2.

GHANA

CSRD to log submerged hardwoods

It is estimated that the Volta Lake reservoir holds timber

resources worth US$2.8 billion. The Volta River Authority

and the government of Ghana signed an agreement with

Clark Sustainable Resource Developments Ltd. (CSRD)

for logging, processing and marketing of this underwater

timber.

Harvesting is about to start as a 400,000 pounds SHARC

harvester has been brought in and will now undergo

testing.

The project will secure legally certified timber products

from Ghana for international markets.

3.

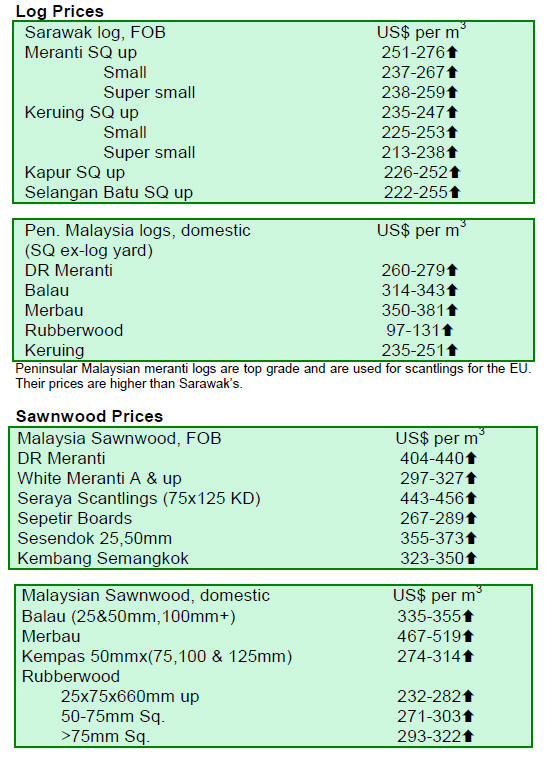

MALAYSIA

Higher shipping rates concern exporters

Exporters of timber and timber products in Malaysia have

expressed concern over rising prices of crude oil and the

effect on freight rates. Shipping costs to destinations such

as Europe and North America have been rising. According

to exporters, any further increases freight rates may result

in significant timber price increases and a loss of

competitiveness.

MTIB monitoring the impact of anti-dumping tariff

The Malaysian Timber Industry Board (MTIB) will be

monitoring the timber trade between Malaysia and South

Korea for the next few months following the imposition by

South Korea of anti-dumping duties.

The MTIB calculates that the Korean government has

imposed an average 10% import tariff on Malaysian

plywood.

South Korea was one of the biggest markets last year for

Malaysian timber products such as veneer, plywood and

sawn timber and in 2010 timber product exports to South

Korea amounted to almost RM1 billion.

The anti-dumping duties on plywood imports from

Malaysia, ranging from five per cent to 38 per cent, were

imposed in January this year.

Only slow progress in re-forestation programme

Forest plantation licensees who need the Government's

help to fund their projects have been told to submit their

specific requests to the government. Deputy Finance

Minister Datuk Donald Lim said the Federal Government

would consider providing soft loans. The Minister made

this statement after being briefed on Sarawak's

implementation of forest plantation projects during a

dialogue on tax incentives for forest plantation

development with the Sarawak Timber Association (STA).

The Minister said the Government would consider

supporting such projects to relieve the pressure of

harvesting timber from natural forests. The Finance

Ministry provided some RM200mil in soft loans for the

establishment of 75,000ha of plantations in 2007.

The Minister said Malaysia had made slow progress in its

re-forestation. The Sarawak state government's 2020 target

is to reforest 1.3mil ha by planting fast growing

commercial timber species. However to-date only 262,000

ha have been planted by both the private and public

sectors.

Through the Income Tax (Exemption) (No.10) Order 2009

tax incentives are given for forest plantation development

but this exemption is due to expire in December this year.

the Minister advised the Sarawak Timber Association to

write to the Plantation Industries and Commodities

Ministry to seek an extension of the order.

4.

