|

Report

from

North America

US Import trends

US year-to-October 2012 imports were 6% above the

previous year. China¡¯s share in total imports year-todate

remained at around 66%, Year-to-October imports

from Indonesia soared by 29%, compared to a 5%

growth in imports from China.

Softwood plywood

US imports of softwood plywood were down 16%

from 2011 on a year-to-date basis. Chile remains the

top supplier, but imports from Chile continue to

decline. China¡¯s share of US imports increased from

just 3% in 2011 to 12% in 2012, on a year-to-date

basis.

Mouldings

Total US 2012 moulding imports (year-to-October)

declined by 8% compared to levels in 2011. Much of

the decline was in Brazilian shipments, but imports

from China were also down. Softwood moulding

imports as of October 2012 were up by 12% from

2011. Softwood moulding imports from China

increased by 27% on a year-to-date basis.

Flooring

US year-to-October imports of assembled hardwood

flooring panel increased by 10% from the previous

year. China¡¯s share of imports was around 68%, down

slightly from levels in 2011. Canada and Brazil

increased their share of US imports.

Hardwood flooring imports are less than a third of

assembled flooring panel imports, but they grew by

57% year-to-date from 2011. The main beneficiaries of

the growth in US imports were Indonesia and

Malaysia.

Doors

While US wooden door imports declined in October

2012 overall the level of imports was still 5% above

levels in 2011. Most major suppliers to the US market

increased their shipments compared to 2011, but door

imports from China had dropped by 5% up to October

2012.

Furniture

Year-to-October US imports of wooden furniture were

up 9% compared to 2011. China was a major supplier

and China¡¯s share of total US imports grew by 9%

year-on year.

China¡¯s share in total US furniture imports year-on

year was 49%, slightly up from levels in 2011

Vietnam¡¯s share of US imports year on year from 13%

in 2011 to 15% in 2012. India, Mexico and Malaysia

also substantially increased furniture shipments to the

US.

Release of US plywood dumping investigation

postponed

The US Department of Commerce has postponed the

release of preliminary countervailing duty from its

probe into plywood imports from China. The

countervailing duty results would demonstrate the

value of subsidies by China¡¯s government for plywood

producers in China.

The preliminary results were scheduled for release in

December, but the Department postponed the release to

26 February 2013 at the request of US producers.

The US began investigating antidumping and

countervailing duties on imports of plywood from

China in November 2012. The release of the

preliminary antidumping duty (in addition to the

countervailing duty) is still expected for 6 March,

2013.

A group of American hardwood plywood

manufacturers, the Coalition for Fair Trade of

Hardwood Plywood, initiated the investigation, while

another industry group, American Alliance for

Hardwood Plywood, and the International Wood

Products Association oppose the introduction of duties

on plywood from China.

Housing market forecast to recover

Demand for windows and doors are forecast to grow

significantly over the next four years, according to

information in two recently published market research

reports.

The steep decline in housing starts between 2007 and

2010 resulted in a decline in demand for windows and

doors. Most US door and window manufacturers

(millwork companies) are small to medium-sized and

between 2007 and 2012 the number of millwork

companies in the US because of the collapse in demand

from house builders.

Over the next five years new housing construction in

the US is expected to recover and demand for windows

and doors will improve. Demand from the home repair

and remodelling sector is also expected to grow, but at

a slower pace.

The US government offered tax credits to home owners

between 2009 and 2011 for installing energy efficient

windows and doors but this scheme has ended which

will further affect demand.

Growth in door and window market

US demand for wood windows and doors is forecast to

grow by an average of 10% annually until 2016 and

will be worth around US$10 billion in 2016.

The market share of wood in total window and door

demand is forecast to be stable at around 30%. Plastic

windows and doors are expected to continue taking

market share from wood and metal because of their

low cost.

Residential construction

Construction of new homes in the US fell 3% in

November 2012 driving the seasonally adjusted annual

rate to 861,000. Analysts are forecasting that the

annual 2012 starts will come in at 865,000.

The US housing starts rate for October was revised

down to 888,000 from an estimated 894,000.

Despite the decline in November, US housing starts

expanded more than 20% over the past 12 months but

the rate of new home building is far below the peak of

nearly 2.3 million in 2006.

The US housing market continues to recover but

discussions in the US Congress about reducing the

popular tax deduction on mortgage interest may reduce

demand for homes.

It seems unlikely, however, that the tax deduction

would be completely eliminated. President Obama has

suggested a limit on deductions by high-income

earners. It is possible that such changes could reduce

the price of homes, especially when renting is an

attractive alternative to owning a home.

Housing starts increased by 3.6% in October to a

provisional 894,000 units, at a seasonally adjusted

annual rate. Single-family starts remained the same

from October at 594,000, while multi-family housing

starts increased by almost 12% to 300,000 units.

Building permits for new homes fell in October to

866,000 units (seasonally adjusted annual rate). The

decline was in multi-family housing permits, while

permits for single-family home construction increased.

The number of permits issued is an indicator of future

building activity.

Decline in 2013 Canadian housing starts expected

In Canada, housing starts declined further to 204,107 in

October, at a seasonally adjusted annual rate. The

Canada Housing and Mortgage Corporation expects a

slight decrease in housing starts for 2013.

In 2012, the growth in housing starts was driven by

multi-family home starts, while single-family home

construction was stable. Multi-family construction is

expected to decline in 2013, which will moderate the

total number of starts. Canadian sales of existing

homes slightly declined to an estimated 457,400 in

2012, but they are forecast to rise again in 2013, to

461,500.

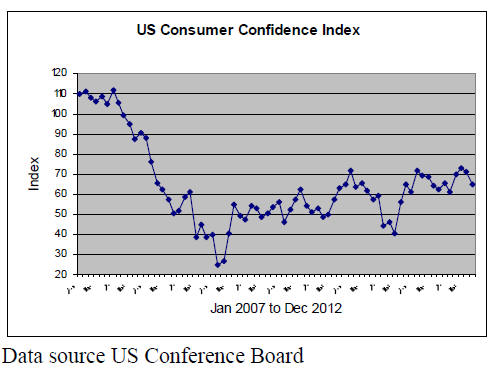

US Consumer confidence falls in December

The Thomson Reuters/University of Michigan US

consumer sentiment index was 30% higher in

November 2012 than in the same month in 2011.

However, the US consumer confidence index fell

almost seven points in December 2012 because of

uncertainty over prolonged negotiations in the US

aimed at avoiding the fiscal cliff.

The US Conference Board, which conducts the

consumer survey, reported that the consumer

confidence index dropped to 65 in December 2012

from close to 72 in November of the same year,

(1985=100).

Consumers' optimism seem in November was short

lived. The proportion of consumers expecting an

improvement in business conditions over the next six

months fell three points, those consumers expecting

conditions to worsen increased by six points

* The market information above has been generously

provided by the Chinese Forest Products Index Mechanism

(FPI)

¡¡

|