US Dollar Exchange Rates of 28th July 2010

China Yuan 6.7782

Report from China

China adjusts export tax rebates

According to the Ministry of Finance and the State

Administration of Taxation, China removed export tax

rebates on 406 items effective from 15 July 2010.

The commodities that will no longer enjoy export tax

rebates include certain steel products, non-ferrous

processed metal products, silver powder, alcohol, corn

starch, crop protection products, medicine, chemicals,

plastic products, rubber and related products. These goods

used to have tax rebate rates ranging from 5% to 17%.

Wood products are still enjoying export tax rebates as

means to promote them as green alternatives.

The export tax rebate removal is aimed at restricting the

export of "high-pollution, high-energy consumption and

resource-dependent" products in order to accomplish

energy and emission reduction targets during the Five-

Year Plan period (2006-2010).

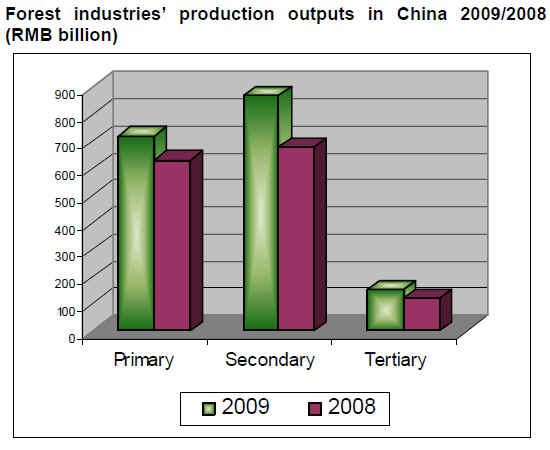

National forest industry statistics 2009

The State Forestry Administration, the State Development

and Reform Commission, the Ministry of Finance, the

Ministry of Commerce and the State Administration of

Taxation have jointly published the Plan for the

Revitalization of the Forest Industry 2010-2012. The

publication introduces and employs the 2009 forest

industry statistics.

According to the statistics, the total value of national

forest industry output was RMB1.75 trillion in 2009, up

21% compared to the year 2008. The average growth rate

of the output has been about 20% every year since 2001.

Of the total output value, a share of 41% representing

RMB723 billion came from the primary forest industry

(mainly non-wood forest products), a 14% increase over

the output in 2008. The secondary forest industry (mainly

SPWPs and bamboo products) accounted for 50% of the

total output value with RMB872 billion, up 28% from

2008. Tertiary forest industry (mainly tourism and

recreation) accounted for 8.9% of the total with RMB155

billion, up 28% from previous year.

In the primary forest industry, the output value of the

plantation and collection industry including fresh and

dried fruits, tea, Chinese medicine products and forest

food was the largest with RMB390 billion, accounting for

54% of the total primary industry output. In 2009, the

output value of bamboo continued to increase reaching a

9.8% share of the total, which translates to RMB70.9

billion in value. However, the output of timber declined

13% from the level recorded in 2008 to 71 million cu.m in

2009. The value of timber output was RMB76.4 billion

accounting for 11% of the national total.

In the secondary forest industry, the proportion of output

value of the timber and bamboo processing industry

including sawnwood and wood-based panels was the

biggest with 45%, representing RMB393 billion in value.

In 2009, the output of logs was 65 million cu.m, down

13% from the previous year, while the output of

sawnwood was 32 million cu.m, up 14% from 2008. The

output of wood-based panels reached 115 million cu.m, a

23% increase from 2008. The wood-based panel

production was mainly concentrated in eight provinces:

Jiangsu, Henan, Shandong, Hebei, Guangxi, Fujian, Anhui

and Guangdong. The total wood-based panel output of

these provinces was 86.9 million cu.m, accounting for

76% of the national total. The output of wood flooring

recorded 378 million square metres, staying at the 2008

level. The province with the largest flooring output was

Zhejiang with around 72 million square metres.

In the tertiary forest industry, the proportion of output

value of forest tourism and recreation services was the

biggest with 62%, representing RMB96.5 billion in value.

The forest industry statistics of 2009 show that the

structure of forest industry has changed from the ratio of

66:30:4 for primary, secondary and tertiary production in

2001, to the ratio of 41:50:9 in 2009. Out of all forest

industries, the wood and bamboo pulp&paper industry,

wood and bamboo furniture industry, and forest tourism

and recreation services are growing fastest, at the annual

rate of 41%, 40% and 40% respectively.

According to the statistics, the output value in 10

provinces in east China accounted for 47% of the national

total, in 6 provinces in central China 21%, in 12 provinces

in west China 2%, and in northeast China 11%. There

were 9 provinces with the total forestry output value

exceeding RMB80 billion in 2009. The top provinces were

Guangdong, Fujian and Zhejiang.

