|

Report

from

North America

OECD reduces US economic growth forecast

The recent fiscal debate in the US has negatively affected

consumer confidence and the confidence of the financial

markets in the government’s ability to reduce federal debt

while improving the country’s economy. The Organization

for Economic Cooperation and Development (OECD) has

revised the US growth forecast for this year from 2.6% to

1.4% in its latest world economic outlook.

To reduce unemployment and boost the economy,

President Obama unveiled a package of US$450 billion in

tax cuts and new spending. This includes social security

and payroll tax reductions if passed by the US Congress.

The package would be financed by reducing the federal

deficit and increasing taxes for the wealthy.

US Unemployment has not declined significantly since the

recession ended, and the August unemployment rate was

9.1%, unchanged from July, according to the US

Department of Labor.

The combined rate of unemployed and underemployed

Americans is estimated at 16% of the working-age

population. The usual rate of unemployment before the

recession was around 6%. Reducing unemployment is key

for the US economy where consumer spending accounts

for about 70% of the country’s GDP.

Little change in US housing market

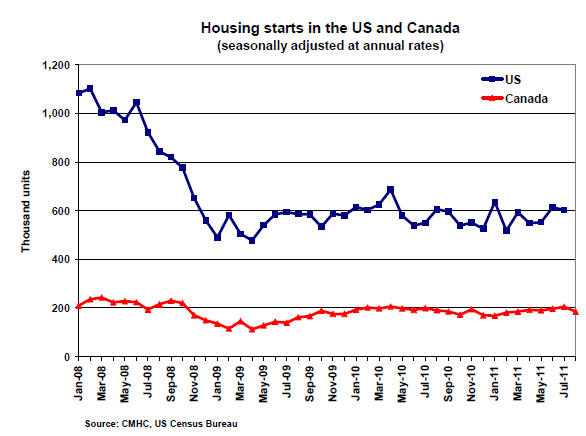

US housing starts increased in June and July compared to

levels earlier this year, but the outlook for new home

construction has not changed significantly in recent

months; the number of foreclosed homes on the market is

high and home prices are low.

Housing (un)-affordability remained at its highest level in

the second quarter of 2011 since measurements of the

National Association of Home Builders/Wells Fargo

Housing Opportunity Index started more than twenty years

ago.

In July, 604,000 (seasonally adjusted annual rate) new

homes were started according to the US Department of

Commerce figures. While this is down from June, housing

starts remained above the 600,000 mark.

Housing starts are almost 10% above starts in July last

year. Single-family home starts declined (-4.9%) while

multi-family housing construction continued increasing

(+7.8%) because of strong demand for rental housing.

There was little change in sales of new single-family

homes in July. Sales of single-family homes declined by

less than 1% from the previous month. The National

Association of Home Builders expects only marginal

improvements in sales of new homes in 2011 because of

subdued economic growth.

Building permits for new homes fell by 3.2% to a

seasonally adjusted annual rate of 597,000 units in July.

The number of permits issued can be an indicator of future

building activity. Builders’ confidence in the market for

new single-family homes was low but unchanged in

August, according the National Association of Home

Builders/Wells Fargo Housing Market Index.

Canadian housing starts in 2011 higher than expected

In Canada, housing starts decreased by 9.7% to 184.700 in

August (seasonally adjusted annual rate) after several

month-on-month increases earlier this year according to

the Canada Mortgage and Housing Corporation (CMHC).

Overall, housing starts have been higher this year than the

agency expected, but residential construction activity is

forecast to moderate in the coming months.

The majority of Canadian housing starts are multi-family

buildings in the larger urban centres, unlike in the US

where single-family home construction drives wood

demand. Single-family home starts in Canada’s urban

areas were almost steady at 64,400 units in August, while

urban multi-family starts declined by 16% to 101,400 units

(seasonally adjusted annual rate).

The value of permits for commercial building construction

remained unchanged in July after declining by 16% in

June, according to Statistics Canada.

Canada’s unemployment rate changed little over the

summer and stood at 7.3% in August. The central bank

announced in September that it maintains its key interest

rate at 1%. Mortgage rates are expected to remain at

historically low levels.

Net migration into Canada is forecast to remain steady at

245,900 in 2011, but is forecast to increase to 263,250 in

20 ITTO TTM Report 16:17 1 – 15 September 2011

2012. Migration is a significant driver of housing demand

in Canada.

Expected slowdown in Canadian housing market will

affect the demand for wood

CMHC revised its annual forecast up to a total of 183,200

housing starts for 2011, which is only slightly below 2010

starts. While interest rates remain relatively low, the

government introduced measures last year to prevent a

housing market boom.

Despite this, housing prices have increased in 2011 and

housing affordability has declined, mainly because of

home price increases in Vancouver without corresponding

growth in the economy and income.

CMHC forecasts a slowdown in terms of home prices and

new housing starts, but a housing market crash similar to

the US appears unlikely. While mortgage debt has

increased significantly (currently at 65%), Canada’s

housing market is not boosted by mortgage-backed

securities and sub-prime lending as the US market was

prior to the crash.

