|

Report

from

North America

US tropical timber imports

Hardwood sawnwood imports

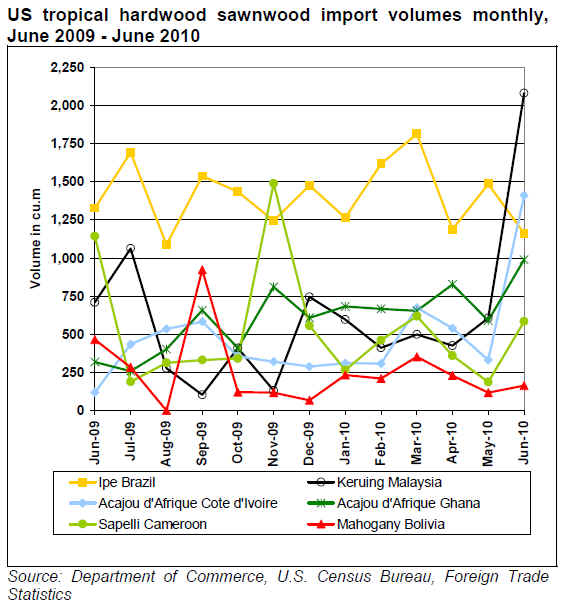

The US imported 20,657 cu.m of tropical sawnwood in June 2010, up from 14,652 cu.m in May. The top three imported species were balsa (5,608 cu.m), acajou d’Afrique (3,783 cu.m) and keruing (2,128 cu.m). Imports of most species increased from May with the exception of ipe, mahogany, red meranti and padauk. In June, the exports of species from South East Asia and Africa picked up significantly due to the exhausted inventories and low availability from South America. In Brazil, some sawmills have reportedly shut down or the domestic market is consuming all the production leaving no exports to the US. The depreciation of the Euro against the US dollar pushed up the tropical sawnwood imports priced in Euro, e.g. imports from African countries. Monthly import volumes of key imported species by country of origin are shown in the chart below.

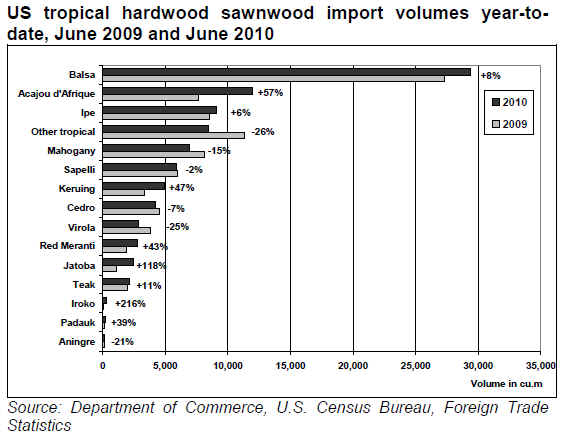

Year-to-date, import volumes of tropical sawnwood increased by 7% compared to the same period in 2009. Among the species that gained significantly in the period to June 2010 are acajou d’Afrique (+57%), keruing (+47%), red meranti (+43%) and jatoba (+118%).

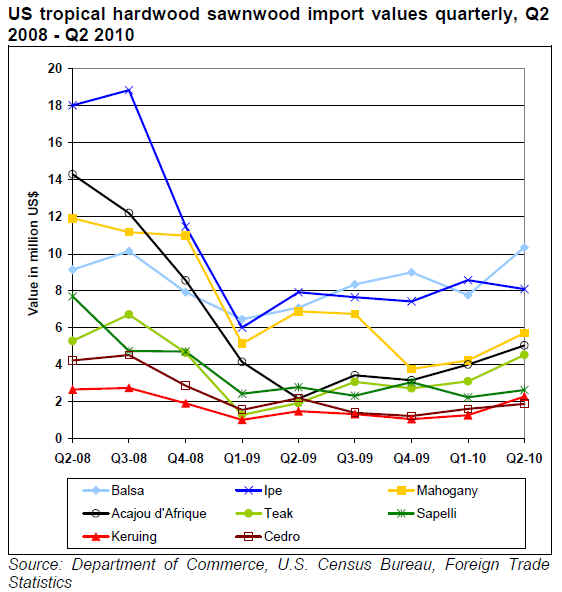

The volumes of tropical sawnwood imported into the US have recovered somewhat from 2009. However, in value terms, imports remain much lower than in 2008, albeit import values have been going up in 2010. Exchange rate fluctuations also have had an influence, first the drop in the value of the US dollar, which further depressed sales to the US market, and recently the weaker Euro favoured sales of products priced in Euro.

