|

Report

from

Europe

Eurozone crises severely damages European

economic sentiment

The eurozone debt crisis is having an increasingly

negative influence on economic growth and sentiment

across Europe. The eurozone itself is almost certainly back

in recession, dashing hopes that it can grow its way out of

trouble.

In a forecast issued in the second week of November, the

European Commission warns that “sharply deteriorating

confidence and intensified financial turmoil are affecting

investment and consumption, while urgent fiscal

consolidation is weighing on domestic demand and

weakening global economic conditions are holding back

exports. The best Europe can look forward to is “a gradual

and feeble return to growth” in the second half of next

year, according to the Commission.

The shockwaves of the euro crisis are too powerful to

avoid even for those European countries outside the

eurozone. This week, the Bank of England is expected to

revise down its UK growth forecasts for the eighth

successive quarter. Having once predicted 4% growth in

the UK for 2011, it will end the year with an expected 1%

growth.

Against this background, it is hardly surprising that the

autumn months have seen little or no improvement in

European demand for tropical hardwood lumber. This

sluggish trend is now expected to continue well into next

year – perhaps much longer if the worst fears of the euro

crises are realised.

Exchange rate volatility is another factor deterring new

purchases of tropical hardwoods. Over recent weeks the

euro has fallen dramatically against the dollar. This has

tended to increase the price competitiveness of African

hardwoods against Asian and North American species.

However with no-one certain how far the euro value will

fall, few importers are placing large new orders for

products that might be devalued by future changes in

exchange rates.

As a result, only small contracts are being negotiated for

new imports of tropical wood, with little or no speculative

purchasing. Importers and wholesalers are looking for

very specific items that can be received and turned around

as quickly as possible.

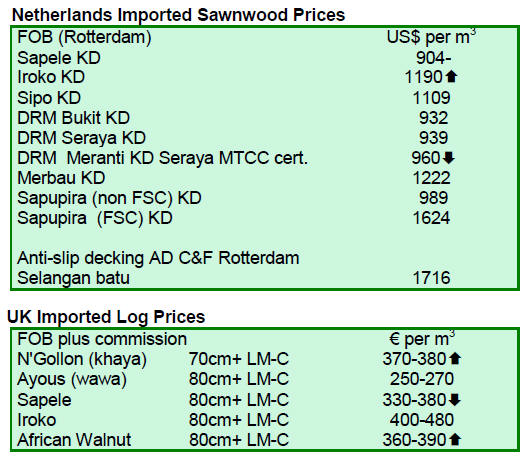

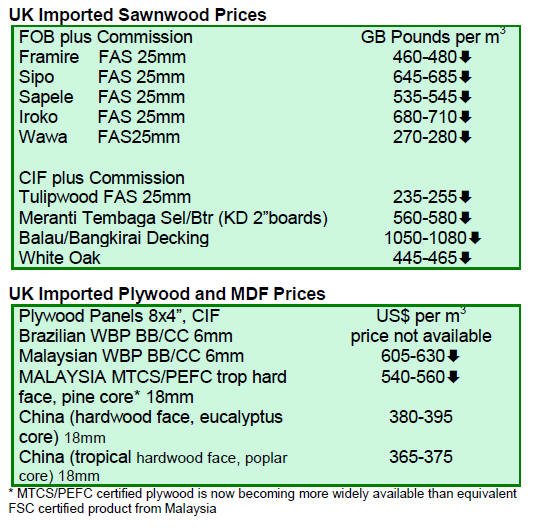

The general view is that existing landed stocks of standard

commercial items like sapele, sipo, iroko and meranti are

sufficient to meet current sluggish market demand. Where

gaps do open up in inventories, enough wood can be

obtained by cross-trading with other importers. Despite

reports of delayed shipments with the onset of seasonal

rains in African supply regions, European importers seem

much more concerned about demand-side than supply-side

issues.

One notable exception to this, according to the German

trade journal EUWID, is in the market for close-grained

hardwoods such as bubinga, padouk and doussie. These

species, formerly sourced in log form from Gabon, have

been in very short supply since introduction of Gabon’s

log export ban last year. EUWID reports continuing

intense competition to buy and rising prices for lumber of

these species in Europe.

Okoume plywood in the doldrums

The German trade journal EUWID reports that demand for

okoume plywood in Europe, having weakened during the

summer, has shown little sign of improvement since then.

Slow demand reflects sluggish activity in the construction

sector in France and neighbouring countries.

There has also been no improvement in demand from

yacht builders. Some French and Italian suppliers are now

dumping stock at low prices in an effort to boost cash

flow. As a result, producers have had to put on hold their

plans to raise prices to accommodate rising log and veneer

costs. Demand and prices for FSC certified, special

dimensions and better quality products are more stable

than for standard specifications.