The expected slowdown in new construction in the next

two years will remove a source of wood demand at a time

when the US housing market is still at historically low

levels. It will also negatively affect Canada’s economic

growth by reducing employment in construction.

Americans spending less on home improvements

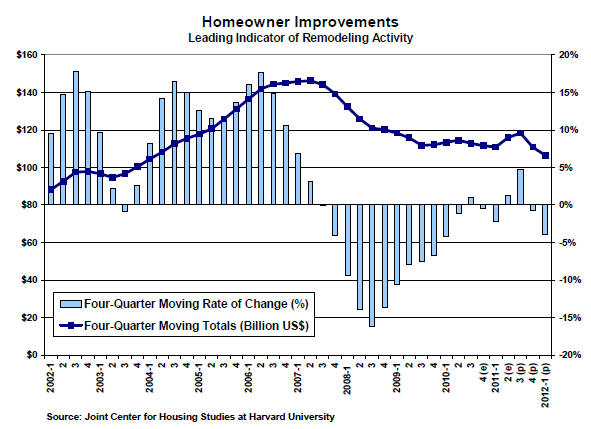

Spending on home repair and remodelling has weakened

in the first half of 2011 according to the US Census

Bureau. The Harvard Joint Center for Housing Studies had

forecast growing expenditures for this year, but after an

upturn earlier this year, spending is expected to weaken

again.

The recent slowdown in the US economy and the weak

housing market are the main reasons for homeowners to

postpone repair and remodelling projects. Compared to the

slump in new home construction, however, spending on

improvement remains much stronger and it is at levels last

seen in 2004.

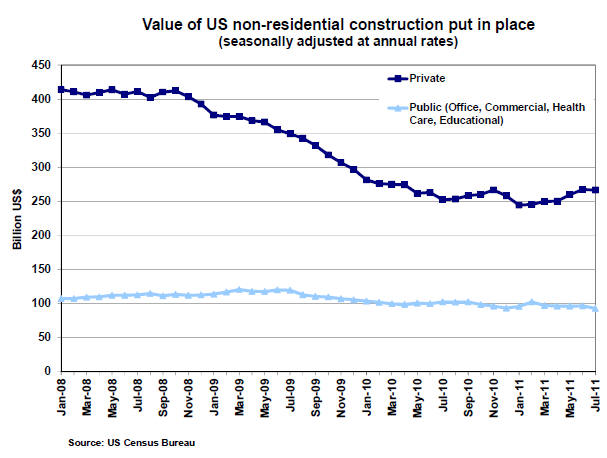

No recovery in US non-residential building construction

Non-residential construction declined by 1.3% from June

to July after a period of growth in May and June. This is

mainly due to lower public spending on health care and

education building construction. The value of public

construction put in place fell by 3.8% from June to July,

while private construction declined by 0.4%.

Business conditions in non-residential construction

worsened for the fourth month in a row according to the

American Institute of Architects. Design firms in both

commercial/industrial and institutional sectors have seen a

decline in activity after conditions improved last fall and

winter.

Impacts from the Lacey Act

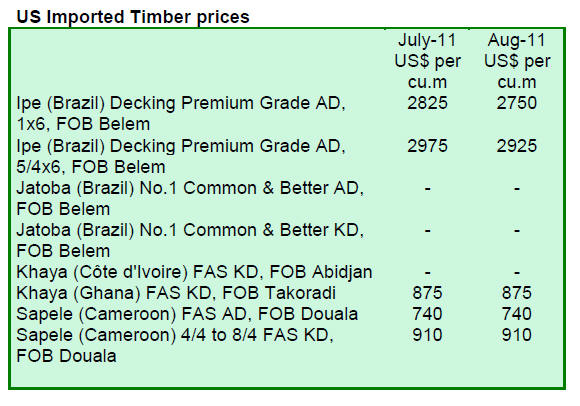

The Wall Street Journal reported in early September on the

effects of the Lacey Act on US companies.

The Lacey Act requires importers and users of imported

wood in the US to ensure that the wood is legally sourced.

Although the newspaper article’s evidence is anecdotal,

the Lacey Act appears to have three main effects in the US

market: where species substitution is feasible, companies

have reduced the volume of imported tropical wood and

rely instead more often on domestic species (the weak US

dollar may play role in this development as well).

Where substitution is difficult, for example in musical

instrument manufacturing, US companies have to spend

more resources on sourcing of wood and on obtaining the

required documentation.

Thirdly, countries that enforce laws against illegal logging

and that can provide full documentation benefit from the

Lacey Act, while supplier countries where reliable

documentation is difficult to obtain appear to lose market

share among US buyers.

Even relatively large companies, such as Gibson Guitar,

have had their manufacturing facilities raided by US Fish

and Wildlife Service agents. The latest raid was in late

August 2011 over Gibson Guitar’s ebony imports from

India.

In other cases timber shipments have been seized if the

documentation was incomplete or faulty. The federal

agency and the US Justice Department have made it clear

that they intend to enforce the Lacey Act.

Related News:

|