2.

GHANA

GCNet sensitisation for timber exporters

The Timber Industry Development Division (TIDD) of the

Ghana Forestry Commission has organised a series of

seminars for timber exporters and major stakeholders in

the industry in order to explain the use of the so-called

eMDA in the processing and approval of timber export

permits. (eMDA is the acronym for the new online

information network between Ministries, Departments and

Agencies)

The exporters were shown the means for electronic

processing of Timber Export Permits, using the Ghana

Community Network Services Ltd (GCNet) platform. This

initiative is expected to address the perceived

communication gap between the TIDD and the industry on

the issuance of permits.

In an address at a workshop in Tema, the Executive

Director of TIDD, Mr. Alhassan Attah said the seminar

formed part of the division’s’ repositioning strategy of

bringing the processing of timber exports to the doorsteps

of exporters.

He added tha, the use of GCNet in timber operations

would also help reduce the cost of doing business, enhance

competitiveness and provide the domestic timber industry

the comparative advantage in the trading of wood

products.

New system an element of VPA

The Executive Director said, GCNet would be benefit the

Forestry Commission in effectively monitoring the

country’s export trade, enhancing data retrieval and serve

as a reliable database for planning, reporting and decision

making. The system would also enable the Commission to

maximise the export revenue collected by the state and

reduce irregularities in the timber trade.

According to Mr. Attah, the use of the GCNet would also

allow for a closer exchange of information among report

related agencies such as the Customs and Exercise and

Preventive Service (CEPS) and other revenue-collecting

agencies for the state.

He said the electronic issuance of export permits was in

line with the terms and conditions of the Voluntary

Partnership Agreement signed between Ghana and the EU

in Sep.2009, where one of the elements was the issuance

of Forest Law Enforcement Governance and Trade

(FLEGT) licence electronically.

The eMDA portal is designed for the electronic processing

of documents and the system enables online submission,

approval and distribution of permits and licenses.

3.

MALAYSIA

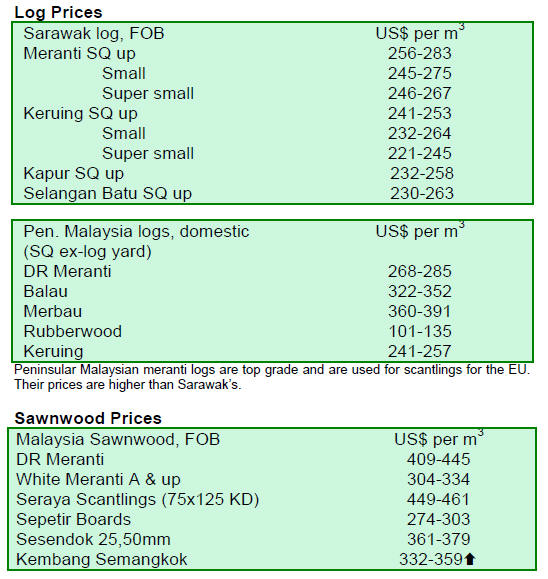

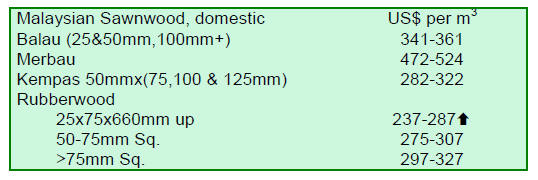

Strengthening ringgit hist furniture exports

With the Malaysian ringgit strengthening against most

major currencies, including the US dollar, the Euro and

Sterling, a decline in furniture exports in the current year

is being forecast.

Exports of Malaysian furniture are expected to decline by

up to 15%, from RM7.95 billion in 2010 to RM6.8 billion

for 2011. This decline would be the worst in the past 3

years.

The Malaysia Furniture Entrepreneur Association (MFEA)

reported that exports by its members had declined from

RM1.97 billion in the first quarter 2010 to RM1.66 billion

in the first quarter of 2011. Exports for the second quarter

are expected to come in below RM1.98 billion.

For the Japanese furniture market, exports registered a

12% decline to RM166 million for the first quarter 2011

compared to RM186 million for the first quarter 2010.

Japan was the second largest market for MFEA members

in 2010, with exports valued at RM709 million out of a

total of RM7.95 billion for the year.

