Japan Wood Products

Prices

Dollar Exchange Rates of

15th November 2011

Japan Yen 77.03

Reports From Japan

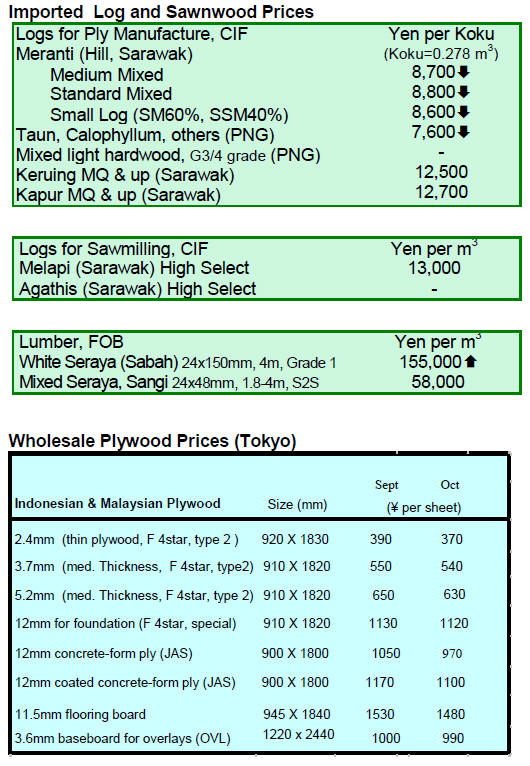

Plywood imports slow bringing some stability to the market

Plywood imports in September dropped sharply and were

down to about 202,300 cu.m, 36% less than in August and

25% less than the same month a year ago. The high level

of plywood imports following the March earthquake has

now come to an end. Estimates of plywood arrivals for

October are also low so the market, says the Japan Lumber

Reports (JLR), should firm as inventories decline.

In September plywood arrivals by source were; Malaysia

63,000cu.m, 52% down from August and 49% down from

September last year.

Imports from Indonesia were72, 000 cu.m, 32% down

compared to August and around 20% down year on year.

Imports from China totalled 56,000 cu.m, almost 18%

down on levels in August but still 19% up on September

2010 levels.

The supply of plywood from Malaysia dropped by almost

a third from the peak levels in May and supplies from

China are now down by half. In September this year

supplies from Canada were only 1,000 cu.m, 95% less

than in the peak month of June.

In late August, the plywood market virtually collapsed

under the strain of huge imports and prices plunged, says

the JLR. Today, plywood prices in the Japanese market are

bottoming out and there has been a hint of a rebound for

12 mm concrete formboards.

Importers estimate October arrivals at around 220-230,000

cu.m and say inventories are continuing to fall.

SE Asian log supplies tight

The JLR is reporting that log supplies in Malaysia remain

tight and vary by region. In the regions of Malaysia where

India is aggressively purchasing the supply is tight and the

log prices are higher than in other areas. In Sarawak

suppliers said to be asking more than US$330 per cu.m

FOB for meranti regular logs.

Logs suitable for the Japanese market are also in tight

supply but Japanese plywood mills are not chasing these

high priced logs because of uncertainty in the Japanese

plywood market and because they have adequate

inventories of about three months supply.

Sarawak meranti regular log prices are US$285-300 per

cu.m FOB, which is up by US$10-15 per cu.m. Meranti

small log prices are ranging from US$250 to US$270 per

cu.m FOB reports the JLR.

In recent months there has been an increase in ocean

freight costs adding around US$1 per cu.m to the landed

cost mainly because the number of loading ports for any

one shipment has had to be increased, says the JLR.

Third supplementary budget plan by the Forestry Agency

The third supplementary budget includes money for

restoration in Eastern Japan and for restoration work after

the typhoon during the summer. Funds are also allocated

for disaster prevention.

Around Yen140 billion has been allocated for extension of

the forest industry revitalization fund and for domestic

forest maintenance. Part of this fund is to be used to

subsidise transportation of thinnings from domestic forests

reports the JLR.

Another Yen11.24 billion is for restoration of quake

damaged wood processing facilities. This, it is estimated

by the JLR, will be enough to restore about 50 plants in

Iwate, Miyagi and Fukushima.

Plans are also in place to utilise wood waste resulting from

the damage caused by the earthquake and tsunami for

power generation. Around Yen 9.5 billion has been

allocated for this in the latest budget.

Housing starts rise after slowing in aftermath of the

March disaster

Housing starts in July and August were over 900,000 units

in terms of annual starts. The supply of homes has started

to catch up after the slow down because of the March

earthquake and negative effect of the termination of the

house eco point system. The eco point system has now

been re-introduced giving a boost to starts.

September starts were 64,206 units, around 11% less than

the same month a year ago and this was the first decline in

six months. Seasonally adjusted starts were 745,000 units,

20% less than August, the lowest in two years.

The largest decline by category was rental units, 18%

down, the lowest on record for the month of September.

Owners’ units also dropped recording the first decline in

three months and the second lowest in record.

Condominium starts, which were the driving factor for

housing starts recently also declined.

Japanese company to market FSC certified plywood

Jutec Corporation (Tokyo) will start marketing

domestically made FSC certified softwood plywood from

January next year. Jutec has been handling certified

products since 2008. So far, the certified products have

been imported but now the company will handle

commodity softwood plywood.

Jutec acquired ISO 14001 in December 2005 and started

marketing environmentally friendly products. It obtained

CoC certification by both FSC and PEFC in 2009.

Initially, imported certified materials were the main

products such as FSC certified Indonesian and Malaysian

plywood, Chilean radiate pine plywood, European OSB

and Chinese radiata pine products.

The company also traded the first FSC certified

domestically produced tropical hardwood plywood

produced by Ofunato Plywood, however this plywood mill

was destroyed by the tsunami in March this year.

Since November this year Jutec started marketing FSC

certified softwood structural plywood produced by Akita

Plywood. Jutec trades a variety of hardwood and softwood

panel products as well as imported and domestic products.

Nankai Plywood builds sawmill in Indonesia

The JLR is reporting that Nankai Plywood Co., Ltd. is

building a sawmill in South East Java in Indonesia. The

mill will be completed by March next year and will utilise

plantation falcata.

The mill will produce boards for lamination which will be

sent to their Surabaya finishing plant. Nankai Plywood

began its plantation development in 2006.

Related News:

|