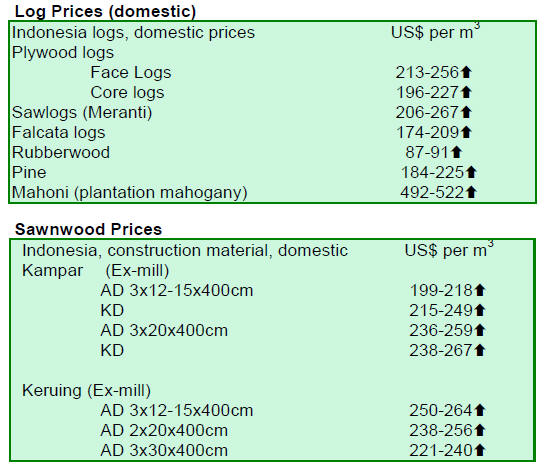

INDONESIA

Indonesia ready for the VPA

The Indonesian government is ready to sign the Forest

Law Enforcement, Governance and Trade - Voluntary

Partnership Agreement (FLEGT-VPA), with the European

Union (EU) within the next two to three months,

according to a joint statement.

The Indonesian government noted that the VPA will be

the

first of its kind to be signed between an Asian country and

the EU, with a significant implication for the US$1 billion

annual timber trade between these two parties.

Disagreements hamper establishing legal framework

for moratorium

Last year, the Indonesian president signed an agreement

with the Norwegian government the purpose of which is to

halt deforestation. One of the first steps Indonesia took on

signing was to impose a moratorium on forest conversions

from 2011 to 2013.

However, disagreements between the Forestry Ministry

and the newly established Presidential Taskforce on

reducing deforestation and forest degradation (REDD)

programmes has hampered the government’s efforts to

implement a legal framework for the moratorium.

It appears that there are differences of opinion on

which

forests should be included in the moratorium and whether

the new Taskforce should be given authority to oversee

forest management — traditionally the domain of the

Forestry Ministry.

Tropical Forests Conservation Act Agreement between

Indonesia and US

Indonesia and the US have signed a Tropical Forests

Conservation Act Agreement which includes a grant to

improve forest management and protect biodiversity in

Sumatra.

The agreement is said to be an important part of the

USIndonesia

Comprehensive Partnership. The US$30 million

grant will help to improve management of 1.3 million

hectares of peatland and forests over a three year period.

5.

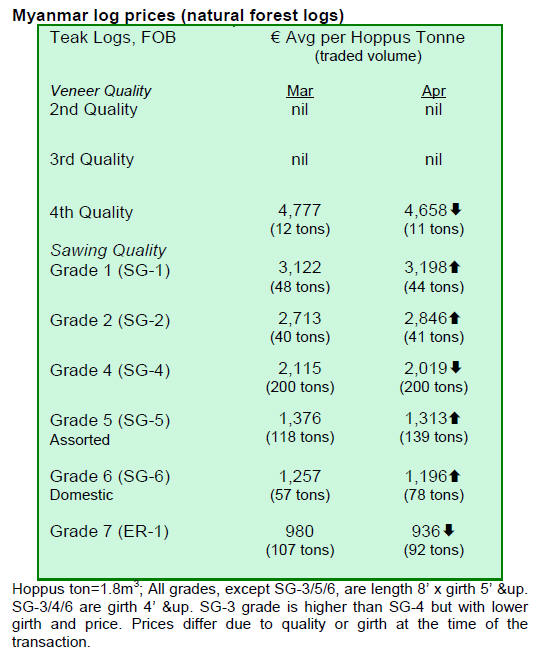

MYANMAR

Improvement in demand situation

The market situation for teak and other hardwoods has

been improving. As a result, prices at the Myanmar Timber

Enterprise (MTE) tender sales are buoyant. Demand for

teak remains good especially for SG-7 (Sawing Grade-7)

logs.

While demand for pyinkadoe did not show much

improvement over the past months, the kayin market was

buoyant following the steep decline seen in mid 2010. It is

reported that even some old logs are being sought for

export. According to analysts, the supply of logs from

Northern Myanmar is tight as river levels are low

hampering log transportation by rafts.