Hardwood moulding imports

Hardwood moulding imports showed a slight decline year-to-date June 2010 even compared with the low levels seen in 2009. Year-to-date imports were US$87.5 million, 2% less compared to 2009. China is the top supplier with US$28.3 million year-to-date June, up 19% from the same period in 2009. In 2009 Brazil passed China and was the largest supplier, but according to trade data, Brazil is back to second place at US$24.6 million year-to-date June 2010, a drop of 16% compared to last year.

June imports from Brazil of jatoba moulding were US$2.1 million (down 26% year-to-date), of cumaru moulding US$570,000 (up 2% year-to-date), and of ipe moulding US$232,000 (down 23% year-to-date). Supplies of cumaru mouldings from Peru continued to grow; June imports were US$306,000 (up 232% year-to-date). Both ipe and mahogany moulding imports were down by approximately one third compared to the same period last year.

Hardwood plywood imports

US imports of hardwood plywood will likely exceed 2009 volumes, based on year-to-date imports of 1.1 million cu.m, which is 32% higher than in the same period last year. China remains the dominant supplier. June 2010 imports from China were 165,355 cu.m (up 25% year-to-date). Indonesia is the second-largest supplier, imports to the US totalling 20,375 cu.m in June (up 99% year-to-date). June imports from Ecuador were 5,975 cu.m (up 49% year-to-date) and from Brazil 1,738 cu.m (down 21% year-to-date).

Hardwood flooring imports

The decline in hardwood flooring imports that began in 2006 continues this year. Year-to-date June imports were US$7.2 million, down 54% compared to the same period in 2009. In recent years, import values have roughly halved every year, from US$332 million in 2006 to under US$24 million in 2009. All major supplying countries are affected and among the top three, China has seen the steepest drop of 76% in exports to the US year-to-date 2010. Hardwood flooring imports from Brazil were US$1.3 million year-to-date June 2010, down 22% compared to the same period in 2009. Malaysia has seen a similar drop to US$1.2 million, a 25% fall compared to the same period last year.

US demand for cabinets forecast to grow 7.4% per year

US demand for cabinets is forecast to expand 7.4% per year to 2014, according a new Freedonia market study published in August. In 2009, the US market for cabinets was worth US$10.6 billion. Kitchen cabinets accounted for 80% of demand, bathroom cabinets for 12% and other types of cabinets for the remaining 8%.

The growth will mainly be driven by a rebound in residential construction from the low levels seen in 2009, although the study authors expect housing starts to remain below the peak reached in 2006. Remodelling will also boost demand for cabinets. Demand for cabinets in the residential market is forecast to rise 8.8% annually to US$12.1 billion in 2014 from US$9.8 billion in 2009. Demand for other cabinets, such as cabinets in offices, home entertainment centres, garages and other areas, is expected to increase 3.8% annually through 2014.

Design trends that support the use of cabinets include more and larger cabinets in kitchens, larger cabinets in bathrooms, and replacing shelving with cabinets in other rooms and in offices.

Publication promotes tropical species in flooring and decking

The International Wood Products Association (IWPA) publishes every year a buyer’s guide to trends and sources of imported wood products. The 2010 issue of International Wood was released at the International Woodworking Fair in Atlanta, and it includes an expanded section titled International Floors and Decks. It highlights applications, design trends and suppliers of imported tropical species. The IWPA outlines in the publication how architects and designers can support sustainable forest management and communities in developing countries by specifying tropical species in their projects.

Debt-for-nature deal for Brazilian forests

The governments of the US and Brazil signed an agreement that will reduce Brazil’s debt payments to the US by almost US$21 million over the next five years. In return Brazil has committed funds to support the protection of the Atlantic rainforest and the Caatinga and Cerrado ecosystems.

This is the 16th agreement that the US has signed under its Tropical Conservation Act of 1998. The law offers eligible countries opportunities to reduce a portion of their debt owed to the US while generating funds for tropical conservation activities. The majority of agreements to date include funds leveraged from private donors and NGOs, according to

USAID.

Related News:

|