|

Report

from

North America

US tropical timber imports

Sawn hardwood imports remain low

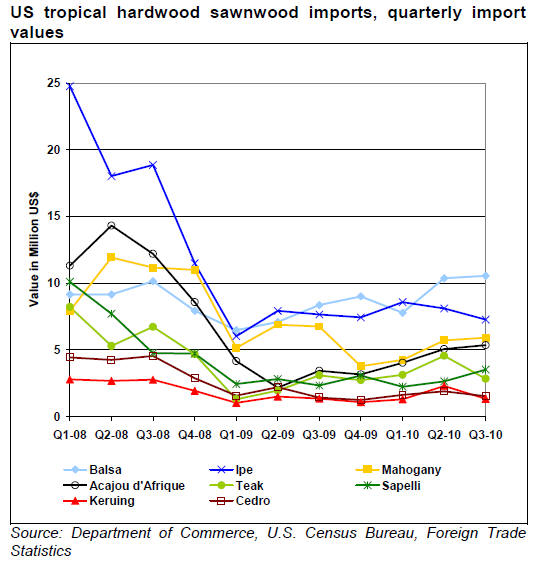

The value of sawn tropical hardwood imported into the US remains well

below the levels seen before 2009. The US imported US$49.1 million worth

of sawn tropical hardwood in the third quarter of 2010, up 2.4% from the

previous quarter and 19% increase from the same period in 2009, but 41%

below the third quarter of 2008. Ipe imports fell by 10.3% from the

second quarter, while imports of balsa, mahogany and acajou d’Afrique

saw a slight increase.

September imports of sawn tropical hardwood were 16,901 cu.m, down from

17,382 cu.m in August. The top three imported species were balsa (4,301

cu.m), ipe (1,776 cu.m) and mahogany (1,645 cu.m). Imports of most

species declined from August with the exception of ipe, keruing, red

meranti, cedro, virola and mahogany.