Furniture exports drop

According to the Myanmar Timber Merchants

Association, exports of furniture have dropped by about

70% to 40 - 60 containers a month.

The export of value-added products from Myanmar is very

small compared to log exports. Furniture for export is

made from teak and sagawa (Michelia champaca) and

yemane (Gmelina arborea). Rattan furniture is also

produced and exported.

6. INDIA

MOU to expand Sandalwood forest area

in Karnataka

The state of Karnataka is the largest producer of

sandalwood (Santalum album) in India. However, as a

result of illegal logging and smuggling, sandalwood in

natural forests is under threat of extinction and imports

from other tropical countries are needed to meet the

demand in India.

In order to revive the state’s sandalwood

production, the

Forest Department, local industries and farmers have

entered into a MOU to expand the area for sandalwood

production to 2,000 acres in the state of Karnataka. In

addition, the state government has removed the 50% tax

on profits from sandalwood production.

Trade of non-wood materials

Paper laminates

As a result of reduced supply of premium quality logs

from natural forests, coupled with environmental concerns

and promotion of non-wood products by government

departments, demand and thus production capacities for

manufacture of paper laminates, metals and plastics for

furniture manufacturing and joinery has grown. However,

Indian manufactures of these non-wood materials are

facing increasing competition from imports from China.

Particleboard

The estimated production of particleboard in India is

around 150,000 tonnes per year. Shortages of raw material

and improved market acceptance of Medium Density

Fibreboard (MDF) has slowed the growth of investment in

particleboard production in the country.

Several interior joinery firms have begun to use

boards

made of agricultural waste to manufacture doors and

furniture. However, the domestic supply of particleboard

falls short of demand and this has raised the need to

increase imports from Australia, Malaysia and Europe.

MDF

Indian MDF production capacity had tripled in four years

to 310,000 cu.m per year by 2010 and new plant is under

construction. However, China’s MDF production capacity

is reportedly 30 times that of India’s. As a result, Indian

manufacturers are facing stiff competition from China. In

order to compete and maintain profitability Indian MDF

manufacturers have focused on production of value-added

products.

Laminated flooring

The domestic market for laminated flooring has been

growing fast. New designs and concepts are being

imported from around the world to the Indian market. For

example, Southern European manufacturers have

introduced new paper-free laminated flooring with a slate

stone surface.

Plywood manufacturers importing more core veneers

The Indian plywood industry is continuously facing

shortages of logs and skilled labour, coupled with rising

costs of chemicals. In order to cope with the raw material

shortage, plywood manufacturers have been importing

more core veneers.

Around the world, plywood prices have been trending

upwards. Prices of imported plywood have been

increasing in India.

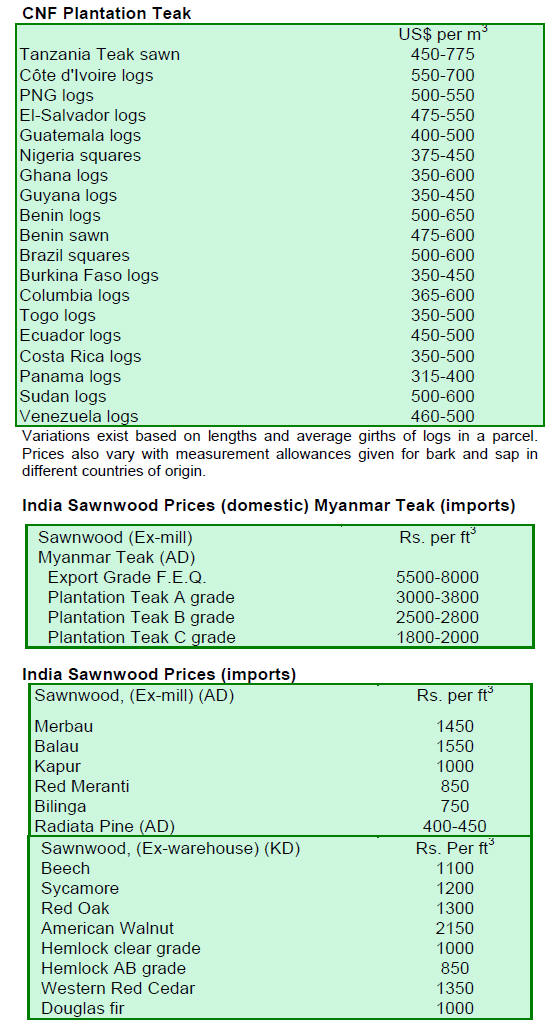

Imported teak prices steady

Demand for imported teak continues to be good and prices

vary depending on quality. However, a lack of containers

in some exporting ports limits shipping.