Spanish hardwood demand very poor

Demand for hardwoods in Spain remains very poor.

Maintaining cash flow is a constant problem for importers

because turnover so low and banks are reluctant to lend to

the wood sector. Activity in the new build sector is

stagnant, with the private sector suffering from a large

overhang of unsold property and the public sector

curtailing spending.

The furniture sector is suffering both from poor domestic

sales and pressure from cheaper imports. The little demand

that exists for hardwood lumber is for joinery and flooring

in renovation projects.

The veneer sector is only slightly more robust due mainly

to export demand for decorative panels. Those Spanish

hardwood importers that built up stocks earlier in the year

in hope of stronger market conditions are now under

considerable pressure to offload and are actively selling to

importers in other parts of the continent.

AHEC Convention highlights hardwood market opportunities

Despite the gloomy economic picture, delegates at the

American Hardwood Export Council (AHEC) European

Convention in Warsaw on 27 October did not seem too

despondent about future market prospects.

There was general optimism that new opportunities for

sustainably managed hardwoods are opening up in Europe

on the back of new innovations and policy developments.

On the other hand, it was hard to paper over some obvious

signs of market distress in some parts of Europe. There

were also strong indications of tropical wood’s declining

competitiveness in certain sectors.

Held bi-annually, the AHEC Convention is a staple of the

international timber industry’s calendar, providing

networking for the timber trade and updates on market

conditions, forecasts and trends which will impact on their

business in the future.

Speakers at the Convention suggested that Germany has

probably been the strongest European market for

hardwoods this year, although there are emerging

obstacles to sale of tropical hardwoods. Underlying

economic conditions in the country remain relatively good

despite growing unease over the future of the euro.

New residential construction has been strong in Germany

this year, while public support for energy-saving measures

has boosted demand in the window sector. Lack of

alternative investment opportunities is encouraging more

consumers to increase spending on refurbishing their own

homes. The German door industry has been particularly

strong.

Fashion in Germany does not favour tropical woods

However fashions in Germany do not favour tropical

woods. Although there is a strong preference for dark

colours at present, the demand is for wood with lots of

character and grain. Much of this demand is now satisfied

by application of stain or heat treatment to oak and ash.

Clear grained species, both tropical and temperate (such as

hard maple), remain out of fashion.

A representative of a large European trading company

selling into Poland suggested that similar trends exist in

that country. This company formally concentrated on

selling tropical woods in Poland – particularly meranti for

window frames - because these are not easily replicated by

domestic timbers. However the fashion for tropical wood

has been declining in Poland while imported oak is

making ground.

Importers desire for rapid turnaround times must be

addressed by tropical hardwood suppliers

Several speakers from different corners of Europe noted

that the increasing need for rapid turnaround times in the

wholesale sector, combined with declining availability of

species like ramin, ayous and wawa, is a driving a shift

away from tropical species in favour of American

tulipwood for manufacture of mouldings and skirtings.

A hardwood importer based in Italy described the market

as “stop-go” this year. In the early months of 2011, the

Italian economy seemed to be strengthening and there was

rising confidence that the hardwood market was ready to

resume growth. However the market changed dramatically

over the summer months as economic uncertainty mounted

and costs of borrowing rose significantly.

Meanwhile, the Italian hardwood sector continues to

undergo significant structural change. Demand in the

furniture sector has been declining due to the shift by

larger manufacturers to lower cost locations, while the

joinery sector has become relatively more important.

Decline in furniture manufacturing in Belgium and

France bad news for tropical hardwoods

A Belgium-based importer noted similar trends in Belgium

and France. These markets are still “open for wood” as it

remains a very fashionable material. However there is

little likelihood of hardwood consumption in either market

ever returning to the sort of volumes typical before the

economic crises.

This is partly due to a major decline in furniture

manufacturing across the region. The trend in Belgium and

France is towards purchase of only small volumes of very

high quality hardwoods.

While the structure of European hardwood demand has

changed, AHEC was determined to highlight that new and

exciting opportunities exist to grow the market. Mike

Snow, Executive Director of AHEC, observed “Europe

continues to be a vital market with international influence

which punches above its weight, pushing innovation and

advancements in timber technologies and treatments.”

With such advancements, timber is finding markets and

applications not previously considered, such as in

structural uses.

Twelve metre high ‘Timber Wave’ built in central

London to promote US hardwoods

This was vividly illustrated by a film and panel discussion

examining the process to design and construct a 12 metre

high self-standing ‘Timber Wave’ in American red oak

outside the V&A Museum in central London. The work

was commissioned by AHEC for the London Design

Festival and created by AL_A and Arup.

The Wave employs construction techniques and materials

normally used in furniture making to create a majestic

three - storey - high structure.

Related News:

|