Global WoodMart - one-stop centre for buyers and suppliers

The Malaysian Timber Council (MTC) expects that its

Global WoodMart (MGW) 2012 exhibition will showcase

timber and timber products from both tropical and

temperate countries. MTC added that MGW 2012 will act

as a one-stop centre for both buyers and suppliers of

timber and timber products.

Official partner organizations of MGW 2012 are the

American Hardwood Export Council (AHEC) and

FrenchTimber. AHEC has been active in the Asian

markets for many years but FrenchTimber is a relative

newcomer.

FrenchTimber was formed in 2001 at the initiative of the

“Fédération Nationale du Bois” and a group of French

sawmills and it pursues two main goals :

• To promote, on a national as well as international

basis, the use of the different sawn timber species

and processed wood products, coming from

sustainably managed French forests.

• To ease supplies of sawn timber to foreign

companies by increasing the visibility of the

French sawmills’ offer and expertise.

Low river water makes rafting difficult

Prices of Malaysian timber and timber products began to

stabilise in Peninsular Malaysia as dry weather conditions

returned, allowing uninterrupted harvesting and

transportation. However, for Sarawak, the problem of low

water levels in rivers continues to hamper rafting of logs.

No slowing in demand from China and India

The spill-over effects of the EU debt problems and the

weak economy in the US weigh heavily on the timber

export market. This, coupled with the strong Malaysian

ringgit, means that market prospects are gloomy and

analysts report that buyers are maintaining a wait and see

outlook.

However, China and India remain two of the most

important markets for Malaysian timber exporters and

there has been no slowing in the demand in these countries

for raw materials and semi-finished timber products.

4.

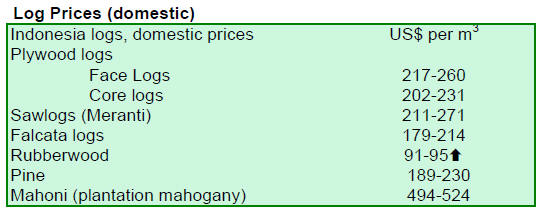

INDONESIA

ASEAN cooperation aim at increasing rattan

exports

Indonesia will be the main production centre for rattan

furniture and rattan products among ASEAN countries.

This decision was made by the ASEAN Furniture

Industries Council (AFIC) after taking into consideration

that ASEAN countries were major producers of rattan,

with Indonesia being the largest producer.

According to the director of forest industry and

plantations

at the Indonesian Industry Ministry, the furniture

industries within each ASEAN country will undertake

creation of their own designs and implement marketing

programmes, however, production will take place in

Indonesia as it is only here that raw material is available.

To achieve this manufacturers in the Philippines were the

first to say they would welcome the opportunity to invest

in new factories in Indonesia.

The Indonesian Furniture Industries and Handicraft

Association added that additional market promotion in

countries outside ASEAN member countries will be

organized jointly.

Indonesia claims to possess a sustainable rattan

production

of up to 140,000 tons per year out of a potential yield of

620,000 tons. This constitutes 75% to 80% of the total

global production.

Indonesia’s exports of rattan products stood at US$133

million in 2010 and the latest cooperation between

ASEAN companies is expected to increase exports by

15% and this would mount a challenge to manufacturers in

China.

Indonesia attracts major construction sector

consulting group

UK-based ARUP, one of the world’s largest consulting

firms for the construction industry, will move into

Indonesia to take advantage of one of the world’s fastest

growing construction markets. The move will make it the

second major UK construction related consulting firm to

do so.

According to ARUP, global construction spending is

estimated to increase by US4 trillion from 2010 to 2020,

of which up to 4% is expected to derive from Indonesia

alone. This constitutes an increase of almost U$200bn,

according to a report by Global Construction Perspectives

and Oxford Economics.

The other countries expected to contribute

significantly to

global construction spending within the next decade will

be China, India and the USA.

Indonesia is set to be one of the seven countries that

will

contribute to two-thirds of growth in global construction

projects.

See:

http://www.building.co.uk/news/arup-to-move-into-indonesia-as-marketgrows/

5018287.article

5.

MYANMAR

Demand shifts from Pyinkado to Gurjan

Analysts report that the market for Pyinkado is quiet while

it remains active for Gurjan. Over the past months there

has been a significant shift in demand from Pyinkado to

Gurjan.