The total allocated forest sector financing for 2009 was

RMB137 billion, 37% more than in 2008. Some RMB135

billion of forestry finance was completed in 2009.

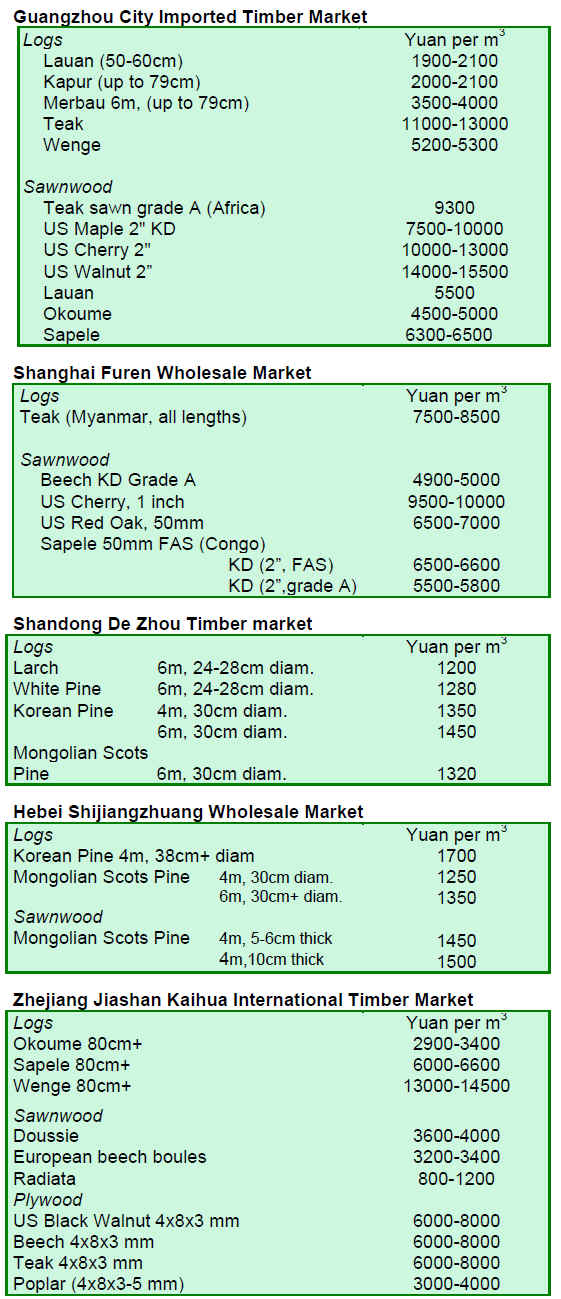

Mixed price trends in 2009

According to the forest industry statistics of 2009, there

was no common trend for log and major wood product

prices in the market. The average prices in 2009 were as

follows: logs RMB564 per cu.m, down 15.4% from last

year; bamboo RMB7 per piece; sawnwood RMB1,017 per

cu.m, down 6.2%; wood chips RMB661 per cu.m, up

3.3%; wood flooring RMB121 per square metre, up 1.7%;

plywood RMB1,774 per cu.m, down 3.3%; hardboard

RMB1,503 per cu.m, up 23.3%; MDF RMB1,439 per

cu.m, up 2.1%; particle board RMB1,151 per cu.m, up

4.8%.

B.C. logs to be shipped year-round into China

The Fujian Entry-Exit Inspection & Quarantine Bureau

has announced that a trade agreement on Canadian BC

Province Logs to China was recently signed between the

Chinese and Canadian governments. In the agreement, the

import period of Canadian logs to China has been

extended from 7 months to a whole year, in order to meet

the growing demand from timber processing companies in

Fujian Province. The arrangement is also favourable for

Fujian companies in terms of more flexible log import

planning and reduced storage costs.

The former trade agreement signed in 2008 prohibited log

imports from Canadian BC Province between May to

September because of the pest risks. During that period,

Fujian timber processing companies were left without

Canadian hemlock, spruce and Douglas fir logs.

More on BC logs:

http://www.vancouversun.com/business/China+opens+doo

r+logs/3253233/story.html

Log imports through Zhangjiagang surge

Log imports through the Zhangjiagang sea port during the

first half of 2010 jumped 21% to a total of 1.8 million

cu.m. Log imports valued US$504 million, a 53% hike

over the same period in 2009. Of the total log imports, 1.7

million cu.m were shipped in bulk and 60,800 cu.m in

containers, up 19% and 82% respectively from the same

period in 2009.

According to analysts, there are two main reasons for the

surge in log imports:

• Malaysian timber traders increased exports to China

due to the low demand in developed countries. The

total import value of Southeast Asian timber rose 7%

from the first half of 2009;

• Domestic demand for tropical timber and wooden

products has increased steadily in line with China’s

economic recovery.

|