According to an analyst, the quality of plantation

teak logs

imported from West Africa is dropping. However, due to

the log shortage and lower imports from Myanmar, prices

have remained stable.

For example, teak supplied from Tanzania is from old

plantations, some of them reaching 80 years old. The

colour of heartwood is good with some occasional black

stripes. However, the major defect inr Tanzanian teak is

that it has many knots and thus good quality logs are only

available in short lengths.

The Indian market buys Tanzanian plantation teak

mostly

for door frames with lengths of 7" / 7 1/2". Even shorter

lengths are sourced for window frames and furniture.

Besides length, good color is the major determinant in

sales of teak for doors, windows and furniture. Tanzanian

plantation teak imports to India include sawnwood, but the

majority are boules due to the lower import duty imposed

by India. Boules are assessed in India for duty as round

logs.

7. BRAZIL

Deforestation rate declines in

Amazon

The National Institute for Space Research (INPE) Real

Time Deforestation Detection System (DETER) released

information showing that between August 2010 and

February 2011, the deforestation rate in the Amazon

declined 7.1% compared to the same period in 2009 and

2010.

Other data shows that in 2010 deforestation was

reduced

in the 43 priority municipalities combating deforestation.

In 36 municipalities in the Amazon identified as major

deforesters in 2008, the current deforestation rate has been

reduced by 29%.

According to the Brazilian Ministry of Environment

(MMA), Querencia municipality in the state of Mato

Grosso will be deleted from the list of major deforesters in

the Amazon. Paragominas, in the state of Para, was the

first municipality to be removed from the list, in 2010. In

both municipalities, the average deforestation rate over the

past two years was equal to or less than 60% compared to

the average between 2005 and 2008.

In the same period, DETER shows that deforestation

rate

in the states of Roraima and Mato Grosso declined 77%.

However, in other states, such as Acre, Amazonas and

Tocantins, deforestation increased and by as much as

181%, in the case of Acre.

In the coming weeks, MMA expects to hold a meeting

with state governments to discuss deforestation rates and

to critically assess why the deforestation, that previously

occurred only during dry season, is now also occurring in

the rainy season.

SFB Promotes Education for forest Management

The Brazilian Forest Service (SFB) and other institutions

will launch an “Education for Sustainable Forest

Management” project to deliver information and provide

training on the importance of forest management. The

objective is to increase the number of skilled professionals

in the Amazon able to conduct sustainable logging.

The demand for skilled professionals is currently

high and

growing especially for those operating forest concessions

in national forests and for community forest management

operations. There are over 1 million hectares of forest

concessions at different stages of implementation in the

Amazon, but this could rise to 10 million hectares in the

coming years. It is estimated that, in the short term, at least

10,000 trained/skilled workers will be needed for these

operations.

The SFB will use distance education methods as well

as

field training. The expected benefits include an

improvement in worker safety, more efficient sustainable

harvesting and an overall increase in the returns from

forest activities in the Amazon.

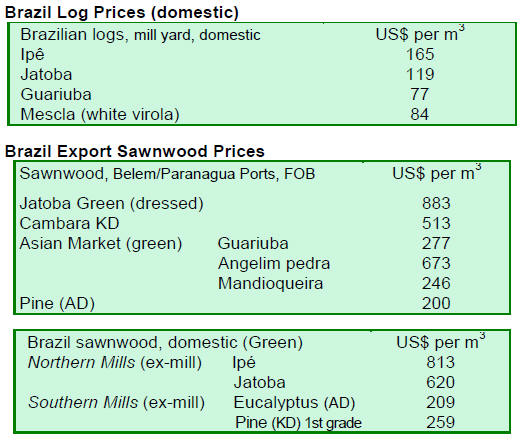

March trade figure released, timber exports

decline

In March 2011, the value of exports of timber products

(except pulp and paper) fell 3.6% compared to values in

March 2010, from US$ 225 million to US$ 217 million.