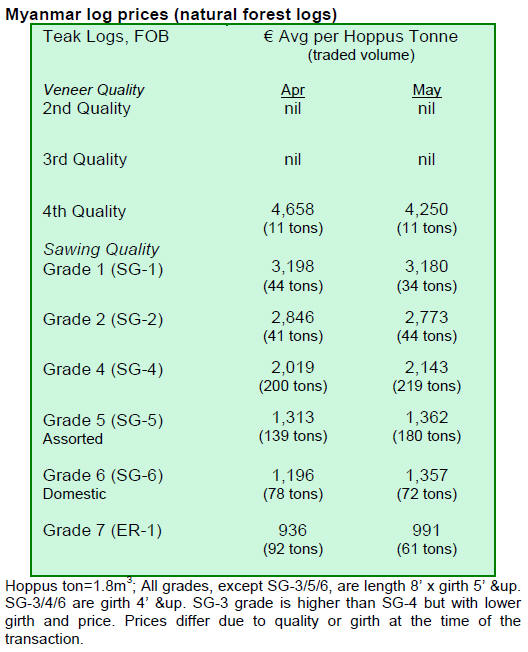

Concern over availability of high grade teak logs

The impression of traders is that the availability of high

grade logs is falling. High grades such as Sawing Grades I,

II, and IV, are now not readily available and the same can

be said for Veneer Grades like 2nd, 3rd, and 4th quality logs.

Analysts say that teak logs from areas known to produce

high quality teak can be sold quickly, but these areas are

now not producing as much as in the past. Other, not-sopopular,

areas produce a larger volume of logs, but the log

grades are lower (mainly because of the high incidence of

defects in the logs)and these logs are slow movers.

Trade anticipates shift to conservation

Some local observers are saying there is a need to put

more emphasis on conservation and trade analysts seem to

think that this is the direction the Ministry of Forestry is

heading. June is the month for tree planting and the most

newspapers report this important national activity in detail.

Most analysts feel a change to reduced log harvests is

likely some time soon.

Timber used to be the second most important foreign

exchange earner for the country but this has changed as

natural gas, gems, fisheries and agricultural products are

becoming more important.

Under these circumstances, many analysts agree that

Myanmar has the opportunity to seriously consider a

reduction in log harvests and a switch to more local

processing and export of finished or semi-finished

products. They say that this would be more beneficial for

the country in the long run. Revenue from the forestry

sector at this point in time is made up of around eighty per

cent from log exports.

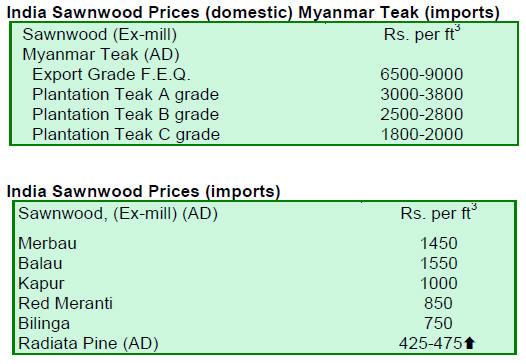

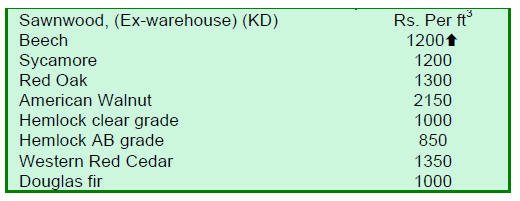

6. INDIA

Teak log prices firm at local

auctions

Auction sales at Government Forest Depots in Gujarat and

Central India are continuing and price trends for teak have

been reported as firm, this also applies to other hardwood

logs. In the recent sales the ratio of teak to other

hardwoods has been 80: 20.

