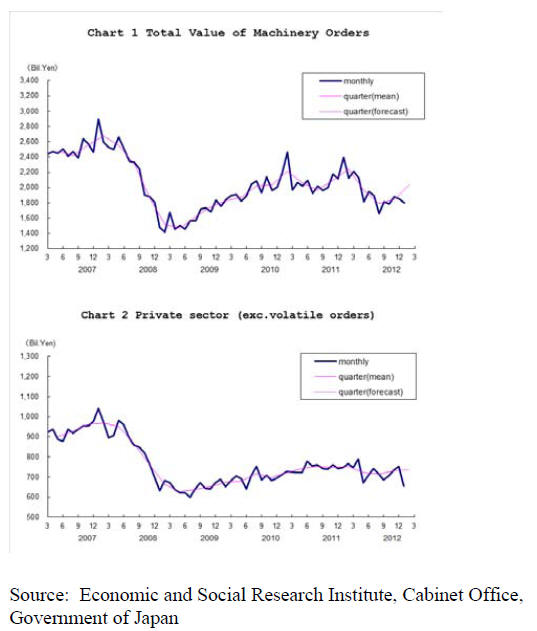

Machinery orders

The trends in the value of machinery orders are a good indication of

business sentiment in Japan. The latest data show that the total value of

machinery orders received by 280 manufacturers operating in Japan fell by

3.0% in January compared to the level in December.

Private-sector machinery orders, excluding those for ships and those from

electric power companies, fell by a seasonally adjusted by 13.1% in January.

Weak yen, unexpected consequences for Japanese manufacturers overseas

The Trade and Industry Ministry is forecasting trade with China, the number

one trading partner, should recover this year. In 2012 trade levels between

the two neighbours fell for the first time in three years because of a

territorial dispute and the slowdown in the Chinese economy.

The weaker yen also affected the trade deficit with China because Japan

imports so much from the country. Much of the import from China is of goods

manufactured in China by Japanese companies which relocated during the time

the yen was so strong.

Because the yen has weakened this ‘escape’ has the unexpected consequence of

making imports from Japanese manufacturers located in China more expensive

in the Japanese domestic market.

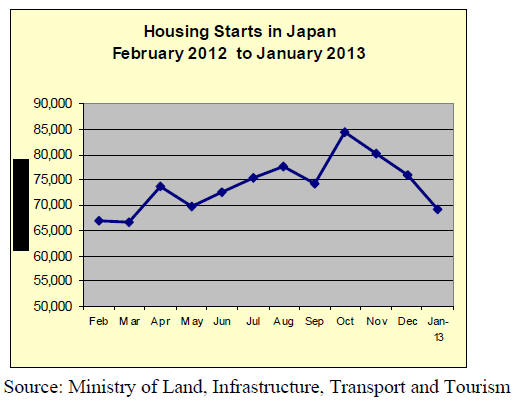

Housing starts in Japan

Housing starts in Japan fell 1.9 % in January compared to levels a month

earlier however, on a year to year basis, they have increased around 5%.

Over the past 5 months housing starts have exceeded levels in the same

period last year.

Housing starts in 2012 were 863 ,292 units slightly down on the average for

the previous 5 years (870,000 units). Investment in owner occupied homes in

January was up 2.2% while the number of units built for rent fell slightly.

The pace of starts in January was below expectations but it is difficult to

determine a trend from January data as there was an extended holiday period.

Another factor influencing the pace of starts was the severe weather across

Japan.

For the complete housing data see the Construction Research and Statistics

Office. Policy Bureau, Ministry of Land, Infrastructure, Transport and

Tourism website at:

http://www.mlit.go.jp/toukeijouhou/chojou/stat-e.htm

Trade news from the Japan Lumber Reports (JLR)

The Japan Lumber Reports (JLR), a subscription trade journal published every

two weeks in English, is generously allowing the ITTO Tropical Timber Market

Report to extract and reproduce news on the Japanese market.

The JLR requires that ITTO reproduces newsworthy text exactly as it appears

in their publication.

For the JLR report please see:

http://www.n-mokuzai.com/modules/general/index.php?id=7

Shortage of softwood plywood

Nationwide supply shortage of softwood plywood continues. Production of

plywood mills in Northern Japan has been down due to cold weather and heavy

snow and deliveries are largely delayed.

Meantime, the demand is steady and distributors are placing more orders, out

of which about a half seems to be speculative orders. Plywood mills have

been shipping contracted volume for house builders and precutting plants but

are declining to take spot orders.

Since last December, order balance increased to almost one month so that

shipment is delayed about two to three weeks even in February. The delayed

deliveries accelerate speculative orders.

The market last year had been down through the year by off balance of supply

and demand and the prices had kept falling so that dealers carry very little

inventories. Dealers had impression that the supply is ample and the volume

is available at any time but all of a sudden, things reversed with short

supply.

Mills in the North East have hard time in cold weather as logs are frozen so

that they have to go to hot bath to thaw then veneers are stick together

with ice so that they have to be separated sheet by sheet by hands to send

to dryer. This causes natural production drop.

Plywood

Domestic softwood plywood manufacturers are speeding up increase of the

prices. All through 2012, large shipments continued but the prices had kept

falling so they are determined to stabilize the market for long period this

year.

Delayed shipments of plywood started in December last year due to heavy

orders then there is no sign of ending of the delay in March yet after

peaking in February. The delay has been mainly for dealers but now even for

some precutting plants suffer such delayed shipment.