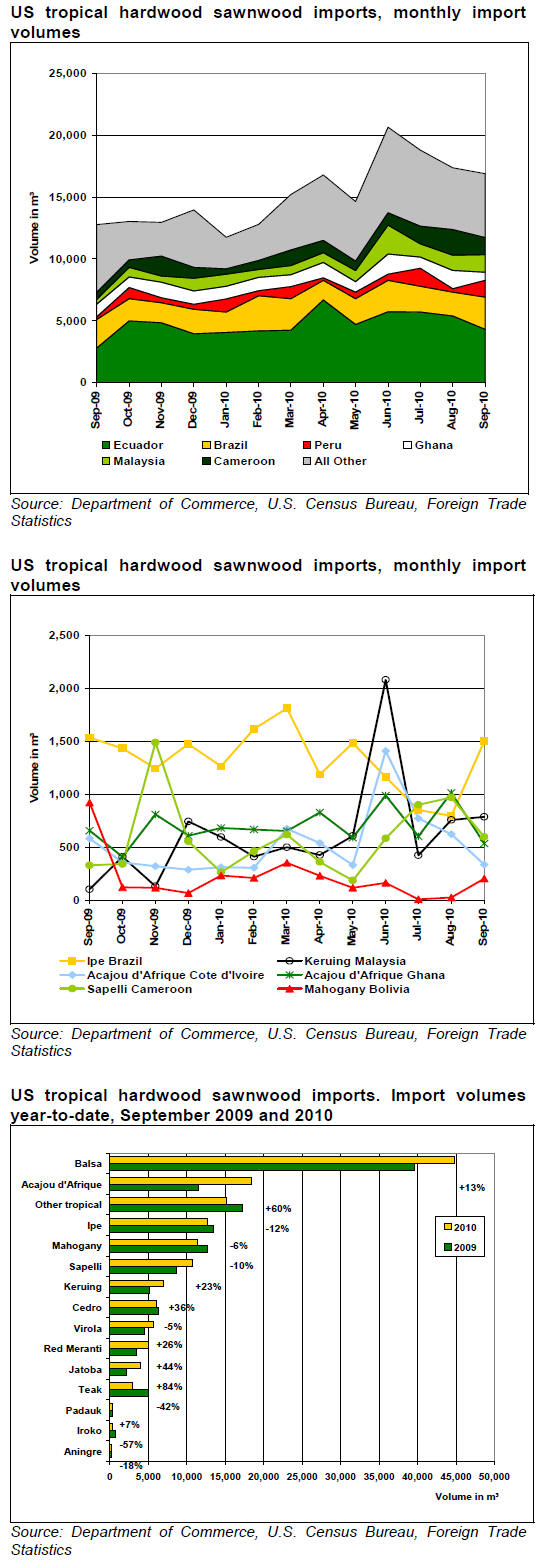

Year-to-date, import volumes of tropical sawnwood increased by 8% compared

with 2009. Among the species that gained significantly in the period to

September 2010 are jatoba (+84%), acajou d’Afrique (+60%), red meranti

(+44%) and keruing (+36%).

Hardwood plywood imports on the mend

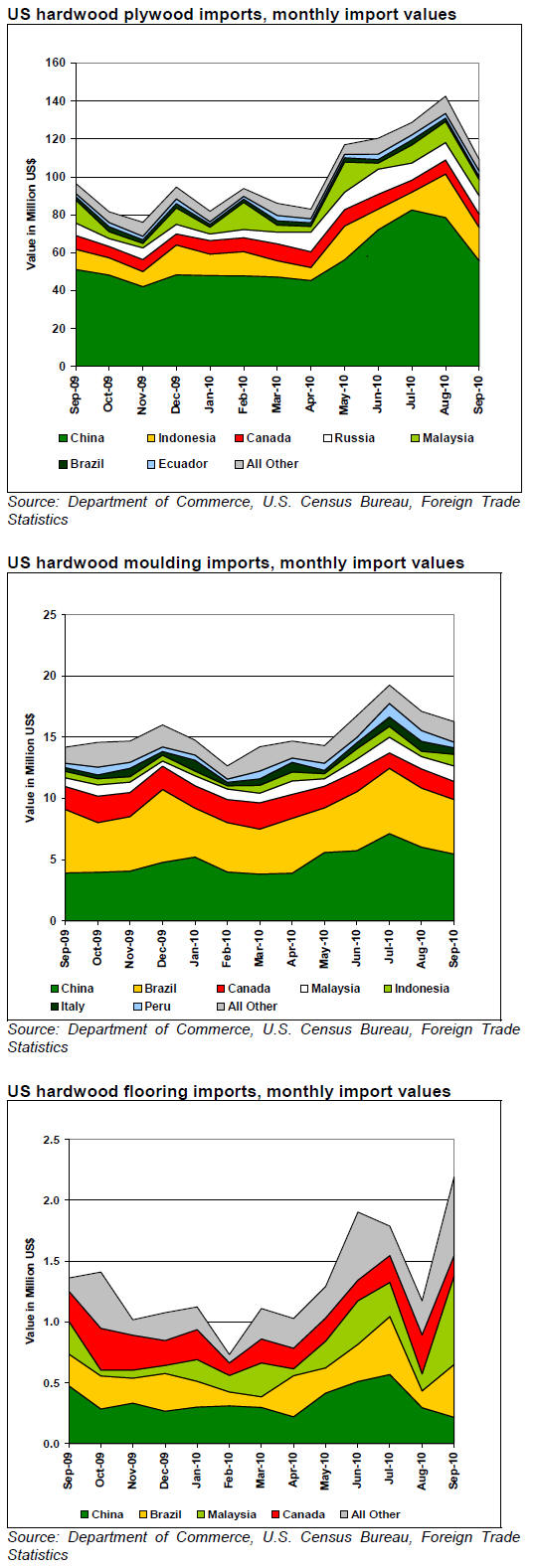

US imports of hardwood plywood are set to exceed 2009 volumes, based on

year-to-date September imports of US$963 million, which is 36% above the

same period last year. China accounts for 55% (US$533 million) of total

imports year-to-date. In September 2010, imports from China were US$55.8

(+25% year-to-date) and from Indonesia US$17.6 million (+100%

year-to-date). September imports from Malaysia were US$8.6 million

(+167% year-to-date), from Ecuador US$2.9 million (+54% year-to-date),

and from Brazil US$1.6 million (+3% year-to-date).

