|

Report

from

North America

February US housing market figures disappoint

New housing starts decreased by 22.5% from January to

February to 479,000 (seasonally adjusted) according to US

Department of Commerce figures.

This is 20.5% below the starts in February last year. In

January, housing starts had gone up because multi-family

starts soared, but this sector also posted a decline in

February. Single-family starts continued the downward

trend and decreased by 11.8% from January to February,

while analysts had expected a slight increase in the new

year. Every region of the country posted a decline in starts

in February.

Permits for new homes fell in January and February, but

this less of a surprise because there was a scheduled

change in building codes and builders applied for more

permits than usual in December before the code changes

took effect in January. The number of permits issued can

be an indicator of future building activity.

The National Association of Home Builders attributes the

poor numbers to tight credit for housing and uncertainty

around interest rates, energy costs and the economy.

Home renovation spending expected to grow in 2011

Home remodeling expenditure in the US is expected to

recover in 2011. The Joint Center for Housing Studies at

Harvard University projects an annual growth of 6.5% in

home improvement spending in the third quarter of 2011.

Home sales (and as a result remodeling expenditure) is

expected to pick up in the summer this year.

However, the large number of foreclosed homes on the

market and the resulting low house prices will put a

damper on home renovations and spending is projected to

decline again in the third quarter of 2011.

Launch of “Green Marketing Pledge”

A group of US green product manufacturers, distributors,

retailers and purchasers have launched a public campaign

to put an end to the use of misleading green product claims

in the marketplace. The Green Products Roundtable

includes the Business and Institutional Furniture

Manufacturers’ Association and the forest products

company Weyerhaeuser.

The Roundtable members commit to responsible green

marketing and to adherence to environmental marketing

guidelines established by the Federal Trade Commission.

The Green Products Roundtable is funded by membership

fees, foundations and the US government.

Signs that the US market continues to recover

The latest US import statistics which are for February

2011 show that imports are up compared to the previous

year, a sign that the market continues to recover, although

import volumes and values remain much lower than before

the recession started in 2008.

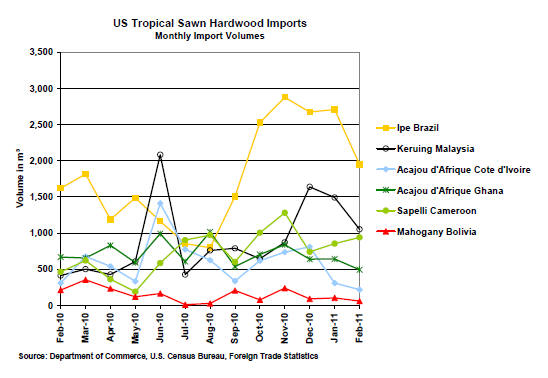

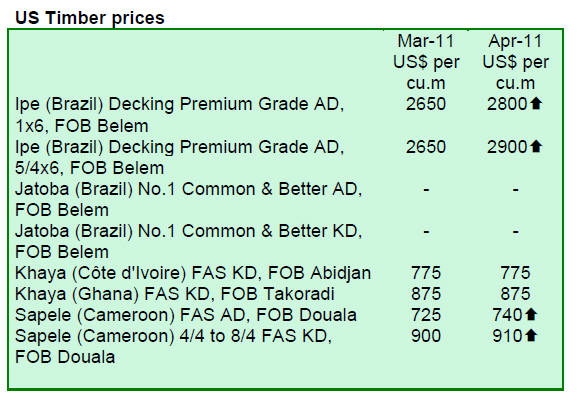

The US imported 14,991 cu.m. of sawn tropical hardwood

in February 2011, which represents a drop of 19% from

18,448 cu.m. in January. All major imported species

showed declines with the exception of sapele for which

imports increased to 2,060 cu.m. (+24%).

Balsa imports dropped by 26% to 3,970 cu.m. in February.

Ipe imports were 2,127 cu.m. (-28%), acajou d’Afrique

1,339 cu.m. (-18%) and keruing 1,246 cu.m. (-25%).

While imports of most species declined from January,

import volumes increased for virola (1,129 cu.m. (+92%)

and cedro (1,141 cu.m., +131%).

Cameroon was the only major supplier that increased sawn

tropical hardwood shipments in February, mostly in acajou

d’Afrique sawnwood while Cote d’Ivoire shipments of

acajou declined. Monthly import volumes of key imported

species by country of origin are shown below.

Year-to-date, import volumes of tropical sawnwood

increased by 19% compared with February 2010. Among

the species that gained significantly year-to-date February

2011 are ipe (+68%), sapelle (+201%) and keruing

(+141%).

Hardwood plywood imports from China rebound

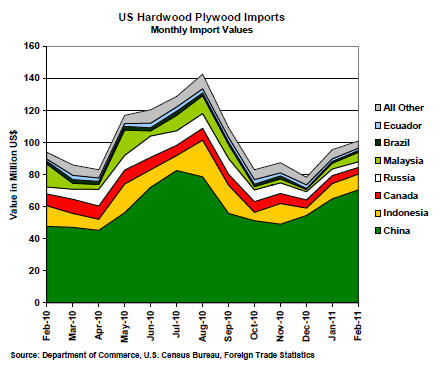

US imports of hardwood plywood increased to US$101

million in February 2011, up 6% from January. Year-todate

the gain was 12%. Imports from China rebounded:

70% of total February imports were from China and yearto-

date imports from China were up 41% compared to

2010.

Imports from other major supplying countries fell,

especially Malaysia which saw a year-to-date decline of -

47% compared to the previous year. February imports

from Indonesia were US$9.9 million (-19% year-to-date),

from Malaysia US$5.9 million (-47% year-to-date), from

Ecuador US$1.5 million (+8% year-to-date), and from

Brazil US$1.1 million (-29% year-to-date).

Brazil and China dominate hardwood moulding

imports

Imports of hardwood moulding were worth US$15.8

million in February 2011, a decrease of -7% from January.

Year-to-date imports were still higher than in 2010, with

strong gains from all tropical suppliers.

Imports from Brazil were US$5.1 million (+27% year-todate),

from Malaysia US$1.3 million (+45% year-to-date),

from Indonesia US$452,000 (+32% year-to-date). Imports

from China were US$4.8 million (+16% year-to-date).

February imports of jatoba mouldings from Brazil were

US$2.4 million (+46% year-to-date), of ipe moulding

US$387,000 (-8% year-to-date), and of cumaru moulding

US$175,000 (-35% year-to-date). Supplies of cumaru

mouldings from Peru were US$399,000 in February

(+90% year-to-date).

Mahogany moulding imports from Peru were US$170,000

in December (-12% year-to-date) and from Paraguay

US$168,000 (+74% year-to-date).

Year-to-date imports of all tropical hardwood moulding

species increased in February. Jatoba accounts for the vast

majority of tropical hardwood moulding imports. The

value of jatoba imports year-to-date February increased by

+54% compared to 2010.

Year-to-date imports of cumaru moulding were up +19%,

ipe moulding +23% and mahogany moulding +10%.

Hardwood flooring imports more than doubled from

2010

Hardwood flooring imports were US$1.6 million in

February, a -29% decline from January, but total 2011

imports to date more than doubled from 2010.

Hardwood flooring imports from China were US$509,000,

from Brazil US$314,000 and from Malaysia US$280,000.

On a year-to-date basis, imports from Brazil increased by

+106% from 2009, Malaysian exports increased by

+150%, Indonesian exports increased by +144%. Chinese

exports to the US recovered from the decline last fall and

were up by +123% year-to-date compared to 2009.

Related News:

|