The manufacturers give priority to ship direct to precutting plants and

house builders then send the surplus cargoes to wholesalers and dealers.

Normally this time of the year is demand slow season with snow and cold

weather but this year is different. Precutting plants are busy with full of

orders then plywood mills in Northern Japan suffer frozen logs, which

reduces the production.

Under this situation, in wholesale channels, short supply lasted for two

months now and this pushes the prices up. Currently in Tokyo market, 12 mm

3x6 (special type/F 4 star) panel prices are 850-880 yen per sheet

delivered, 80-100 yen higher than February.

The prices of imported plywood are also rising. The suppliers’ offer prices

are high then with rapid progress of depreciation of the yen, the cost is

way up. The market prices eased some in mid February then as soon as high

offers by suppliers reached the market, the prices in Japan again took off.

Knowing that future arrivals would cost higher, there are some speculative

purchases in the market.

Market prices are 1,050-1,100 yen per sheet delivered on JAS concrete

forming 3x6 panel, 80 yen higher than February and 1,150-1,200 yen on 3x6

JAS concrete forming for coating, 20-50 yen up. Price trends are illustrated

below.

January 2013 furniture imports

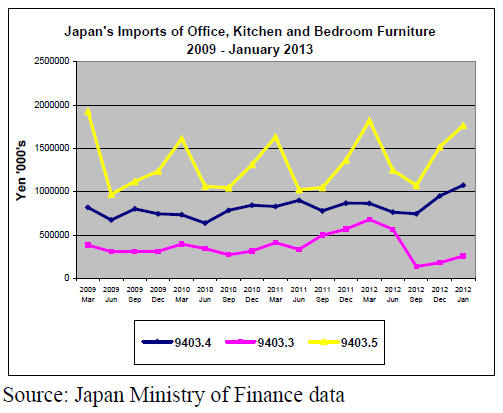

The source and value of Japan’s office, kitchen and bedroom furniture

imports for January 2013 are shown below. Also illustrated is the trend in

imports of office furniture (HS 9403.30), kitchen furniture (HS 9403.40) and

bedroom furniture (HS 9403.50) between 2009 and Jan 2013.

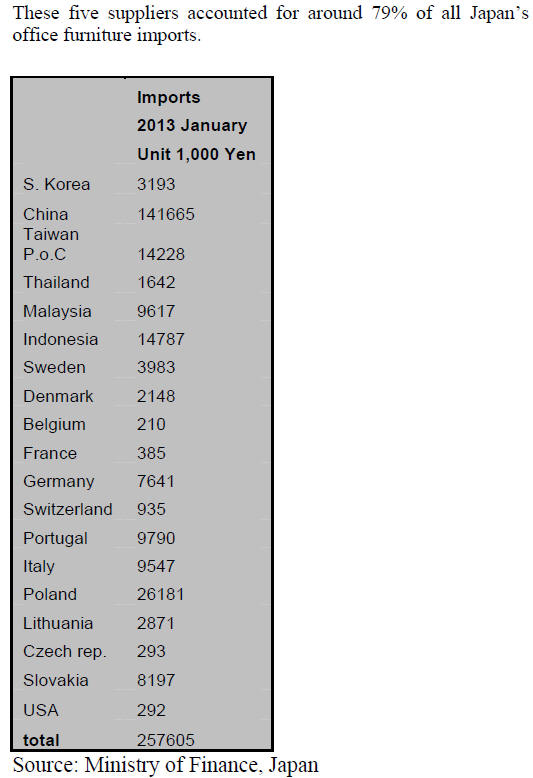

Office furniture (HS 9403.30)

January 2013 imports of office furniture totaled Yen 2.6 bil. Up around 7%

on imports in January 2012. In January 2013 China was the largest supplier

of office furniture to Japan accounting for approx 54% of imports. In

January 2013 the top five suppliers in terms of value of imports were China

(54%), Poland (10.1%), Indonesia (5.5%), Taiwan P.o.C (5.3%) and Portugal

(3.8%).

Kitchen furniture (HS 9403.40)

Kitchen furniture imports are the second largest segment of all furniture

imports into Japan after bedroom furniture. In January 2013 kitchen

furniture imports totaled Yen 10.8 bil. an increase of around 37% on levels

in January 2012.

The major suppliers in terms of value of imports in January 2013 were

Vietnam (39%), Indonesia (21%), Philippines (15%), China (12.6%) and the USA

(4.5%). In January all of the top suppliers increased sales to Japan except

China were the value of imports by Japan fell around 20%. The top five

suppliers accounted for over 90% of all kitchen furniture imports in January

2013.

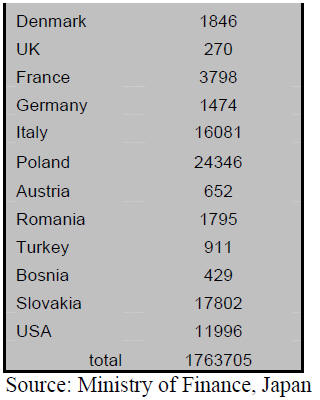

Bedroom furniture (HS 9403.50)

The value of bedroom furniture imports in January 2013 was almost 65% higher

than imports of kitchen furniture and some five times the value of office

furniture imports. The top five suppliers accounted for just over 93% of all

imports of bedroom furniture with the largest supplier being China (59%)

followed by Vietnam (22%), Malaysia (8.5), Thailand (2.5%).

In January 2013 bedroom furniture imports increased by around 5% compared

the levels in January 2012.

|