Pre-monsoon stock building drives up prices of

imported teak

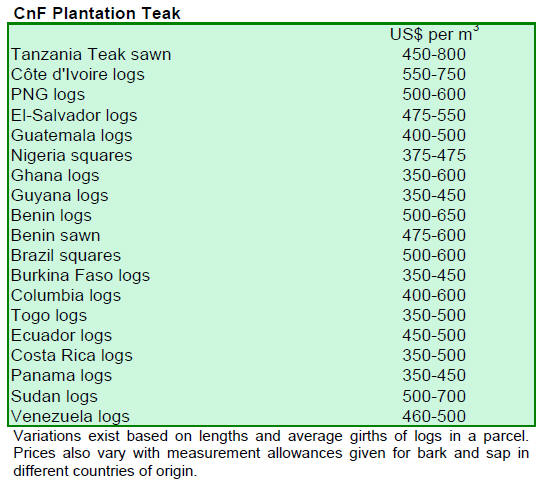

Supplies of plantation teak from Ghana and Ivory Coast

have been erratic recently but Central and South American

supplies have been steady and have continued to support

the demand in Mumbai, Kandla and Mangalore.

Forward contract levels are also reportedly good and

supplies will be maintained in the weeks to come. Premonsoon

stock building by sawmillers is keeping prices

firm.

Shipbuilding quality Teak logs

Rs.2200~2300

First quality Teak Saw-logs

Rs.1800~2000

Long length high girth Teak logs Rs.1500~1800

Average sawmill quality logs

15’& up

Rs.1100~1200

12’& up

Rs.900~1000

8’~10’

Rs.800~ 900

Hardwood logs, Haldu and Laurel Rs.350 ~ 500

Current plantation teak prices C & F Indian ports

remain

unchanged.

Demand from Europe, USA and Middle East for teak and

other hardwoods remains steady.

Domestic demand for plywood is firm as construction

activity is in full swing. Raw material prices are not

relenting which has forced local manufacturers to increase

prices once again.

7. BRAZIL

Furniture Federation pleads for tax

relief

The Ceará Federation (FIEC) has pleaded for tax

relief for the furniture and sawmill companies operating in

the state of Ceará.

FIEC has presented a proposal on this on behalf of

two

state unions. The proposal emphasises the importance of

the industrial sector where, in the early part of the year,

sector growth was around 6% above the same period in

2010. However, in recent months this has fallen to around

4.5%.

FIEC claims that the declining growth rate is due

to the

slowdown in the implementation of some government

programmes. For example planned infrastructure

works have not started as scheduled and house building

under the Rural Light Programme is yet to get underway.

However, a growth of 4.5% creates an enormous

incentive

for companies to continue their operations. Entrepreneurs

in the furniture sector are benefiting from the stable

economy and look forward to opportunities stemming

from the World Cup (2014) and the Olympic Games

(2016). These events will likely create opportunities for

many development projects.

FEMADE 2011

The International Fair for the Wood, Furniture and

Forestry Industries is scheduled for late this year and this

will be the 7th fair held.

This is an international event focusing on the development

of the entire production chain – from forestry to furniture

manufacturing. FEMADE 2011 will offer an opportunity

for networking and technology transfer across many

sectors of the forestry and timber industries.

FEMADE 2010 saw a growth of 45% in the number of

exhibitors compared to the previous fair in 2008. Asian,

European and North American companies have invested in

the Brazilian wood and furniture industry and they use

FEMADE to develop business opportunities.

The participation of Deutsche Messe in the

commercialisation of FEMADE 2010 was a decisive

factor for the effective internationalization of the show say

analysts. See

http://www.feirafemade.com.br/

Timber exports double in Alta Floresta, Mato

Grosso

In the first four months of 2011, the municipality of Alta

Floresta has exported a total of just over US$ 10 million,

123% above the same period of 2010 according to the

Ministry of Development, Industry and Foreign Trade

(MDIC).

The main product exported since January, was

tropical

timber, (US$ 5.1 million) followed by meat products (US$

3.8 million). Exports of Ipe sawnwood and veneer sheets

amounted to US$ 536,300.

The United States tops the list of destinations for

exports

(US$ 3.9 million), followed by China/ Hong Kong, (US$

2.6 million), and Iraq (US$ 1.2 million).

Commission approves export processing zones in

Para

The Amazon, National Integration and Regional

Development Commission has approved the Law 7859/10

which authorizes the government to establish an Export

Processing Zone (EPZ) in the municipality of

Parauapebas, in the Northern Brazilian state of Pará.

Companies set up in the EPZs will have tax and

foreign

exchange benefits as well as simplified administrative

procedures for customs.