Pine sawnwood exports increased 15.7% in value in

March 2011 compared to March 2010, from US$ 13.4

million to US$ 15.5 million. In terms of volume, exports

increased 7.2% from 62,400cu.m in March 2010 to 66,900

cu.m in March 2011.

Exports of tropical sawnwood fell both in volume

and in

value, i.e. from 50,800 cu.m in March 2010 to 35,100

cu.m in March 2011 and from US$ 25 million to US$ 19.3

million, over the same period.

Pine plywood exports also fell, dropping 7.3% in

value in

March 2011 compared to the same month in 2010, from

US$ 32.8 million to US$ 30.4 million. The volume of

exports also dropped 15% during the same period, from

98,200 cu.m to 83,500 cu.m.

March 2011 exports of tropical plywood fell to

6,900 cu.m

down from 9,500 cu.m in March 2010, a 27.4% decline. In

value terms, a 29.3% decline was recorded, from US$ 5.8

million to US$ 4.1 million.

Exports of wooden furniture also dropped. Export

values

dropped from US$ 55.2 million in March 2010 to US$

43.4 million in March 2011, representing a 21.4% drop.

Brazil’s economic situation favors timber

imports

Brazil’s annual timber imports average around US$ 120 to

US$ 140 million per year. The United States is the major

supplier and most business is supported by the American

Hardwood Export Council (AHEC).

The economic situation in Brazil, the sustained

appreciation of the Brazilian currency and the staggering

increase in the domestic timber demand is driving imports.

Additionally, weaknesses in domestic timber production

systems and product quality are said to be factors favoring

timber imports in Brazil.

Computerised timber identification system

Work on timber identification considering environmental

and tax issues is conducted by the Institute of Agricultural

Protection of the State of Mato Grosso (INDEA-MT), the

Renewable Natural Resources Control (CFRNR) Unit. The

timber identification tools developed by CFRNR have

been in interest of other states seeking to develop their

own systems, including the state of Para.

Since January 2011, the Computerized Timber Control

System (SICMAD) has been operational at the INDEA's

timber identification check points. This tool is used to

monitor, audit and control Timber Identification

Certificates issued by the INDEA Local Units. These units

assist to develop activities for timber identification,

improved forest control and preventing tax evasion in the

state.

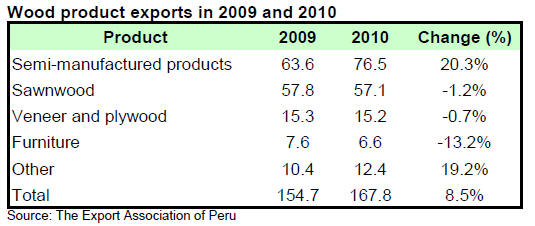

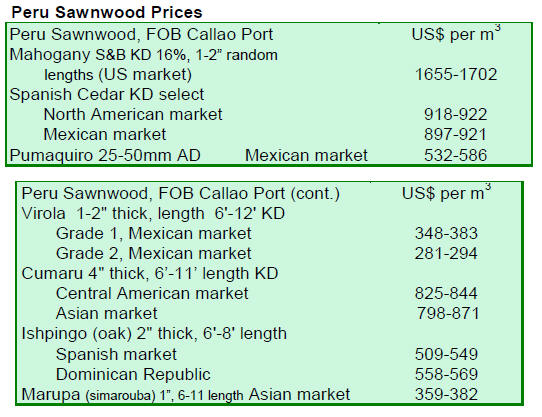

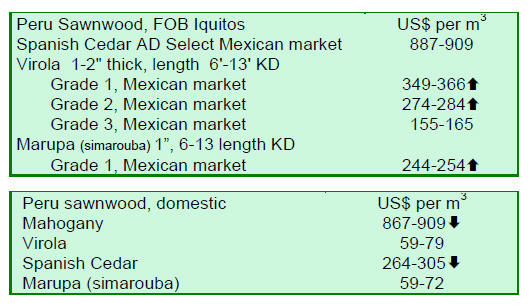

8. PERU

Promoting new species for furniture

manufacturing

The Ministry of Production of Peru is promoting the use of

64 lesser used timber species for furniture manufacturing.