Hardwood moulding imports continue to fall

Hardwood moulding imports declined again in September to US$16.3

million, a 5% drop from August. However, year-to-date imports increased

by 6% to US$140.1 million compared to the same period in 2009. China

increased shipments substantially from 2009. Imports from China were

US$5.5 million in September (+24% year-to-date). Brazil supplied US$4.4

million (-6% year-to-date), Malaysia US$1.3 million (+21% year-to-date)

and Indonesia US$946,000 (+32% year-to-date).

September imports from Brazil of jatoba moulding were US$2.5 million (-13%

year-to-date), of cumaru moulding US$296,000 (-11% year-to-date), and of

ipe moulding US$596,000 (-5% year-to-date). Supplies of cumaru mouldings

from Peru declined from August to US$215,000 (+329% year-to-date).

Mahogany moulding imports from Peru were just US$160,000 in September

(-17% year-to-date), compared with US$320,000 from Paraguay. Overall US

imports of cumaru moulding are up by 34%, while jatoba, ipe and mahogany

moulding imports are down compared to the same period last year.

Upswing in hardwood flooring imports

September hardwood flooring imports were the highest since June 2009.

Flooring imports remain far below levels seen in recent years, but the

upswing in September is mainly due to an increase in shipments from

Brazil and Malaysia, while imports from China and Canada declined.

Year-to-date September imports were US$12.3 million, down 39% compared

to the same period in 2009. Hardwood flooring imports from Brazil were

US$434,000 in September, up by 217% from August. Malaysia shipped

US$727,000 worth in September, up by 419% from August. On a year-to-date

basis, imports from Brazil are at the same level at last year, Malaysian

exports increased by 5% and Chinese exports to the US are down by 69%.

Hardwood resolution passed by US Senate

A resolution that recognises US hardwood products as a sustainable

resource was unanimously passed by the US Senate after having been

approved by the House of Representative last September. The resolution

identifies US hardwoods as a sustainable, abundant and legal resource.

It also recommends giving full consideration to US hardwoods in any

programme that promotes the construction of environmentally preferable

public, commercial or residential buildings.

AHEC commissions LCA study

The American Hardwood Export Council (AHEC) has commissioned a

consultant firm to conduct life cycle assessments (LCA) for American

hardwood species. AHEC announced that the study not only collects life

cycle inventory data on sawnwood, but also veneer and finished products

such as flooring, doors and furniture. The study will compare US

hardwoods with alternative materials in terms of environmental impact

and carbon footprint.

The LCA results will help manufacturers who rely on US hardwoods in

preparing Environmental Product Declarations (EPD) for their products in

line with international ISO standards. EPD is becoming an increasingly

important means to communicate the environmental performance of

products. Several green building initiatives, including LEED in the US,

use EPDs to evaluate the materials and products used in the building

sector.

Tropical sawnwood markets and prices

Demand for most species has reportedly slowed significantly since the

end of summer. Sales of jatoba, mahogany, acajou d’Afrique and sapelli

are down. Flooring manufacturers have reduced purchasing and demand from

the moulding and millwork sector remains subdued. Generally prices for

tropical sawnwood have remained stable from October. Availability of

tropical sawnwood is good with the exception of ipe. Ipe prices may

increase further as the Brazilian real is gaining strength. At the same

time the log supply situation to Brazilian mills remains tight.

Related News:

|