The state of Para has a large number and

concentration of

tropical timber sawmills and these mills export a high

proportion of their production. It is expected some of these

mills will relocate to the EPZ to secure the benefits

offered.

Few industries utilising plantation teak for

wood products

The state of Mato Grosso is the largest producer of teak in

Brazil, accounting for 90% of the supply in the country.

Many see an opportunity to raise the awareness of

consumers in Brazil and to expand the market for wood

products manufactured from plantation teak.

Currently, young plantation teak in Brazil is used

mainly

as fuelwood by energy-producing companies, grain- and

meat-processing mills, and the ceramic industry, among

others.

The teak plantations in Mato Grosso cover an area

of

around 60,000 ha, with a potential sustainable production

of 900,000 cu.m per year but there are only a few

industries currently utilising this teak for the production of

wood products.

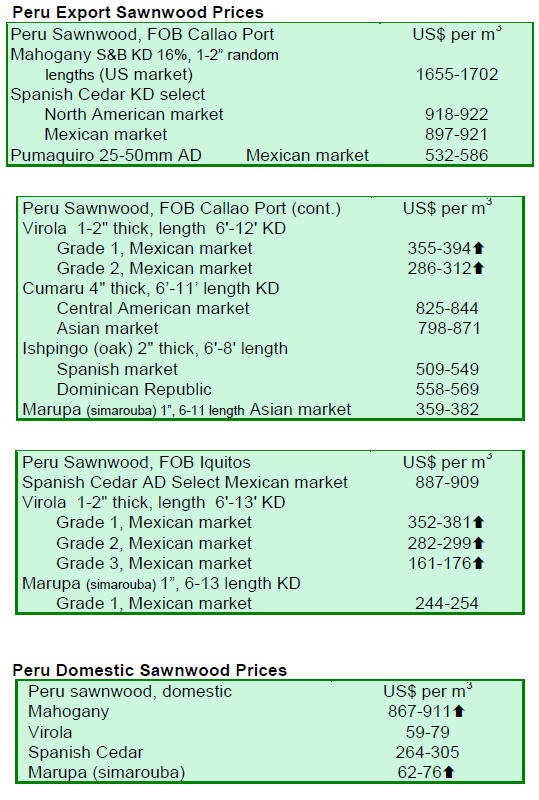

8. PERU

Deadline fast approaching for

enacting forestry law

In the coming weeks, the alternative Forest and Wildlife

Law will be discussed at the plenary session of Congress.

The new draft law contains 147 items that must be

approved before the legislature ends on June 15.

The chairman of the Agricultural Commission has

indicated that his organisation has asked that Congress

make the debate on the new law a priority since the

enactment of this law is essential in order to meet one

element referred to in the various FTAs signed between

Peru and other nations.

The lawmaker added that the new draft is much

improved

and has been strengthened through the input of more than

2,300 community leaders who attended the last national

meeting of native and indigenous communities during the

second half of May.

On the same subject, the chairman of the Timber and

Wood Industry Exporters Association (ADEX) has said

that everything was ready for enactment of the new law

and that it essential that the current session of Congress

enact the law adding that, in his opinion, it would be

irresponsible to defer a decision.

The ADEX representative emphasised that an enacted

Forestry and Wildlife law is one of Peru's outstanding

obligations under the FTA with the United States and if it

is not enacted Peru could face sanctions on its timber

sector.

FSC certification for 75,000 ha. in Madre de

Dios

A spokesperson for one of the largest companies in Peru’s

forestry sector, Wood Bozovich SAC, has obtained a FSC

forest management certification for 75,000 hectares

covering its forest concession "Otorongo" in the Madre de

Dios region.

The company has indicated that the certification

process

was very expensive even for a major Peruvian company

and that other companies as well as some indigenous

communities who had secured certification could not pay

the cost of sustaining the certification.

The company added that unfortunately the market

pays

little or no premium price for certified timber.

9.

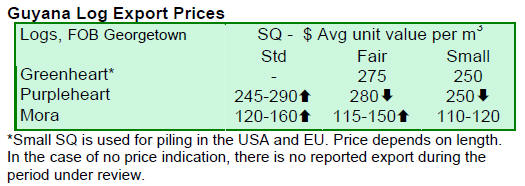

GUYANA

Active demand for Greenheart,

Purpleheart and Mora logs

During the period under review the market for Greenheart

logs was active for both the small and fair sawmill

qualities and good prices were secured.