The executive director of the Center for Technological

Innovation Wood (Cite Maderas), Jessica Moscoso, said

that this initiative seeks to ease the intensive use of

mahogany and cedar by introducing alternatives with

similar qualities.

Peru domestic furniture sales are forecast to grow

10% this

year compared to 2010, driven by demand or office

furniture and by shopping centres.

9.

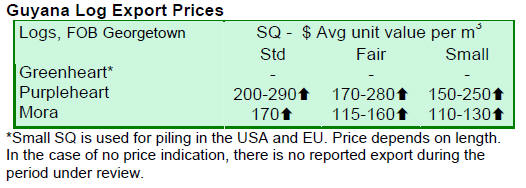

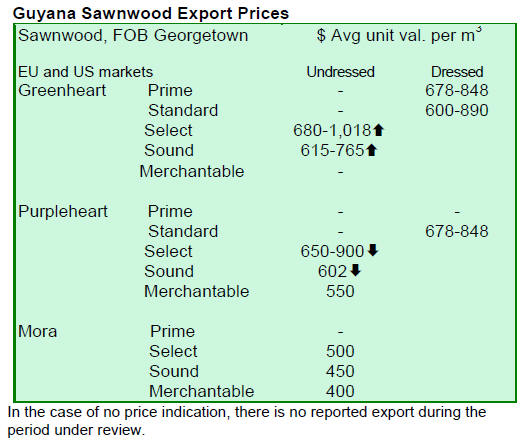

GUYANA

Price trends

In early April there were no exports of Greenheart logs.

Export prices for all categories of purpleheart and mora

logs increased. Some of Guyana’s lesser used species were

also exported in log form fetching good average prices.

Un-dressed Greenheart (select) sawnwood prices

improved towards US$730 to US$975 per cu.m. but

prices for un-dressed purpleheart declined. On the other

hand prices for Dressed Greenheart dropped from US$

1,350 to US$ 1,011 per cu.m. Prices for un-dressed Mora

sawnwood were generally maintained.

The export of piles and poles made a noteworthy

contribution towards the export earnings, for these

products the major market is North America.

Guyana’s Ipe (Washiba) continues to attract

significant

top-end prices reaching as high as US$ 2,250 per cu.m.

Wallaba splitwood is in good demand and export

earnings

from this product were significant.

Many of Guyana’s lesser used species were exported

for

the production of sawn construction timbers as these

woods have very good structural properties. Europe was

the major destination for these sustainable and durable

Guyanese timber species.

Guyana‘s Plywood factory to restart operations

Guyana’s single plywood manufacturing company Barama

is aiming to restart its plywood operations as soon as June

of this year and hopes to have export products ready for

shipment in December.

Domestic demand for plywood is strong and the

reopening

of this mill will ensure that that the development of the

domestic housing sector is not held back. The plywood

factory is looking to achieve a production rate in excess of

2,400 cu.m. per month.

The company is also engaged in the production of

veneers

to further compliment the plywood factory. The plywood

company is providing employment to a significant number

of workers within the forest industry. The re-opened

factory will reduce the shortages of panels faced by

contractors and builders.

10.

BOLIVIA

CITES Plants Committee to classify Big Leaf

Mahogany as a "species of urgent concern"

A CITES Plants Committee meeting was recently held in

Switzerland and there are unconfirmed reports that Bolivia

was advised to set zero harvesting quota for Big leaf

Mahogany (Swietenia macrophylla)

Bolivia did not submit a non-detriment findings

report for

Big Leaf Mahogany and this triggered the Plants

Committee to classify Big Leaf Mahogany as a "species of

urgent concern" and to recommend that within three

months Bolivia should set a zero quota.

This information is not yet on the CITES website

but

importers are advised to follow developments as it may

take some time for Bolivia to re-validate its non-detriment

process.

Related News: