|

Report

from

Europe

European economy shows signs of recovery

Although economic trends across Europe point to some signs of improvement during the second quarter of 2010, these have yet to result in any significant improvement in demand for tropical hardwood. In fact, as the European trade prepares for the summer vacation period and against a background of volatile currency movements raising the threat of stock depreciation, the instinct of many importers is to avoid speculative purchasing and keep stocks very low.

The European economy seems to have returned to growth. The latest GDP figures for the euro-zone as a whole show annualised growth of around 2% in the second quarter, a decent number by recent standards. The upturn has been largely driven by an increase in exports as the euro weakened against the dollar. Germany, where GDP growth may have been as high as 4% at an annualised rate in the second quarter, did particularly well primarily due to rising exports of infra-structure, cars and other engineering-related goods. While Germany’s high tech goods have led the way, analysts now expect sustained improvements in export demand for other products to boost growth in a wider range of European countries during the rest of the year. This should include high-end interior furniture products which remain a small, but nevertheless important, outlet for tropical hardwood sawnwood and veneers.

Less encouraging is the latest news from the European construction sector which suggests that sustained improvements in Europe’s domestic consumption of tropical hardwoods and other wood products will take time to materialise. In June, delegates at the Euroconstruct conference reported that output in the European construction sector fell by 8.8% in 2009 and that a further contraction of 4% is expected in 2010 (Euroconstruct). Further deep fall in construction activity in Ireland, Spain and Portugal will be only partly compensated by gains elsewhere, notably in Poland where construction activity is expected to grow by 10% in 2010. Construction output across Europe is expected to increase by 1.2% in 2011, but this forecast rate of growth implies a much weaker rebound in most European countries.

Nevertheless, there are other reasons for greater optimism in sections of the European hardwood trade and industry. The decline in new-build across large parts of Europe has fed a tendency in the residential sector to “improve-not-move”, boosting hardwood demand from continuing refurbishment and renovation activity. Refurbishment activity has also been encouraged to some extent by high-profile government measures aimed at improving the energy efficiency of existing buildings. Reports from flooring and furniture trade shows in Europe in the first half of 2010 suggest that activity in the high-end bespoke sector of these markets – which particularly value hardwoods – has often held-up better than the lower-end mass produced sectors.

Better demand for high-end veneer

This last fact is borne out by EUWID’s latest report on the status of the European veneer industry. While noting that the second quarter of 2010 brought little improvement in overall market momentum and order volumes remain generally low and inconsistent, EUWID also suggests that sales opportunities for “exclusive” veneers in top-end building projects, furniture and car, boat and airplane construction are satisfactory. In contrast, shipments of medium-quality veneers to the door and furniture industries are described as “unacceptable”. EUWID reports that Central European mills are now running at somewhere between 70% and 85% of their processing capacity, an improvement on last year which is partly explained by the complete closure of a number of mills.

EUWID suggests that, despite slow consumption, availability of veneer quality logs from all areas remains an issue after the big reductions in harvesting over the last two years. Gabon’s ban on the export of logs from May 2010 is also set to have a dramatic long term impact on supply of tropical veneer logs to European manufacturers.

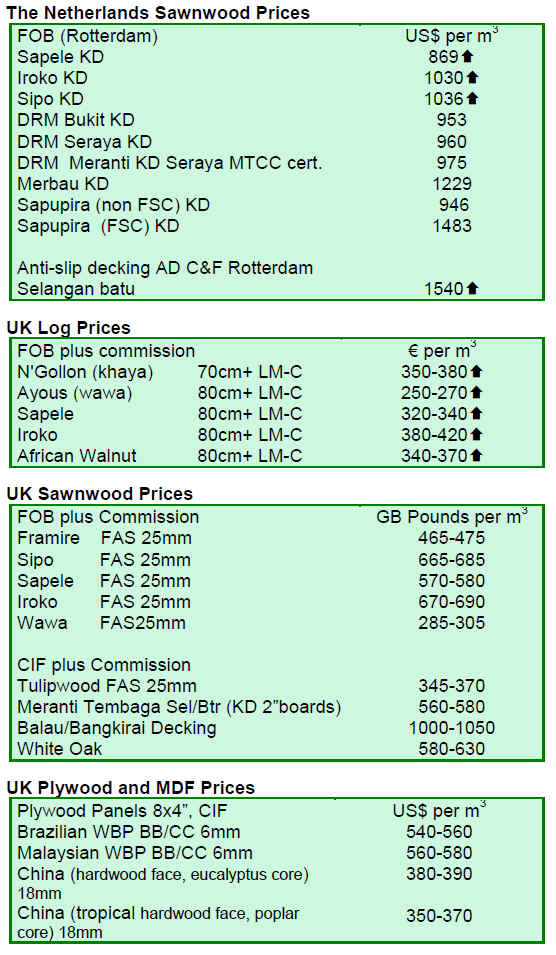

Weaker euro exchange rate leads to shifts in sawn hardwood market

The weakened euro-dollar exchange rate combined with variable availability is leading to some significant shifts in demand for different species of tropical sawn lumber in Europe. The strong dollar is an extra disincentive to any further imports of bangkarai and other dollar-denominated decking products, demand for which is already winding down as the main spring and early summer season is now at an end.

On the other hand, the stronger dollar has led to an increased level of enquiries in Europe for the leading commercial African hardwoods such as sapele and sipo – which are invoiced in euros – compared to their dollar-denominated Asian counterparts such as meranti. This is also providing scope for European importers to push through increases in their wholesale prices for African hardwoods so that they are better aligned with firming FOB prices in Africa. However very extended lead times, now upwards of 6 months for many African products, are restricting the potential for African shippers to exploit the increased level of enquiries for their products.

The stronger dollar and lack of supply of American tulipwood led to improved demand for light West African sawnwood like wawa and ayous during the second quarter of 2010. However recent indications that tulipwood in the US may be moving from shortage to over-supply may mean this trend is short lived.

European illegal logging legislation passes last major hurdle

During June, representatives of the European Commission, Council and Parliament reached agreement on the text of legislation designed to remove illegal wood from European trade. On July 7, the European Parliament voted overwhelmingly in favour of the agreed text, thereby removing the last major hurdle to passage of the legislation. It is now expected the European Council will rubber-stamp the text and formally accept it into European law in September.

The agreed text represents a compromise between the positions of the European Parliament and European Council. The former had wanted to impose tough requirements on all European traders to demonstrate the legality of all wood products and to demand a timetable for moves to mandatory sustainability certification. The latter had favoured less onerous obligations more closely allied to existing private sector procurement policies and procedures.

A key part of the compromise is that the text now includes a clause making European wood traders liable for prosecution if found in possession of wood sourced contrary to the laws of any country, including those outside the EU. This brings the legislation much closer to that of the U.S. Lacey Act Amendment of May 2008. It should also provide a strong incentive to European traders to act in accordance with the other major requirement of the law which is to implement a “due diligence” system designed to minimise the risk of their trading in illegal wood.

Under the agreed text, the requirement for a “due diligence” system extends to those European operators that “first place” timber and timber products (excluding recycled products) on to the EU market. “First placers” are taken to include both timber and timber product importers and domestic log suppliers within the EU. “First placers” must systematically assess the risk of their wood purchases being derived from illegal sources and implement procedures that are “adequate and proportionate” to minimise any risks identified. Risk mitigation may include requiring additional documents or third party verification.

European operators may establish their own due diligence procedures or they may join systems operated by so-called “monitoring organisations”. The compromise text effectively represents a victory for timber trade associations in the EU as it provides scope for them to act as “monitoring organisations” despite efforts by green groups to exclude them on grounds of conflict of interest. The legislation also states that in order to avoid any undue administrative burden, operators already using systems or procedures which comply with the requirements of the regulation should not be required to set up new systems. The implication is that companies already part of independently audited systems like the UK, French and Dutch timber trade association codes of practice and responsible timber procurement policies will not be subject to any significant additional requirements.

A key clause in the agreed text is to the effect that “risk mitigation” procedures will not be required in cases where there is a “negligible risk” of illegal logging. This clause was introduced to prevent imposition of unnecessary additional bureaucracy on wood chains where illegal logging is widely acknowledged not to be a problem. Although formal definitions of “negligible risk” have yet to be agreed, it is expected that account will be taken of independent studies like that commissioned from Seneca Creek Associates by the American Hardwood Export Council (AHEC) which showed there is a less than 1% risk of any American hardwood being derived from an illegal source.

The agreed text of the legislation also makes clear that timber and timber products subject to legality licensing under the terms of bilateral Forest Law Enforcement Governance and Trade (FLEGT) Voluntary Partnership Agreements (VPAs) will not be subject to additional requirements. In fact an underlying aim of the new legislation is to provide an added incentive to timber supplying countries to enter into FLEGT VPAs by demanding that European importers introduce extra “risk mitigation” measures when dealing with wood products from non-VPA countries where there is a high risk of illegal logging. EU VPAs have so far been agreed with Ghana, Republic of Congo and Cameroon. Negotiations are also well developed with the Central African Republic, Indonesia, Liberia, Malaysia, and Vietnam.

The agreed text also makes clear that independent certification or third party legality verification schemes may be used in the risk assessment. CITES listed species are explicitly excluded from additional measures under the legislation.

Much news coverage of the law has focused on new requirements for wood tracking. These new requirements need to be clarified. The reality is that the agreed text greatly waters down earlier proposals (promoted heavily by green members of the European Parliament) for mandatory traceability of all wood products in the EU. This is in recognition of the fact that traceability is often unrealistic, particularly when dealing with complex products or when wood is sourced from numerous small family and community owned forests.

Two areas of the agreed text have a bearing on wood tracking:

• As part of their due diligence systems, “first placers” will be required “where applicable” to identify the “sub-national region and concession of harvest” of their wood products. The implication is that tracking to the specific forest of origin outside the EU will only be required in those instances where there is a significant risk of illegal logging.

• There is also an obligation on all “downstream traders” in the EU to know from whom timber and timber products are obtained and to whom sold (so-called "one-up-and-one-down" traceability). This is not expected to involve any extra bureaucracy since the evidence required need only be an invoice or receipt which in any case have to be kept for financial purposes.

Despite pressure from the European Parliament and some EU Member States to impose a tough EU-wide system of enforcement and sanctions, the agreed text establishes that responsibility for enforcement and sanctions will remain with the individual member states.

Related News:

|