Purpleheart log prices were also very favourable

for all

qualities, a noticeable improvement from the price levels

last month.

Mora log prices rose for all categories as compared

to the

previous fortnight period.

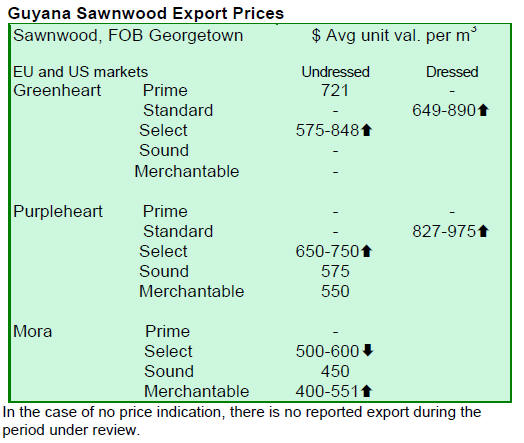

Guyana’s structural timbers attractive in

overseas markets

Some of Guyana’s structural timbers continue to be of

interest to buyers in Asia, the Caribbean, Europe and

North America. Many of Guyana’s lesser used species are

penetrating the international markets and appear to be used

for structural, outdoor as well as indoor applications.

Locust and Red Cedar in demand

Sawnwood prices for this reported period have been

favourable for both dressed and undressed categories.

Some species, such as dressed Locust, secured

notable

price increases up to US$ 1,018 per cubic metre. Dressed

Red Cedar prices rose to US$1,166 per cubic metre. The

high demand for Guyana’s Washiba (Ipe) continues to

drive up prices which are currently at US$ 2,350 per cubic

metre.

Demand improves for Sawn Greenheart and

Purpleheart

For the period reviewed undressed Greenheart sawnwood

was well received in the market and secured prices of US$

765 to US$ 848 per cubic metre for select grades.

Exporters of un-dressed Purpleheart (select) also enjoyed a

positive rise in the top-end price from US$700 to US$750

per cubic metre.

Dressed Greenheart prices saw an increase in price

from

US$806 to US$890 per cubic metre while dressed

Purpleheart prices also firmed from US$890 to US$975

per cubic metre.

Roundwood and fuelwood exports made a positive

impact

to the overall export earnings. Piles, Poles and Posts all

recorded favorable price increases on the export market in

the Caribbean and North America.

Splitwood exports were consumed entirely by the

Caribbean market and received top-end prices as much as

US$1,135 per cubic metre.

Higher export earnings despite lower log prices

Guyana’s earnings from the forestry sector were mixed

during the first quarter of 2011 compared with the same

period last year, according to the Ministry of Agriculture’s

Commodity Market Update for January to March, 2011.

Against the backdrop of a general decline in

prices, export

earnings from the sector during the first quarter of this

year reached US$9,485,303 compared with

US$11,249,552 during the first quarter of 2010.

During the first quarter of 2011, timber and

plywood sales

accounted for the highest share of export earnings by the

forestry sector, bringing in US$9,189,073 compared to the

US$11,034,741 between January and March 2010.

Earnings from sawnwood exports during the January

to

March 2011 period totalled US$4,566,805 compared to

US$5,059,321 last year, while export earnings from logs

rose to US$4,191,312.50 during the first quarter of 2010.

Overall, export prices for forestry sector trended

down

during the first quarter of 2011 compared with the

corresponding period last year. Export prices for logs fell

by 16% during the January – March period this year

compared with earnings during the same period last year.

Export prices for sandalwood and splitwood also

fell

during the first quarter of this year.

Reduction in export prices but higher export

volumes

Despite the reduction in export prices, increased export

volumes meant that the total export earnings from log

exports from January to March 2011 increased by 9%

compared with the corresponding period last year.

However earnings from the other categories of wood

product exports fell significantly during the first quarter of

this year compared with the same period last year.

Earnings from poles slipped by 70% over the period while

the export value of splitwood dipped by 43% between

January and March this year compared with the same

period last year. Earning from sawnwood also declined

during the first quarter of this year compared to the

corresponding period last year.

Related News: